“Seize the Opportunity: Transform Potential into Profit with Wall Street’s Top Pick!”

Introduction

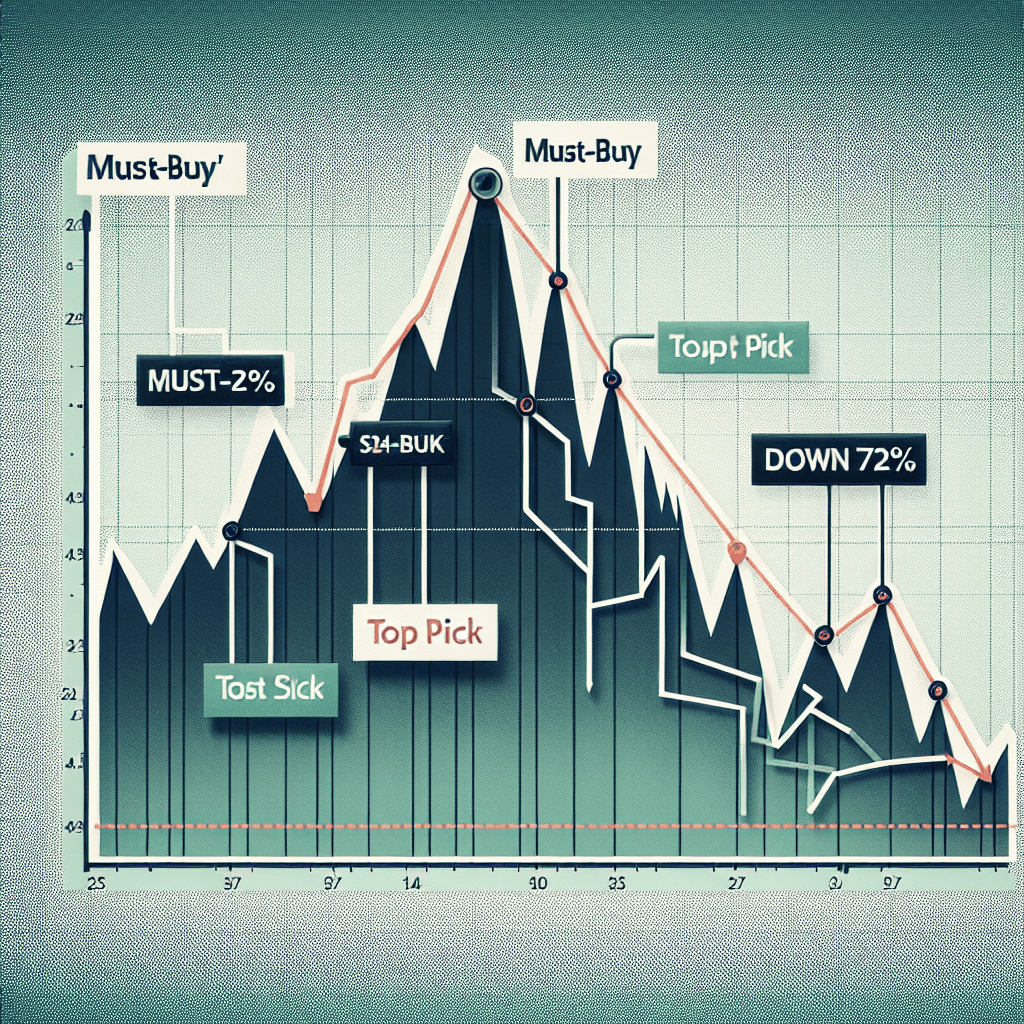

Wall Street’s Top Pick: A Must-Buy Stock Down 72% delves into the intriguing world of investment opportunities, spotlighting a particular stock that has captured the attention of leading financial analysts despite its significant decline. This stock, now trading at a fraction of its previous value, presents a compelling case for investors seeking potential high returns amidst market volatility. The report explores the factors contributing to the stock’s downturn, the strategic insights driving Wall Street’s bullish outlook, and the potential catalysts that could trigger a remarkable turnaround. As seasoned investors know, the stock market is a landscape of risks and rewards, and this analysis provides a comprehensive overview of why this beleaguered stock is considered a must-buy by some of the most astute minds in finance.

