“Unlock Your 401(k) Potential: Strategies to Maximize Your $850k for a Secure Retirement”

Introduction

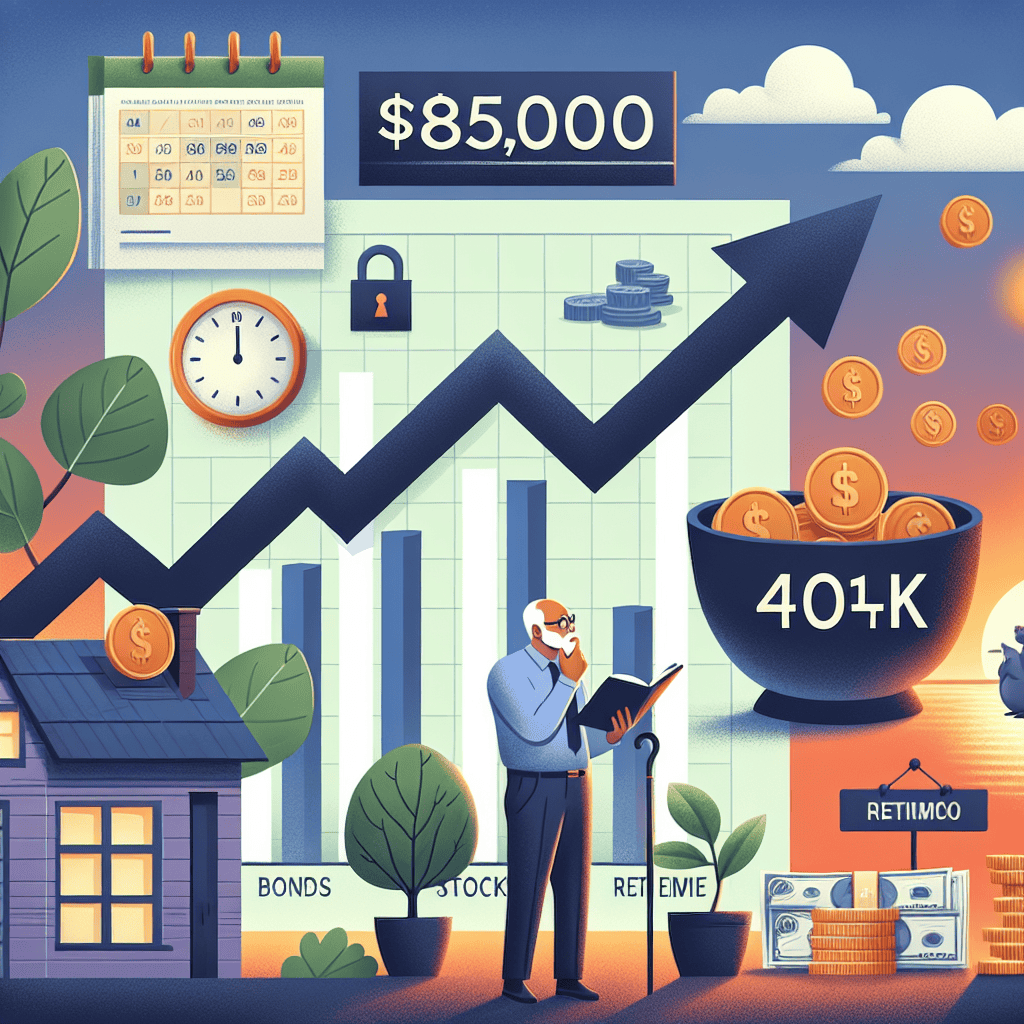

Maximizing your $850k 401(k) for retirement involves strategic planning to ensure financial security and growth. As you approach retirement, it’s crucial to evaluate your investment options, risk tolerance, and withdrawal strategies to make the most of your savings. This guide explores various avenues to optimize your 401(k), including asset allocation, diversification, tax-efficient withdrawals, and potential rollovers to IRAs. By understanding these options, you can tailor a retirement plan that aligns with your financial goals and lifestyle aspirations, ensuring a comfortable and sustainable retirement.

