“Intel’s Exit: Navigating the Shifts in Tech and Market Dynamics”

Introduction

In 2020, Intel Corporation, a stalwart in the semiconductor industry, was removed from the Dow Jones Industrial Average, marking a significant shift in the composition of this prestigious stock market index. This decision reflected broader trends in the technology sector and the evolving landscape of the global economy. Historically, the Dow has undergone numerous changes to better represent the dynamic nature of the market, and Intel’s removal underscored the increasing influence of software and services over traditional hardware manufacturing. As the industry continues to evolve, future predictions suggest a continued emphasis on companies that drive innovation in cloud computing, artificial intelligence, and digital transformation. This shift highlights the importance of adaptability and foresight for companies aiming to maintain their relevance and influence in an ever-changing economic environment.

Impact Of Intel’s Removal From The Dow On Stock Market Trends

The removal of Intel from the Dow Jones Industrial Average marks a significant shift in the landscape of stock market indices, reflecting broader trends in the technology sector and the evolving priorities of investors. This decision, while surprising to some, is emblematic of the dynamic nature of the stock market, where companies must continuously adapt to maintain their positions. The impact of Intel’s removal is multifaceted, influencing not only the company itself but also the broader market trends and investor sentiment.

Historically, the Dow Jones Industrial Average has been a barometer of the American economy, representing a diverse cross-section of industries. Intel’s inclusion in the index since 1999 underscored the growing importance of technology in the modern economy. However, as the tech landscape has evolved, so too have the criteria for inclusion in the Dow. The decision to remove Intel can be seen as a reflection of the increasing emphasis on companies that are at the forefront of innovation, particularly in areas such as cloud computing, artificial intelligence, and renewable energy. This shift highlights a broader trend where traditional tech giants are being challenged by newer, more agile companies that are better positioned to capitalize on emerging technologies.

The immediate impact of Intel’s removal from the Dow is likely to be felt in its stock performance. Historically, companies removed from major indices often experience a decline in stock price due to reduced visibility and investor interest. This is compounded by the fact that many investment funds and institutional investors use the Dow as a benchmark, meaning that Intel’s exclusion could lead to a reallocation of capital away from the company. However, it is important to note that while short-term volatility is expected, the long-term impact on Intel will largely depend on its ability to innovate and adapt to changing market conditions.

Moreover, Intel’s removal from the Dow may also influence broader stock market trends. It serves as a reminder to investors of the importance of diversification and the need to stay attuned to shifts in industry dynamics. As the technology sector continues to evolve, investors may increasingly look towards companies that are driving the next wave of technological advancements. This could lead to a rebalancing of portfolios, with a greater emphasis on emerging tech companies that are perceived to have higher growth potential.

Looking to the future, Intel’s removal from the Dow could also signal a shift in how stock indices are constructed. As the economy becomes more digital and interconnected, traditional metrics for evaluating companies may need to be redefined. This could lead to the inclusion of more companies from sectors that are currently underrepresented in major indices, such as biotechnology and clean energy. Such changes would not only reflect the changing economic landscape but also provide investors with a more comprehensive view of the market.

In conclusion, the removal of Intel from the Dow Jones Industrial Average is a significant event with implications for both the company and the broader stock market. It highlights the need for companies to continuously innovate and adapt to remain relevant in an ever-changing economic environment. For investors, it underscores the importance of staying informed about industry trends and being prepared to adjust their strategies accordingly. As the market continues to evolve, the ability to anticipate and respond to these changes will be crucial for achieving long-term investment success.

Historical Analysis Of Companies Removed From The Dow

The removal of Intel from the Dow Jones Industrial Average marks a significant moment in the history of this prestigious stock market index. To understand the implications of such a change, it is essential to examine historical trends of companies that have been removed from the Dow and consider what these trends might suggest for Intel’s future. The Dow, established in 1896, is a price-weighted index that includes 30 prominent companies representing various sectors of the U.S. economy. Over the years, the composition of the Dow has evolved, reflecting shifts in the economic landscape and the emergence of new industries.

Historically, companies removed from the Dow often face challenges that prompt their exclusion. These challenges can range from declining market relevance to financial instability. For instance, in 2018, General Electric, a company that had been part of the Dow since its inception, was removed due to its diminishing influence in the industrial sector and financial struggles. Similarly, Eastman Kodak was removed in 2004 as it failed to adapt to the digital revolution, which significantly impacted its business model. These examples illustrate that removal from the Dow often signals a need for companies to reassess their strategies and adapt to changing market conditions.

