“Ferrari’s Race Hits a Bump: China Delivery Woes Stall Shares”

Introduction

Ferrari, the iconic Italian luxury sports car manufacturer, has recently experienced a dip in its share prices, attributed to challenges in delivering vehicles to the Chinese market. As one of the world’s largest and most lucrative automotive markets, China represents a significant portion of Ferrari’s global sales strategy. However, logistical hurdles, regulatory changes, and fluctuating demand have posed obstacles to the company’s ability to efficiently meet its delivery targets in the region. These challenges have raised concerns among investors about Ferrari’s growth prospects in China, leading to a noticeable impact on its stock performance. The situation underscores the complexities of navigating international markets and the critical importance of adapting to regional dynamics in the automotive industry.

Impact Of China’s Economic Slowdown On Ferrari’s Market Performance

Ferrari, the iconic Italian luxury sports car manufacturer, has recently experienced a dip in its share value, a development closely tied to the economic slowdown in China. As one of the world’s largest automotive markets, China plays a crucial role in the global strategies of luxury carmakers, including Ferrari. The economic deceleration in China, therefore, poses significant challenges to Ferrari’s market performance, impacting its sales and delivery operations in the region.

To understand the implications of China’s economic slowdown on Ferrari, it is essential to consider the broader context of the Chinese economy. Over the past decade, China has been a powerhouse of economic growth, contributing significantly to the global luxury market. However, recent indicators suggest a deceleration in economic activity, driven by factors such as trade tensions, regulatory changes, and a shift towards more sustainable growth models. This slowdown has led to a decrease in consumer spending, particularly in the luxury segment, where high-end brands like Ferrari have traditionally thrived.