Understanding The Market Dynamics Behind A 72% Stock Drop

In the ever-evolving landscape of financial markets, the performance of individual stocks can often be as unpredictable as the weather. A stock that has recently caught the attention of Wall Street analysts is one that has experienced a precipitous decline of 72%. While such a dramatic drop might initially deter potential investors, it is essential to delve deeper into the market dynamics that have contributed to this decline and understand why it is now being hailed as a must-buy opportunity.

To begin with, the stock in question belongs to a company that operates in a highly volatile industry, where market sentiment can shift rapidly based on external factors. The initial decline in the stock’s value can be attributed to a confluence of macroeconomic challenges, including rising interest rates and geopolitical tensions, which have collectively exerted downward pressure on the broader market. These factors have led to a risk-averse environment, prompting investors to shy away from stocks perceived as high-risk, thereby exacerbating the decline.

Moreover, the company has faced its own set of challenges, including a temporary setback in its supply chain operations and a subsequent dip in quarterly earnings. These operational hiccups, while significant, are not uncommon in the industry and are often viewed as short-term obstacles rather than long-term impediments. It is crucial to recognize that the company’s fundamentals remain robust, with a strong balance sheet and a history of innovation that positions it well for future growth.

In light of these considerations, Wall Street analysts have begun to reassess the stock’s potential, identifying it as a compelling investment opportunity. The rationale behind this optimistic outlook is multifaceted. Firstly, the company’s management has implemented strategic initiatives aimed at streamlining operations and enhancing efficiency, which are expected to yield positive results in the coming quarters. Additionally, the company is poised to benefit from emerging trends within its industry, such as technological advancements and increasing consumer demand, which could serve as catalysts for a rebound in its stock price.

Furthermore, the current valuation of the stock presents an attractive entry point for investors. With the stock trading at a significant discount relative to its historical averages, there is considerable upside potential for those willing to adopt a long-term perspective. This sentiment is echoed by several prominent analysts who have upgraded their ratings on the stock, citing its undervaluation and growth prospects as key factors.

It is also worth noting that the broader market environment is showing signs of stabilization, with central banks taking measures to address inflationary pressures and restore investor confidence. As these macroeconomic conditions improve, the stock is likely to benefit from a more favorable market backdrop, further enhancing its appeal as an investment.

In conclusion, while a 72% drop in a stock’s value may initially appear alarming, it is imperative to consider the underlying market dynamics and company-specific factors that have contributed to this decline. By doing so, investors can gain a more nuanced understanding of the stock’s potential and make informed decisions. As Wall Street’s top pick, this stock represents a unique opportunity for those seeking to capitalize on its current undervaluation and future growth prospects.

Analyzing Wall Street’s Criteria For A Must-Buy Stock

In the ever-evolving landscape of financial markets, Wall Street analysts are constantly on the lookout for stocks that present compelling investment opportunities. One such stock, currently down 72% from its peak, has emerged as a top pick among analysts, sparking interest and debate among investors. To understand why this stock is considered a must-buy, it is essential to delve into the criteria that Wall Street employs when evaluating such opportunities.

First and foremost, analysts often look for companies with strong fundamentals, even if their stock prices have suffered significant declines. A drop in stock price does not necessarily reflect the intrinsic value of a company; rather, it may be indicative of broader market trends or temporary setbacks. In this case, the company in question boasts a robust balance sheet, with manageable debt levels and a healthy cash flow. These financial metrics suggest that the company is well-positioned to weather economic downturns and capitalize on future growth opportunities.

Moreover, Wall Street analysts pay close attention to a company’s competitive advantage, often referred to as its “moat.” A strong moat can protect a company from competitors and ensure long-term profitability. This particular stock is backed by a company with a unique product offering and a loyal customer base, which together create a formidable barrier to entry for potential rivals. Such competitive advantages are crucial in maintaining market share and driving future earnings growth.

In addition to these factors, analysts also consider the management team’s track record and strategic vision. Effective leadership can be a significant determinant of a company’s success, particularly in challenging market conditions. The management team of this must-buy stock has demonstrated a history of prudent decision-making and adaptability, which instills confidence in their ability to navigate the current market environment and execute on growth initiatives.

