“Boeing’s Descent: Strike Resolved, Union Absolved.”

Introduction

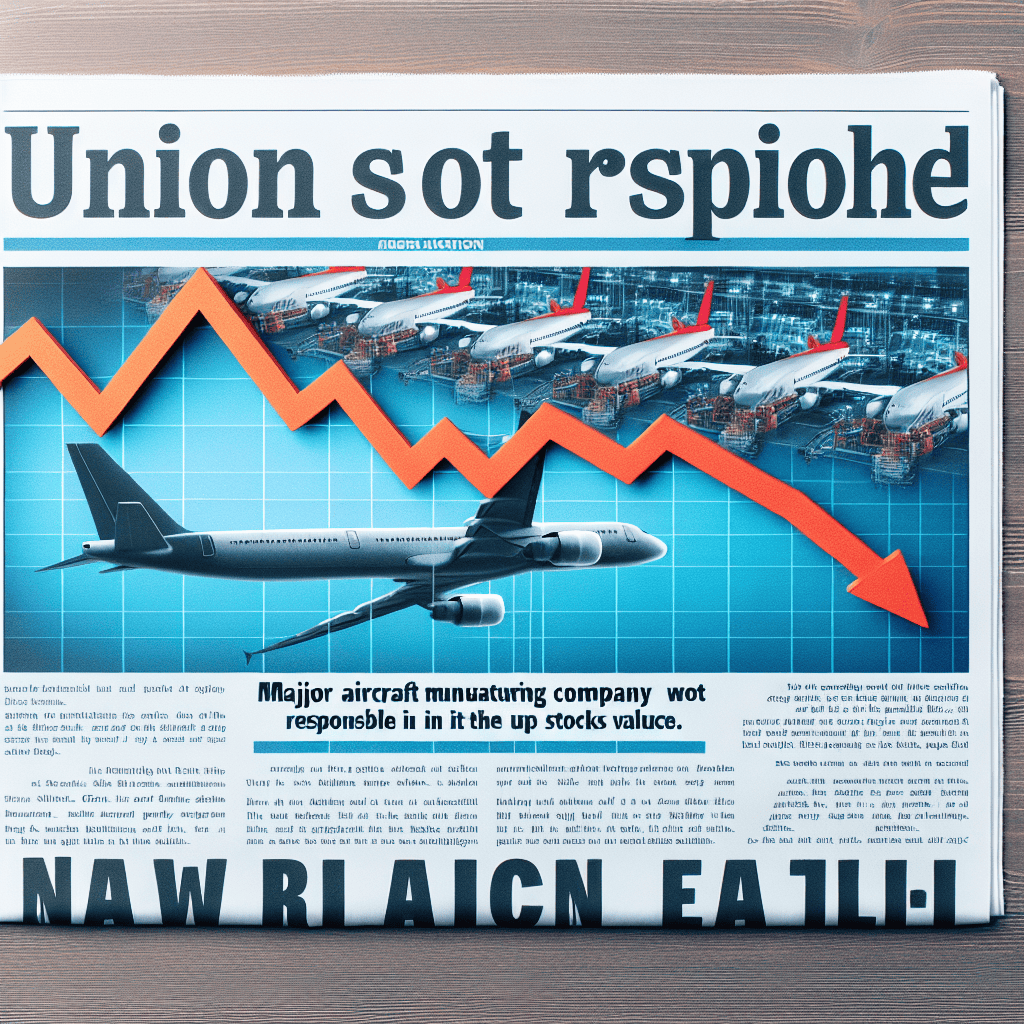

Boeing, a titan in the aerospace industry, has recently faced a notable decline in its stock value, a development that has captured the attention of investors and market analysts alike. This downturn comes on the heels of a significant labor strike that has now concluded, yet the resolution of this industrial action has not alleviated the pressures on Boeing’s financial performance. Interestingly, the union involved in the strike has been largely absolved of blame for the stock’s poor performance, suggesting that other underlying factors are at play. These may include broader market conditions, operational challenges, or strategic missteps that continue to weigh heavily on Boeing’s market valuation. As the company navigates these turbulent times, stakeholders are keenly observing how Boeing will address these challenges to restore investor confidence and stabilize its financial trajectory.

