“Markets in Motion: Stocks Sway as Treasury Yields Dip Before Key Data Unveiling”

Introduction

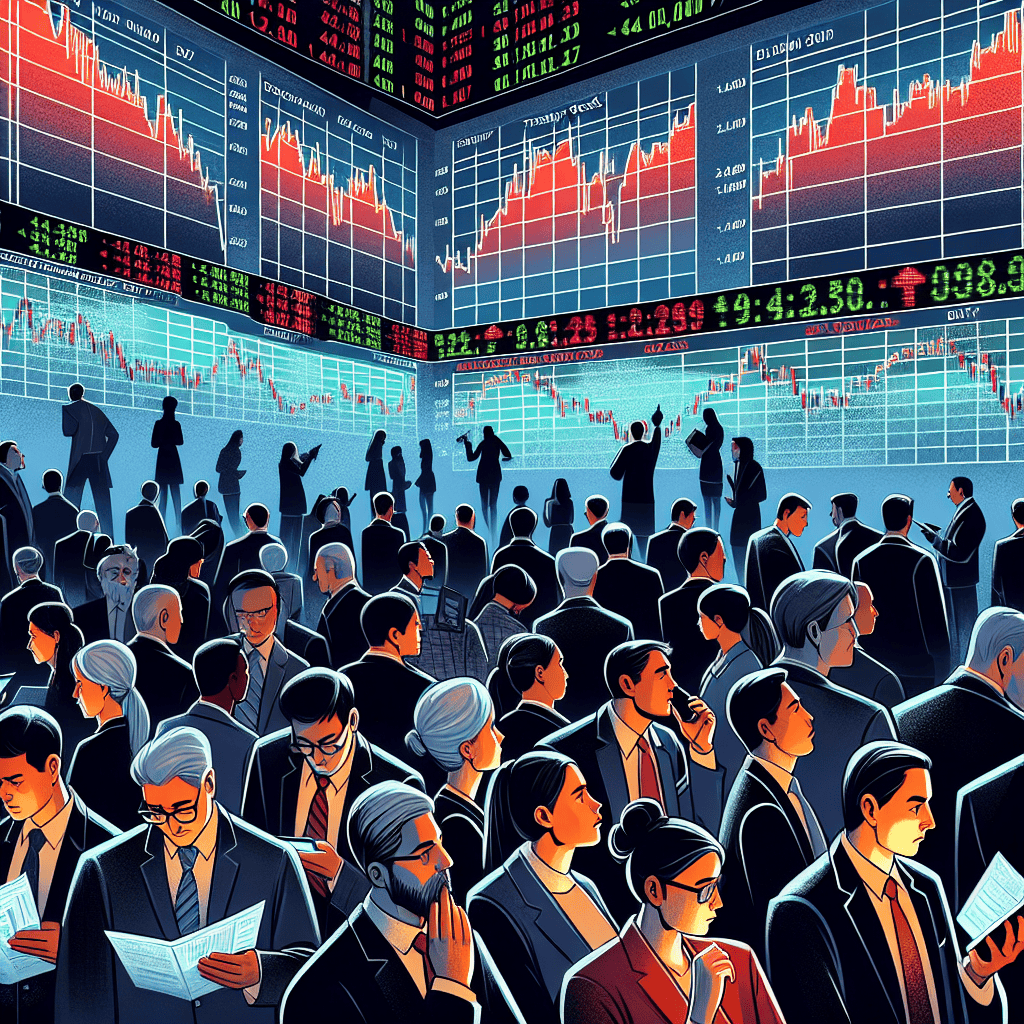

Stocks experienced fluctuations today as investors reacted to a decline in Treasury yields, with market participants closely monitoring upcoming economic data releases. The movement in equities reflects a cautious sentiment as traders assess the potential impact of the data on future monetary policy decisions. The Treasury market’s performance has been a focal point, influencing investor behavior and contributing to the volatility observed in stock prices. As anticipation builds for the forthcoming economic indicators, market analysts are keenly observing how these developments might shape the broader financial landscape.

