“Markets Waver: Powell’s Words and Trump’s Headlines Shake Wall Street”

Introduction

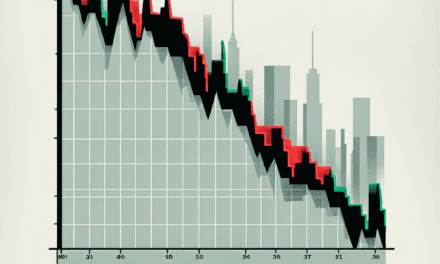

In a recent market update, the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite experienced notable declines, reflecting investor reactions to key developments on the economic and political fronts. Federal Reserve Chair Jerome Powell’s latest speech has stirred market sentiment, as investors closely analyze his remarks for insights into future monetary policy directions. Concurrently, political dynamics are in flux with new developments surrounding former President Donald Trump, adding another layer of complexity to market movements. These factors combined have contributed to a cautious atmosphere among investors, prompting a reevaluation of risk and strategy in the current economic landscape.

Impact Of Powell’s Speech On The Dow, S&P 500, And Nasdaq

In recent developments, the financial markets have experienced notable fluctuations, with the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite all witnessing declines. These movements can be attributed to a confluence of factors, prominently featuring Federal Reserve Chair Jerome Powell’s recent speech and unfolding events surrounding former President Donald Trump. As investors navigate these turbulent waters, understanding the implications of these events is crucial for making informed decisions.

Jerome Powell’s speech, delivered at a key economic symposium, has been a focal point for market participants. His remarks, which emphasized the Federal Reserve’s commitment to combating inflation, have sparked a wave of reactions across the financial landscape. Powell reiterated the central bank’s stance on maintaining higher interest rates for an extended period, a strategy aimed at curbing inflationary pressures. This hawkish tone, while intended to reassure markets of the Fed’s resolve, has simultaneously raised concerns about the potential impact on economic growth. Consequently, investors have been prompted to reassess their risk appetites, leading to a sell-off in equities.

The Dow Jones Industrial Average, a barometer of blue-chip stocks, has not been immune to these developments. The index has experienced a decline as investors digest the implications of prolonged higher interest rates. Companies within the Dow, particularly those in interest-sensitive sectors such as financials and real estate, have faced increased scrutiny. The prospect of higher borrowing costs and a potentially slower economic environment has weighed on investor sentiment, contributing to the downward pressure on the index.

Similarly, the S&P 500, which encompasses a broader range of industries, has also felt the impact of Powell’s speech. The index’s decline reflects a widespread reassessment of valuations, as market participants grapple with the potential for tighter monetary policy. Technology stocks, which have been a driving force behind the S&P 500’s gains in recent years, have been particularly affected. The sector’s sensitivity to interest rate changes has led to heightened volatility, as investors recalibrate their expectations for future growth and profitability.

Meanwhile, the Nasdaq Composite, heavily weighted towards technology and growth-oriented companies, has experienced a pronounced decline. The index’s performance underscores the challenges faced by tech stocks in an environment of rising interest rates. As borrowing costs increase, the attractiveness of future cash flows diminishes, prompting investors to reevaluate their positions in high-growth companies. This recalibration has resulted in a notable pullback in the Nasdaq, as market participants seek to mitigate risk amid an uncertain economic landscape.

In addition to Powell’s speech, developments surrounding former President Donald Trump have added another layer of complexity to the market dynamics. Legal proceedings and political uncertainties have introduced an element of unpredictability, further influencing investor sentiment. The potential for heightened political tensions and their implications for policy-making have contributed to the cautious approach adopted by market participants.

In conclusion, the recent declines in the Dow, S&P 500, and Nasdaq can be attributed to a combination of factors, with Jerome Powell’s speech and developments related to Donald Trump playing pivotal roles. As investors navigate these challenges, the interplay between monetary policy and political developments will continue to shape market trajectories. Understanding these dynamics is essential for making informed investment decisions in an ever-evolving financial landscape.

Analyzing Market Reactions To Trump’s Latest Developments

In recent days, the financial markets have been closely monitoring a confluence of events that have significantly influenced investor sentiment. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite have all experienced declines, reflecting the market’s reaction to a combination of Federal Reserve Chair Jerome Powell’s latest speech and recent developments involving former President Donald Trump. These events have created a complex landscape for investors, who are attempting to navigate the potential implications for the broader economy and financial markets.