However, being removed from the Dow does not necessarily spell doom for a company. Some companies have successfully reinvented themselves post-removal. For example, AT&T was removed from the Dow in 2015 but has since focused on strategic acquisitions and expanding its telecommunications and media presence. This demonstrates that while removal can be a setback, it can also serve as a catalyst for transformation and growth.

In the case of Intel, its removal from the Dow may reflect broader trends in the technology sector. The semiconductor industry, in which Intel is a key player, is experiencing rapid changes driven by advancements in artificial intelligence, cloud computing, and the Internet of Things. Intel’s exclusion could indicate a need for the company to innovate and reposition itself to remain competitive in this dynamic environment. Moreover, the rise of other technology companies that are more aligned with current market trends may have contributed to Intel’s removal, as the Dow seeks to represent the most influential sectors of the economy.

Looking to the future, Intel’s path forward will likely involve a focus on strategic investments and innovation. The company has already announced plans to expand its manufacturing capabilities and invest in new technologies, which could help it regain its footing in the industry. Additionally, Intel’s leadership will need to navigate the challenges posed by global supply chain disruptions and increased competition from other semiconductor manufacturers.

In conclusion, the removal of Intel from the Dow Jones Industrial Average is a noteworthy event that underscores the evolving nature of the stock market index and the industries it represents. By examining historical trends of companies removed from the Dow, it becomes evident that while removal can be indicative of underlying challenges, it also presents an opportunity for reinvention and growth. For Intel, the future will depend on its ability to adapt to technological advancements and market demands, ensuring its continued relevance in the ever-changing landscape of the semiconductor industry.