Understanding 401(k) Investment Options: A Comprehensive Guide

As you approach retirement, understanding how to maximize your $850,000 401(k) becomes crucial for ensuring financial security in your golden years. A 401(k) plan is a powerful tool for retirement savings, offering tax advantages and employer contributions that can significantly boost your nest egg. However, to make the most of your 401(k), it is essential to explore the various investment options available and tailor them to your individual financial goals and risk tolerance.

To begin with, it is important to recognize the range of investment choices typically offered within a 401(k) plan. These options often include a mix of mutual funds, target-date funds, and sometimes individual stocks or bonds. Mutual funds are a popular choice, as they pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities. This diversification can help mitigate risk, as the performance of the fund is not reliant on a single investment. On the other hand, target-date funds automatically adjust the asset allocation based on your expected retirement date, gradually shifting from higher-risk investments to more conservative ones as you near retirement.

In addition to these traditional options, some 401(k) plans offer access to a brokerage window, allowing you to invest in a broader array of securities, including individual stocks and exchange-traded funds (ETFs). This option can provide greater flexibility and control over your investment strategy, but it also requires a more hands-on approach and a deeper understanding of the market. Therefore, it is crucial to assess your comfort level with managing investments and your ability to withstand market volatility before venturing into this territory.

As you evaluate these options, it is essential to consider your risk tolerance and time horizon. Younger investors with a longer time until retirement may be more inclined to take on higher-risk investments, such as stocks, to maximize growth potential. Conversely, those closer to retirement may prioritize preserving capital and generating income, making bonds or dividend-paying stocks more attractive. Balancing risk and reward is key to developing a strategy that aligns with your retirement objectives.

Moreover, it is important to regularly review and adjust your investment portfolio to ensure it remains aligned with your goals. Life events, such as changes in employment, health, or family circumstances, can impact your financial needs and risk tolerance. Periodic rebalancing of your portfolio can help maintain your desired asset allocation and prevent overexposure to any single asset class.

Furthermore, understanding the fees associated with your 401(k) investments is vital. High fees can erode your returns over time, so it is important to compare the expense ratios of different funds and consider lower-cost alternatives if available. Many plans offer index funds, which typically have lower fees than actively managed funds, as they aim to replicate the performance of a specific market index.

In conclusion, maximizing your $850,000 401(k) for retirement involves a careful examination of the investment options available within your plan. By considering your risk tolerance, time horizon, and the associated fees, you can develop a strategy that supports your financial goals. Regularly reviewing and adjusting your portfolio will help ensure that you remain on track to achieve a comfortable and secure retirement. As you navigate these decisions, consulting with a financial advisor can provide valuable insights and guidance tailored to your unique situation.

Diversifying Your 401(k) Portfolio for Maximum Growth

When planning for retirement, the importance of a well-diversified 401(k) portfolio cannot be overstated. With an impressive $850,000 already accumulated, the focus should now be on maximizing growth while managing risk. Diversification is a key strategy in achieving this balance, as it involves spreading investments across various asset classes to reduce exposure to any single risk. By doing so, you can potentially enhance returns and safeguard your nest egg against market volatility.

To begin with, it is essential to understand the different asset classes available within a 401(k) plan. Typically, these include stocks, bonds, and cash equivalents. Stocks, or equities, offer the potential for high returns but come with increased risk. Bonds, on the other hand, are generally more stable and provide regular income, albeit with lower growth potential. Cash equivalents, such as money market funds, offer the least risk but also the lowest returns. By allocating your investments across these asset classes, you can create a balanced portfolio that aligns with your risk tolerance and retirement goals.

Moreover, within the stock component of your portfolio, diversification can be further enhanced by investing in a mix of domestic and international equities. This approach allows you to capitalize on growth opportunities in different regions and sectors, thereby reducing the impact of a downturn in any single market. Additionally, consider including a blend of large-cap, mid-cap, and small-cap stocks. Large-cap stocks are typically more stable, while small-cap stocks offer higher growth potential, albeit with increased volatility. Mid-cap stocks provide a balance between the two, offering both growth and stability.

In addition to diversifying across asset classes and geographies, it is also prudent to consider the role of sector diversification. Different sectors of the economy, such as technology, healthcare, and consumer goods, perform differently under various economic conditions. By investing in a range of sectors, you can mitigate the risk associated with a downturn in any particular industry. This approach not only helps in managing risk but also positions your portfolio to benefit from growth in emerging sectors.