Jerome Powell’s speech, delivered at a key economic symposium, provided insights into the Federal Reserve’s current stance on monetary policy. Powell emphasized the central bank’s commitment to combating inflation while also acknowledging the challenges posed by a slowing economy. His remarks suggested that the Federal Reserve might continue its policy of gradual interest rate hikes, a move that has historically been met with mixed reactions from the market. On one hand, higher interest rates can help curb inflation, but on the other, they can also dampen economic growth by increasing borrowing costs for businesses and consumers. Consequently, investors have been left to weigh the potential benefits of inflation control against the risks of a potential economic slowdown.

Simultaneously, developments surrounding former President Donald Trump have added another layer of complexity to the market’s outlook. Recent legal proceedings and investigations have brought Trump’s activities back into the spotlight, raising questions about potential political and economic ramifications. While the direct impact of these developments on the financial markets may be difficult to quantify, they contribute to an atmosphere of uncertainty that can influence investor behavior. Historically, markets have shown sensitivity to political instability, as it can lead to unpredictable policy shifts and affect investor confidence.

The interplay between Powell’s speech and the Trump-related developments has created a challenging environment for market participants. Investors are grappling with the dual concerns of monetary policy direction and political uncertainty, both of which have the potential to significantly impact market dynamics. In such a context, market volatility is not uncommon, as traders and investors react to new information and attempt to adjust their strategies accordingly.

Moreover, the declines in the Dow, S&P 500, and Nasdaq reflect broader concerns about the global economic outlook. With ongoing geopolitical tensions, supply chain disruptions, and the lingering effects of the COVID-19 pandemic, the markets are navigating a complex web of factors that can influence asset prices. In this environment, investors are increasingly seeking safe-haven assets, such as gold and government bonds, as they attempt to mitigate risk and preserve capital.

In conclusion, the recent declines in major U.S. stock indices underscore the market’s sensitivity to a range of factors, including monetary policy signals and political developments. As investors continue to assess the implications of Powell’s speech and the latest Trump-related news, market volatility is likely to persist. In this uncertain landscape, a cautious approach may be warranted, as market participants strive to balance the pursuit of returns with the need to manage risk effectively. As always, staying informed and maintaining a diversified portfolio can be key strategies for navigating the complexities of today’s financial markets.

How Powell’s Economic Outlook Influences Stock Market Trends

In recent developments, the stock market has experienced notable fluctuations, with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all witnessing declines. These movements can be attributed to a confluence of factors, prominently featuring Federal Reserve Chair Jerome Powell’s recent speech and unfolding events related to former President Donald Trump. Understanding how Powell’s economic outlook influences stock market trends is crucial for investors and analysts alike, as it provides insights into the broader economic landscape and potential future market directions.

Jerome Powell’s speeches are closely monitored by market participants because they often provide critical insights into the Federal Reserve’s monetary policy stance. In his latest address, Powell emphasized the ongoing challenges posed by inflation and the Fed’s commitment to bringing it under control. He reiterated the central bank’s readiness to adjust interest rates as necessary to achieve its inflation targets. This hawkish tone, while aimed at stabilizing prices, has sparked concerns among investors about the potential for higher borrowing costs, which could dampen economic growth and corporate profitability.

The prospect of rising interest rates tends to weigh heavily on stock markets, as it increases the cost of capital for businesses and consumers alike. Consequently, sectors that are particularly sensitive to interest rate changes, such as technology and consumer discretionary, often experience heightened volatility. The Nasdaq, with its heavy concentration of tech stocks, is especially susceptible to such fluctuations. As investors recalibrate their expectations in response to Powell’s remarks, the resulting market adjustments can lead to declines in major indices, as observed in the recent downturn.

Moreover, Powell’s speech comes at a time when the global economic environment is fraught with uncertainties. Supply chain disruptions, geopolitical tensions, and the lingering effects of the COVID-19 pandemic continue to pose challenges. These factors contribute to a complex backdrop against which the Federal Reserve must navigate its policy decisions. Investors, therefore, remain vigilant, seeking to interpret Powell’s words for any indications of future policy shifts that could impact market dynamics.

In addition to Powell’s speech, developments surrounding former President Donald Trump have also played a role in shaping market sentiment. Legal proceedings and political controversies involving Trump can create an atmosphere of uncertainty, which often translates into market volatility. Investors tend to adopt a cautious approach during such periods, as political instability can have far-reaching implications for economic policy and regulatory environments.

