“Aramco: Steadfast Dividends in a Sea of Uncertainty”

Introduction

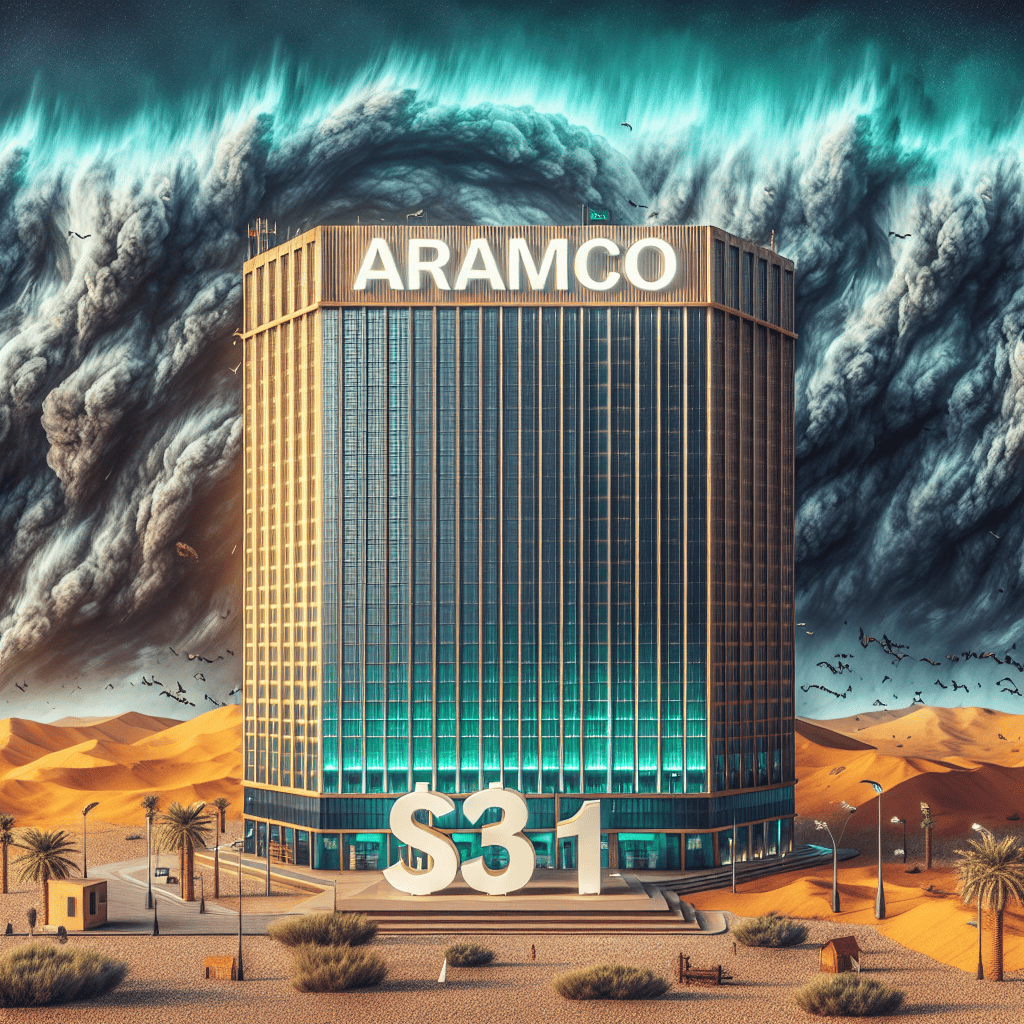

Saudi Aramco, the world’s largest oil company, has announced its decision to maintain a $31 billion dividend payout, underscoring its commitment to shareholder returns despite the backdrop of financial uncertainty in Saudi Arabia. This move comes as the kingdom grapples with fluctuating oil prices and broader economic challenges, highlighting Aramco’s strategic role in supporting the national economy. The decision to uphold such a substantial dividend reflects the company’s robust financial performance and its pivotal position in the global energy market, even as it navigates the complexities of geopolitical tensions and evolving energy demands.

Aramco’s Strategic Decision: Maintaining Dividends in Uncertain Times

In the midst of a fluctuating global economic landscape, Saudi Aramco, the world’s largest oil company, has made a strategic decision to maintain its $31 billion dividend payout. This move comes at a time when Saudi Arabia faces financial uncertainty, driven by volatile oil prices and broader economic challenges. By choosing to uphold its dividend commitment, Aramco aims to balance shareholder expectations with the kingdom’s fiscal needs, reflecting a nuanced approach to navigating economic unpredictability.