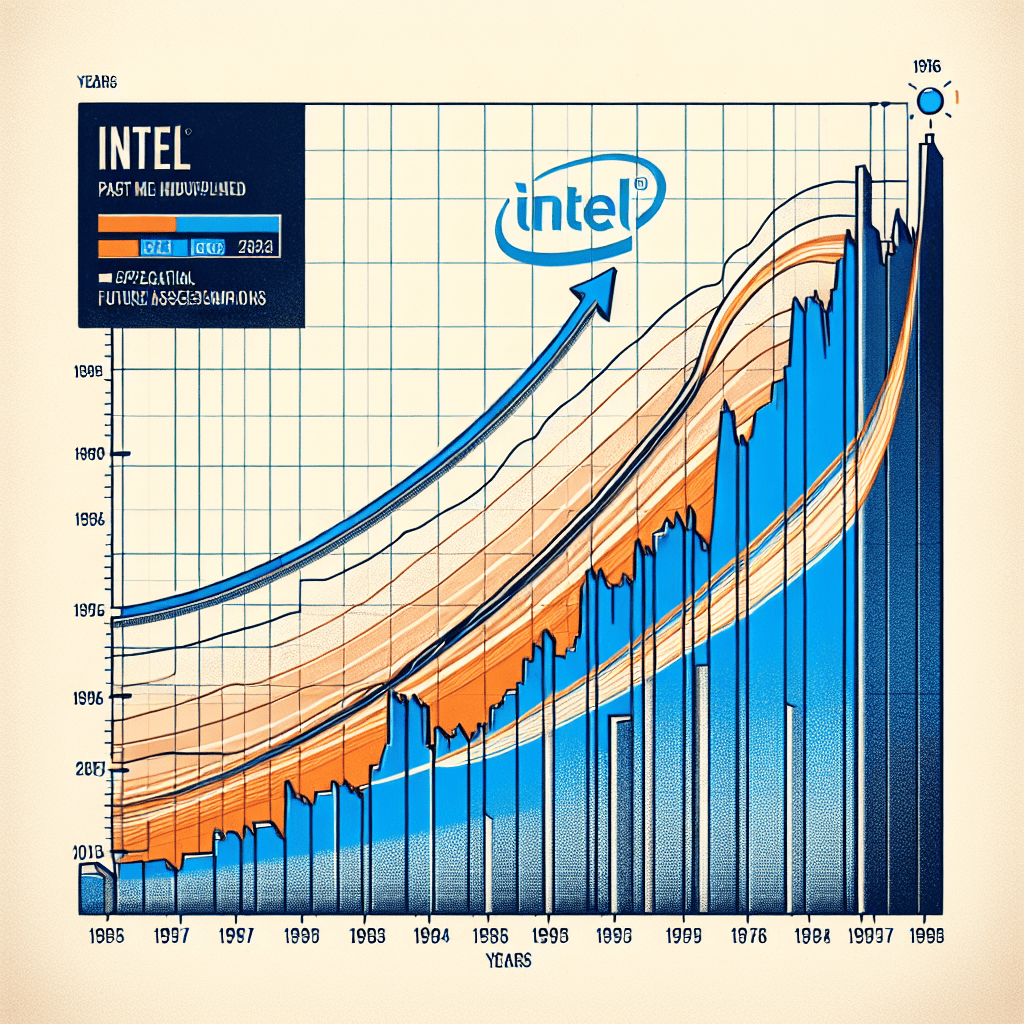

Future Predictions For Intel’s Market Performance

The removal of Intel from the Dow Jones Industrial Average marks a significant moment in the company’s history, prompting analysts and investors to speculate about its future market performance. Historically, being part of the Dow has been seen as a hallmark of stability and prestige, reflecting a company’s influence and success within the broader economy. Intel’s exclusion, therefore, raises questions about its current market position and future trajectory. As we delve into future predictions for Intel’s market performance, it is essential to consider both historical trends and emerging industry dynamics.

Historically, Intel has been a dominant player in the semiconductor industry, renowned for its innovation and technological leadership. However, recent years have seen a shift in the competitive landscape, with rivals such as AMD and NVIDIA gaining ground. This shift can be attributed to several factors, including Intel’s struggles with manufacturing delays and its slower transition to advanced process nodes. Consequently, these challenges have impacted Intel’s market share and investor confidence, leading to its removal from the Dow.

Looking ahead, Intel’s future market performance will likely hinge on its ability to address these challenges and adapt to evolving industry trends. One of the critical areas for Intel’s future growth is its investment in advanced manufacturing technologies. The company has already announced plans to expand its manufacturing capabilities, aiming to regain its competitive edge by producing more advanced and efficient chips. If successful, these efforts could help Intel reclaim its position as a leader in the semiconductor industry, potentially boosting its market performance.

Moreover, Intel’s strategic focus on diversification and expansion into new markets could also play a crucial role in shaping its future. The company has been actively investing in areas such as artificial intelligence, autonomous vehicles, and data centers, recognizing the growing demand for these technologies. By leveraging its expertise and resources, Intel aims to capture a significant share of these emerging markets, which could provide new revenue streams and enhance its overall market performance.

In addition to these strategic initiatives, Intel’s ability to forge strong partnerships and collaborations will be vital for its future success. Collaborating with other technology companies and industry leaders can facilitate innovation and accelerate the development of new products and solutions. Such partnerships could also help Intel tap into new customer bases and expand its global reach, further strengthening its market position.

However, it is important to acknowledge the potential risks and uncertainties that could impact Intel’s future market performance. The semiconductor industry is highly competitive and subject to rapid technological advancements, making it crucial for Intel to stay ahead of the curve. Additionally, geopolitical tensions and supply chain disruptions could pose challenges to Intel’s operations and growth prospects.

In conclusion, while Intel’s removal from the Dow may signal a period of uncertainty, the company’s future market performance will largely depend on its ability to navigate these challenges and capitalize on emerging opportunities. By focusing on advanced manufacturing, diversification, and strategic partnerships, Intel has the potential to regain its competitive edge and achieve sustainable growth. As the semiconductor industry continues to evolve, Intel’s adaptability and innovation will be key determinants of its success in the years to come.

The Dow Jones: Criteria For Inclusion And Exclusion

The Dow Jones Industrial Average (DJIA), often referred to simply as the Dow, is one of the most well-known stock market indices in the world. It serves as a barometer for the overall health of the U.S. economy and is closely watched by investors, analysts, and policymakers alike. The index is composed of 30 prominent companies listed on stock exchanges in the United States, and its composition is periodically reviewed to ensure it reflects the current economic landscape. The criteria for inclusion and exclusion in the Dow are not strictly defined by a set formula, but rather are based on a combination of factors that include a company’s reputation, its contribution to the economy, and its representation of the sectors that drive the U.S. economy.