Impact Of The Strike On Boeing’s Stock Performance

The recent decline in Boeing’s stock performance has been a topic of considerable discussion among investors and analysts alike. While the conclusion of the strike by the International Association of Machinists and Aerospace Workers (IAM) was expected to bring stability, the anticipated rebound in Boeing’s stock has not materialized as swiftly as some had hoped. It is crucial to understand that the union’s actions are not the primary factor behind the stock’s downturn. Instead, a confluence of broader market conditions and internal challenges has played a more significant role in shaping the current financial landscape for Boeing.

To begin with, the strike, which lasted several weeks, undoubtedly had an immediate impact on Boeing’s operations. Production delays and disruptions were inevitable, leading to short-term financial setbacks. However, the resolution of the strike was expected to alleviate these issues, allowing Boeing to resume its production schedule and meet its delivery targets. Despite this, the stock’s performance has continued to falter, suggesting that other underlying factors are at play.

One of the primary reasons for the continued decline in Boeing’s stock is the broader economic environment. The global aerospace industry is still grappling with the aftereffects of the COVID-19 pandemic, which severely disrupted air travel and, consequently, aircraft demand. Although there has been a gradual recovery, the pace has been uneven, with some regions experiencing slower rebounds than others. This sluggish recovery has affected Boeing’s order book, leading to investor concerns about future revenue streams.

Moreover, Boeing has been dealing with its own set of challenges that extend beyond the strike. The company has faced scrutiny over safety issues, particularly in relation to its 737 MAX aircraft. Although the aircraft has been cleared to fly again after extensive modifications and regulatory approvals, lingering concerns about safety and reliability continue to weigh on investor sentiment. These issues have been compounded by supply chain disruptions, which have affected the timely delivery of aircraft components, further straining Boeing’s production capabilities.

In addition to these operational challenges, Boeing is navigating a competitive landscape that is becoming increasingly complex. Rival companies are making significant strides in innovation and efficiency, putting pressure on Boeing to maintain its market position. This competitive pressure necessitates substantial investment in research and development, which can strain financial resources and impact short-term profitability.

Despite these challenges, it is important to note that the union’s actions during the strike were not the root cause of Boeing’s stock decline. The IAM’s demands were primarily focused on securing better wages and working conditions for its members, which are standard objectives in labor negotiations. The resolution of the strike, achieved through mutual agreement, indicates that both parties were able to find common ground without causing long-term damage to the company’s financial health.

In conclusion, while the strike did have a temporary impact on Boeing’s operations, it is not the primary factor behind the continued decline in the company’s stock performance. Broader economic conditions, internal challenges, and competitive pressures have played a more significant role in shaping the current financial outlook for Boeing. As the company works to address these issues, investors will be closely monitoring its ability to adapt and thrive in an evolving aerospace industry.

Analysis Of Boeing’s Post-Strike Recovery Strategies

Boeing’s recent stock decline has been a topic of considerable discussion among investors and industry analysts alike. The end of the strike by the International Association of Machinists and Aerospace Workers (IAM) was expected to bring some relief to the aerospace giant. However, the anticipated recovery in Boeing’s stock price has not materialized as swiftly as hoped. This situation prompts a closer examination of the factors influencing Boeing’s post-strike recovery strategies and the broader implications for the company’s financial health.

To begin with, it is essential to understand that the union strike, while disruptive, is not the primary factor behind Boeing’s stock decline. The strike, which lasted several weeks, certainly had an impact on production schedules and delivery timelines. However, Boeing’s challenges extend beyond labor disputes. The company has been grappling with a series of complex issues, including supply chain disruptions, regulatory hurdles, and the lingering effects of the 737 MAX crisis. These factors have collectively contributed to a more cautious investor sentiment, overshadowing the resolution of the strike.

In the wake of the strike’s conclusion, Boeing has been actively working on implementing recovery strategies aimed at stabilizing its operations and restoring investor confidence. One of the key areas of focus has been addressing supply chain bottlenecks. The global supply chain has been under significant strain due to the pandemic, and Boeing is no exception. The company has been collaborating closely with suppliers to ensure a steady flow of components, which is crucial for meeting production targets and fulfilling customer orders.