The interplay between Powell’s economic outlook and the Trump-related developments underscores the multifaceted nature of market influences. While monetary policy remains a key driver, political factors can amplify or mitigate its effects. As such, market participants must consider a wide array of variables when assessing potential risks and opportunities.

In conclusion, the recent declines in the Dow, S&P 500, and Nasdaq highlight the intricate relationship between economic policy and market trends. Jerome Powell’s speech, with its emphasis on inflation control and potential interest rate adjustments, has prompted investors to reassess their strategies in light of possible economic headwinds. Simultaneously, political developments involving Donald Trump add another layer of complexity to the market landscape. As these factors continue to evolve, staying informed and adaptable will be essential for navigating the ever-changing financial markets.

The Role Of Political Events In Market Volatility

In the ever-evolving landscape of financial markets, political events often play a pivotal role in influencing market volatility. This phenomenon was recently exemplified by the decline in major U.S. stock indices, including the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite, following a speech by Federal Reserve Chair Jerome Powell and developments related to former President Donald Trump. Understanding the interplay between political events and market reactions is crucial for investors seeking to navigate these turbulent waters.

To begin with, the Federal Reserve’s monetary policy decisions are a significant driver of market sentiment. Jerome Powell’s speeches are closely scrutinized by investors for any hints regarding future interest rate adjustments. In his recent address, Powell emphasized the Fed’s commitment to curbing inflation, suggesting that interest rates might remain elevated for a longer period than previously anticipated. This hawkish stance often leads to increased market volatility, as higher interest rates can dampen economic growth and corporate profits. Consequently, investors tend to reassess their risk exposure, leading to fluctuations in stock prices.

Moreover, political developments, such as those involving high-profile figures like Donald Trump, can further exacerbate market volatility. Trump’s legal challenges and political maneuvers continue to capture public attention, creating an environment of uncertainty. Markets generally dislike uncertainty, as it complicates the process of making informed investment decisions. When political events unfold, they can trigger rapid shifts in investor sentiment, resulting in abrupt market movements. In this context, the recent legal developments surrounding Trump have added another layer of complexity to the already volatile market environment.

Furthermore, the interconnectedness of global markets means that political events in one country can have ripple effects across the world. Investors are increasingly aware of the potential for geopolitical tensions to impact global trade and economic stability. For instance, any significant political event in the United States, given its economic influence, can have far-reaching consequences for international markets. This interconnectedness amplifies the impact of political events on market volatility, as investors must consider a broader range of factors when making investment decisions.

In addition to these direct impacts, political events can also influence market volatility through their effects on investor psychology. The behavior of market participants is often driven by emotions such as fear and greed, which can be heightened during times of political uncertainty. When investors perceive increased risk, they may engage in panic selling, leading to sharp declines in stock prices. Conversely, positive political developments can boost investor confidence, resulting in market rallies. Understanding these psychological dynamics is essential for investors aiming to navigate the complexities of market volatility.

In conclusion, political events play a significant role in shaping market volatility, as evidenced by the recent declines in major U.S. stock indices following Jerome Powell’s speech and developments related to Donald Trump. The interplay between monetary policy, political developments, and investor psychology creates a complex environment that requires careful analysis and strategic decision-making. As global markets remain interconnected, the influence of political events on market volatility is likely to persist, underscoring the importance of staying informed and adaptable in the face of uncertainty. By recognizing the multifaceted nature of these influences, investors can better position themselves to navigate the challenges and opportunities presented by market volatility.

Comparing Historical Market Responses To Federal Reserve Announcements

In the ever-evolving landscape of financial markets, the recent declines in the Dow, S&P 500, and Nasdaq have drawn significant attention, particularly in light of Federal Reserve Chairman Jerome Powell’s speech and developments surrounding former President Donald Trump. To better understand these market movements, it is instructive to compare them with historical market responses to Federal Reserve announcements. Historically, the Federal Reserve’s communications have played a pivotal role in shaping market sentiment. Investors closely scrutinize these announcements for insights into the central bank’s monetary policy direction, which can influence interest rates, inflation expectations, and overall economic growth. Consequently, markets often react with heightened volatility, as traders adjust their positions based on perceived shifts in policy.

For instance, during the 2008 financial crisis, the Federal Reserve’s announcements regarding interest rate cuts and quantitative easing measures were met with significant market fluctuations. Investors were keenly aware that these policy decisions were aimed at stabilizing the economy, and the markets responded accordingly, albeit with initial uncertainty. Similarly, in the aftermath of the COVID-19 pandemic, the Federal Reserve’s commitment to maintaining low interest rates and implementing asset purchase programs provided a crucial backstop for financial markets, leading to a robust recovery in stock prices.