Historically, the Dow has undergone numerous changes since its inception in 1896. Companies are added or removed from the index to ensure it remains a relevant and accurate reflection of the economic environment. The decision to include or exclude a company is made by the S&P Dow Jones Indices committee, which considers various qualitative and quantitative factors. These factors include the company’s market capitalization, trading volume, and the sector it represents. Additionally, the committee evaluates whether a company is a leader in its industry and if it has a strong financial standing. The goal is to maintain a balance of industries within the index, ensuring that no single sector is overly represented.

The removal of Intel from the Dow Jones Industrial Average is a significant event that underscores the evolving nature of the index. Intel, a leading technology company, had been a part of the Dow for many years, symbolizing the growing importance of the tech sector in the U.S. economy. However, as the economic landscape shifts, so too must the composition of the Dow. The decision to remove Intel may have been influenced by several factors, including changes in the company’s market performance, competitive pressures, and the emergence of new players in the technology sector that better represent current trends.

This change in the Dow’s composition reflects broader historical trends in the index’s evolution. Over the years, the Dow has transitioned from being dominated by industrial companies to including a more diverse array of sectors, such as technology, healthcare, and consumer goods. This shift mirrors the transformation of the U.S. economy from a manufacturing-based economy to one driven by innovation and services. As such, the inclusion and exclusion criteria for the Dow are inherently dynamic, adapting to the changing economic landscape and ensuring the index remains a relevant indicator of market trends.

Looking to the future, predictions about the Dow’s composition suggest that it will continue to evolve in response to technological advancements and economic shifts. As new industries emerge and existing ones transform, the Dow will likely see further changes in its lineup. Companies that are at the forefront of innovation, particularly in areas such as artificial intelligence, renewable energy, and biotechnology, may become candidates for inclusion. Conversely, companies that fail to adapt to these changes may find themselves at risk of exclusion.

In conclusion, the criteria for inclusion and exclusion in the Dow Jones Industrial Average are designed to ensure the index remains a relevant and accurate reflection of the U.S. economy. The removal of Intel highlights the dynamic nature of the Dow and its ability to adapt to changing economic conditions. As the economy continues to evolve, so too will the composition of the Dow, reflecting the ongoing transformation of industries and the emergence of new economic drivers.

Intel’s Strategic Shifts Post-Dow Removal

In the ever-evolving landscape of global finance, the removal of Intel from the Dow Jones Industrial Average marked a significant moment, reflecting broader trends in the technology sector and the stock market. This decision, while surprising to some, was not entirely unforeseen given the shifting dynamics within the industry. Historically, the Dow Jones has been a barometer for the U.S. economy, representing a cross-section of influential companies. Intel’s removal underscores the changing priorities and strategies within the tech industry, as well as the Dow’s ongoing efforts to remain relevant in a rapidly transforming economic environment.

Intel, a stalwart in the semiconductor industry, has long been synonymous with innovation and technological advancement. However, recent years have seen the company grappling with increased competition and a rapidly changing market landscape. The rise of companies like NVIDIA and AMD, which have capitalized on emerging technologies such as artificial intelligence and cloud computing, has challenged Intel’s dominance. Consequently, Intel has been compelled to reassess its strategic priorities to maintain its competitive edge. This shift is evident in its increased focus on areas such as data centers, Internet of Things (IoT), and autonomous driving technologies.

Following its removal from the Dow, Intel has embarked on a series of strategic initiatives aimed at revitalizing its market position. One of the most notable shifts has been its renewed emphasis on manufacturing capabilities. Intel has announced significant investments in expanding its production facilities, with the goal of enhancing its ability to produce cutting-edge chips. This move is not only a response to the global semiconductor shortage but also a strategic effort to regain leadership in chip manufacturing, an area where it has faced stiff competition from companies like TSMC and Samsung.

Moreover, Intel’s strategic realignment includes a stronger focus on partnerships and collaborations. By forging alliances with other tech giants and startups, Intel aims to leverage synergies and accelerate innovation. These partnerships are expected to play a crucial role in Intel’s efforts to penetrate new markets and develop next-generation technologies. For instance, collaborations in the field of artificial intelligence are anticipated to yield significant advancements, positioning Intel as a key player in this burgeoning sector.

In addition to these strategic shifts, Intel is also placing a greater emphasis on sustainability and corporate responsibility. Recognizing the growing importance of environmental, social, and governance (ESG) factors, Intel has committed to reducing its carbon footprint and enhancing its sustainability practices. This commitment is not only a response to increasing regulatory pressures but also a strategic move to align with the values of a more environmentally conscious consumer base.