Moreover, Boeing has been prioritizing regulatory compliance and safety enhancements, particularly in light of the 737 MAX incidents. The company has made substantial investments in improving its safety protocols and has been working diligently with aviation authorities to ensure that its aircraft meet the highest safety standards. These efforts are critical not only for regaining the trust of regulators and customers but also for securing future orders, which are vital for long-term growth.

In addition to operational improvements, Boeing has been exploring strategic partnerships and diversification opportunities to bolster its market position. The aerospace industry is undergoing significant transformation, with emerging technologies such as electric and autonomous flight gaining traction. Boeing’s investment in research and development, as well as its collaboration with tech companies, underscores its commitment to innovation and adaptation in a rapidly evolving landscape.

While these recovery strategies are promising, it is important to acknowledge that the path to recovery is fraught with challenges. The competitive landscape in the aerospace sector is intensifying, with rivals like Airbus making significant strides in capturing market share. Furthermore, macroeconomic factors such as inflation and geopolitical tensions add layers of complexity to Boeing’s recovery efforts.

In conclusion, Boeing’s post-strike recovery strategies are multifaceted and aimed at addressing both immediate operational challenges and long-term strategic goals. While the union strike was a notable event, it is not the sole reason for the company’s stock decline. Boeing’s ability to navigate supply chain issues, enhance regulatory compliance, and capitalize on emerging opportunities will be crucial determinants of its future success. As the company continues to implement these strategies, investors and stakeholders will be closely monitoring its progress, hoping for a turnaround that reflects positively in its stock performance.

Union’s Role In Boeing’s Operational Challenges

The recent decline in Boeing’s stock has sparked widespread discussion among investors and industry analysts, particularly in light of the recent strike that concluded without placing blame on the union. While labor disputes often contribute to operational disruptions, it is crucial to examine the broader context of Boeing’s challenges to understand the multifaceted nature of its current predicament. The union’s role, although significant, is not the primary factor in the company’s recent struggles.

To begin with, the strike, which involved a substantial number of Boeing’s workforce, was primarily centered around negotiations for better wages and improved working conditions. Such demands are not uncommon in the aerospace industry, where skilled labor is essential for maintaining high standards of production and safety. The resolution of the strike, achieved through constructive dialogue between the union and Boeing’s management, underscores the importance of collaboration in addressing labor concerns. However, attributing the decline in Boeing’s stock solely to the strike would be an oversimplification of the situation.

In addition to labor issues, Boeing has been grappling with a series of operational challenges that have significantly impacted its financial performance. The company has faced delays in the production and delivery of its aircraft, partly due to supply chain disruptions exacerbated by the global pandemic. These delays have not only affected Boeing’s revenue streams but have also strained relationships with key customers who rely on timely deliveries to meet their own operational needs. Consequently, the stock market has responded to these broader operational inefficiencies, reflecting investor concerns about Boeing’s ability to navigate these challenges effectively.

Moreover, Boeing’s ongoing efforts to address safety concerns related to its 737 MAX aircraft have also played a role in shaping investor sentiment. The grounding of the 737 MAX fleet following two fatal crashes had a profound impact on Boeing’s reputation and financial stability. Although the aircraft has since been recertified and returned to service, the company continues to face scrutiny from regulators and the public. This ongoing scrutiny has necessitated significant investments in safety enhancements and compliance measures, further straining Boeing’s financial resources.

Furthermore, the competitive landscape in the aerospace industry has intensified, with rival companies making significant strides in innovation and market expansion. Boeing’s competitors have capitalized on opportunities to capture market share, particularly in regions where demand for new aircraft is burgeoning. This increased competition has placed additional pressure on Boeing to innovate and adapt, a task made more challenging by its existing operational and financial constraints.

In light of these factors, it is evident that the union’s role in Boeing’s operational challenges is but one piece of a larger puzzle. While labor relations are undeniably important, the company’s current difficulties are rooted in a complex interplay of internal and external factors. As Boeing works to regain its footing, it must address not only labor concerns but also the broader operational, safety, and competitive challenges that have contributed to its stock decline.

In conclusion, the recent strike and its resolution highlight the importance of effective labor relations in maintaining operational stability. However, to fully understand the decline in Boeing’s stock, one must consider the myriad challenges the company faces. By addressing these issues holistically, Boeing can work towards restoring investor confidence and securing its position as a leader in the aerospace industry.

