“Revving Up Returns: Power Equipment’s Electrifying 2,400% Profit Surge!”

Introduction

Power Equipment Stock Surges with Projected 2,400% Profit Growth

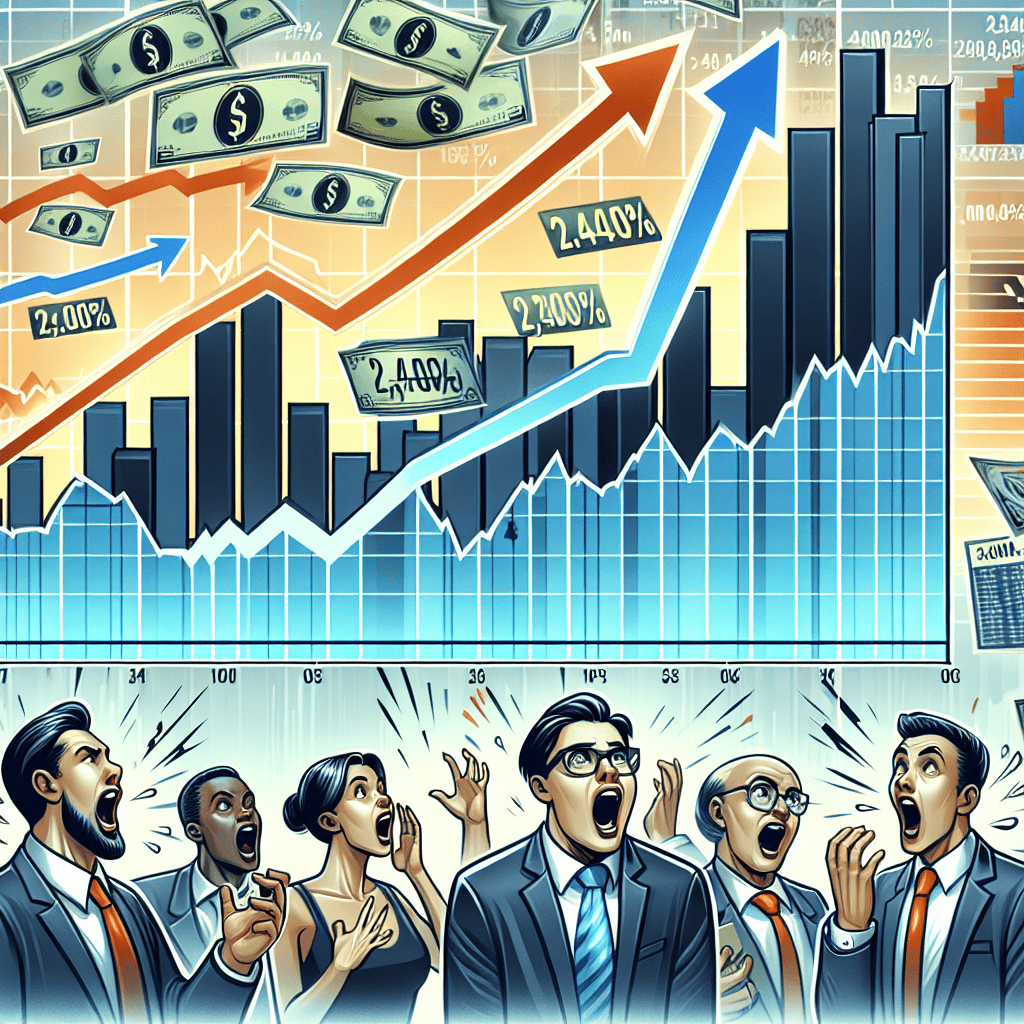

In a remarkable turn of events, the power equipment sector is witnessing an unprecedented surge in stock valuations, driven by projections of a staggering 2,400% profit growth. This explosive increase is capturing the attention of investors and market analysts alike, as companies within the industry capitalize on burgeoning demand and innovative advancements. The surge is attributed to a confluence of factors, including heightened global energy needs, technological breakthroughs in power generation and distribution, and strategic expansions into emerging markets. As the sector continues to evolve, stakeholders are keenly observing how these dynamics will shape the future landscape of power equipment and its role in the global economy.