Impact Of Treasury Decline On Stock Market Volatility

In recent weeks, the financial markets have been characterized by notable fluctuations, with stocks experiencing significant volatility. This turbulence can be largely attributed to the decline in U.S. Treasury yields, which has created a ripple effect across various sectors of the stock market. As investors brace for the upcoming economic data release, the interplay between Treasury yields and stock market performance has become a focal point of analysis.

To understand the impact of Treasury declines on stock market volatility, it is essential to consider the role of Treasury yields as a benchmark for risk-free interest rates. When Treasury yields fall, it often signals a shift in investor sentiment towards a more risk-averse stance. This decline can be driven by several factors, including expectations of slower economic growth, geopolitical tensions, or changes in monetary policy. As yields decrease, the relative attractiveness of equities compared to fixed-income securities can increase, prompting investors to reassess their portfolios.

However, the relationship between Treasury yields and stock prices is not always straightforward. While lower yields can make stocks more appealing due to the lower opportunity cost of holding equities, they can also indicate underlying economic concerns that may weigh on corporate earnings and growth prospects. Consequently, the stock market may experience heightened volatility as investors grapple with these conflicting signals.

Moreover, the anticipation of upcoming economic data releases adds another layer of complexity to the current market environment. Investors are keenly awaiting indicators such as employment figures, inflation rates, and consumer spending data, which could provide further insights into the health of the economy. These data points are crucial in shaping expectations around future monetary policy actions by the Federal Reserve. A stronger-than-expected economic performance could lead to a reassessment of interest rate trajectories, potentially reversing the decline in Treasury yields and impacting stock valuations.

In this context, market participants are closely monitoring sectors that are particularly sensitive to interest rate changes. For instance, the financial sector, which benefits from higher interest rates through improved net interest margins, may face headwinds if yields continue to decline. Conversely, sectors such as utilities and real estate, which are often seen as bond proxies due to their stable cash flows and dividend yields, might experience increased investor interest in a low-yield environment.

Furthermore, the current market dynamics underscore the importance of diversification and risk management strategies. Investors are increasingly seeking to balance their portfolios by incorporating assets that can provide stability amid uncertainty. This approach not only helps mitigate the impact of market volatility but also positions investors to capitalize on potential opportunities that may arise from shifts in economic conditions.

In conclusion, the decline in Treasury yields has introduced a new dimension of volatility to the stock market, as investors navigate the complex interplay between interest rates, economic data, and market sentiment. As the release of key economic indicators looms, market participants remain vigilant, ready to adjust their strategies in response to evolving conditions. While the path forward remains uncertain, the ability to adapt to changing market dynamics will be crucial for investors seeking to achieve their financial objectives in this challenging environment.

Key Data Releases Influencing Stock Market Trends

In recent days, the stock market has experienced notable fluctuations, primarily influenced by the decline in Treasury yields and the anticipation of key economic data releases. Investors are closely monitoring these developments, as they hold significant implications for market trends and investment strategies. The interplay between Treasury yields and stock market performance is a critical factor that investors consider when making decisions. As Treasury yields decline, it often signals a shift in investor sentiment towards safer assets, reflecting concerns about economic growth or inflationary pressures. This shift can lead to increased volatility in the stock market, as investors reassess their portfolios in response to changing economic conditions.

The anticipation of upcoming economic data releases adds another layer of complexity to the current market environment. Investors are particularly focused on data related to inflation, employment, and consumer spending, as these indicators provide valuable insights into the health of the economy. For instance, inflation data can influence expectations regarding future interest rate adjustments by the Federal Reserve, which in turn affects stock valuations. Similarly, employment figures offer a glimpse into the labor market’s strength, impacting consumer confidence and spending patterns. As these data points are released, they have the potential to either alleviate or exacerbate market concerns, leading to further fluctuations in stock prices.

Moreover, the global economic landscape plays a crucial role in shaping market trends. Geopolitical tensions, trade negotiations, and international economic policies can all impact investor sentiment and market dynamics. For example, ongoing trade discussions between major economies can create uncertainty, prompting investors to adopt a cautious approach. Additionally, central bank policies across different regions influence global liquidity and capital flows, further affecting stock market performance. In this interconnected environment, investors must remain vigilant and adaptable, as developments in one part of the world can have ripple effects across global markets.