Furthermore, as you approach retirement, it is crucial to periodically review and adjust your asset allocation to reflect changes in your risk tolerance and financial goals. A common strategy is to gradually shift towards more conservative investments, such as bonds and cash equivalents, as retirement nears. This transition helps to preserve capital and reduce the impact of market fluctuations on your portfolio. However, it is important to maintain some exposure to equities to ensure continued growth and to combat inflation, which can erode purchasing power over time.

In conclusion, diversifying your 401(k) portfolio is a fundamental strategy for maximizing growth and managing risk as you prepare for retirement. By spreading investments across various asset classes, geographies, and sectors, you can create a robust portfolio that is well-positioned to weather market volatility and capitalize on growth opportunities. Regularly reviewing and adjusting your asset allocation ensures that your investment strategy remains aligned with your evolving financial goals and risk tolerance. With careful planning and a diversified approach, you can maximize the potential of your $850,000 401(k) and secure a comfortable retirement.

The Role of Employer Matching in Maximizing Your 401(k)

When planning for retirement, one of the most effective strategies to maximize your 401(k) is to take full advantage of employer matching contributions. Employer matching is a benefit offered by many companies, where they contribute a certain amount to your 401(k) based on the amount you contribute, up to a specified limit. This can significantly enhance your retirement savings, making it a crucial component of your financial planning.

To begin with, understanding the mechanics of employer matching is essential. Typically, employers match a percentage of the employee’s contribution, often up to a certain percentage of the employee’s salary. For instance, an employer might offer a 50% match on contributions up to 6% of your salary. This means if you contribute 6% of your salary to your 401(k), your employer will contribute an additional 3%. This is essentially free money that can substantially boost your retirement savings over time.

Moreover, the impact of employer matching on your 401(k) can be profound when considering the power of compound interest. Contributions made by your employer, along with your own, are invested and have the potential to grow exponentially over the years. The earlier you start contributing enough to receive the full employer match, the more time your investments have to grow, thereby maximizing your retirement fund. Therefore, it is advisable to contribute at least enough to your 401(k) to receive the full employer match, as failing to do so is akin to leaving money on the table.

In addition to maximizing contributions, it is important to be aware of the vesting schedule associated with employer matching. Vesting refers to the amount of time you must work for your employer before you have full ownership of the matching contributions. While your contributions are always 100% vested, employer contributions may be subject to a vesting schedule. Understanding this schedule is crucial, as leaving the company before you are fully vested could result in forfeiting some or all of the employer’s contributions.

Furthermore, while employer matching is a significant advantage, it is also important to consider the overall investment strategy for your 401(k). Diversifying your investments and periodically reviewing your portfolio can help ensure that your retirement savings are aligned with your long-term financial goals. This includes assessing the risk level of your investments and making adjustments as needed, especially as you approach retirement age.

Additionally, staying informed about changes in contribution limits and tax laws can help you make the most of your 401(k). The IRS periodically adjusts the maximum contribution limits for 401(k) plans, and being aware of these changes can allow you to increase your contributions and take full advantage of tax-deferred growth.

In conclusion, employer matching plays a pivotal role in maximizing your 401(k) for retirement. By contributing enough to receive the full match, understanding vesting schedules, and maintaining a strategic investment approach, you can significantly enhance your retirement savings. As you plan for the future, leveraging employer matching is a key step in ensuring a financially secure retirement.

Tax Strategies for Optimizing Your 401(k) Withdrawals

As you approach retirement, the prospect of managing your $850,000 401(k) can be both exciting and daunting. One of the most critical aspects of this process is understanding the tax implications of your withdrawals. By strategically planning your withdrawals, you can optimize your tax situation and ensure that your retirement savings last as long as possible. To begin with, it is essential to recognize that 401(k) withdrawals are generally taxed as ordinary income. This means that the amount you withdraw will be added to your taxable income for the year, potentially pushing you into a higher tax bracket. Therefore, it is crucial to consider the timing and amount of your withdrawals to minimize your tax liability.