Understanding the Factors Behind Power Equipment Stock Surges

The recent surge in power equipment stock has captured the attention of investors and analysts alike, driven by a projected 2,400% profit growth that has sparked widespread interest in the sector. This remarkable increase in profitability can be attributed to several key factors that are reshaping the landscape of the power equipment industry. Understanding these factors is crucial for stakeholders aiming to capitalize on this unprecedented growth.

To begin with, the global shift towards renewable energy sources has significantly bolstered the demand for power equipment. As countries strive to meet ambitious climate goals and reduce their carbon footprints, investments in renewable energy infrastructure have surged. This transition has necessitated the development and deployment of advanced power equipment, such as wind turbines, solar panels, and energy storage systems. Consequently, companies specializing in these technologies have experienced a substantial uptick in orders, driving their stock prices upward.

Moreover, technological advancements have played a pivotal role in enhancing the efficiency and effectiveness of power equipment. Innovations in materials science, digitalization, and automation have led to the creation of more reliable and cost-effective solutions. These advancements not only improve the performance of power equipment but also reduce operational costs, thereby increasing profit margins for manufacturers. As a result, investors are increasingly optimistic about the long-term growth prospects of companies that are at the forefront of these technological developments.

In addition to technological progress, government policies and incentives have provided a significant boost to the power equipment sector. Many governments around the world have introduced favorable policies, such as tax credits, subsidies, and grants, to encourage the adoption of clean energy technologies. These incentives have lowered the financial barriers for both producers and consumers, accelerating the deployment of power equipment. Consequently, companies that are well-positioned to take advantage of these policy measures have seen their stock values rise in anticipation of increased revenues.

Furthermore, the growing emphasis on energy security and resilience has underscored the importance of modernizing power infrastructure. Recent geopolitical tensions and natural disasters have highlighted vulnerabilities in existing energy systems, prompting a renewed focus on building robust and adaptable power networks. This has led to increased investments in grid modernization and the integration of smart technologies, further driving demand for power equipment. Companies that offer solutions to enhance grid reliability and flexibility are particularly well-positioned to benefit from this trend.

Additionally, the global economic recovery following the COVID-19 pandemic has contributed to the surge in power equipment stock. As economies rebound and industrial activities resume, there is a heightened demand for energy, which in turn fuels the need for power equipment. This recovery has been accompanied by increased capital expenditure in infrastructure projects, providing a further impetus for growth in the sector.

In conclusion, the projected 2,400% profit growth in power equipment stock is the result of a confluence of factors, including the transition to renewable energy, technological advancements, supportive government policies, a focus on energy security, and the post-pandemic economic recovery. These elements have collectively created a favorable environment for power equipment companies, leading to a surge in their stock prices. As the industry continues to evolve, stakeholders must remain vigilant and adaptable to capitalize on the opportunities presented by this dynamic and rapidly growing sector.

Analyzing the 2,400% Profit Growth Projection in Power Equipment

The power equipment industry has recently captured the attention of investors and analysts alike, as a particular stock within this sector has experienced a remarkable surge, driven by projections of a staggering 2,400% profit growth. This unprecedented forecast has sparked a flurry of interest and speculation, prompting a closer examination of the factors contributing to such an optimistic outlook. To understand the dynamics at play, it is essential to delve into the underlying reasons for this projected growth and the broader implications for the industry.

At the heart of this extraordinary profit projection lies a confluence of technological advancements and increasing global demand for sustainable energy solutions. As the world continues to grapple with the pressing need to transition from fossil fuels to cleaner energy sources, power equipment manufacturers are uniquely positioned to capitalize on this shift. The company in question has strategically aligned itself with this trend by investing heavily in research and development, leading to the creation of innovative products that cater to the burgeoning renewable energy market. Consequently, this has not only enhanced the company’s competitive edge but also positioned it as a leader in the industry.

Moreover, government policies and incentives aimed at promoting renewable energy adoption have further bolstered the growth prospects for power equipment manufacturers. Many countries are implementing stringent regulations to reduce carbon emissions, thereby accelerating the demand for energy-efficient technologies. This regulatory environment has created a fertile ground for companies that can provide the necessary equipment and infrastructure to support this transition. As a result, the company’s ability to deliver cutting-edge solutions that align with these policy objectives has significantly contributed to the optimistic profit projections.

