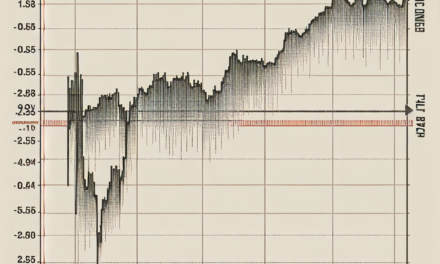

“Dollar Soars: Trump Takes the Lead in Presidential Race”

Introduction

In a dramatic turn of events, global financial markets are witnessing a significant shift as the US dollar experiences a robust surge, coinciding with former President Donald Trump’s lead in the ongoing US presidential election count. This unexpected development has sent ripples through the economic landscape, reflecting investor sentiment and market reactions to the potential implications of a Trump resurgence in American politics. The dollar’s ascent underscores the intricate relationship between political dynamics and currency valuations, as traders and analysts closely monitor the unfolding electoral scenario. As the world watches the election results with bated breath, the dollar’s performance serves as a barometer of market confidence and geopolitical anticipation.

Impact Of A Strong Dollar On Global Markets

The recent surge of the US dollar, driven by the unfolding results of the US presidential election with Donald Trump taking a lead, has sent ripples across global markets. As the dollar strengthens, its impact is felt far and wide, influencing everything from international trade to emerging market economies. This phenomenon is not merely a reflection of domestic political dynamics but also a testament to the interconnectedness of global financial systems.

To begin with, a strong dollar typically exerts pressure on commodities priced in the US currency, such as oil and gold. As the dollar appreciates, these commodities become more expensive for holders of other currencies, often leading to a decrease in demand. Consequently, this can result in lower commodity prices, which can have a cascading effect on economies heavily reliant on commodity exports. For instance, countries in the Middle East and Africa, whose revenues are significantly tied to oil exports, may experience budgetary constraints and economic slowdowns as their income diminishes.

Moreover, the appreciation of the dollar can have profound implications for emerging markets. Many of these economies have substantial amounts of debt denominated in US dollars. As the dollar strengthens, the cost of servicing this debt increases, potentially leading to financial strain. This scenario can be particularly challenging for countries already grappling with economic instability or those with limited foreign exchange reserves. In such cases, governments may be forced to implement austerity measures or seek assistance from international financial institutions, which can further impact their economic growth and social stability.

In addition to affecting commodities and emerging markets, a robust dollar can also influence global trade dynamics. US exports become more expensive for foreign buyers, potentially leading to a decrease in demand for American goods and services. This shift can widen the US trade deficit, as imports become relatively cheaper, encouraging domestic consumers to purchase more foreign goods. While this may benefit countries exporting to the US, it can also exacerbate trade tensions, particularly if the US administration seeks to address the trade imbalance through tariffs or other protectionist measures.

Furthermore, the strong dollar can impact multinational corporations, especially those based in the US. Companies with significant overseas operations may see their foreign earnings diminish when converted back into dollars, affecting their profitability and stock valuations. This scenario can lead to volatility in equity markets, as investors reassess the financial health and growth prospects of these corporations.

On the other hand, a strong dollar can have some positive effects, particularly for US consumers and travelers. Imported goods and international travel become more affordable, potentially boosting consumer spending and contributing to economic growth. However, these benefits may be offset by the broader economic challenges posed by a strong dollar, particularly if it leads to reduced export competitiveness and increased trade tensions.

In conclusion, the surge of the US dollar, spurred by Donald Trump’s lead in the presidential election count, underscores the complex interplay between political events and global financial markets. While a strong dollar can offer certain advantages, its broader impact on commodities, emerging markets, trade dynamics, and multinational corporations highlights the multifaceted challenges that policymakers and businesses must navigate. As the situation continues to evolve, stakeholders across the globe will be closely monitoring developments, seeking to mitigate risks and capitalize on opportunities in an increasingly interconnected world.

Historical Analysis Of Currency Fluctuations During US Elections

The relationship between political events and currency fluctuations is a complex and multifaceted subject, particularly during pivotal moments such as the United States presidential elections. Historically, the U.S. dollar has demonstrated a tendency to react to the political climate, with election outcomes often serving as catalysts for significant currency movements. As the 2024 U.S. presidential election unfolds, the dollar’s recent surge, coinciding with Donald Trump leading in the election count, offers a compelling case study in understanding these dynamics.