In light of these factors, market participants are employing various strategies to navigate the current landscape. Diversification remains a key approach, as it allows investors to spread risk across different asset classes and sectors. By maintaining a balanced portfolio, investors can mitigate the impact of market volatility and capitalize on potential opportunities. Furthermore, some investors are turning to defensive stocks, which tend to perform well during periods of economic uncertainty. These stocks, often found in sectors such as utilities and consumer staples, provide stability and consistent returns, making them attractive options in a fluctuating market.

As the market continues to react to Treasury yield movements and upcoming data releases, it is essential for investors to stay informed and agile. Keeping abreast of economic indicators and global developments can help investors make informed decisions and adjust their strategies accordingly. Additionally, consulting with financial advisors and leveraging analytical tools can provide valuable insights and enhance decision-making processes. In conclusion, the current market environment is characterized by fluctuations driven by Treasury yield declines and anticipation of key data releases. By understanding the factors influencing these trends and adopting prudent investment strategies, investors can navigate the complexities of the market and position themselves for long-term success.

Strategies For Investors During Market Fluctuations

In the ever-evolving landscape of financial markets, investors are often faced with the challenge of navigating periods of volatility and uncertainty. The recent fluctuations in stock prices, coupled with a decline in Treasury yields, have underscored the importance of strategic planning and adaptability. As market participants brace for the upcoming data release, which is anticipated to provide further insights into the economic outlook, it becomes crucial for investors to reassess their strategies to mitigate risks and capitalize on potential opportunities.

One of the primary strategies investors might consider during such turbulent times is diversification. By spreading investments across a variety of asset classes, sectors, and geographies, investors can reduce the impact of adverse movements in any single market segment. This approach not only helps in managing risk but also positions investors to benefit from potential gains in different areas of the market. For instance, while equities may experience volatility, fixed-income securities or commodities might offer more stability or even growth, depending on the prevailing economic conditions.

In addition to diversification, maintaining a long-term perspective is essential. Market fluctuations, while unsettling, are often temporary and can be influenced by short-term events or sentiment. By focusing on long-term goals and maintaining a disciplined investment approach, investors can avoid making impulsive decisions that might be detrimental to their portfolios. Historical data suggests that markets tend to recover over time, rewarding those who remain patient and committed to their investment strategies.

Moreover, during periods of market uncertainty, it is prudent for investors to reassess their risk tolerance. Understanding one’s ability and willingness to endure market volatility is crucial in determining the appropriate asset allocation. For some, this might mean reducing exposure to high-risk assets and increasing holdings in more conservative investments. For others, it might present an opportunity to buy undervalued stocks at a discount, provided they have the risk appetite and financial capacity to do so.

Another strategy that can be beneficial is staying informed and vigilant. Keeping abreast of economic indicators, corporate earnings reports, and geopolitical developments can provide valuable insights into market trends and potential turning points. This knowledge enables investors to make informed decisions and adjust their strategies as needed. However, it is equally important to filter out noise and focus on information that is relevant to one’s investment objectives.

Furthermore, consulting with financial advisors or investment professionals can offer additional guidance and perspective. These experts can provide tailored advice based on an individual’s financial situation, goals, and risk tolerance. They can also help in identifying opportunities that may not be immediately apparent to the average investor, thereby enhancing the potential for portfolio growth.

In conclusion, while market fluctuations and declining Treasury yields may pose challenges, they also present opportunities for astute investors. By employing strategies such as diversification, maintaining a long-term perspective, reassessing risk tolerance, staying informed, and seeking professional advice, investors can navigate these uncertain times with greater confidence. As the market awaits the forthcoming data release, these strategies can serve as a foundation for making sound investment decisions that align with one’s financial objectives.

Analyzing The Relationship Between Treasury Yields And Stock Prices

In the ever-evolving landscape of financial markets, the intricate relationship between treasury yields and stock prices remains a focal point for investors and analysts alike. As stocks fluctuate amid a decline in treasury yields, understanding the dynamics at play becomes crucial, especially ahead of significant data releases that could further influence market behavior. The interplay between these two financial instruments is complex, yet it offers valuable insights into broader economic conditions and investor sentiment.