In addition to technological and regulatory factors, the company’s strategic partnerships and global expansion efforts have played a crucial role in its projected growth. By forging alliances with key players in the energy sector, the company has been able to expand its market reach and tap into new revenue streams. These collaborations have not only facilitated access to new markets but have also enabled the company to leverage the expertise and resources of its partners, thereby enhancing its operational efficiency and profitability.

Furthermore, the company’s robust financial health and prudent management practices have instilled confidence among investors, further fueling the stock’s upward trajectory. With a strong balance sheet and a track record of consistent performance, the company is well-equipped to navigate the challenges and opportunities that lie ahead. This financial stability, coupled with a clear strategic vision, has reinforced investor trust and contributed to the stock’s impressive surge.

While the projected 2,400% profit growth is undoubtedly ambitious, it is important to approach such forecasts with a degree of caution. Market conditions can be unpredictable, and unforeseen challenges may arise that could impact the company’s performance. Nevertheless, the factors underpinning this projection are grounded in tangible developments within the industry, suggesting that the company is on a promising trajectory.

In conclusion, the power equipment stock’s surge, driven by a projected 2,400% profit growth, is a testament to the transformative changes occurring within the energy sector. By capitalizing on technological advancements, regulatory support, strategic partnerships, and sound financial management, the company has positioned itself as a formidable player in the industry. As the world continues to prioritize sustainable energy solutions, the prospects for power equipment manufacturers remain bright, offering exciting opportunities for growth and innovation.

Investment Strategies for Capitalizing on Power Equipment Stock Gains

The recent surge in power equipment stock, driven by a projected 2,400% profit growth, has captured the attention of investors seeking lucrative opportunities in the market. This remarkable growth projection is not only a testament to the sector’s resilience but also an indication of the increasing demand for power equipment across various industries. As the global economy continues to recover and expand, the need for reliable and efficient power solutions has become more pronounced, thereby fueling the growth of companies within this sector. Consequently, investors are keen to capitalize on these gains by adopting strategic approaches that maximize their returns.

To begin with, understanding the factors contributing to this unprecedented growth is crucial for investors aiming to make informed decisions. The power equipment industry is experiencing a significant transformation, driven by technological advancements and a shift towards sustainable energy solutions. Innovations in renewable energy technologies, such as solar and wind power, have created new opportunities for power equipment manufacturers to expand their product offerings and cater to a broader market. Additionally, the increasing emphasis on energy efficiency and the reduction of carbon emissions has led to a surge in demand for advanced power equipment that can meet these requirements. As a result, companies that are at the forefront of these innovations are well-positioned to benefit from the growing market demand.

Moreover, the global push for infrastructure development, particularly in emerging economies, has further bolstered the power equipment sector. Governments worldwide are investing heavily in infrastructure projects to support economic growth and improve the quality of life for their citizens. This has led to an increased demand for power equipment, as these projects require reliable and efficient energy solutions to be successful. Consequently, companies that can provide high-quality power equipment and services are likely to experience significant growth in their revenues and profits.

In light of these developments, investors should consider several strategies to capitalize on the potential gains in power equipment stocks. One effective approach is to conduct thorough research and analysis of the companies within the sector. By examining their financial performance, market position, and growth prospects, investors can identify those that are best positioned to benefit from the industry’s expansion. Additionally, keeping an eye on industry trends and technological advancements can provide valuable insights into which companies are likely to maintain a competitive edge.

Furthermore, diversification is a key strategy for managing risk and maximizing returns. By investing in a diverse portfolio of power equipment stocks, investors can mitigate the impact of potential market fluctuations and capitalize on the growth opportunities across different segments of the industry. This approach not only reduces the risk associated with investing in a single company but also allows investors to benefit from the overall growth of the sector.

In conclusion, the projected 2,400% profit growth in power equipment stocks presents a compelling opportunity for investors seeking to enhance their portfolios. By understanding the factors driving this growth and adopting strategic investment approaches, investors can position themselves to capitalize on the gains in this dynamic and rapidly evolving industry. As the demand for power equipment continues to rise, those who are well-prepared and informed will be best equipped to reap the rewards of this burgeoning market.

The Role of Renewable Energy in Power Equipment Market Expansion

The power equipment market has witnessed a remarkable surge, driven by an unprecedented projected profit growth of 2,400%. This extraordinary expansion is largely attributed to the increasing role of renewable energy sources in the global energy landscape. As nations worldwide strive to meet ambitious climate goals and reduce carbon emissions, the demand for renewable energy technologies has soared, consequently boosting the power equipment sector. This growth is not only reshaping the market dynamics but also redefining the future of energy production and consumption.