To appreciate the current scenario, it is essential to examine past elections and their impact on the dollar. Historically, the U.S. dollar has been sensitive to political uncertainty, with investors often seeking stability in times of potential upheaval. For instance, during the 2016 election, when Donald Trump unexpectedly won, the dollar initially experienced volatility. However, it soon strengthened as markets adjusted to the anticipated economic policies of the Trump administration, which were perceived as pro-business and growth-oriented. This pattern underscores the dollar’s responsiveness to shifts in political power and policy expectations.

Moreover, the dollar’s behavior during elections is not solely influenced by domestic factors. Global perceptions of U.S. political stability and economic policy play a crucial role. In times of uncertainty, the dollar often benefits from its status as a safe-haven currency. Investors worldwide tend to flock to the dollar, seeking refuge from potential market disruptions. This phenomenon was evident during the 2008 financial crisis and subsequent elections, where the dollar’s strength was bolstered by its perceived safety.

In the current election cycle, as Donald Trump leads in the count, the dollar’s surge can be attributed to several factors. Firstly, markets may be anticipating a continuation of Trump’s economic policies, which previously included tax cuts and deregulation, measures that were generally well-received by investors. Secondly, the prospect of political continuity, despite the contentious nature of Trump’s candidacy, may be viewed as a stabilizing factor for markets that prefer predictability over uncertainty.

Furthermore, the dollar’s rise can also be linked to broader economic conditions. The U.S. economy, despite facing challenges such as inflation and geopolitical tensions, remains a dominant force globally. The Federal Reserve’s monetary policy decisions, particularly interest rate adjustments, continue to influence the dollar’s strength. As the election count progresses, any indication of policy shifts or economic strategies under a potential Trump administration could further impact the dollar’s trajectory.

It is also important to consider the role of market psychology in currency fluctuations. Investor sentiment, driven by media narratives and public perception, can amplify currency movements during elections. The dollar’s current surge may reflect a collective market response to the unfolding political landscape, with traders positioning themselves based on anticipated outcomes.

In conclusion, the dollar’s surge as Donald Trump leads in the U.S. presidential election count is a testament to the intricate interplay between politics and currency markets. By examining historical precedents and current economic conditions, one can gain a deeper understanding of how elections influence currency fluctuations. As the election process continues, the dollar’s performance will likely remain a focal point for investors and analysts alike, offering insights into the broader implications of political developments on global financial markets.

Economic Implications Of A Trump Presidency On The US Dollar

As the US presidential election count unfolds, the financial markets are closely monitoring the developments, with the US dollar experiencing a notable surge as former President Donald Trump takes the lead. This unexpected shift in the political landscape has significant implications for the US economy, particularly concerning the strength and stability of the dollar. The currency’s performance is often seen as a barometer of investor confidence, and Trump’s potential return to the presidency is stirring a complex mix of optimism and uncertainty among market participants.

To understand the economic implications of a Trump presidency on the US dollar, it is essential to consider the policies and economic strategies that characterized his previous term. Trump’s administration was marked by a focus on deregulation, tax cuts, and a robust “America First” trade policy. These measures were designed to stimulate domestic economic growth, which, in turn, contributed to a stronger dollar. Investors are now speculating whether a similar approach will be adopted if Trump returns to office, potentially leading to a further appreciation of the currency.

Moreover, Trump’s stance on international trade could play a pivotal role in shaping the dollar’s trajectory. His administration’s aggressive trade policies, including tariffs on Chinese goods, aimed to reduce the trade deficit and protect American industries. While these measures were controversial, they did contribute to a stronger dollar by making US exports more expensive and imports cheaper. If Trump were to resume such policies, the dollar might continue to strengthen, albeit with potential repercussions for global trade relations.

In addition to trade policies, fiscal policy under a Trump presidency could also impact the dollar. The tax cuts implemented during his previous term were intended to boost consumer spending and business investment, leading to economic growth. However, these cuts also resulted in increased federal deficits, raising concerns about long-term fiscal sustainability. Should Trump pursue similar fiscal policies, the immediate effect might be a stronger dollar due to increased economic activity, but the long-term implications could include heightened inflationary pressures and concerns about the national debt.

Furthermore, the Federal Reserve’s monetary policy will be a critical factor in determining the dollar’s future under a Trump presidency. During his previous term, Trump frequently criticized the Fed for maintaining high interest rates, advocating for lower rates to stimulate economic growth. If Trump were to influence the Fed’s policy direction, it could lead to a more accommodative monetary stance, potentially affecting the dollar’s value. A lower interest rate environment might weaken the dollar by reducing the returns on dollar-denominated assets, although this could be offset by other factors such as economic growth and investor sentiment.