To begin with, treasury yields, which represent the return on investment for U.S. government bonds, are often viewed as a barometer of economic health. When yields decline, it typically signals that investors are seeking safer assets, possibly due to concerns about economic growth or geopolitical uncertainties. This flight to safety can lead to a decrease in yields as bond prices rise. Conversely, rising yields may indicate confidence in economic expansion, prompting investors to shift towards riskier assets like stocks in pursuit of higher returns.

The relationship between treasury yields and stock prices is not always straightforward, as various factors can influence their correlation. For instance, when yields fall, borrowing costs for companies decrease, potentially boosting corporate profits and, by extension, stock prices. However, if the decline in yields is driven by fears of an economic downturn, the positive impact on stocks may be offset by concerns over future earnings growth. Thus, the context in which yield changes occur is paramount in determining their effect on equity markets.

Moreover, the current market environment is characterized by heightened sensitivity to economic data releases, which can significantly sway both treasury yields and stock prices. Investors keenly anticipate these releases, as they provide critical insights into the state of the economy and the potential direction of monetary policy. For example, stronger-than-expected employment data might lead to an increase in yields, as it could prompt the Federal Reserve to consider tightening monetary policy. In turn, this could exert downward pressure on stock prices due to the prospect of higher borrowing costs.

Conversely, weaker economic data might lead to a decline in yields, as it could reinforce expectations of accommodative monetary policy. In such scenarios, stocks might benefit from the prospect of continued low interest rates, which can support higher valuations. However, the underlying reason for the data weakness—such as slowing economic growth—could temper investor enthusiasm for equities.

In addition to economic data, geopolitical developments and central bank communications also play a pivotal role in shaping the relationship between treasury yields and stock prices. For instance, unexpected geopolitical tensions can lead to a surge in demand for safe-haven assets like treasuries, driving yields lower and potentially impacting stock market performance. Similarly, statements from central bank officials regarding future policy actions can influence investor expectations and, consequently, market dynamics.

In conclusion, the relationship between treasury yields and stock prices is multifaceted and influenced by a myriad of factors. As markets fluctuate amid a decline in treasury yields ahead of key data releases, investors must carefully consider the broader economic context and potential implications for monetary policy. By doing so, they can better navigate the complexities of financial markets and make informed investment decisions. Understanding this intricate relationship not only aids in interpreting current market movements but also provides a framework for anticipating future trends in an ever-changing economic landscape.

Historical Context: Treasury Declines And Stock Market Reactions

The intricate relationship between treasury yields and stock market performance has long been a subject of interest for investors and analysts alike. Historically, fluctuations in treasury yields have often served as a barometer for broader economic conditions, influencing investor sentiment and, consequently, stock market movements. As we delve into the historical context of treasury declines and their impact on stock markets, it becomes evident that this dynamic interplay is shaped by a multitude of factors, including economic data releases, monetary policy decisions, and global economic trends.

To understand the current market scenario, it is essential to consider past instances where treasury yields have declined and the subsequent reactions in the stock market. Typically, a decline in treasury yields suggests a flight to safety, as investors seek the relative security of government bonds amid economic uncertainty. This shift often results in lower yields due to increased demand. However, the implications for the stock market are not always straightforward. While lower yields can reduce borrowing costs for companies, potentially boosting corporate profits and stock prices, they can also signal underlying economic weaknesses that may dampen investor confidence.

In previous episodes of declining treasury yields, such as during the financial crisis of 2008 and the early stages of the COVID-19 pandemic in 2020, stock markets experienced significant volatility. During these periods, the initial reaction to falling yields was often negative, as investors grappled with fears of economic downturns. However, as central banks intervened with accommodative monetary policies, including interest rate cuts and quantitative easing, stock markets eventually rebounded, buoyed by the prospect of lower borrowing costs and increased liquidity.

The current market environment presents a similar conundrum. As treasury yields decline ahead of an anticipated data release, investors are once again faced with the challenge of interpreting the signals. On one hand, the decline in yields could be perceived as a precursor to further monetary easing, which might support stock prices. On the other hand, it could also reflect concerns about slowing economic growth or geopolitical tensions, which could weigh on market sentiment.