Looking ahead, the future of Intel will likely be shaped by its ability to adapt to these strategic shifts and capitalize on emerging opportunities. While the removal from the Dow may have been a setback, it also serves as a catalyst for transformation. By focusing on innovation, collaboration, and sustainability, Intel is positioning itself to navigate the challenges of a rapidly changing industry landscape. As the company continues to implement its strategic initiatives, it will be crucial for Intel to remain agile and responsive to market trends, ensuring its continued relevance and success in the years to come. In conclusion, while Intel’s removal from the Dow marks the end of an era, it also heralds the beginning of a new chapter, characterized by strategic realignment and renewed focus on future growth.

Comparing Intel’s Removal With Other Tech Giants

The removal of Intel from the Dow Jones Industrial Average marks a significant moment in the history of the stock market, reflecting broader trends within the technology sector and the evolving landscape of the global economy. To understand the implications of this change, it is essential to compare Intel’s removal with similar instances involving other tech giants. This comparison not only sheds light on the factors leading to such decisions but also offers insights into potential future trends within the industry.

Historically, the Dow Jones Industrial Average has been a barometer of the American economy, representing a diverse cross-section of industries. However, as the economy has evolved, so too has the composition of the Dow. The inclusion and exclusion of companies from this index are often indicative of broader economic shifts. For instance, when IBM was removed from the Dow in 2013 after an 80-year tenure, it signaled a shift away from traditional hardware and towards software and services. Similarly, Intel’s removal underscores a transition within the tech sector, where semiconductor companies face increasing competition and rapid technological advancements.

Comparing Intel’s situation with other tech giants, such as Apple and Microsoft, provides a clearer picture of the dynamics at play. Apple, which was added to the Dow in 2015, has consistently demonstrated its ability to innovate and adapt to changing consumer preferences. Its focus on consumer electronics, coupled with a robust ecosystem of services, has allowed it to maintain a strong market position. Microsoft, on the other hand, has successfully transitioned from a software-centric company to a leader in cloud computing, reflecting its strategic pivot to meet the demands of the digital age. These companies have managed to stay relevant by anticipating market trends and investing in future technologies.

In contrast, Intel’s challenges have been more pronounced. The semiconductor industry is characterized by rapid innovation cycles and intense competition. Intel, once a dominant player in the microprocessor market, has faced stiff competition from companies like AMD and newer entrants such as ARM-based chip manufacturers. These competitors have capitalized on emerging trends, such as the demand for energy-efficient processors and the rise of mobile computing. Intel’s struggle to keep pace with these developments has been a contributing factor to its removal from the Dow.

Looking ahead, the removal of Intel from the Dow may serve as a catalyst for the company to reassess its strategic priorities. The tech industry is at a pivotal moment, with emerging technologies such as artificial intelligence, quantum computing, and 5G networks poised to reshape the landscape. For Intel, embracing these innovations and investing in research and development could be key to regaining its competitive edge. Moreover, the company’s ability to forge strategic partnerships and diversify its product offerings will likely play a crucial role in its future success.

In conclusion, Intel’s removal from the Dow Jones Industrial Average is emblematic of broader trends within the technology sector. By comparing this event with similar instances involving other tech giants, it becomes evident that adaptability and innovation are critical to maintaining relevance in an ever-evolving market. As the tech industry continues to transform, companies must remain vigilant and proactive in their strategies to navigate the challenges and opportunities that lie ahead.

Investor Reactions To Intel’s Dow Exit

The recent removal of Intel from the Dow Jones Industrial Average has sparked a wave of reactions among investors, reflecting both historical trends and future predictions for the company and the broader technology sector. This decision, while significant, is not entirely unprecedented, as the Dow periodically undergoes adjustments to better represent the evolving landscape of the U.S. economy. However, Intel’s exit has prompted a closer examination of the factors leading to this change and its implications for investors.

Historically, the Dow Jones Industrial Average has been a barometer of the American economy, comprising 30 prominent companies that are leaders in their respective industries. Intel’s inclusion in the Dow in 1999 marked a recognition of the growing importance of technology in the global economy. Over the years, Intel has been a stalwart in the semiconductor industry, driving innovation and growth. However, recent challenges, including increased competition and delays in product development, have raised concerns about its ability to maintain its leadership position.