Market Reactions To The End Of Boeing’s Strike

The recent conclusion of the strike at Boeing has sparked a flurry of activity in the stock market, with investors closely monitoring the aerospace giant’s performance. Despite the resolution of labor disputes, Boeing’s stock has experienced a decline, prompting analysts and stakeholders to examine the underlying factors contributing to this downturn. While it might be tempting to attribute the stock’s performance solely to the strike, a closer analysis reveals that the union’s actions are not the primary cause of the decline.

To begin with, the strike, which involved thousands of Boeing workers, was primarily centered around demands for better wages and improved working conditions. The resolution of these issues was expected to bring stability and potentially boost investor confidence. However, the market’s reaction has been more complex, suggesting that other elements are at play. It is essential to consider the broader context in which Boeing operates, including the challenges it faces in the global aerospace industry.

One significant factor influencing Boeing’s stock performance is the ongoing supply chain disruptions that have plagued the industry. These disruptions, exacerbated by the COVID-19 pandemic, have led to delays in production and delivery schedules. Consequently, Boeing has struggled to meet its targets, affecting its financial performance and investor sentiment. The end of the strike, while a positive development, does not immediately resolve these supply chain issues, which continue to weigh heavily on the company’s prospects.

Moreover, Boeing is navigating a highly competitive landscape, with rival companies making significant strides in innovation and market share. The aerospace sector is witnessing rapid advancements in technology, with competitors investing heavily in research and development to gain an edge. Boeing’s ability to keep pace with these developments is crucial for maintaining its market position. Investors are keenly aware of this dynamic, and any perceived lag in Boeing’s innovation efforts can lead to a lack of confidence, reflected in the stock’s performance.

In addition to these industry-specific challenges, macroeconomic factors also play a role in shaping market reactions. The global economy is currently experiencing volatility, with concerns over inflation, interest rates, and geopolitical tensions. These factors contribute to an environment of uncertainty, prompting investors to be more cautious in their decision-making. Boeing, as a major player in the aerospace sector, is not immune to these broader economic trends, which can influence its stock performance irrespective of internal developments such as the resolution of a strike.

Furthermore, it is important to recognize that stock market reactions are often driven by investor perceptions and expectations. The end of the strike may have been anticipated by the market, leading to a “buy the rumor, sell the news” scenario, where investors had already factored in the resolution and subsequently adjusted their positions. This behavior underscores the complexity of market dynamics, where multiple factors converge to influence stock prices.

In conclusion, while the end of the strike at Boeing is a significant event, it is not the sole determinant of the company’s stock performance. A confluence of supply chain challenges, competitive pressures, macroeconomic conditions, and investor behavior all contribute to the current market reactions. Understanding these multifaceted influences is crucial for stakeholders seeking to navigate the evolving landscape of the aerospace industry and make informed decisions regarding Boeing’s future prospects.

Long-Term Implications Of The Strike On Boeing’s Financial Health

The recent decline in Boeing’s stock has sparked considerable discussion among investors and analysts, particularly in light of the recent strike that has now come to an end. While it might be tempting to attribute the downturn in stock value directly to the strike, a closer examination reveals that the union is not at fault for the long-term financial implications facing Boeing. Instead, a confluence of factors, both internal and external, has contributed to the current financial landscape of the aerospace giant.

To begin with, the strike, which involved a significant portion of Boeing’s workforce, undoubtedly caused short-term disruptions in production and delivery schedules. However, such labor disputes are not uncommon in the industry and are typically resolved without long-lasting damage to a company’s financial health. The resolution of the strike, achieved through negotiations that addressed workers’ concerns, suggests that the union’s actions were not the primary catalyst for the stock’s decline. Rather, the strike served as a temporary hurdle that Boeing has historically managed to overcome.

Transitioning to a broader perspective, it is essential to consider the external market conditions that have exerted pressure on Boeing’s financial performance. The aerospace industry is currently navigating a complex landscape marked by fluctuating demand, supply chain disruptions, and increased competition. These factors have collectively strained Boeing’s operations, impacting its ability to maintain profitability and investor confidence. Moreover, the global economic environment, characterized by inflationary pressures and geopolitical tensions, has further complicated the company’s efforts to stabilize its financial footing.