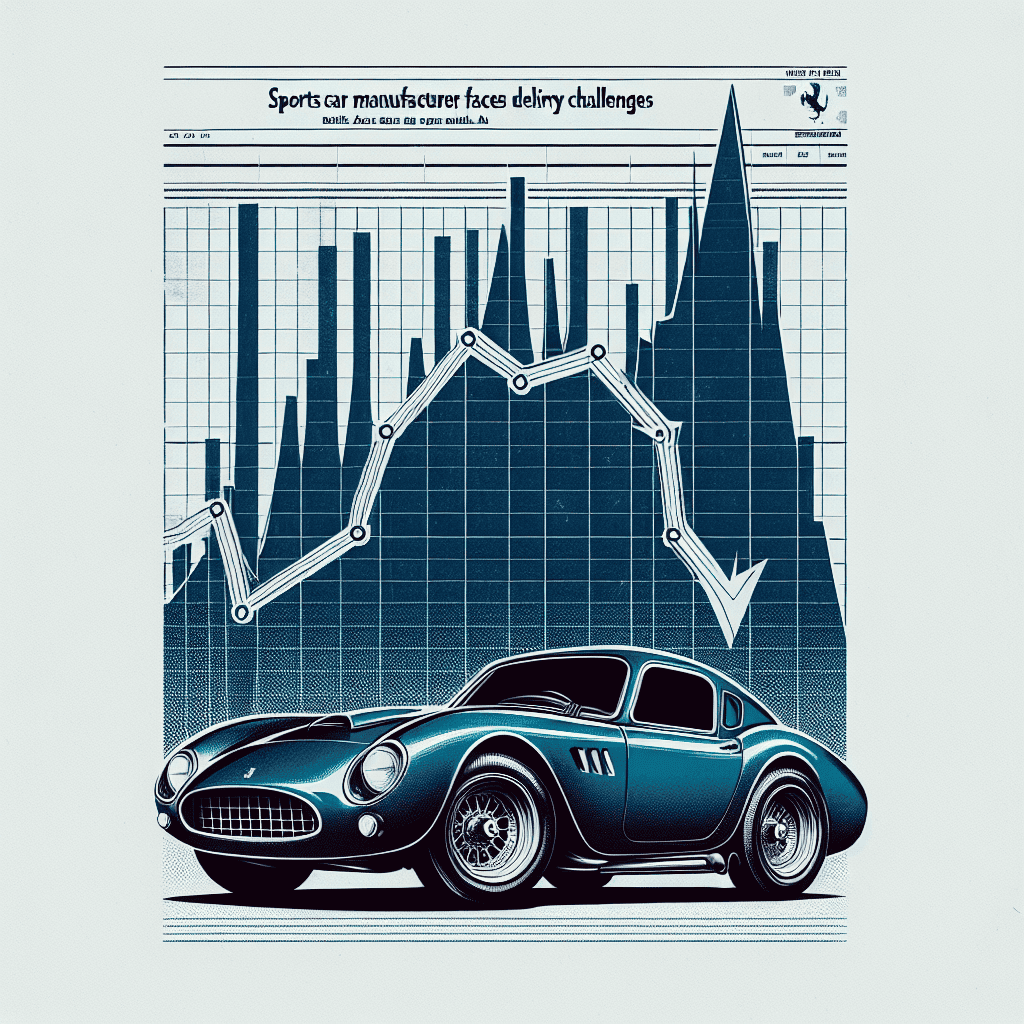

In light of these economic challenges, Ferrari has faced difficulties in maintaining its sales momentum in China. The company has reported delays in vehicle deliveries, a situation exacerbated by logistical disruptions and regulatory hurdles. These delivery challenges have not only affected Ferrari’s sales figures but have also raised concerns among investors about the company’s ability to navigate the complexities of the Chinese market. Consequently, Ferrari’s share price has experienced a decline, reflecting the market’s apprehension about the company’s future performance in this critical region.

Moreover, the impact of China’s economic slowdown on Ferrari is not limited to immediate sales figures. The luxury car market is highly sensitive to consumer confidence and economic stability, both of which have been undermined by the current economic climate in China. As a result, potential buyers may be more hesitant to invest in high-end vehicles, opting instead for more conservative spending choices. This shift in consumer behavior poses a long-term challenge for Ferrari, as it seeks to sustain its brand appeal and market share in China.

Despite these challenges, Ferrari remains committed to its growth strategy in China. The company has been proactive in addressing delivery issues, working closely with local partners to streamline logistics and ensure timely vehicle distribution. Additionally, Ferrari has been investing in brand-building initiatives, such as exclusive events and personalized customer experiences, to reinforce its position as a symbol of luxury and performance in the Chinese market. These efforts are aimed at mitigating the impact of the economic slowdown and maintaining Ferrari’s allure among affluent Chinese consumers.

In conclusion, the economic slowdown in China has undeniably affected Ferrari’s market performance, leading to a dip in its share value and raising concerns about its future prospects in the region. However, Ferrari’s strategic initiatives and commitment to the Chinese market demonstrate its resilience and adaptability in the face of economic challenges. As the company navigates these turbulent times, its ability to maintain its brand prestige and customer loyalty will be crucial in determining its long-term success in China. While the road ahead may be fraught with obstacles, Ferrari’s legacy of excellence and innovation provides a strong foundation for overcoming the challenges posed by China’s economic slowdown.

Ferrari’s Strategic Response To Declining Deliveries In China

Ferrari, the iconic Italian luxury sports car manufacturer, has recently faced a notable dip in its share prices, primarily attributed to challenges in delivering vehicles to the Chinese market. This development has prompted the company to reassess its strategic approach to one of its most significant growth regions. As China continues to be a pivotal market for luxury brands, Ferrari’s response to these delivery challenges is crucial for maintaining its competitive edge and ensuring long-term success.

The decline in Ferrari’s share prices can be traced back to logistical hurdles and regulatory changes in China, which have collectively impacted the company’s ability to meet its delivery targets. These challenges are not unique to Ferrari, as many global automakers have encountered similar obstacles in the region. However, the high stakes associated with the luxury car segment necessitate a swift and effective response from Ferrari to mitigate potential losses and reassure investors.

In response to these challenges, Ferrari has embarked on a comprehensive strategy aimed at enhancing its operational efficiency and strengthening its presence in the Chinese market. One of the key components of this strategy involves optimizing its supply chain to ensure timely deliveries. By collaborating with local partners and leveraging advanced logistics solutions, Ferrari aims to streamline its distribution processes and reduce delays. This approach not only addresses the immediate delivery issues but also positions the company for sustainable growth in the future.

Moreover, Ferrari is keenly aware of the importance of maintaining strong relationships with its Chinese clientele. To this end, the company has intensified its focus on customer engagement and brand loyalty initiatives. By offering exclusive events, personalized experiences, and tailored services, Ferrari seeks to reinforce its brand image and deepen its connection with Chinese consumers. These efforts are designed to enhance customer satisfaction and foster a sense of exclusivity, which is integral to the luxury car buying experience.