In conclusion, the prospect of a Trump presidency brings a complex set of economic implications for the US dollar. While his policies could lead to a stronger dollar in the short term through deregulation, tax cuts, and trade measures, there are potential risks associated with fiscal sustainability and monetary policy. As the election count progresses, investors and policymakers alike will be closely watching the developments, weighing the potential benefits and challenges of a Trump-led economic agenda. The dollar’s performance will ultimately depend on a delicate balance of these factors, reflecting the broader economic landscape and the evolving political dynamics in the United States.

How A Surging Dollar Affects International Trade

The recent surge of the US dollar, driven by Donald Trump’s lead in the presidential election count, has significant implications for international trade. As the dollar strengthens, it exerts a profound influence on global markets, affecting everything from import and export dynamics to the balance of trade between nations. Understanding these effects is crucial for businesses and policymakers alike, as they navigate the complexities of a fluctuating currency landscape.

To begin with, a stronger dollar makes US exports more expensive for foreign buyers. This is because when the dollar appreciates, foreign currencies have less purchasing power relative to the dollar. Consequently, American goods and services become costlier on the international market, potentially leading to a decrease in demand. For US exporters, this scenario can result in reduced sales and profits, as their products become less competitive compared to those from countries with weaker currencies. This shift can have a ripple effect on the US economy, particularly in sectors heavily reliant on exports, such as manufacturing and agriculture.

Conversely, a surging dollar benefits US importers by making foreign goods cheaper. As the dollar gains strength, American consumers and businesses can purchase more with the same amount of money. This can lead to an increase in imports, as foreign products become more attractive due to their lower relative cost. While this may benefit consumers through lower prices and increased variety, it can also pose challenges for domestic producers who face stiffer competition from abroad. The influx of cheaper imports can pressure local industries, potentially leading to job losses and reduced economic activity in certain sectors.

Moreover, the impact of a strong dollar extends beyond trade balances to influence global financial markets. Many countries hold significant amounts of debt denominated in US dollars. As the dollar appreciates, the cost of servicing this debt increases for these nations, as they need more of their local currency to meet their obligations. This can strain national budgets and lead to economic instability, particularly in emerging markets with large dollar-denominated liabilities. Additionally, a robust dollar can lead to capital outflows from these countries, as investors seek higher returns in the US, further exacerbating financial challenges.

Furthermore, the interplay between a strong dollar and commodity prices is another critical aspect to consider. Commodities such as oil, gold, and agricultural products are typically priced in US dollars on the global market. When the dollar strengthens, these commodities become more expensive for buyers using other currencies, potentially leading to a decrease in demand. This can result in lower commodity prices, impacting countries that rely heavily on commodity exports for their economic well-being. For instance, oil-exporting nations may experience reduced revenues, affecting their fiscal stability and economic growth prospects.

In conclusion, the surge of the US dollar, influenced by Donald Trump’s lead in the presidential election count, has far-reaching effects on international trade and the global economy. While it presents opportunities for US importers and consumers, it poses challenges for exporters and domestic industries facing increased competition. Additionally, the implications for global financial markets and commodity prices underscore the interconnectedness of today’s economic landscape. As such, businesses and policymakers must remain vigilant and adaptable, employing strategies to mitigate risks and capitalize on opportunities in this dynamic environment.

Investor Reactions To Election-Driven Currency Changes

As the United States presidential election count unfolds, the financial markets are responding with notable volatility, particularly in the currency sector. The dollar has surged in value as former President Donald Trump takes a lead in the election count, a development that has caught the attention of investors worldwide. This unexpected shift in the political landscape has prompted a series of reactions from investors, who are now recalibrating their strategies in response to the evolving situation.

The dollar’s rise can be attributed to several factors, chief among them being the perception of stability and predictability associated with Trump’s economic policies. During his previous tenure, Trump implemented tax cuts and deregulation measures that were generally well-received by the business community. Consequently, investors are anticipating a potential return to these policies, which they believe could stimulate economic growth and bolster the dollar’s strength. This expectation has led to increased demand for the dollar, driving its value upward in the currency markets.

Moreover, the dollar’s surge is also influenced by the broader context of global economic uncertainty. In times of geopolitical tension or economic instability, investors often flock to the dollar as a safe-haven asset. The current election, marked by contentious debates and legal challenges, has heightened uncertainty, prompting investors to seek refuge in the relative safety of the dollar. This flight to safety is further compounded by concerns over inflation and interest rates, which continue to loom large in the minds of investors.

In addition to these factors, the dollar’s appreciation is also being fueled by the comparative weakness of other major currencies. The euro, for instance, has been under pressure due to ongoing economic challenges within the Eurozone, including sluggish growth and energy supply concerns. Similarly, the Japanese yen has faced headwinds as the Bank of Japan maintains its ultra-loose monetary policy. These dynamics have made the dollar more attractive by comparison, contributing to its upward trajectory.