The decision to maintain such a substantial dividend is not without its complexities. Aramco’s dividends are a critical source of revenue for the Saudi government, which relies heavily on oil income to fund its budget and ambitious Vision 2030 reform plans. These reforms are designed to diversify the economy away from oil dependency, fostering growth in sectors such as tourism, entertainment, and technology. However, the path to diversification is fraught with challenges, particularly when oil prices are subject to global market fluctuations. In this context, Aramco’s dividends serve as a financial lifeline, providing the government with the necessary resources to pursue its long-term economic goals.

Moreover, Aramco’s decision underscores its commitment to maintaining investor confidence. In an era where energy markets are increasingly unpredictable, ensuring a stable return for shareholders is paramount. By upholding its dividend payout, Aramco signals its financial resilience and operational strength, even in the face of external pressures. This move is likely to reassure investors, who may otherwise be wary of the risks associated with the oil sector, particularly given the global push towards renewable energy sources and the potential for regulatory changes aimed at reducing carbon emissions.

Transitioning from the broader economic implications, it is essential to consider the operational strategies that enable Aramco to sustain such a significant dividend. The company’s robust financial performance, driven by efficient production processes and strategic investments, plays a crucial role. Aramco’s ability to maintain low production costs allows it to remain profitable even when oil prices dip. Additionally, its investments in technology and infrastructure enhance its capacity to adapt to market changes, ensuring long-term sustainability.

Furthermore, Aramco’s strategic partnerships and international ventures contribute to its financial stability. By expanding its global footprint and diversifying its portfolio, the company mitigates risks associated with regional market fluctuations. These efforts not only bolster Aramco’s revenue streams but also align with Saudi Arabia’s broader economic diversification objectives.

Nevertheless, the decision to maintain the dividend is not without potential drawbacks. Critics argue that prioritizing dividend payouts could limit Aramco’s ability to reinvest in its core operations or explore new growth opportunities. In a rapidly evolving energy landscape, where innovation and adaptation are key, striking a balance between rewarding shareholders and investing in future capabilities is crucial.

In conclusion, Aramco’s decision to maintain its $31 billion dividend amid Saudi financial uncertainty reflects a strategic balancing act. By prioritizing shareholder returns while supporting the kingdom’s economic objectives, Aramco demonstrates its resilience and adaptability in uncertain times. As the global energy landscape continues to evolve, the company’s ability to navigate these challenges will be instrumental in shaping its future trajectory and, by extension, the economic fortunes of Saudi Arabia.

Financial Stability: How Aramco Balances Dividends and Market Volatility

In the ever-fluctuating landscape of global finance, Saudi Aramco’s decision to maintain its $31 billion dividend stands as a testament to its strategic financial management and commitment to shareholder value. This decision comes at a time when Saudi Arabia faces financial uncertainty, driven by fluctuating oil prices and broader economic challenges. As the world’s largest oil company, Aramco plays a pivotal role in the kingdom’s economy, and its financial strategies are closely watched by investors and analysts alike.

To understand the significance of Aramco’s dividend policy, it is essential to consider the broader economic context. Saudi Arabia, heavily reliant on oil revenues, has been navigating a complex economic environment marked by volatile oil prices and efforts to diversify its economy under the Vision 2030 initiative. In this context, Aramco’s dividends are not merely a financial obligation but a critical component of the kingdom’s fiscal strategy. The dividends provide a substantial source of revenue for the Saudi government, which holds a majority stake in the company. Consequently, maintaining the dividend is crucial for funding public spending and supporting economic diversification efforts.

Aramco’s ability to sustain such a substantial dividend amidst market volatility is indicative of its robust financial health and operational efficiency. The company has consistently demonstrated its capacity to generate significant cash flow, even in challenging market conditions. This resilience is underpinned by its low-cost production capabilities and strategic investments in technology and infrastructure, which enhance its operational efficiency. Moreover, Aramco’s integrated business model, encompassing upstream, midstream, and downstream operations, provides a diversified revenue stream that mitigates the impact of oil price fluctuations.

Furthermore, Aramco’s financial strategy is characterized by a prudent approach to debt management. The company has maintained a strong balance sheet, with manageable levels of debt relative to its earnings. This financial discipline not only supports its dividend policy but also positions Aramco to capitalize on growth opportunities and navigate potential market disruptions. By balancing its dividend commitments with strategic investments, Aramco ensures long-term sustainability and value creation for its shareholders.