In addition to operational improvements and customer-centric initiatives, Ferrari is also exploring opportunities to expand its product offerings in China. Recognizing the diverse preferences of Chinese consumers, the company is considering the introduction of new models and limited-edition vehicles that cater specifically to this market. By aligning its product portfolio with local tastes and preferences, Ferrari aims to capture a larger share of the luxury car segment in China and drive sales growth.

Furthermore, Ferrari’s strategic response extends to its marketing and communication efforts. The company is leveraging digital platforms and social media channels to enhance its brand visibility and engage with a broader audience in China. By adopting a more localized approach to marketing, Ferrari can effectively communicate its brand values and product offerings to Chinese consumers, thereby strengthening its market position.

In conclusion, Ferrari’s strategic response to the challenges of declining deliveries in China underscores the company’s commitment to maintaining its leadership in the luxury automotive sector. Through a combination of supply chain optimization, customer engagement, product diversification, and targeted marketing efforts, Ferrari is poised to navigate the complexities of the Chinese market and emerge stronger. While the current challenges have undoubtedly impacted the company’s share prices, Ferrari’s proactive measures and strategic foresight are likely to restore investor confidence and drive future growth. As the company continues to adapt to the evolving landscape, its ability to innovate and respond to market dynamics will be key to sustaining its success in China and beyond.

Analyzing The Financial Implications Of Ferrari’s Share Price Drop

Ferrari, the iconic luxury sports car manufacturer, has recently experienced a dip in its share price, a development that has caught the attention of investors and market analysts alike. This decline is primarily attributed to challenges the company faces in delivering vehicles to China, a crucial market for luxury carmakers. Understanding the financial implications of this situation requires a closer examination of the factors at play and their potential impact on Ferrari’s overall performance.

To begin with, China represents a significant portion of the global luxury car market, and Ferrari has long been keen on expanding its presence in this region. The country’s growing affluent population and increasing appetite for luxury goods make it an attractive destination for high-end brands. However, recent logistical challenges have hindered Ferrari’s ability to meet the demand in China, leading to delays in vehicle deliveries. These disruptions are largely due to ongoing supply chain issues, exacerbated by the global semiconductor shortage and stringent COVID-19 restrictions that have affected manufacturing and transportation.

The immediate consequence of these delivery challenges is a decrease in sales revenue from the Chinese market. As a result, investors have become increasingly concerned about Ferrari’s ability to maintain its growth trajectory in the face of these obstacles. This apprehension has been reflected in the company’s share price, which has seen a noticeable decline. The drop in share price is not only a reflection of current operational difficulties but also an indication of the market’s perception of Ferrari’s future prospects in China.

Moreover, the financial implications extend beyond just the immediate loss of revenue. The delay in deliveries could potentially damage Ferrari’s brand reputation in China, where consumer expectations for luxury products are exceptionally high. Any perceived inability to deliver on promises could lead to a loss of customer trust and loyalty, which are critical components of success in the luxury market. Consequently, Ferrari may need to invest additional resources into marketing and customer relationship management to mitigate any negative perceptions and reassure its clientele.

In addition to these challenges, Ferrari must also navigate the broader economic landscape, which is currently characterized by inflationary pressures and fluctuating currency exchange rates. These factors can further complicate the company’s financial planning and operational strategies. For instance, increased costs of raw materials and production could squeeze profit margins, while currency volatility might affect the profitability of international sales.

Despite these challenges, it is important to note that Ferrari remains a strong and resilient brand with a loyal customer base. The company’s commitment to innovation and excellence in automotive engineering continues to set it apart from competitors. Furthermore, Ferrari’s strategic initiatives, such as expanding its hybrid and electric vehicle offerings, demonstrate its adaptability and forward-thinking approach. These efforts could potentially offset some of the current challenges and position the company for long-term success.

In conclusion, while the dip in Ferrari’s share price amidst China delivery challenges presents immediate financial implications, the company’s robust brand equity and strategic initiatives offer a foundation for recovery and growth. Investors and stakeholders will be closely monitoring how Ferrari addresses these issues and capitalizes on emerging opportunities in the evolving global market. As the situation unfolds, the company’s ability to navigate these complexities will be crucial in determining its financial trajectory and maintaining its status as a leader in the luxury automotive industry.

The Role Of Global Supply Chain Disruptions In Ferrari’s China Challenges

Ferrari, the iconic Italian luxury sports car manufacturer, has recently faced a dip in its share prices, a development closely linked to challenges in delivering vehicles to the Chinese market. This situation underscores the broader issue of global supply chain disruptions, which have become a significant concern for many industries worldwide. As the world continues to grapple with the aftermath of the COVID-19 pandemic, supply chain disruptions have emerged as a persistent obstacle, affecting production timelines and delivery schedules across various sectors. For Ferrari, a brand synonymous with precision and excellence, these disruptions pose a unique set of challenges, particularly in a market as crucial as China.