As investors navigate this complex landscape, they are employing a range of strategies to manage risk and capitalize on potential opportunities. Some are increasing their exposure to dollar-denominated assets, such as U.S. Treasury bonds, which are perceived as low-risk investments. Others are diversifying their portfolios to hedge against potential currency fluctuations, incorporating assets like gold or cryptocurrencies that may offer protection against volatility.

Furthermore, multinational corporations are also adjusting their currency strategies in response to the dollar’s rise. Companies with significant international operations are reassessing their hedging strategies to mitigate the impact of currency fluctuations on their earnings. This involves a careful analysis of currency exposure and the implementation of financial instruments such as forward contracts or options to lock in favorable exchange rates.

In conclusion, the dollar’s surge amid Trump’s lead in the U.S. presidential election count underscores the intricate interplay between politics and financial markets. As investors react to these developments, they are faced with the challenge of balancing risk and opportunity in an environment characterized by uncertainty and rapid change. By closely monitoring the evolving political landscape and adjusting their strategies accordingly, investors aim to navigate the complexities of election-driven currency changes and position themselves for success in the global market.

The Role Of Political Uncertainty In Currency Markets

The role of political uncertainty in currency markets is a subject of perennial interest to economists, investors, and policymakers alike. The recent surge of the US dollar, coinciding with Donald Trump’s lead in the US presidential election count, serves as a compelling case study in understanding how political developments can influence currency valuations. Political uncertainty often acts as a catalyst for volatility in financial markets, and the currency market is no exception. Investors, seeking to hedge against potential risks, frequently turn to currencies perceived as safe havens. The US dollar, with its status as the world’s primary reserve currency, often benefits from this flight to safety, even when the source of uncertainty is domestic.

As Donald Trump leads in the election count, market participants are recalibrating their expectations regarding future economic policies. Trump’s presidency is associated with a distinct set of economic policies, including tax cuts, deregulation, and a focus on domestic manufacturing. These policies, while controversial, are generally perceived as pro-business and have historically been linked to economic growth. Consequently, the prospect of a Trump presidency may lead investors to anticipate a more robust economic outlook, thereby increasing demand for the US dollar. However, it is crucial to recognize that political uncertainty does not always result in a stronger currency. The relationship between political events and currency movements is complex and influenced by a multitude of factors, including investor sentiment, economic fundamentals, and geopolitical considerations.

In the current scenario, the dollar’s surge can also be attributed to the relative stability it offers compared to other currencies. The euro, for instance, is grappling with its own set of challenges, including economic stagnation in key member states and ongoing debates over fiscal policy. Similarly, the British pound remains under pressure due to uncertainties surrounding Brexit and its long-term economic implications. In this context, the US dollar emerges as a relatively attractive option for investors seeking stability amidst global uncertainty. Moreover, the Federal Reserve’s monetary policy plays a significant role in shaping currency dynamics. The central bank’s decisions regarding interest rates and quantitative easing measures have a direct impact on the dollar’s value. A Trump presidency could influence the Fed’s policy trajectory, particularly if it leads to changes in fiscal policy that affect inflation and growth expectations. Investors, therefore, closely monitor political developments to gauge potential shifts in monetary policy, which in turn affect currency valuations.

It is also important to consider the role of market psychology in driving currency movements. Political events often trigger emotional responses among investors, leading to herd behavior and exaggerated market reactions. In the case of the US presidential election, the media’s portrayal of the candidates and their policies can significantly influence investor sentiment, contributing to currency volatility. As such, understanding the interplay between political narratives and market psychology is essential for comprehending the impact of political uncertainty on currency markets.

In conclusion, the surge of the US dollar amidst Donald Trump’s lead in the presidential election count underscores the intricate relationship between political uncertainty and currency markets. While the dollar’s rise can be attributed to a combination of factors, including investor perceptions of economic policy, relative stability, and market psychology, it is essential to recognize the multifaceted nature of this relationship. As political events continue to unfold, market participants must remain vigilant, adapting their strategies to navigate the ever-changing landscape of global currency markets.

Comparing Currency Trends In Past US Elections

The dynamics of currency markets during U.S. presidential elections have long been a subject of interest for economists and investors alike. Historically, the U.S. dollar’s performance during election periods can be influenced by a myriad of factors, including market sentiment, economic policies proposed by candidates, and the overall political climate. As the 2024 U.S. presidential election unfolds, the dollar has experienced a notable surge, coinciding with former President Donald Trump leading in the election count. This development invites a comparison with past elections to understand the underlying trends and implications for the currency market.