One effective strategy is to take advantage of the standard deduction. By carefully planning your withdrawals, you can keep your taxable income below the threshold that would push you into a higher tax bracket. This approach allows you to maximize the amount of money you can withdraw while minimizing the taxes you owe. Additionally, if you are married, filing jointly can provide further opportunities to optimize your tax situation, as the standard deduction is higher for married couples.

Another option to consider is the Roth conversion strategy. This involves converting a portion of your traditional 401(k) into a Roth IRA. While you will have to pay taxes on the amount converted, the advantage is that future withdrawals from the Roth IRA will be tax-free, provided certain conditions are met. This strategy can be particularly beneficial if you anticipate being in a higher tax bracket in the future or if you want to leave a tax-free inheritance to your heirs.

Moreover, it is important to be aware of the required minimum distributions (RMDs) that begin at age 73. Failing to take these distributions can result in significant penalties, so it is crucial to incorporate them into your withdrawal strategy. By planning ahead, you can ensure that your RMDs do not inadvertently push you into a higher tax bracket. One way to manage this is by starting withdrawals before reaching the age for RMDs, thereby spreading out your taxable income over a longer period.

In addition to these strategies, consider the impact of Social Security benefits on your tax situation. Depending on your total income, up to 85% of your Social Security benefits may be taxable. By coordinating your 401(k) withdrawals with your Social Security benefits, you can potentially reduce the amount of your benefits that are subject to taxation. This requires a careful analysis of your overall income and tax situation, but the potential savings can be substantial.

Furthermore, charitable contributions can also play a role in optimizing your tax strategy. If you are charitably inclined, consider making qualified charitable distributions (QCDs) directly from your 401(k). These distributions can satisfy your RMD requirements while also reducing your taxable income, as they are not included in your adjusted gross income.

In conclusion, maximizing your $850,000 401(k) for retirement involves a comprehensive understanding of the tax implications of your withdrawals. By employing strategies such as timing your withdrawals, considering Roth conversions, managing RMDs, coordinating with Social Security benefits, and utilizing charitable contributions, you can optimize your tax situation and ensure a more financially secure retirement. As always, consulting with a financial advisor or tax professional can provide personalized guidance tailored to your specific circumstances.

Balancing Risk and Reward in Your 401(k) Investments

When planning for retirement, one of the most critical aspects to consider is how to balance risk and reward within your 401(k) investments. With an impressive $850,000 already accumulated in your 401(k), the challenge now lies in optimizing this nest egg to ensure a comfortable and secure retirement. Understanding the dynamics of risk and reward is essential, as it will guide your investment decisions and help you achieve your financial goals.

To begin with, it is important to assess your risk tolerance, which is influenced by factors such as your age, financial situation, and retirement timeline. Younger investors typically have a higher risk tolerance because they have more time to recover from potential market downturns. Conversely, as you approach retirement, preserving capital becomes more crucial, and a more conservative approach may be warranted. Therefore, evaluating your risk tolerance will help you determine the appropriate asset allocation for your 401(k).

Diversification is a key strategy in balancing risk and reward. By spreading your investments across various asset classes, such as stocks, bonds, and real estate, you can mitigate the impact of a poor-performing asset on your overall portfolio. Stocks generally offer higher potential returns but come with increased volatility, while bonds are typically more stable but provide lower returns. Real estate can offer a middle ground, with moderate risk and the potential for steady income. By diversifying your portfolio, you can achieve a balance that aligns with your risk tolerance and investment objectives.

Another important consideration is the selection of specific investments within each asset class. For instance, within the stock portion of your portfolio, you might choose a mix of domestic and international equities, as well as a blend of large-cap, mid-cap, and small-cap stocks. This approach can further enhance diversification and reduce risk. Additionally, consider incorporating index funds or exchange-traded funds (ETFs) into your portfolio, as they offer broad market exposure and typically have lower fees compared to actively managed funds.

Regularly reviewing and rebalancing your portfolio is also crucial in maintaining the desired risk-reward balance. Over time, market fluctuations can cause your asset allocation to drift from its original target. By periodically rebalancing, you can realign your portfolio with your investment strategy and risk tolerance. This process may involve selling overperforming assets and buying underperforming ones, which can be counterintuitive but is essential for long-term success.