In addition to its internal financial strategies, Aramco’s dividend policy is influenced by external factors, including geopolitical dynamics and global energy transitions. The company operates in a complex geopolitical environment, where regional tensions and international relations can impact oil markets and, by extension, its financial performance. Moreover, the global shift towards renewable energy sources presents both challenges and opportunities for Aramco. While the transition poses a potential threat to traditional oil markets, it also opens avenues for Aramco to diversify its energy portfolio and invest in sustainable energy solutions.

In conclusion, Aramco’s decision to maintain its $31 billion dividend amidst Saudi financial uncertainty reflects a strategic balance between fulfilling shareholder expectations and navigating market volatility. Through its robust financial management, operational efficiency, and strategic investments, Aramco not only sustains its dividend policy but also contributes to the broader economic stability of Saudi Arabia. As the company continues to adapt to evolving market dynamics and global energy trends, its financial strategies will remain a focal point for stakeholders seeking insights into the future of the energy sector and the economic trajectory of the kingdom.

Saudi Arabia’s Economic Landscape: The Role of Aramco’s Dividend Policy

In the intricate tapestry of Saudi Arabia’s economic landscape, the role of Aramco’s dividend policy emerges as a pivotal thread, weaving together the nation’s fiscal stability and its broader economic ambitions. As the Kingdom navigates a period of financial uncertainty, Aramco’s decision to maintain its $31 billion dividend stands as a testament to its strategic importance and the delicate balance it seeks to achieve between shareholder expectations and national economic imperatives.

Saudi Arabia, the world’s largest oil exporter, has long relied on its vast hydrocarbon resources to fuel its economic engine. However, fluctuating oil prices and global shifts towards renewable energy sources have introduced a layer of unpredictability to its financial outlook. In this context, Aramco, the state-owned oil giant, plays a crucial role not only as a revenue generator but also as a stabilizing force within the Kingdom’s economy. By upholding its substantial dividend payout, Aramco signals its commitment to providing a steady stream of income to the Saudi government, which holds the majority stake in the company.

This dividend policy is not merely a financial maneuver; it is a strategic decision that reflects the broader economic goals of Vision 2030, Saudi Arabia’s ambitious reform plan aimed at diversifying its economy away from oil dependency. The dividends from Aramco serve as a vital source of funding for various initiatives under this vision, including investments in infrastructure, tourism, and technology. Thus, maintaining the dividend is essential for ensuring the continuity of these transformative projects, which are designed to create a more sustainable and resilient economic future for the Kingdom.

Moreover, Aramco’s dividend policy has significant implications for investor confidence. In an era where geopolitical tensions and market volatility can easily unsettle investors, the assurance of a consistent dividend payout provides a sense of stability and predictability. This, in turn, enhances Aramco’s attractiveness as an investment vehicle, potentially drawing in foreign capital that can further bolster the Saudi economy. By maintaining its dividend, Aramco not only reinforces its financial robustness but also underscores its role as a reliable partner in the global energy market.

However, this decision is not without its challenges. The global energy landscape is undergoing a profound transformation, with increasing emphasis on sustainability and the transition to cleaner energy sources. Aramco, while committed to maintaining its dividend, must also navigate these changes by investing in renewable energy and reducing its carbon footprint. Balancing these competing demands requires a nuanced approach that aligns with both national interests and global environmental imperatives.

In conclusion, Aramco’s decision to maintain its $31 billion dividend amid Saudi financial uncertainty is a multifaceted strategy that underscores its integral role in the Kingdom’s economic framework. It reflects a commitment to supporting national development goals while also addressing the expectations of investors and stakeholders. As Saudi Arabia continues to chart its course through a complex economic landscape, Aramco’s dividend policy will remain a key instrument in achieving fiscal stability and advancing the nation’s long-term vision. Through careful management and strategic foresight, Aramco can continue to serve as a cornerstone of Saudi Arabia’s economic resilience and transformation.

Investor Confidence: The Impact of Aramco’s $31 Billion Dividend Commitment

In the realm of global finance, few events capture the attention of investors and analysts quite like the dividend announcements of major corporations. Recently, Saudi Aramco, the world’s largest oil company, reaffirmed its commitment to distribute a staggering $31 billion in dividends, a decision that reverberates through the financial markets and holds significant implications for investor confidence. This move comes at a time when Saudi Arabia faces financial uncertainty, driven by fluctuating oil prices and broader economic challenges. Consequently, Aramco’s steadfast dividend policy serves as a beacon of stability, offering reassurance to investors amid a landscape of unpredictability.