Furthermore, Wall Street’s enthusiasm for this stock is bolstered by its attractive valuation. Despite the recent decline in its share price, the stock is trading at a price-to-earnings ratio that is below its historical average and the industry norm. This suggests that the stock may be undervalued, presenting a potential buying opportunity for investors seeking to capitalize on its long-term growth prospects. Analysts often view such discrepancies between a company’s market price and its intrinsic value as a signal to buy, particularly when other fundamental indicators remain strong.

Additionally, the broader market context plays a role in Wall Street’s assessment. Economic indicators, such as interest rates and inflation, can influence investor sentiment and stock valuations. In this instance, the macroeconomic environment appears to be stabilizing, with signs of recovery in key sectors that are relevant to the company’s operations. This positive outlook provides a supportive backdrop for the stock’s potential rebound.

In conclusion, Wall Street’s designation of this stock as a must-buy is rooted in a comprehensive analysis of its fundamentals, competitive positioning, management quality, valuation, and the broader economic landscape. While the stock’s 72% decline may initially raise concerns, a deeper examination reveals a company with solid prospects for recovery and growth. For investors willing to look beyond short-term market fluctuations, this stock represents a compelling opportunity to invest in a business with enduring strengths and promising future potential.

The Potential For Recovery: Historical Case Studies Of Similar Stocks

In the ever-volatile world of stock markets, the allure of a potential recovery story often captivates investors. Wall Street analysts have recently spotlighted a particular stock, currently down 72%, as a must-buy opportunity. To understand the potential for recovery, it is instructive to examine historical case studies of similar stocks that have experienced significant downturns yet managed to rebound impressively. By analyzing these precedents, investors can gain insights into the factors that might drive a similar resurgence in the current stock under consideration.

Historically, several stocks have demonstrated remarkable recoveries after substantial declines. For instance, during the early 2000s, Apple Inc. faced a challenging period marked by dwindling market share and financial losses. However, through strategic leadership changes, innovative product launches, and a renewed focus on design and user experience, Apple managed to reverse its fortunes. The introduction of the iPod and later the iPhone revolutionized the tech industry, propelling Apple to unprecedented heights. This case underscores the importance of innovation and strategic pivots in facilitating a stock’s recovery.

Similarly, Netflix provides another compelling example. In 2011, the company faced a significant backlash due to a poorly received pricing strategy and the subsequent loss of subscribers. The stock plummeted, and many questioned the company’s future. Nevertheless, Netflix’s commitment to original content production and its strategic shift towards streaming allowed it to recover and dominate the entertainment industry. This case highlights the critical role of adaptability and foresight in navigating market challenges and achieving a successful turnaround.

Moreover, the financial sector offers its own set of recovery narratives. Citigroup, one of the largest financial institutions, experienced a dramatic decline during the 2008 financial crisis. The stock’s value plummeted as the company grappled with massive losses and a tarnished reputation. However, through rigorous restructuring efforts, government support, and a focus on core banking operations, Citigroup managed to stabilize and eventually recover. This example illustrates the significance of robust restructuring and external support in facilitating a stock’s resurgence.

In light of these historical examples, the current stock identified by Wall Street analysts as a must-buy presents intriguing possibilities. While past performance is not indicative of future results, the common threads in these recovery stories offer valuable lessons. Innovation, strategic adaptability, and effective restructuring emerge as key drivers of recovery. For the stock in question, understanding its industry dynamics, management’s strategic vision, and any potential catalysts for growth will be crucial in assessing its recovery potential.

Furthermore, it is essential to consider the broader economic environment and market sentiment. Economic recovery, technological advancements, and shifts in consumer behavior can all play pivotal roles in a stock’s resurgence. Investors should remain vigilant, continuously monitoring developments that could impact the stock’s trajectory.

In conclusion, while the stock market is inherently unpredictable, historical case studies of similar stocks provide a framework for evaluating recovery potential. By examining past recoveries, investors can identify patterns and strategies that may apply to the current stock down 72%. As Wall Street analysts advocate for this must-buy opportunity, understanding the lessons from history can guide investors in making informed decisions, balancing the allure of potential gains with the inherent risks of market volatility.