Moreover, the upcoming data release adds another layer of complexity to the situation. Investors are keenly awaiting key economic indicators, such as employment figures, inflation rates, and consumer spending data, which could provide further insights into the health of the economy. Depending on the nature of the data, market reactions could vary significantly. Strong economic data might alleviate concerns about a slowdown, potentially stabilizing stock markets despite declining yields. Conversely, weaker-than-expected data could exacerbate fears of an economic downturn, leading to increased volatility.

In navigating this uncertain landscape, investors must remain vigilant and adaptable, considering both historical precedents and current market dynamics. While the past provides valuable lessons on the interplay between treasury yields and stock market reactions, each situation is unique, shaped by its own set of circumstances and challenges. As such, a nuanced approach that takes into account both short-term market movements and long-term economic trends is essential for making informed investment decisions.

In conclusion, the historical context of treasury declines and stock market reactions underscores the complexity of financial markets and the myriad factors that influence investor behavior. As markets fluctuate amid declining treasury yields and the anticipation of new economic data, understanding this intricate relationship remains crucial for navigating the ever-evolving financial landscape.

Expert Opinions On Current Market Conditions

In the ever-evolving landscape of global finance, market participants are currently navigating a period of heightened uncertainty, as evidenced by the recent fluctuations in stock prices. This volatility is largely attributed to the decline in Treasury yields, which has captured the attention of investors and analysts alike. As the financial community eagerly anticipates the release of key economic data, expert opinions are converging on the implications of these developments for the broader market.

To begin with, the decline in Treasury yields has been a focal point for market observers. Typically, lower yields suggest a flight to safety, as investors seek refuge in government bonds amid concerns about economic growth or geopolitical tensions. However, the current scenario is more nuanced. Analysts suggest that the decline may be driven by expectations of a potential shift in monetary policy. With central banks around the world grappling with inflationary pressures, there is speculation that interest rates may remain lower for longer than previously anticipated. This has led to a recalibration of risk assessments, prompting investors to reassess their portfolios.

In this context, the stock market’s response has been mixed. On one hand, lower yields can be supportive of equities, as they reduce the cost of borrowing for companies and enhance the relative attractiveness of stocks compared to bonds. On the other hand, the uncertainty surrounding future economic conditions has injected a degree of caution into the market. As a result, stock prices have experienced fluctuations, reflecting the push and pull of these competing forces.

Moreover, the impending release of economic data is adding another layer of complexity to the current market conditions. Investors are keenly awaiting indicators that will provide insights into the health of the economy, particularly in terms of employment, consumer spending, and inflation. These data points are crucial, as they will inform expectations about the trajectory of monetary policy and, by extension, the direction of financial markets. In anticipation of these releases, market participants are adopting a wait-and-see approach, contributing to the observed volatility.

Expert opinions on the current market conditions are varied, yet they converge on a few key themes. Many analysts emphasize the importance of maintaining a diversified portfolio in times of uncertainty. By spreading investments across different asset classes and sectors, investors can mitigate risks and capitalize on potential opportunities. Additionally, there is a consensus that staying informed and agile is crucial. As new data emerges and market conditions evolve, being able to adapt investment strategies will be essential for navigating the current landscape.

Furthermore, some experts highlight the potential for increased market volatility in the near term. As investors digest the forthcoming economic data and its implications for monetary policy, sudden shifts in sentiment could lead to rapid price movements. In this environment, maintaining a long-term perspective and avoiding reactionary decisions will be key to achieving investment objectives.

In conclusion, the current market conditions are characterized by a complex interplay of factors, including declining Treasury yields, stock price fluctuations, and the anticipation of critical economic data. While uncertainty prevails, expert opinions underscore the importance of diversification, adaptability, and a long-term outlook. As the financial community awaits further clarity, these principles will serve as valuable guides for navigating the challenges and opportunities that lie ahead.

Future Projections: How Upcoming Data Releases May Affect Markets

As investors navigate the ever-evolving landscape of financial markets, the recent fluctuations in stock prices have captured significant attention. These movements are occurring against the backdrop of a decline in Treasury yields, a development that has prompted market participants to reassess their strategies. The anticipation of upcoming data releases adds another layer of complexity, as these reports are expected to provide crucial insights into the economic outlook. Understanding how these elements interplay is essential for projecting future market trends.