To understand the impact of Aramco’s dividend commitment, it is essential to consider the broader economic context. Saudi Arabia, heavily reliant on oil revenues, has been navigating a complex economic environment characterized by volatile oil prices and efforts to diversify its economy. The Kingdom’s Vision 2030 initiative aims to reduce dependence on oil by fostering growth in other sectors, yet the transition is fraught with challenges. In this milieu, Aramco’s decision to maintain its dividend payout underscores the company’s financial resilience and its pivotal role in supporting the Saudi economy.

Moreover, the dividend announcement is a strategic maneuver to bolster investor confidence. Dividends are a tangible return on investment, and by committing to such a substantial payout, Aramco signals its robust financial health and ability to generate consistent cash flow. This assurance is particularly crucial for institutional investors and sovereign wealth funds, which rely on stable returns to meet their financial obligations. In essence, Aramco’s dividend policy acts as a stabilizing force, mitigating concerns about the Kingdom’s economic trajectory and reinforcing the company’s position as a reliable investment.

Furthermore, Aramco’s dividend strategy reflects its commitment to shareholder value. By prioritizing dividends, the company aligns its interests with those of its investors, fostering a sense of trust and loyalty. This approach is especially pertinent in an era where environmental, social, and governance (ESG) considerations are increasingly influencing investment decisions. While Aramco faces scrutiny over its environmental impact, its consistent dividend payments offer a counterbalance, appealing to investors seeking both financial returns and long-term stability.

In addition to reinforcing investor confidence, Aramco’s dividend policy has broader implications for the global oil market. As one of the largest oil producers, Aramco’s financial decisions can influence market dynamics and pricing trends. By maintaining its dividend, the company signals its confidence in the oil market’s recovery and its ability to navigate potential headwinds. This, in turn, can have a stabilizing effect on oil prices, benefiting not only Aramco but also other oil-dependent economies.

In conclusion, Aramco’s commitment to a $31 billion dividend amid Saudi financial uncertainty is a testament to its financial strength and strategic foresight. By prioritizing dividends, the company not only reassures investors but also reinforces its role as a cornerstone of the Saudi economy. As the Kingdom continues its journey towards economic diversification, Aramco’s dividend policy serves as a crucial anchor, providing stability and confidence in an ever-evolving financial landscape. Through this strategic decision, Aramco not only upholds its reputation as a reliable investment but also contributes to the broader stability of the global oil market, underscoring its significance on the world stage.

Aramco’s Financial Strategy: Navigating Uncertainty with Consistent Dividends

In the midst of a fluctuating global economic landscape, Aramco has made a strategic decision to maintain its $31 billion dividend, a move that underscores its commitment to shareholder value even as Saudi Arabia faces financial uncertainty. This decision is emblematic of Aramco’s broader financial strategy, which seeks to balance the demands of its investors with the economic challenges that the Kingdom is currently navigating. By upholding its dividend, Aramco not only reinforces its reputation as a reliable investment but also signals confidence in its financial resilience and operational stability.

The decision to maintain such a substantial dividend comes at a time when Saudi Arabia is grappling with various economic pressures, including fluctuating oil prices and ambitious domestic economic reforms. The Kingdom’s Vision 2030 initiative, aimed at diversifying the economy away from oil dependency, requires significant investment and resources. In this context, Aramco’s financial strategy plays a crucial role in supporting the national agenda while ensuring that it remains a profitable enterprise. By continuing to distribute dividends at this level, Aramco provides a steady stream of income to the Saudi government, which is its largest shareholder, thereby indirectly supporting the broader economic objectives of the nation.

Moreover, Aramco’s decision reflects a calculated approach to managing its financial resources. Despite the inherent volatility in the oil market, the company has consistently demonstrated an ability to generate substantial cash flow, which enables it to sustain its dividend payouts. This financial discipline is further evidenced by Aramco’s ongoing efforts to optimize its operations and reduce costs, ensuring that it remains competitive even in challenging market conditions. By prioritizing efficiency and innovation, Aramco not only safeguards its profitability but also positions itself to capitalize on future opportunities as the global energy landscape evolves.