Key Factors Driving Wall Street’s Optimism Despite The Decline

In the ever-volatile world of stock markets, Wall Street analysts often find themselves navigating through a labyrinth of financial data, market trends, and economic indicators to identify potential investment opportunities. One such opportunity has emerged in the form of a stock that, despite experiencing a significant decline of 72%, has been earmarked as a must-buy by leading financial experts. This recommendation may seem counterintuitive at first glance, but a closer examination reveals several key factors driving Wall Street’s optimism.

To begin with, the company’s fundamentals remain robust, despite the recent downturn in its stock price. Financial analysts have pointed out that the decline is not reflective of the company’s intrinsic value but rather a result of external market pressures. These pressures include macroeconomic factors such as interest rate hikes and geopolitical tensions, which have collectively contributed to a broader market sell-off. However, the company’s balance sheet remains strong, with healthy cash reserves and manageable debt levels, providing a solid foundation for future growth.

Moreover, the company’s strategic initiatives have positioned it well for long-term success. It has been investing heavily in research and development, aiming to innovate and expand its product offerings. This commitment to innovation is expected to drive revenue growth and enhance competitive advantage in its industry. Additionally, the company has been actively pursuing strategic partnerships and acquisitions, which are anticipated to open new markets and diversify its revenue streams. These forward-looking strategies have not gone unnoticed by Wall Street analysts, who view them as catalysts for future stock price appreciation.

Furthermore, the company’s management team has demonstrated a track record of effective leadership and execution. Under their guidance, the company has consistently met or exceeded earnings expectations, even in challenging market conditions. This level of performance instills confidence among investors, as it suggests that the management team is capable of navigating through periods of uncertainty and delivering shareholder value. Analysts believe that this strong leadership will be instrumental in steering the company back to a growth trajectory.

In addition to these internal factors, the broader industry outlook also plays a crucial role in shaping Wall Street’s positive sentiment. The industry in which the company operates is poised for significant growth, driven by technological advancements and increasing consumer demand. As a key player in this industry, the company is well-positioned to capitalize on these trends, further bolstering its growth prospects. Analysts argue that the current stock price does not adequately reflect the company’s potential to benefit from these industry tailwinds.

Finally, it is important to consider the valuation aspect. With the stock down 72%, it is trading at a significant discount compared to its historical valuation multiples. This presents an attractive entry point for investors seeking to capitalize on the stock’s potential upside. Wall Street analysts have highlighted that the current valuation offers a compelling risk-reward proposition, making it an opportune time for investors to consider adding the stock to their portfolios.

In conclusion, while the 72% decline in the stock price may initially raise concerns, a comprehensive analysis reveals several compelling reasons for Wall Street’s optimism. The company’s strong fundamentals, strategic initiatives, effective management, favorable industry outlook, and attractive valuation collectively make it a must-buy stock. As such, investors who are willing to look beyond the short-term volatility may find this stock to be a valuable addition to their investment portfolios.

Risk Assessment: Is This Stock A Good Fit For Your Portfolio?

In the ever-evolving landscape of financial markets, investors are constantly on the lookout for opportunities that promise substantial returns. One such opportunity has recently emerged, capturing the attention of Wall Street analysts and investors alike. A particular stock, which has experienced a significant decline of 72% from its peak, is now being hailed as a must-buy by some of the most astute minds in the industry. However, before making any investment decisions, it is crucial to conduct a thorough risk assessment to determine if this stock is a suitable fit for your portfolio.

To begin with, understanding the reasons behind the stock’s dramatic decline is essential. Often, a steep drop in stock price can be attributed to a combination of factors, including market volatility, company-specific issues, or broader economic conditions. In this case, the decline may have been exacerbated by temporary setbacks such as supply chain disruptions, regulatory challenges, or shifts in consumer demand. By analyzing these factors, investors can gain insight into whether the stock’s current valuation accurately reflects its intrinsic value or if it presents a potential buying opportunity.

Moreover, it is important to consider the company’s fundamentals. A comprehensive evaluation of the company’s financial health, including its revenue growth, profit margins, and debt levels, can provide valuable insights into its long-term viability. Additionally, assessing the company’s competitive position within its industry, its management team’s track record, and its strategic initiatives can help investors gauge its potential for recovery and growth. If the company demonstrates strong fundamentals and a clear path to overcoming its challenges, the stock may indeed represent a compelling investment opportunity.