In addition to external challenges, Boeing has been grappling with internal issues that have compounded its financial woes. The company has faced scrutiny over quality control and safety concerns, particularly in relation to its 737 MAX aircraft. These issues have not only led to regulatory hurdles but have also eroded customer trust, necessitating significant investments in rectifying past mistakes and ensuring future compliance. Consequently, these internal challenges have diverted resources and attention away from growth initiatives, thereby affecting Boeing’s long-term financial prospects.

Furthermore, Boeing’s strategic decisions in recent years have also played a role in shaping its current financial trajectory. The company’s focus on cost-cutting measures, while aimed at improving short-term profitability, has sometimes come at the expense of innovation and product development. This approach has left Boeing vulnerable to competitors who have been more aggressive in pursuing technological advancements and expanding their market share. As a result, Boeing’s ability to capture new business opportunities and sustain its competitive edge has been compromised.

In light of these considerations, it becomes evident that the decline in Boeing’s stock is not solely attributable to the recent strike or the actions of the union. Instead, it is the culmination of various factors that have collectively influenced the company’s financial health. Moving forward, Boeing must address both the external and internal challenges it faces to restore investor confidence and ensure long-term stability. This will require a strategic reassessment of its operations, investments in innovation, and a commitment to rebuilding trust with customers and stakeholders. By doing so, Boeing can navigate the complexities of the aerospace industry and emerge stronger in the years to come.

Comparing Boeing’s Stock Decline With Industry Peers

Boeing’s recent stock decline has captured the attention of investors and industry analysts alike, particularly in light of the recent resolution of a strike that many initially speculated might have been a contributing factor. However, upon closer examination, it becomes evident that the union’s actions were not the primary catalyst for the downturn. Instead, a broader analysis reveals that Boeing’s stock performance is part of a larger trend affecting the aerospace and defense sector, with several industry peers experiencing similar challenges.

To begin with, it is essential to consider the broader market conditions that have influenced Boeing’s stock trajectory. The aerospace industry has been grappling with a series of disruptions, including supply chain constraints, fluctuating demand, and geopolitical tensions. These factors have collectively exerted pressure on companies within the sector, leading to a ripple effect that has impacted stock valuations. Boeing, as a major player in the industry, has not been immune to these challenges, and its stock decline can be partially attributed to these overarching market dynamics.

Moreover, when comparing Boeing’s stock performance with that of its industry peers, a pattern emerges that suggests a sector-wide struggle rather than an isolated issue. For instance, other aerospace giants such as Airbus and Lockheed Martin have also experienced stock fluctuations in recent months. These companies, like Boeing, are navigating the complexities of a post-pandemic recovery, where demand for commercial aircraft is gradually rebounding but remains unpredictable. Additionally, defense contracts, which form a significant portion of revenue for these companies, are subject to government budgetary constraints and shifting priorities, further complicating the financial outlook.

In this context, it becomes clear that the recent strike at Boeing, while certainly a factor to consider, was not the primary driver of the stock decline. The strike, which involved a segment of Boeing’s workforce, was resolved relatively swiftly and did not result in significant production delays or financial losses. Consequently, attributing the stock decline solely to union activities would be an oversimplification of the complex interplay of factors at play.

Furthermore, it is important to recognize that Boeing has been undertaking strategic initiatives to address some of the challenges it faces. The company has been investing in technological advancements and sustainability efforts, aiming to position itself favorably in a competitive market. These initiatives, while promising in the long term, require substantial capital and may not yield immediate financial returns, thereby influencing short-term stock performance.

In conclusion, while the resolution of the strike at Boeing is a positive development, it is not the sole factor influencing the company’s stock decline. A comprehensive analysis reveals that Boeing’s stock performance is reflective of broader industry trends and challenges that are affecting its peers as well. By understanding these dynamics, investors and analysts can gain a more nuanced perspective on Boeing’s position within the aerospace sector. As the company continues to navigate these complexities, its strategic initiatives and adaptability will play a crucial role in shaping its future trajectory.