Furthermore, it is important to stay informed about economic trends and market conditions, as these can impact your investment strategy. For example, in a low-interest-rate environment, bonds may offer less attractive returns, prompting a shift towards equities or alternative investments. Conversely, during periods of economic uncertainty, a more conservative approach may be prudent. Staying informed will enable you to make timely adjustments to your portfolio and capitalize on emerging opportunities.

Finally, consider seeking professional advice to help navigate the complexities of 401(k) investment management. A financial advisor can provide personalized guidance based on your unique circumstances and help you develop a comprehensive retirement plan. They can also assist in identifying tax-efficient strategies and ensuring that your investment choices align with your long-term objectives.

In conclusion, maximizing your $850,000 401(k) for retirement requires a careful balance of risk and reward. By assessing your risk tolerance, diversifying your portfolio, selecting appropriate investments, regularly rebalancing, staying informed, and seeking professional advice, you can optimize your 401(k) and work towards a financially secure retirement.

The Impact of Fees on Your 401(k) and How to Minimize Them

When planning for retirement, the importance of understanding the impact of fees on your 401(k) cannot be overstated. With an impressive $850,000 nest egg, it is crucial to ensure that your savings are not eroded by unnecessary costs. Fees, often overlooked, can significantly affect the growth of your retirement fund over time. Therefore, it is essential to be aware of the types of fees associated with 401(k) plans and explore strategies to minimize them, thereby maximizing your retirement savings.

To begin with, it is important to recognize the different types of fees that may be associated with your 401(k) plan. These typically include administrative fees, investment fees, and individual service fees. Administrative fees cover the cost of maintaining the plan, such as record-keeping and customer service. Investment fees, on the other hand, are related to the management of the investment options within the plan, including mutual fund expense ratios. Lastly, individual service fees are charged for specific services, such as taking out a loan from your 401(k) or making a withdrawal.

Understanding these fees is the first step in minimizing their impact. One effective strategy is to review the fee disclosure statement provided by your plan administrator. This document outlines the fees associated with your 401(k) and can help you identify areas where you might be paying more than necessary. By comparing these fees with industry averages, you can determine whether your plan is cost-effective or if there are opportunities to reduce expenses.

Moreover, it is advisable to consider the investment options available within your 401(k) plan. Often, plans offer a range of mutual funds with varying expense ratios. Opting for funds with lower expense ratios can significantly reduce the overall cost of your investments. Index funds, for example, typically have lower fees compared to actively managed funds, as they simply track a market index rather than relying on a fund manager’s expertise. By choosing low-cost index funds, you can potentially enhance the growth of your retirement savings over time.

In addition to selecting cost-effective investment options, it is also beneficial to periodically review and rebalance your portfolio. This ensures that your asset allocation remains aligned with your retirement goals and risk tolerance. Rebalancing can help you avoid overexposure to high-fee investments and maintain a diversified portfolio, which can mitigate risk and optimize returns.

Furthermore, it is worth exploring whether your employer offers a low-cost 401(k) plan. Some employers have negotiated lower fees with plan providers, which can result in significant savings for participants. If your current plan has high fees, consider discussing this with your employer or human resources department to explore the possibility of switching to a more cost-effective plan.

Finally, staying informed about regulatory changes and industry trends can also be advantageous. The retirement landscape is constantly evolving, and new regulations may impact the fees associated with 401(k) plans. By keeping abreast of these changes, you can make informed decisions about your retirement savings strategy.

In conclusion, while fees are an inevitable aspect of 401(k) plans, their impact can be minimized through careful planning and informed decision-making. By understanding the types of fees, reviewing your plan’s fee disclosure statement, selecting low-cost investment options, rebalancing your portfolio, and exploring employer-sponsored plans, you can effectively reduce costs and maximize the growth of your $850,000 401(k) for a secure retirement.

Planning for Required Minimum Distributions from Your 401(k)

As you approach retirement, understanding how to manage your 401(k) effectively becomes increasingly important, particularly when it comes to planning for Required Minimum Distributions (RMDs). With an impressive $850,000 nestled in your 401(k), the decisions you make now can significantly impact your financial security in retirement. The Internal Revenue Service (IRS) mandates that individuals begin taking RMDs from their 401(k) accounts starting at age 72. This requirement ensures that the government can collect taxes on the funds that have grown tax-deferred over the years. Therefore, it is crucial to strategize how to handle these distributions to optimize your retirement income and minimize tax liabilities.