To understand the impact of renewable energy on the power equipment market, it is essential to consider the broader context of the global energy transition. Governments and organizations are increasingly investing in renewable energy projects, such as wind, solar, and hydroelectric power, to diversify their energy portfolios and reduce reliance on fossil fuels. This shift is driven by both environmental concerns and the economic benefits associated with renewable energy, including job creation and energy security. As a result, the demand for power equipment that supports these technologies has surged, leading to significant market growth.

Moreover, technological advancements in renewable energy have played a crucial role in this expansion. Innovations in solar panel efficiency, wind turbine design, and energy storage solutions have made renewable energy more competitive with traditional energy sources. These advancements have not only reduced the cost of renewable energy production but have also increased its reliability and scalability. Consequently, power equipment manufacturers are experiencing heightened demand for their products, as they are essential components in the deployment and maintenance of renewable energy systems.

In addition to technological advancements, supportive government policies and incentives have further accelerated the growth of the power equipment market. Many countries have implemented policies that encourage the adoption of renewable energy, such as tax credits, subsidies, and feed-in tariffs. These measures have created a favorable environment for investment in renewable energy projects, thereby driving demand for power equipment. Furthermore, international agreements, such as the Paris Agreement, have underscored the global commitment to reducing carbon emissions, providing an additional impetus for the transition to renewable energy.

The integration of renewable energy into existing power grids also necessitates the development of advanced power equipment. As renewable energy sources are often intermittent and decentralized, there is a growing need for equipment that can efficiently manage and distribute energy. This includes smart grid technologies, energy storage systems, and advanced power converters, all of which are critical for ensuring a stable and reliable energy supply. The increasing complexity of energy systems has thus created new opportunities for power equipment manufacturers to innovate and expand their product offerings.

While the projected 2,400% profit growth in the power equipment market is impressive, it is important to recognize the challenges that accompany this rapid expansion. Supply chain disruptions, regulatory hurdles, and the need for skilled labor are potential obstacles that could impact the market’s trajectory. Nevertheless, the overall outlook remains positive, as the global commitment to renewable energy continues to drive demand for power equipment.

In conclusion, the surge in power equipment stocks, fueled by the projected profit growth, underscores the transformative impact of renewable energy on the market. As the world increasingly embraces sustainable energy solutions, the power equipment sector is poised for continued growth and innovation. This expansion not only reflects the evolving energy landscape but also highlights the critical role of power equipment in facilitating the transition to a more sustainable future.

Key Players Driving the Power Equipment Industry Boom

The power equipment industry is experiencing a remarkable surge, driven by a confluence of factors that have positioned key players for unprecedented growth. At the forefront of this boom is the projected 2,400% profit growth, a figure that has captured the attention of investors and industry analysts alike. This extraordinary growth projection is not merely a result of market speculation but is underpinned by tangible developments within the sector. As we delve into the dynamics propelling this industry forward, it becomes evident that several key players are instrumental in driving this transformation.

To begin with, the global shift towards renewable energy sources has significantly bolstered the demand for power equipment. Governments worldwide are implementing policies to reduce carbon emissions, thereby incentivizing the adoption of clean energy technologies. This transition has created a fertile ground for companies specializing in solar panels, wind turbines, and energy storage solutions. These firms are not only meeting the current demand but are also innovating to enhance efficiency and reduce costs, thereby expanding their market reach. Consequently, companies that have strategically positioned themselves in the renewable energy sector are reaping substantial benefits, contributing to the overall profit surge.

Moreover, technological advancements are playing a pivotal role in reshaping the power equipment landscape. The integration of smart technologies and the Internet of Things (IoT) into power systems has revolutionized how energy is generated, distributed, and consumed. Companies that have embraced these innovations are leading the charge in creating more resilient and efficient power grids. By leveraging data analytics and real-time monitoring, these firms are optimizing energy usage and minimizing downtime, thus offering significant value to consumers and stakeholders. This technological edge is a critical factor in the impressive profit growth projections, as it enhances operational efficiency and opens new revenue streams.