Investor reactions to Intel’s removal from the Dow have been mixed, reflecting a blend of disappointment and cautious optimism. On one hand, some investors view this as a signal of Intel’s waning influence in the technology sector, prompting a reevaluation of their portfolios. The company’s struggles to keep pace with competitors like AMD and NVIDIA have been well-documented, and its exclusion from the Dow may be seen as a confirmation of these challenges. Consequently, some investors have opted to reduce their exposure to Intel, seeking opportunities in companies that are perceived to be more dynamic and better positioned for future growth.

On the other hand, there are investors who perceive Intel’s exit from the Dow as an opportunity for the company to refocus and realign its strategies. The removal could serve as a catalyst for Intel to accelerate its transformation efforts, including investments in new technologies and strategic partnerships. These investors remain optimistic about Intel’s long-term prospects, believing that the company has the resources and expertise to overcome its current hurdles. Moreover, they argue that the Dow’s decision does not necessarily reflect Intel’s intrinsic value or potential for future success.

In addition to individual investor reactions, the broader market has also responded to Intel’s Dow exit. The technology sector, as a whole, continues to experience rapid growth and innovation, with new players emerging and established companies adapting to changing market dynamics. Intel’s removal from the Dow may prompt other technology firms to reassess their strategies and competitive positioning, potentially leading to increased volatility and shifts in market leadership.

Looking ahead, the future of Intel and its impact on investors will largely depend on the company’s ability to navigate the challenges it faces. As the semiconductor industry continues to evolve, Intel must demonstrate agility and innovation to regain its competitive edge. Investors will be closely monitoring the company’s progress in areas such as advanced manufacturing processes, artificial intelligence, and data center solutions. Furthermore, Intel’s ability to forge strategic partnerships and expand its presence in emerging markets will be critical to its long-term success.

In conclusion, while Intel’s removal from the Dow Jones Industrial Average has elicited varied reactions from investors, it also presents an opportunity for the company to redefine its trajectory. As the technology landscape continues to shift, Intel’s response to these changes will be pivotal in shaping investor sentiment and determining its future role in the industry.

Q&A

1. **Why was Intel removed from the Dow Jones Industrial Average?**

– Intel was removed from the Dow Jones Industrial Average due to shifts in the technology sector and the need for the index to better reflect the evolving economy. The decision often involves considerations of market capitalization, sector representation, and company performance.

2. **When did Intel get removed from the Dow?**

– Intel was removed from the Dow Jones Industrial Average in June 2013.

3. **What historical trends led to Intel’s removal from the Dow?**

– Historical trends included the rise of new technology companies, changes in consumer technology preferences, and Intel’s challenges in adapting to mobile and cloud computing markets, which affected its growth and market position.

4. **How has Intel’s stock performance been since its removal from the Dow?**

– Since its removal, Intel’s stock performance has experienced fluctuations, influenced by its strategic shifts, competition, and broader market trends. It has faced challenges but also periods of growth due to new product lines and market strategies.

5. **What impact did Intel’s removal have on the Dow Jones Industrial Average?**

– Intel’s removal allowed the Dow to include companies that better represented the current economic landscape, such as those in the technology and financial sectors, thereby maintaining the index’s relevance and balance.

6. **What are the future predictions for Intel’s market position?**

– Future predictions for Intel involve potential growth through diversification into areas like artificial intelligence, 5G, and autonomous vehicles, though it faces significant competition and must innovate to maintain its market position.

7. **Could Intel be re-added to the Dow in the future?**

– Intel could potentially be re-added to the Dow if it demonstrates significant growth, innovation, and market relevance, aligning with the criteria and strategic goals of the index’s composition.

Conclusion

Intel’s removal from the Dow Jones Industrial Average reflects broader trends in the technology sector and the evolving landscape of the stock market. Historically, the Dow has periodically adjusted its components to better represent the U.S. economy’s leading sectors. Intel’s exclusion may indicate a shift towards companies with stronger growth trajectories or those more aligned with current technological advancements, such as cloud computing and artificial intelligence. Looking forward, Intel’s future will likely depend on its ability to innovate and compete in these rapidly evolving areas. The company’s strategic pivots, investments in new technologies, and market performance will be crucial in determining its role in the tech industry and potential re-entry into major stock indices.