In addition to its operational strategies, Aramco’s financial prudence is also evident in its approach to capital expenditure and investment. The company continues to invest in key projects that enhance its production capabilities and expand its presence in international markets. These investments are carefully aligned with its long-term strategic goals, ensuring that Aramco remains at the forefront of the energy sector. By balancing immediate financial commitments with future growth prospects, Aramco demonstrates a comprehensive understanding of the complexities of the global energy market and the need for adaptability in its financial planning.

Furthermore, Aramco’s commitment to maintaining its dividend is likely to have positive implications for investor confidence. In an era where many companies are reassessing their dividend policies in response to economic uncertainties, Aramco’s steadfast approach provides a sense of stability and predictability for its shareholders. This, in turn, enhances its attractiveness as an investment, potentially broadening its investor base and supporting its market valuation.

In conclusion, Aramco’s decision to uphold its $31 billion dividend amidst Saudi financial uncertainty is a testament to its robust financial strategy and commitment to shareholder value. By navigating the complexities of the current economic environment with a focus on operational efficiency, strategic investment, and financial discipline, Aramco not only reinforces its position as a leading energy company but also contributes to the broader economic stability of Saudi Arabia. As the global energy landscape continues to evolve, Aramco’s strategic foresight and resilience will undoubtedly play a pivotal role in shaping its future success.

The Economic Implications of Aramco’s Dividend Amid Saudi Financial Challenges

In the midst of a fluctuating global economic landscape, Saudi Aramco’s decision to maintain its $31 billion dividend has garnered significant attention, particularly given the financial uncertainties facing Saudi Arabia. This move, while ensuring a steady income stream for investors, also reflects broader economic strategies and challenges within the Kingdom. As the world’s largest oil company, Aramco’s financial decisions are closely intertwined with Saudi Arabia’s economic health, given that the government is its largest shareholder. Consequently, the maintenance of such a substantial dividend payout is not merely a corporate decision but a strategic maneuver with far-reaching implications.

To understand the significance of this decision, it is essential to consider the broader economic context. Saudi Arabia, like many oil-dependent economies, has faced considerable challenges due to fluctuating oil prices and the global push towards renewable energy. These factors have necessitated a diversification of the Kingdom’s economy, as outlined in the Vision 2030 initiative. However, the transition from an oil-reliant economy to a more diversified one is fraught with challenges, requiring substantial investment in non-oil sectors. In this context, Aramco’s dividend serves as a critical source of revenue for the Saudi government, helping to fund these diversification efforts.

Moreover, maintaining the dividend is also a signal to international investors about the stability and reliability of Aramco as an investment. In an era where investor confidence can be easily shaken by geopolitical tensions and economic volatility, Aramco’s commitment to its dividend policy underscores its financial robustness. This assurance is particularly vital as the company seeks to attract foreign investment, which is crucial for funding its ambitious expansion and diversification projects.

However, this decision is not without its challenges. The substantial dividend payout places a significant financial burden on Aramco, especially in times of lower oil prices. It raises questions about the company’s ability to balance shareholder returns with the need for reinvestment in its operations and future growth. Furthermore, the global shift towards sustainable energy sources poses a long-term challenge to Aramco’s traditional business model, necessitating strategic investments in renewable energy and technology.

In addition to these corporate considerations, the decision has broader implications for Saudi Arabia’s fiscal policy. The reliance on Aramco’s dividends to fund government spending highlights the ongoing challenge of reducing the Kingdom’s dependence on oil revenues. While the Vision 2030 initiative aims to address this issue, the path to economic diversification is complex and requires careful management of resources and strategic investments in emerging sectors.

In conclusion, Aramco’s decision to maintain its $31 billion dividend amid Saudi financial uncertainty is a multifaceted strategy that reflects both the company’s financial priorities and the broader economic goals of the Kingdom. While it provides immediate fiscal support to the Saudi government and reassures investors, it also underscores the challenges of balancing short-term financial commitments with long-term strategic objectives. As Saudi Arabia navigates its economic transformation, the role of Aramco and its financial decisions will continue to be pivotal in shaping the Kingdom’s economic future.

Aramco’s Dividend Policy: A Pillar of Stability in a Fluctuating Economy

In the midst of a fluctuating global economy, Saudi Aramco has made a decisive move to maintain its $31 billion dividend, underscoring its role as a pillar of stability within the Kingdom’s financial landscape. This decision comes at a time when Saudi Arabia faces economic uncertainties, driven by fluctuating oil prices and broader geopolitical tensions. By upholding its substantial dividend, Aramco not only reinforces its commitment to shareholders but also signals confidence in its financial resilience and strategic foresight.