In addition to technological advancements, strategic partnerships and mergers are also contributing to the industry’s robust growth. Key players are increasingly collaborating to pool resources, share expertise, and expand their market presence. These alliances are enabling companies to scale operations rapidly and enter new markets with reduced risk. By combining strengths, these partnerships are fostering innovation and driving down costs, which in turn boosts profitability. The synergies created through these collaborations are a testament to the strategic foresight of industry leaders who recognize the importance of cooperation in a competitive landscape.

Furthermore, the global economic recovery post-pandemic has reignited industrial activities, leading to increased energy consumption. This resurgence has amplified the demand for power equipment, particularly in emerging markets where infrastructure development is a priority. Companies that have established a strong foothold in these regions are well-positioned to capitalize on the growing demand, thereby contributing to the projected profit growth. The ability to adapt to regional market dynamics and cater to diverse consumer needs is a hallmark of the industry’s key players.

In conclusion, the power equipment industry’s projected 2,400% profit growth is a reflection of the strategic initiatives and innovations undertaken by its key players. The confluence of renewable energy adoption, technological advancements, strategic partnerships, and global economic recovery has created a perfect storm for growth. As these companies continue to navigate the evolving landscape, their ability to sustain this momentum will be crucial in shaping the future of the power equipment industry. The remarkable surge in stock prices is not just a fleeting phenomenon but a testament to the transformative changes underway, driven by visionary leaders and cutting-edge technologies.

Risks and Opportunities in the Power Equipment Stock Market

The power equipment stock market has recently captured the attention of investors and analysts alike, driven by a remarkable projection of 2,400% profit growth. This surge in potential profitability has sparked both excitement and caution, as stakeholders evaluate the risks and opportunities inherent in this dynamic sector. As the global demand for energy continues to rise, power equipment companies are positioned at the forefront of this growth, offering essential technologies and solutions that facilitate energy production, distribution, and efficiency. However, with such promising prospects come inherent risks that must be carefully navigated.

To begin with, the primary driver of this projected profit growth is the increasing global emphasis on renewable energy sources. Governments and corporations worldwide are investing heavily in wind, solar, and other sustainable energy technologies, creating a burgeoning market for power equipment manufacturers. These companies are tasked with providing the necessary infrastructure to harness and distribute renewable energy, thus positioning themselves as critical players in the transition to a greener economy. Consequently, investors are keen to capitalize on this trend, anticipating substantial returns as the demand for power equipment escalates.

Nevertheless, the power equipment stock market is not without its challenges. One significant risk is the volatility of raw material prices, which can significantly impact production costs and profit margins. Many power equipment components rely on metals and other materials that are subject to fluctuating market conditions. As a result, companies must implement effective supply chain strategies to mitigate these risks and maintain profitability. Additionally, the sector faces intense competition, with numerous players vying for market share. This competitive landscape necessitates continuous innovation and differentiation to stay ahead, which can be both a costly and resource-intensive endeavor.

Moreover, regulatory changes pose another layer of complexity for power equipment companies. As governments worldwide implement new policies to address climate change and promote sustainable energy, companies must adapt to evolving standards and requirements. While these regulations can create opportunities for growth, they also demand significant investments in research and development to ensure compliance and maintain a competitive edge. Thus, companies must strike a delicate balance between seizing opportunities and managing regulatory risks.

Despite these challenges, the power equipment stock market offers substantial opportunities for those willing to navigate its complexities. Technological advancements, such as the development of smart grids and energy storage solutions, present new avenues for growth and innovation. Companies that successfully integrate these technologies into their offerings can enhance their value proposition and capture a larger share of the market. Furthermore, strategic partnerships and collaborations can provide access to new markets and resources, enabling companies to expand their reach and capabilities.

In conclusion, the projected 2,400% profit growth in the power equipment stock market underscores the sector’s potential as a lucrative investment opportunity. However, investors must remain vigilant, carefully assessing the risks associated with raw material volatility, competition, and regulatory changes. By leveraging technological advancements and strategic partnerships, companies can position themselves for success in this rapidly evolving landscape. As the world continues to prioritize sustainable energy solutions, the power equipment sector is poised to play a pivotal role in shaping the future of global energy production and distribution.

Future Outlook: Sustaining Growth in the Power Equipment Sector

The power equipment sector has recently captured the attention of investors and industry analysts alike, as a prominent company within the industry has reported a projected profit growth of an astounding 2,400%. This remarkable forecast has led to a significant surge in the company’s stock, reflecting heightened investor confidence and optimism about the future of the sector. As we delve into the factors contributing to this unprecedented growth, it is essential to consider the broader implications for the power equipment industry and the strategies that may sustain this momentum.