In the current context, Powell’s recent speech has once again underscored the Federal Reserve’s influence on market dynamics. His remarks, which hinted at potential adjustments to monetary policy in response to evolving economic conditions, have prompted investors to reassess their expectations. This recalibration has contributed to the observed declines in major indices such as the Dow, S&P 500, and Nasdaq. Moreover, the market’s reaction to Powell’s speech is not occurring in isolation. The developments surrounding former President Donald Trump, including legal proceedings and political implications, have added an additional layer of complexity to the market environment. Historically, political events have had the potential to sway investor sentiment, particularly when they intersect with economic policy considerations.

In comparing these recent market responses to historical precedents, it becomes evident that the interplay between Federal Reserve announcements and broader geopolitical developments can create a multifaceted landscape for investors. While the immediate market reactions may appear volatile, it is essential to recognize that such fluctuations are often part of a broader process of price discovery and adjustment. Investors, therefore, must navigate these dynamics with a keen understanding of both historical patterns and current developments.

In conclusion, the recent declines in the Dow, S&P 500, and Nasdaq amid Powell’s speech and Trump-related developments highlight the intricate relationship between Federal Reserve communications and market behavior. By examining historical market responses to similar announcements, investors can gain valuable insights into the potential trajectory of financial markets. As always, a comprehensive understanding of both economic fundamentals and geopolitical factors remains crucial for making informed investment decisions in an ever-changing environment.

Investor Sentiment: Navigating Uncertainty In The Current Market

Investor sentiment is a crucial factor in the financial markets, often swaying the direction of stock indices such as the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite. Recently, these indices have experienced a decline, influenced by a confluence of factors that have heightened uncertainty among investors. Central to this downturn is the recent speech by Federal Reserve Chair Jerome Powell, coupled with developments surrounding former President Donald Trump. These events have collectively contributed to a cautious atmosphere, prompting investors to reassess their strategies in navigating the current market landscape.

Jerome Powell’s speech, delivered at a pivotal moment, underscored the Federal Reserve’s commitment to combating inflation while maintaining economic stability. His remarks suggested that interest rates might remain elevated for a longer period than previously anticipated. This stance, while aimed at curbing inflationary pressures, has sparked concerns about the potential impact on economic growth. Higher interest rates can lead to increased borrowing costs for businesses and consumers, potentially dampening spending and investment. Consequently, investors are grappling with the implications of a prolonged period of tighter monetary policy, which has contributed to the recent decline in major stock indices.

In addition to Powell’s speech, developments related to Donald Trump have added another layer of complexity to the market environment. Legal proceedings and political controversies surrounding the former president have created a backdrop of uncertainty that investors are keenly monitoring. The potential for political instability or policy shifts can have far-reaching effects on market sentiment, influencing everything from regulatory environments to international trade relations. As these developments unfold, investors are weighing the potential risks and opportunities, further contributing to the cautious sentiment observed in the markets.

Moreover, the interplay between these factors and broader economic indicators cannot be overlooked. Recent data on employment, consumer spending, and corporate earnings have painted a mixed picture of the economy’s health. While some sectors continue to show resilience, others are grappling with challenges such as supply chain disruptions and labor shortages. This uneven economic landscape adds another layer of complexity for investors attempting to gauge the market’s trajectory. As they sift through this data, investors are increasingly focused on identifying sectors and companies that are well-positioned to weather potential headwinds.

In navigating this uncertain environment, investors are employing a range of strategies to mitigate risk and capitalize on potential opportunities. Diversification remains a key approach, allowing investors to spread risk across different asset classes and sectors. Additionally, some investors are turning to defensive stocks, which tend to be more resilient during economic downturns. These include companies in sectors such as utilities, healthcare, and consumer staples, which provide essential goods and services regardless of economic conditions. Furthermore, the use of hedging strategies, such as options and futures, is gaining traction as investors seek to protect their portfolios from potential volatility.

In conclusion, the recent decline in the Dow, S&P 500, and Nasdaq reflects a complex interplay of factors that have heightened investor uncertainty. Jerome Powell’s speech and developments surrounding Donald Trump have been pivotal in shaping market sentiment, prompting investors to reassess their strategies. As they navigate this challenging landscape, a focus on diversification, defensive positioning, and risk management will be essential in adapting to the evolving market dynamics. While uncertainty remains a defining feature of the current market environment, it also presents opportunities for those who are adept at navigating its complexities.