The decision to maintain such a significant dividend is not merely a financial maneuver; it is a strategic assertion of Aramco’s robust operational capabilities and its pivotal role in the Saudi economy. As the world’s largest oil company, Aramco’s financial health is intrinsically linked to the economic stability of Saudi Arabia. The dividend, therefore, serves as a critical source of revenue for the Saudi government, which relies heavily on oil income to fund its ambitious Vision 2030 reform agenda. This initiative aims to diversify the economy away from oil dependency, and Aramco’s consistent dividend payments are vital in supporting these transformative efforts.

Moreover, Aramco’s dividend policy is a testament to its operational efficiency and ability to generate substantial cash flow, even in challenging market conditions. The company’s integrated business model, which spans exploration, production, refining, and distribution, provides a diversified revenue stream that cushions against market volatility. This financial resilience is further bolstered by Aramco’s strategic investments in technology and innovation, which enhance its operational efficiency and environmental sustainability. By maintaining its dividend, Aramco demonstrates its capacity to balance shareholder returns with long-term strategic investments.

In addition to its economic implications, Aramco’s dividend policy also carries significant geopolitical weight. As a key player in the global energy market, Aramco’s financial decisions are closely watched by international investors and governments alike. By upholding its dividend, Aramco sends a strong signal of stability and reliability, which is crucial in maintaining investor confidence amidst global economic uncertainties. This move is particularly important given the current geopolitical landscape, where energy security concerns are at the forefront of international relations.

Furthermore, Aramco’s commitment to its dividend policy reflects its broader corporate governance principles, which prioritize transparency, accountability, and shareholder value. By consistently delivering on its dividend promises, Aramco reinforces its reputation as a trustworthy and dependable entity in the global energy sector. This reputation is essential in attracting and retaining international investors, who are increasingly seeking stable and reliable investment opportunities in a volatile market environment.

In conclusion, Aramco’s decision to maintain its $31 billion dividend amidst Saudi financial uncertainty is a strategic affirmation of its financial strength and operational resilience. This move not only supports the Saudi government’s economic diversification efforts but also reinforces Aramco’s position as a cornerstone of stability in the global energy market. By upholding its dividend policy, Aramco demonstrates its unwavering commitment to shareholder value, economic stability, and geopolitical reliability, thereby solidifying its role as a key player in shaping the future of the global energy landscape.

Q&A

1. **What is Aramco’s dividend policy amid financial uncertainty?**

Aramco has maintained its $31 billion dividend despite financial uncertainty in Saudi Arabia.

2. **Why is Aramco maintaining its dividend?**

Aramco is maintaining its dividend to provide financial stability and support to the Saudi government, which relies heavily on oil revenues.

3. **How does the dividend impact Saudi Arabia’s economy?**

The dividend is a crucial source of income for the Saudi government, helping to fund public spending and economic initiatives.

4. **What challenges is Saudi Arabia facing that contribute to financial uncertainty?**

Saudi Arabia is facing challenges such as fluctuating oil prices, economic diversification efforts, and geopolitical tensions.

5. **How does Aramco’s dividend compare to other oil companies?**

Aramco’s dividend is one of the largest in the world, reflecting its significant role in the global oil market and its importance to Saudi Arabia’s economy.

6. **What are the potential risks of maintaining such a high dividend?**

Maintaining a high dividend could strain Aramco’s financial resources, especially if oil prices remain low or if there are disruptions in production.

7. **What strategies might Aramco employ to sustain its dividend?**

Aramco might focus on cost-cutting measures, increasing operational efficiency, and exploring new revenue streams to sustain its dividend payments.

Conclusion

Aramco’s decision to maintain its $31 billion dividend despite financial uncertainty in Saudi Arabia underscores the company’s commitment to providing consistent returns to its shareholders, particularly the Saudi government, which relies heavily on these dividends for national revenue. This move reflects Aramco’s confidence in its financial stability and operational resilience, even amid fluctuating oil prices and global economic challenges. By sustaining its dividend payouts, Aramco aims to reassure investors and stakeholders of its robust financial health and strategic importance to Saudi Arabia’s economic framework. However, this decision also highlights the broader economic pressures facing the kingdom, emphasizing the need for continued diversification efforts to reduce dependency on oil revenues.