The decline in Treasury yields has been a focal point for investors, as it often signals shifts in economic sentiment. Lower yields typically suggest that investors are seeking safer assets, reflecting concerns about economic growth or inflation. This environment can lead to volatility in stock markets, as equities are generally more sensitive to changes in economic conditions. As yields fall, the cost of borrowing decreases, potentially stimulating investment and spending. However, the underlying reasons for the decline can also indicate caution, prompting investors to tread carefully.

In this context, the upcoming data releases are poised to play a pivotal role in shaping market dynamics. Key economic indicators, such as employment figures, inflation rates, and consumer spending data, are eagerly awaited by market participants. These reports will offer valuable insights into the health of the economy, influencing investor sentiment and decision-making. For instance, stronger-than-expected employment data could bolster confidence in economic recovery, potentially driving stock prices higher. Conversely, disappointing figures might exacerbate concerns about a slowdown, leading to further market fluctuations.

Moreover, inflation data remains a critical factor in the current economic landscape. Persistent inflationary pressures could prompt central banks to adjust monetary policy, impacting interest rates and, consequently, market valuations. Investors will be closely monitoring these figures to gauge the likelihood of policy shifts, which could have far-reaching implications for both equity and bond markets. A higher-than-anticipated inflation rate might lead to expectations of tighter monetary policy, exerting downward pressure on stock prices. On the other hand, signs of easing inflation could alleviate some of these concerns, providing a more favorable environment for equities.

Consumer spending data is another crucial element that will influence market projections. As a key driver of economic growth, consumer behavior offers insights into the overall economic trajectory. Robust spending figures could signal a resilient economy, potentially boosting investor confidence and supporting stock market gains. However, any indication of weakening consumer demand might raise alarms about the sustainability of economic recovery, contributing to market volatility.

In light of these considerations, market participants are likely to adopt a cautious approach as they await the forthcoming data releases. The interplay between Treasury yields, economic indicators, and investor sentiment underscores the complexity of projecting future market trends. While the current environment presents challenges, it also offers opportunities for those who can adeptly navigate the shifting landscape.

In conclusion, the fluctuations in stock markets amid declining Treasury yields highlight the intricate relationship between economic indicators and investor behavior. As the release of key data approaches, market participants will be keenly focused on interpreting these reports to inform their strategies. The insights gleaned from employment, inflation, and consumer spending data will be instrumental in shaping future market projections, guiding investors as they seek to capitalize on emerging trends while managing potential risks.

Q&A

1. **Question:** What is causing the fluctuation in stock markets?

– **Answer:** The fluctuation in stock markets is being caused by a decline in Treasury yields ahead of an upcoming data release.

2. **Question:** How are Treasury yields impacting the stock market?

– **Answer:** Declining Treasury yields are contributing to the volatility in the stock market as investors adjust their positions in anticipation of new economic data.

3. **Question:** What type of data release is the market anticipating?

– **Answer:** The market is anticipating an economic data release, which could include information on inflation, employment, or other key economic indicators.

4. **Question:** How might the upcoming data release affect investor sentiment?

– **Answer:** The upcoming data release could significantly affect investor sentiment by providing insights into the economic outlook, potentially influencing decisions on buying or selling stocks.

5. **Question:** Are any specific sectors more affected by the Treasury yield decline?

– **Answer:** Interest rate-sensitive sectors, such as financials and real estate, may be more affected by the decline in Treasury yields.

6. **Question:** What strategies might investors use in response to the current market conditions?

– **Answer:** Investors might adopt strategies such as diversifying their portfolios, increasing cash holdings, or focusing on defensive stocks to mitigate risk amid market fluctuations.

7. **Question:** What are the potential long-term implications of the current market volatility?

– **Answer:** The potential long-term implications of current market volatility could include shifts in investment strategies, changes in asset allocation, and adjustments in expectations for economic growth and interest rates.

Conclusion

The recent fluctuations in stock markets, driven by a decline in Treasury yields, highlight the ongoing uncertainty and sensitivity of financial markets to economic data releases. Investors are closely monitoring upcoming data for insights into economic health and potential policy shifts, which could further influence market dynamics. This environment underscores the importance of strategic positioning and risk management as market participants navigate these volatile conditions.