To begin with, the surge in profit projections can be attributed to several key factors, including technological advancements, increased demand for renewable energy solutions, and strategic market expansions. Technological innovation has played a pivotal role in enhancing the efficiency and performance of power equipment, thereby reducing operational costs and increasing profitability. For instance, the integration of smart technologies and automation has enabled companies to optimize energy consumption and improve maintenance processes, leading to significant cost savings.

Moreover, the global shift towards renewable energy sources has created a burgeoning market for power equipment manufacturers. As governments and corporations worldwide commit to reducing carbon emissions and transitioning to sustainable energy solutions, the demand for advanced power equipment has soared. This trend is expected to continue, driven by policy incentives and the growing awareness of environmental issues. Consequently, companies that can effectively cater to this demand are likely to experience sustained growth in the coming years.

In addition to technological advancements and market demand, strategic market expansions have also contributed to the projected profit growth. By entering new geographical markets and diversifying their product offerings, power equipment companies have been able to tap into previously untapped revenue streams. This approach not only mitigates risks associated with market saturation but also positions companies to capitalize on emerging opportunities in developing regions where infrastructure development is a priority.

However, sustaining this growth trajectory will require companies to navigate several challenges. One of the primary concerns is the increasing competition within the sector. As more players enter the market, companies must differentiate themselves through innovation, quality, and customer service to maintain their competitive edge. Furthermore, supply chain disruptions and fluctuating raw material costs pose potential risks to profitability. Companies must adopt agile supply chain strategies and explore alternative sourcing options to mitigate these risks effectively.

Another critical aspect of sustaining growth is the need for continuous investment in research and development. By fostering a culture of innovation, companies can stay ahead of industry trends and develop cutting-edge solutions that meet evolving customer needs. Additionally, collaboration with research institutions and technology partners can accelerate the development of new products and technologies, further enhancing a company’s competitive position.

In conclusion, the projected 2,400% profit growth in the power equipment sector underscores the transformative potential of technological advancements, renewable energy demand, and strategic market expansions. While the future outlook appears promising, companies must remain vigilant and proactive in addressing challenges such as competition, supply chain disruptions, and the need for ongoing innovation. By doing so, they can sustain their growth momentum and continue to thrive in an increasingly dynamic and competitive industry landscape. As the sector evolves, stakeholders must remain adaptable and forward-thinking to capitalize on the opportunities that lie ahead.

Q&A

1. **What is causing the surge in power equipment stock?**

The surge is driven by projected profit growth of 2,400%, likely due to increased demand for power equipment and favorable market conditions.

2. **Which companies are experiencing significant stock increases?**

Companies involved in renewable energy, electric vehicles, and infrastructure development are likely experiencing significant stock increases.

3. **What factors are contributing to the projected 2,400% profit growth?**

Factors include technological advancements, government incentives, increased infrastructure spending, and a shift towards sustainable energy solutions.

4. **How are investors reacting to the power equipment stock surge?**

Investors are likely showing increased interest and confidence, leading to higher trading volumes and stock price appreciation.

5. **What impact does this have on the overall market?**

The surge in power equipment stocks can boost market indices, attract more investment into the sector, and influence related industries.

6. **Are there any risks associated with investing in power equipment stocks now?**

Risks include market volatility, regulatory changes, supply chain disruptions, and potential overvaluation of stocks.

7. **What is the long-term outlook for power equipment stocks?**

The long-term outlook is positive, driven by ongoing global energy transitions, technological innovations, and increasing demand for sustainable solutions.

Conclusion

The recent surge in power equipment stock, driven by a projected 2,400% profit growth, highlights a significant shift in market dynamics and investor sentiment. This remarkable growth projection suggests that the company is likely capitalizing on increased demand, operational efficiencies, or strategic innovations within the power equipment sector. Such a substantial profit increase can attract more investors, boost market confidence, and potentially lead to further stock price appreciation. However, while the growth prospects appear promising, investors should remain cautious and consider potential risks, such as market volatility, competition, and economic factors that could impact future performance. Overall, the power equipment stock’s surge underscores the importance of strategic positioning and adaptability in rapidly evolving markets.