China represents a significant growth opportunity for Ferrari, given the country’s burgeoning affluent class and its increasing appetite for luxury goods. However, the complexities of global supply chains have made it difficult for Ferrari to meet the rising demand in this key market. The intricate web of suppliers, manufacturers, and logistics providers that constitute the global supply chain has been severely tested in recent years. Factors such as port congestion, container shortages, and fluctuating transportation costs have all contributed to delays and inefficiencies. For a company like Ferrari, which relies on a seamless supply chain to maintain its reputation for quality and exclusivity, these disruptions can have a pronounced impact.

Moreover, the automotive industry, in particular, has been hit hard by shortages of critical components, such as semiconductors. These tiny chips are essential for the advanced electronics that modern vehicles, including Ferrari’s high-performance cars, depend on. The semiconductor shortage has forced many automakers to slow down production or, in some cases, halt it altogether. For Ferrari, this means that even if demand in China remains robust, the ability to deliver vehicles on time is compromised. Consequently, the company’s share prices have reflected investor concerns about its capacity to navigate these supply chain challenges effectively.

In addition to component shortages, geopolitical tensions have also played a role in exacerbating supply chain issues. Trade policies and tariffs can influence the flow of goods across borders, adding another layer of complexity to an already strained system. For Ferrari, which sources materials and components from various parts of the world, navigating these geopolitical hurdles is crucial to maintaining its production schedules and meeting customer expectations in China.

Furthermore, the environmental impact of global supply chains is becoming an increasingly important consideration for companies like Ferrari. As the world moves towards more sustainable practices, the pressure to reduce carbon footprints and adopt greener logistics solutions is mounting. This shift adds another dimension to the supply chain challenges Ferrari faces, as it must balance the need for efficiency with the demand for sustainability.

In conclusion, the dip in Ferrari’s share prices amidst delivery challenges in China highlights the intricate and multifaceted nature of global supply chain disruptions. As the company strives to overcome these obstacles, it must address not only the immediate logistical issues but also the broader geopolitical and environmental factors at play. By doing so, Ferrari can better position itself to capitalize on the opportunities presented by the Chinese market and continue to uphold its legacy of luxury and performance. As the world continues to evolve, the ability to adapt to these changes will be crucial for Ferrari and other global brands navigating the complexities of the modern supply chain landscape.

Investor Reactions To Ferrari’s Performance In The Chinese Market

Ferrari, the iconic luxury sports car manufacturer, has recently faced a dip in its share prices, primarily attributed to challenges in delivering vehicles to the Chinese market. This development has sparked a range of reactions from investors, who are closely monitoring the company’s performance in one of the world’s most lucrative automotive markets. As China continues to be a significant growth driver for luxury brands, any disruption in this market can have substantial implications for a company’s financial health and investor confidence.

The Chinese market has long been a focal point for Ferrari, given the country’s burgeoning affluent class and their increasing appetite for luxury goods. However, recent logistical challenges have hindered Ferrari’s ability to meet the high demand in this region. These challenges include supply chain disruptions, regulatory hurdles, and the ongoing impact of global economic uncertainties. Consequently, Ferrari’s inability to deliver vehicles promptly has led to a backlog of orders, which in turn has affected its revenue projections and stock performance.

Investors, who are always keenly attuned to market dynamics, have reacted with a mix of concern and cautious optimism. On one hand, the dip in share prices reflects immediate apprehensions about Ferrari’s short-term performance in China. The market’s response underscores the critical importance of the Chinese market to Ferrari’s overall growth strategy. On the other hand, some investors remain optimistic about Ferrari’s long-term prospects, citing the brand’s strong global reputation and its ability to innovate and adapt to changing market conditions.

Moreover, Ferrari’s management has been proactive in addressing these challenges, reassuring investors of their commitment to resolving the delivery issues. The company has announced plans to enhance its supply chain resilience and streamline its operations to better navigate the complexities of the Chinese market. These strategic initiatives are aimed at not only overcoming current obstacles but also positioning Ferrari for sustained growth in the future.