Furthermore, investors should take into account the broader market context. Economic indicators such as interest rates, inflation, and geopolitical developments can significantly impact stock performance. In a rising interest rate environment, for instance, companies with high levels of debt may face increased borrowing costs, which could affect their profitability. Conversely, a favorable economic outlook may provide a tailwind for companies poised to capitalize on growth opportunities. By considering these macroeconomic factors, investors can better assess the potential risks and rewards associated with the stock.

In addition to these considerations, diversification remains a key principle of sound investment strategy. While the stock in question may offer attractive upside potential, it is important to balance this with the overall risk profile of your portfolio. Diversifying across different asset classes, sectors, and geographies can help mitigate the impact of any single investment’s underperformance. Therefore, investors should evaluate how this stock fits within their broader investment objectives and risk tolerance.

Finally, it is essential to remain vigilant and adaptable in the face of changing market conditions. Regularly reviewing your investment thesis and staying informed about developments related to the company and its industry can help you make informed decisions. By maintaining a disciplined approach and being prepared to adjust your strategy as needed, you can better navigate the inherent uncertainties of the stock market.

In conclusion, while the stock’s significant decline may present a compelling buying opportunity, a thorough risk assessment is crucial to determine its suitability for your portfolio. By carefully evaluating the company’s fundamentals, considering the broader market context, and adhering to sound investment principles, you can make informed decisions that align with your financial goals.

The Role Of Market Sentiment In Stock Price Fluctuations

Market sentiment plays a pivotal role in the fluctuations of stock prices, often driving them to levels that may not accurately reflect the intrinsic value of the underlying companies. This phenomenon is particularly evident in the case of Wall Street’s top pick, a must-buy stock that has seen its price plummet by 72%. Understanding the dynamics of market sentiment can provide valuable insights into why such significant price movements occur and how investors can navigate these turbulent waters.

Market sentiment refers to the overall attitude of investors toward a particular security or the financial market as a whole. It is influenced by a myriad of factors, including economic indicators, geopolitical events, and company-specific news. When sentiment is positive, investors are generally optimistic about future prospects, leading to increased buying activity and rising stock prices. Conversely, negative sentiment can result in widespread selling, driving prices down, sometimes to levels that are disconnected from the company’s actual performance or potential.

In the case of the stock in question, the dramatic 72% decline can largely be attributed to a shift in market sentiment rather than a fundamental deterioration in the company’s business model or financial health. Often, such declines are precipitated by external factors that create a ripple effect across the market. For instance, macroeconomic concerns such as interest rate hikes or inflation fears can lead to a broad sell-off, affecting even fundamentally strong stocks. Additionally, sector-specific challenges or regulatory changes can disproportionately impact certain industries, further exacerbating negative sentiment.

Despite the steep decline, Wall Street analysts have identified this stock as a top pick, underscoring the disconnect between market sentiment and intrinsic value. Analysts often rely on a combination of quantitative metrics and qualitative assessments to determine a stock’s potential. These include evaluating the company’s earnings growth, competitive position, management effectiveness, and industry trends. When these factors remain robust, a significant drop in stock price may present a compelling buying opportunity for long-term investors.

Moreover, historical data suggests that stocks experiencing sharp declines due to negative sentiment often rebound once the market’s perception aligns more closely with the company’s fundamentals. This phenomenon is known as mean reversion, where prices eventually return to their long-term average. Investors who can identify such opportunities and maintain a disciplined approach may benefit from substantial gains when sentiment shifts back to a more positive outlook.

It is crucial for investors to differentiate between sentiment-driven price movements and those rooted in fundamental changes. Conducting thorough due diligence and maintaining a long-term perspective can help mitigate the risks associated with sentiment-driven volatility. Additionally, diversification across different sectors and asset classes can provide a buffer against the impact of sudden sentiment shifts.