To begin with, understanding how RMDs are calculated is essential. The IRS uses a life expectancy factor, which is based on your age and the balance of your 401(k) at the end of the previous year, to determine the amount you must withdraw. As you age, the life expectancy factor decreases, which generally increases the amount you are required to withdraw each year. Consequently, it is important to plan for these increasing distributions and their potential tax implications. One effective strategy is to consider the timing of your withdrawals. While you must start taking RMDs by April 1 of the year following the year you turn 72, delaying your first withdrawal until this deadline means you will have to take two distributions in one year. This could potentially push you into a higher tax bracket, so it may be beneficial to take your first RMD in the year you turn 72 to spread out the tax burden.

Moreover, it is worth exploring the option of converting a portion of your 401(k) into a Roth IRA before reaching the age of 72. Roth IRAs are not subject to RMDs during the account holder’s lifetime, allowing your investments to continue growing tax-free. However, it is important to note that converting to a Roth IRA involves paying taxes on the converted amount, so careful consideration and possibly consulting with a financial advisor are advisable to determine if this strategy aligns with your overall retirement goals.

Additionally, if you are still working at age 72 and do not own more than 5% of the company, you may be able to delay RMDs from your current employer’s 401(k) plan until you retire. This can be advantageous as it allows your investments to continue growing tax-deferred while you are still earning an income. However, this exception does not apply to 401(k) accounts from previous employers, so it is important to consolidate or roll over old accounts if you wish to take advantage of this provision.

Furthermore, consider the impact of RMDs on your overall retirement income strategy. Since RMDs are considered taxable income, they can affect your eligibility for certain tax credits and deductions, as well as increase the amount of Social Security benefits subject to taxation. Therefore, integrating RMDs into a comprehensive retirement income plan that includes other sources of income, such as Social Security and personal savings, is crucial to maintaining your desired lifestyle in retirement.

In conclusion, effectively managing RMDs from your $850,000 401(k) requires careful planning and consideration of various strategies to minimize tax liabilities and maximize retirement income. By understanding the rules surrounding RMDs, exploring options like Roth IRA conversions, and integrating these distributions into a broader retirement plan, you can ensure a more secure and financially stable retirement.

Q&A

1. **What is a 401(k)?**

A 401(k) is a retirement savings plan sponsored by an employer that allows employees to save and invest a portion of their paycheck before taxes are taken out.

2. **How can I maximize my 401(k) contributions?**

Contribute the maximum allowable amount each year, which is $22,500 for 2023, or $30,000 if you are age 50 or older, to take advantage of catch-up contributions.

3. **What investment options should I consider within my 401(k)?**

Diversify your investments across various asset classes such as stocks, bonds, and mutual funds to balance risk and potential returns.

4. **How can I minimize fees in my 401(k)?**

Choose low-cost index funds or ETFs, and be aware of the expense ratios and administrative fees associated with your investment choices.

5. **Should I consider a Roth 401(k) option?**

If available, a Roth 401(k) allows you to contribute after-tax dollars, which can be beneficial if you expect to be in a higher tax bracket during retirement.

6. **How often should I review my 401(k) portfolio?**

Regularly review your portfolio at least annually or when significant life changes occur to ensure it aligns with your retirement goals and risk tolerance.

7. **What are the withdrawal rules for a 401(k) in retirement?**

You can start taking penalty-free withdrawals at age 59½, and you must begin required minimum distributions (RMDs) at age 73, unless you are still working for the employer sponsoring the plan.

Conclusion

To maximize your $850k 401(k) for retirement, consider the following options: diversify your investments to balance risk and return, increase contributions if possible, take advantage of employer matching, and consider Roth conversions for tax diversification. Regularly review and adjust your asset allocation based on your risk tolerance and retirement timeline. Additionally, minimize fees by choosing low-cost investment options and consider consulting a financial advisor for personalized strategies. By implementing these strategies, you can enhance the growth potential of your 401(k) and better secure your financial future in retirement.