In addition to operational adjustments, Ferrari is also focusing on expanding its product offerings to cater to the evolving preferences of Chinese consumers. The introduction of new models and customization options is expected to bolster Ferrari’s appeal in this competitive market. By aligning its product strategy with consumer trends, Ferrari aims to reinforce its brand presence and capture a larger share of the luxury automotive segment in China.

While the current challenges are significant, it is important to recognize that Ferrari is not alone in facing such issues. Many global companies are grappling with similar difficulties as they navigate the complexities of international markets. The broader economic environment, characterized by fluctuating trade policies and geopolitical tensions, further complicates the landscape for luxury brands operating in China.

In conclusion, the recent dip in Ferrari’s share prices amidst delivery challenges in China has elicited varied reactions from investors. While concerns about short-term performance persist, there is also a recognition of Ferrari’s potential for long-term growth. The company’s efforts to address logistical issues and adapt its strategy to meet consumer demands are seen as positive steps towards regaining investor confidence. As Ferrari continues to navigate these challenges, its performance in the Chinese market will remain a key area of focus for investors and industry analysts alike.

Long-term Prospects For Ferrari In The Asian Automotive Sector

Ferrari, the iconic Italian luxury sports car manufacturer, has recently faced a dip in its share prices, primarily attributed to delivery challenges in China. This development has sparked discussions about the long-term prospects for Ferrari in the Asian automotive sector, a region that has been increasingly pivotal for luxury car brands. Despite the current hurdles, the broader outlook for Ferrari in Asia remains promising, driven by several key factors that continue to bolster its position in the market.

To begin with, the Asian automotive sector, particularly in China, has been experiencing robust growth over the past decade. The burgeoning middle class and the rise in disposable income have fueled a surge in demand for luxury goods, including high-end automobiles. Ferrari, with its storied heritage and reputation for exclusivity, has been well-positioned to capitalize on this trend. However, the recent delivery challenges in China have highlighted the complexities of operating in such a dynamic market. These challenges are not unique to Ferrari; they reflect broader logistical and regulatory issues that many international companies face when doing business in China.

Nevertheless, Ferrari’s commitment to the Asian market remains unwavering. The company has been actively expanding its presence in the region, opening new dealerships and enhancing its service networks to cater to the growing customer base. Moreover, Ferrari’s strategy of limited production runs and bespoke customization options continues to resonate with affluent Asian consumers who value exclusivity and personalization. This approach not only reinforces brand loyalty but also helps maintain the brand’s allure amidst increasing competition from other luxury car manufacturers.

In addition to its strategic initiatives, Ferrari’s long-term prospects in Asia are bolstered by the region’s evolving automotive landscape. The shift towards electric vehicles (EVs) presents both challenges and opportunities for Ferrari. While the transition to EVs poses a potential threat to traditional internal combustion engine models, Ferrari has been proactive in embracing this change. The company has announced plans to introduce hybrid and fully electric models, aligning with global trends towards sustainability and innovation. This forward-thinking approach positions Ferrari to capture a share of the growing demand for luxury EVs in Asia, where environmental concerns and government incentives are driving the adoption of cleaner technologies.

Furthermore, Ferrari’s brand strength and heritage play a crucial role in its long-term success in Asia. The brand’s association with performance, craftsmanship, and exclusivity continues to captivate consumers across the region. Ferrari’s participation in motorsports, particularly Formula 1, further enhances its brand visibility and appeal, creating a strong emotional connection with fans and potential customers. This brand equity is a significant asset that Ferrari can leverage as it navigates the challenges and opportunities in the Asian automotive sector.

In conclusion, while Ferrari’s recent share dip due to delivery challenges in China may raise concerns, the company’s long-term prospects in the Asian automotive sector remain robust. By addressing logistical issues, expanding its presence, and embracing technological advancements, Ferrari is well-equipped to sustain its growth trajectory in the region. The combination of strategic initiatives, brand strength, and adaptability to market trends positions Ferrari to continue thriving in Asia, ensuring that its legacy of luxury and performance endures for years to come.

Comparing Ferrari’s China Strategy With Other Luxury Car Brands

Ferrari, the iconic Italian luxury sports car manufacturer, has recently faced a dip in its share prices, primarily attributed to challenges in delivering vehicles to the Chinese market. This development has sparked discussions about Ferrari’s strategy in China, especially when compared to other luxury car brands that have navigated similar challenges. Understanding the nuances of Ferrari’s approach in contrast to its competitors provides valuable insights into the broader dynamics of the luxury automotive industry in China.