In conclusion, while market sentiment can lead to significant stock price fluctuations, it also presents opportunities for astute investors. The case of Wall Street’s top pick, despite its 72% decline, highlights the importance of looking beyond short-term market noise and focusing on the underlying value of a company. By understanding the role of market sentiment and employing a strategic investment approach, investors can navigate the complexities of the stock market and potentially capitalize on undervalued opportunities.

Expert Opinions: Diverse Perspectives On The Stock’s Future

In the ever-evolving landscape of financial markets, investors are constantly on the lookout for opportunities that promise substantial returns. One such opportunity has recently emerged, capturing the attention of Wall Street analysts and investors alike. A particular stock, which has experienced a significant decline of 72% from its peak, is now being hailed as a must-buy by several experts. This dramatic drop in value has piqued the interest of both seasoned investors and newcomers, prompting a closer examination of the factors contributing to its current valuation and future potential.

To begin with, the stock in question belongs to a company that has been a prominent player in its industry, boasting a robust track record of innovation and growth. Despite its recent downturn, many analysts argue that the company’s fundamentals remain strong. They point to its solid balance sheet, competitive positioning, and strategic initiatives aimed at capturing new market opportunities. These factors, they assert, provide a compelling case for the stock’s potential recovery and long-term growth.

Moreover, the broader market conditions have played a significant role in the stock’s decline. The recent economic uncertainties, coupled with sector-specific challenges, have led to a general sell-off, affecting even fundamentally sound companies. However, experts suggest that this presents a unique buying opportunity for investors who are willing to look beyond short-term volatility. By capitalizing on the current low valuation, investors could potentially reap substantial rewards as the market stabilizes and the company’s strategic initiatives begin to bear fruit.

In addition to the company’s intrinsic strengths, several external factors are also expected to contribute to its resurgence. For instance, the anticipated recovery of the global economy is likely to boost demand for the company’s products and services. Furthermore, regulatory changes and technological advancements within the industry could provide additional tailwinds, enhancing the company’s competitive edge and market share. These developments, when combined with the company’s strategic focus on innovation and expansion, are expected to drive significant growth in the coming years.

However, it is important to acknowledge the diverse perspectives on the stock’s future. While many experts are optimistic about its potential, some caution against the inherent risks associated with investing in a stock that has experienced such a steep decline. They highlight the need for investors to conduct thorough due diligence, considering factors such as market conditions, competitive dynamics, and the company’s ability to execute its strategic plans effectively. By doing so, investors can make informed decisions that align with their risk tolerance and investment objectives.

In conclusion, the stock’s current valuation presents a compelling opportunity for investors seeking to capitalize on its potential recovery and long-term growth prospects. While the recent decline may have raised concerns, the company’s strong fundamentals, coupled with favorable external factors, provide a solid foundation for future success. As with any investment, it is crucial for investors to weigh the potential rewards against the associated risks, ensuring that their decisions are guided by a comprehensive understanding of the stock’s prospects. By adopting a balanced approach, investors can position themselves to benefit from the stock’s anticipated resurgence, while also safeguarding their portfolios against potential uncertainties.

Q&A

1. **What is the stock that is down 72%?**

– The specific stock is not mentioned; additional context is needed.

2. **Why is this stock considered a must-buy?**

– Analysts may see potential for recovery, strong fundamentals, or undervaluation.

3. **What sector does this stock belong to?**

– The sector is not specified; more information is required.

4. **What are the key factors driving the stock’s decline?**

– Possible factors include market volatility, poor earnings, or industry challenges.

5. **What are the potential catalysts for the stock’s recovery?**

– Catalysts could include strategic changes, market rebound, or new product launches.

6. **Who are the analysts recommending this stock?**

– Specific analysts or firms are not identified without further details.

7. **What is the target price set by analysts for this stock?**

– The target price is not provided; it varies by analyst and requires specific data.

Conclusion

Wall Street’s top pick, a stock currently down 72%, presents a compelling investment opportunity for those willing to embrace risk for potential high rewards. Despite its significant decline, analysts may see underlying value or growth potential that the market has overlooked. Factors such as strong fundamentals, innovative products, or strategic positioning in a growing industry could contribute to its appeal. However, investors should conduct thorough due diligence, considering both the reasons for its past decline and the catalysts for future growth, to ensure alignment with their risk tolerance and investment strategy.