Lessons Learned From Boeing’s Strike And Stock Decline

The recent decline in Boeing’s stock has captured the attention of investors and industry analysts alike, particularly in the wake of a significant strike that has now come to an end. While it might be tempting to attribute the stock’s downturn solely to the labor unrest, a closer examination reveals a more nuanced picture. The strike, led by a union representing a substantial portion of Boeing’s workforce, was indeed a critical event. However, it is essential to recognize that the union itself is not the primary culprit behind the stock’s decline. Instead, a confluence of factors, both internal and external, has contributed to the current situation, offering valuable lessons for stakeholders.

To begin with, the strike highlighted underlying tensions between Boeing’s management and its workforce, which had been simmering for some time. These tensions were rooted in issues such as wage disparities, job security, and working conditions. While the strike brought these issues to the forefront, it also underscored the importance of proactive communication and negotiation between management and labor. The resolution of the strike, achieved through a mutually agreeable settlement, demonstrated that constructive dialogue can lead to positive outcomes. This serves as a reminder that fostering a collaborative environment is crucial for maintaining operational stability and, by extension, investor confidence.

Moreover, the strike coincided with broader challenges facing Boeing, including supply chain disruptions and regulatory hurdles. These external pressures have compounded the company’s difficulties, affecting its ability to meet production targets and deliver on its commitments. The global supply chain crisis, exacerbated by geopolitical tensions and the lingering effects of the COVID-19 pandemic, has created bottlenecks that have impacted Boeing’s operations. Consequently, the company’s financial performance has been under strain, contributing to the decline in its stock value. This situation highlights the need for companies to build resilient supply chains and develop contingency plans to mitigate the impact of unforeseen disruptions.

In addition to these operational challenges, Boeing has been navigating a complex regulatory landscape. The company has faced scrutiny from aviation authorities worldwide, particularly in the wake of past safety incidents. Ensuring compliance with stringent safety standards is paramount, but it also requires significant resources and time. The ongoing efforts to address regulatory concerns have added another layer of complexity to Boeing’s operations, further influencing investor sentiment. This underscores the importance of maintaining transparency and prioritizing safety to rebuild trust with regulators and the public.

Furthermore, the stock decline serves as a reminder of the volatile nature of the aerospace industry. Market dynamics, such as fluctuating demand for air travel and competition from other manufacturers, can have a profound impact on a company’s financial health. Boeing’s experience illustrates the need for strategic agility and innovation to remain competitive in an ever-evolving market. By investing in research and development, companies can position themselves to capitalize on emerging opportunities and navigate industry shifts more effectively.

In conclusion, while the recent strike at Boeing was a significant event, it is clear that the union was not solely responsible for the decline in the company’s stock. A combination of internal challenges and external pressures has contributed to the current situation. The lessons learned from this experience emphasize the importance of fostering strong labor relations, building resilient supply chains, ensuring regulatory compliance, and maintaining strategic agility. By addressing these areas, Boeing and other companies in the aerospace sector can better navigate future challenges and enhance their long-term prospects.

Q&A

1. **What caused the decline in Boeing’s stock?**

The decline in Boeing’s stock was primarily due to production and supply chain issues, not the union strike.

2. **How long did the strike last?**

The strike lasted for several weeks but has now ended.

3. **Was the union responsible for the stock decline?**

No, the union was not at fault for the stock decline.

4. **What impact did the strike have on Boeing’s operations?**

The strike caused temporary disruptions but was not the main factor in the stock decline.

5. **Has Boeing addressed the production issues?**

Boeing is actively working to resolve the production and supply chain issues.

6. **What is the outlook for Boeing’s stock post-strike?**

The outlook depends on how effectively Boeing addresses its production challenges.

7. **Are there any other factors affecting Boeing’s stock?**

Broader market conditions and regulatory challenges also impact Boeing’s stock performance.

Conclusion

The decline in Boeing’s stock following the end of a strike cannot be attributed to the union’s actions. While labor disputes can impact a company’s financial performance, the resolution of the strike suggests that other factors are influencing investor sentiment. These may include broader market conditions, operational challenges, or strategic decisions by Boeing that are unrelated to the union’s activities. Therefore, it is essential to consider a range of elements beyond the union’s involvement when analyzing the reasons behind Boeing’s stock decline.