To begin with, Ferrari’s brand is synonymous with exclusivity and performance, a reputation it has meticulously cultivated over decades. This exclusivity is a double-edged sword in the Chinese market, where demand for luxury vehicles is burgeoning. On one hand, the allure of owning a Ferrari is immensely appealing to China’s affluent consumers. On the other hand, the limited production numbers that maintain Ferrari’s exclusivity can hinder its ability to meet the growing demand. This contrasts with brands like Mercedes-Benz and BMW, which have adopted a more flexible production strategy, allowing them to scale up their offerings to cater to the Chinese market’s appetite for luxury vehicles.

Moreover, Ferrari’s distribution strategy in China is another area where it diverges from its peers. While brands such as Audi and Porsche have established extensive dealership networks across China, Ferrari has opted for a more selective approach, focusing on a few high-end showrooms in major cities. This strategy aligns with Ferrari’s brand ethos but can limit its market penetration compared to competitors who have a broader presence. The limited number of dealerships can also exacerbate delivery challenges, as logistical complexities increase when serving a vast and diverse market like China.

In addition to distribution, the adaptation of product offerings to suit local preferences is a critical factor in the success of luxury car brands in China. Companies like Rolls-Royce and Bentley have introduced models and features specifically tailored to Chinese tastes, such as extended wheelbases and enhanced rear-seat comfort, recognizing the cultural importance of chauffeured driving. Ferrari, however, has remained steadfast in its commitment to its core sports car lineup, which may not fully align with the preferences of Chinese consumers who often prioritize luxury and comfort over performance.

Furthermore, the regulatory environment in China presents unique challenges that can impact delivery and sales strategies. Stringent emissions standards and import tariffs can affect the pricing and availability of luxury vehicles. Brands like Tesla have circumvented some of these challenges by establishing local manufacturing facilities, thereby reducing costs and improving delivery times. Ferrari, with its commitment to Italian craftsmanship, has not pursued local production, which may contribute to its delivery challenges and impact its competitive positioning.

Despite these challenges, it is important to note that Ferrari’s brand strength and loyal customer base provide a solid foundation for future growth in China. The company’s recent investments in hybrid technology and its plans to introduce electric models could also enhance its appeal in a market increasingly focused on sustainability. By carefully balancing its brand values with strategic adaptations, Ferrari has the potential to overcome its current challenges and strengthen its position in the Chinese luxury car market.

In conclusion, while Ferrari’s current delivery challenges in China have impacted its share prices, the situation underscores the complexities of operating in a rapidly evolving market. By comparing Ferrari’s strategy with those of other luxury car brands, it becomes evident that a nuanced approach, balancing exclusivity with adaptability, is essential for success in China. As the market continues to grow, Ferrari’s ability to navigate these challenges will be crucial in maintaining its status as a leader in the luxury automotive industry.

Q&A

1. **What caused the dip in Ferrari shares?**

Ferrari shares dipped due to challenges in delivering vehicles to China, a key market for luxury car manufacturers.

2. **How significant is the Chinese market for Ferrari?**

China is one of Ferrari’s largest and fastest-growing markets, making it crucial for the company’s sales and revenue growth.

3. **What specific challenges is Ferrari facing in China?**

Ferrari is facing logistical and regulatory challenges that are delaying vehicle deliveries to Chinese customers.

4. **How has the market reacted to the news of delivery challenges?**

Investors reacted negatively, leading to a decline in Ferrari’s share price as concerns over potential revenue impacts grew.

5. **Are there any broader economic factors affecting Ferrari’s performance in China?**

Broader economic factors such as trade tensions, regulatory changes, and economic slowdown in China may also be impacting Ferrari’s performance.

6. **What steps is Ferrari taking to address these challenges?**

Ferrari is working on improving its supply chain logistics and engaging with Chinese authorities to resolve regulatory issues.

7. **What is the outlook for Ferrari’s performance in China moving forward?**

While short-term challenges persist, Ferrari remains optimistic about long-term growth in China, given the strong demand for luxury vehicles.

Conclusion

Ferrari shares have experienced a decline due to challenges in delivering vehicles to the Chinese market. This dip reflects investor concerns over the company’s ability to navigate logistical and regulatory hurdles in one of its key growth regions. The situation underscores the importance of China as a critical market for luxury automakers and highlights the potential impact of geopolitical and supply chain issues on global operations. To mitigate these challenges, Ferrari may need to enhance its supply chain resilience and adapt its strategies to better align with the evolving regulatory landscape in China.