In previous election cycles, the dollar’s trajectory has often mirrored the prevailing economic and political uncertainties. For instance, during the 2016 election, when Trump first emerged as a significant contender, the dollar initially experienced volatility. However, following his victory, the dollar strengthened considerably, driven by expectations of pro-business policies, tax reforms, and deregulation. This pattern of initial uncertainty followed by a rally is not uncommon, as markets tend to react to the anticipated economic policies of the winning candidate.

Transitioning to the 2020 election, the dollar’s behavior was somewhat different. The election took place amid the global COVID-19 pandemic, which added layers of complexity to the economic landscape. During this period, the dollar weakened as investors sought safer assets like gold and government bonds, reflecting concerns over economic stability and the potential for prolonged fiscal stimulus. The election of Joe Biden, with his focus on substantial fiscal spending and international cooperation, further influenced the dollar’s trajectory, as markets adjusted to the anticipated shifts in economic policy.

Now, as we observe the 2024 election, the dollar’s surge in response to Trump’s lead in the count can be attributed to several factors. Firstly, Trump’s economic policies, characterized by tax cuts and deregulation, are perceived by many investors as conducive to economic growth, thereby boosting confidence in the dollar. Additionally, Trump’s stance on trade and his approach to international relations may also play a role in shaping market expectations, as investors weigh the potential impacts on global trade dynamics and capital flows.

Moreover, the current economic context cannot be overlooked. The U.S. economy is navigating a complex landscape marked by inflationary pressures, interest rate adjustments, and geopolitical tensions. In such an environment, the dollar often serves as a safe haven for investors seeking stability. Consequently, Trump’s lead in the election count may be reinforcing this perception, prompting a flight to the dollar as a reliable store of value.

In comparing these trends with past elections, it becomes evident that while each election cycle presents unique circumstances, certain patterns persist. The interplay between political developments and economic expectations continues to shape currency markets, with the dollar’s performance serving as a barometer of investor sentiment. As the 2024 election progresses, it will be crucial to monitor how these dynamics evolve and what they signal for the future of the U.S. economy and its currency.

In conclusion, the dollar’s surge amid Trump’s lead in the presidential election count underscores the intricate relationship between political events and currency markets. By examining past elections, we gain valuable insights into how market participants interpret and react to the potential economic policies of presidential candidates. As history has shown, the dollar’s journey through election cycles is a reflection of broader economic narratives, offering a window into the complex interplay of politics and economics on the global stage.

Q&A

1. **Question:** What factors contributed to the dollar surge during the US presidential election count when Trump was leading?

– **Answer:** The dollar surged due to market uncertainty, investor preference for safe-haven assets, and expectations of Trump’s business-friendly policies.

2. **Question:** How did the financial markets react to Trump’s lead in the election count?

– **Answer:** Financial markets experienced volatility, with the dollar strengthening and stock markets initially fluctuating before stabilizing.

3. **Question:** What impact did Trump’s potential victory have on global currencies?

– **Answer:** Global currencies, particularly emerging market currencies, weakened against the dollar due to concerns over potential changes in US trade policies.

4. **Question:** How did investors perceive Trump’s economic policies during the election count?

– **Answer:** Investors anticipated that Trump’s policies would include tax cuts, deregulation, and increased infrastructure spending, which were seen as positive for economic growth.

5. **Question:** What role did safe-haven assets play during the election count?

– **Answer:** Safe-haven assets like the US dollar and gold saw increased demand as investors sought stability amid election uncertainty.

6. **Question:** How did the bond market respond to Trump’s lead in the election count?

– **Answer:** The bond market experienced a sell-off, leading to rising yields, as investors anticipated higher inflation and increased government borrowing under a Trump administration.

7. **Question:** What were the long-term expectations for the dollar if Trump won the presidency?

– **Answer:** Long-term expectations included a stronger dollar due to anticipated fiscal stimulus, higher interest rates, and potential trade policy shifts.

Conclusion

The surge of the US dollar as Donald Trump leads in the presidential election count can be attributed to market perceptions of his economic policies, which are often viewed as business-friendly and supportive of growth. Investors may anticipate tax cuts, deregulation, and increased infrastructure spending, which could boost economic activity and attract capital inflows, thereby strengthening the dollar. However, this reaction also reflects market volatility and uncertainty, as currency fluctuations are sensitive to political developments. The long-term impact on the dollar will depend on the actual implementation of policies and their effects on the US economy and global trade relations.