Strategies For Investors During Market Declines And Political Uncertainty

In the ever-evolving landscape of financial markets, investors are often confronted with periods of volatility and uncertainty. Recent developments, such as the decline in major indices like the Dow Jones Industrial Average, the S&P 500, and the Nasdaq, have underscored the challenges faced by market participants. These declines were notably influenced by Federal Reserve Chair Jerome Powell’s recent speech, which hinted at potential interest rate adjustments, and the unfolding legal developments surrounding former President Donald Trump. In such turbulent times, it becomes imperative for investors to adopt strategies that not only safeguard their portfolios but also position them for future growth.

To begin with, diversification remains a cornerstone strategy for mitigating risk during market downturns. By spreading investments across various asset classes, sectors, and geographies, investors can reduce the impact of a decline in any single area. For instance, while technology stocks may be experiencing a downturn, other sectors such as healthcare or consumer staples might offer more stability. This balanced approach can help cushion the blow of market volatility and provide a more consistent return over time.

Moreover, maintaining a long-term perspective is crucial. Market declines, while unsettling, are often temporary. Historical data suggests that markets tend to recover and even reach new highs following periods of downturn. Therefore, investors who remain patient and avoid the temptation to make impulsive decisions based on short-term market movements are often better positioned to achieve their financial goals. This long-term view can be particularly beneficial when political uncertainties, such as those surrounding former President Trump, create additional market noise.

In addition to diversification and a long-term outlook, investors should also consider the importance of liquidity. Having a portion of one’s portfolio in liquid assets, such as cash or cash equivalents, provides the flexibility to take advantage of market opportunities as they arise. During periods of decline, high-quality stocks may become undervalued, presenting attractive entry points for investors with available capital. Thus, maintaining liquidity can be a strategic advantage in navigating uncertain times.

Furthermore, staying informed and adaptable is essential. The financial landscape is influenced by a myriad of factors, including economic indicators, geopolitical events, and policy changes. By keeping abreast of these developments, investors can make more informed decisions and adjust their strategies accordingly. For example, if interest rates are expected to rise, as suggested by Powell’s speech, investors might consider reducing exposure to interest-sensitive sectors and exploring opportunities in areas that typically benefit from higher rates.

Lastly, consulting with financial advisors can provide valuable insights and guidance tailored to individual circumstances. Advisors can help investors assess their risk tolerance, set realistic goals, and develop a comprehensive investment plan that aligns with their objectives. In times of political and market uncertainty, having a trusted advisor can offer reassurance and clarity, enabling investors to navigate challenges with confidence.

In conclusion, while market declines and political uncertainties present challenges, they also offer opportunities for strategic investors. By embracing diversification, maintaining a long-term perspective, ensuring liquidity, staying informed, and seeking professional advice, investors can effectively manage risk and position themselves for future success. As the financial landscape continues to evolve, these strategies will remain vital tools in the investor’s arsenal, helping to navigate the complexities of the market with resilience and foresight.

Q&A

1. **What caused the market decline?**

The market decline was influenced by Federal Reserve Chair Jerome Powell’s speech and developments related to former President Donald Trump.

2. **How did the Dow Jones Industrial Average perform?**

The Dow Jones Industrial Average experienced a decline during the trading session.

3. **What was the impact on the S&P 500?**

The S&P 500 also saw a decrease in its value amid the market developments.

4. **How did the Nasdaq Composite Index react?**

The Nasdaq Composite Index declined as well, reflecting broader market concerns.

5. **What did Jerome Powell discuss in his speech?**

Jerome Powell’s speech likely addressed economic conditions and monetary policy, impacting investor sentiment.

6. **What were the developments related to Donald Trump?**

Specific developments regarding Donald Trump, possibly legal or political, contributed to market uncertainty.

7. **How did investors react to these events?**

Investors reacted with caution, leading to a sell-off in equities across major indices.

Conclusion

The recent market update indicates a decline in the Dow, S&P 500, and Nasdaq, driven by investor reactions to Federal Reserve Chair Jerome Powell’s speech and developments related to former President Donald Trump. Powell’s remarks likely influenced market sentiment by reinforcing concerns about interest rate policies and economic outlooks. Concurrently, news surrounding Trump may have introduced additional uncertainty, affecting investor confidence. Together, these factors contributed to a cautious market environment, prompting declines across major indices as investors reassessed risk and adjusted their portfolios accordingly.