“Trust Shaken: Nursing Home Operator PACS Faces Turmoil After Hindenburg’s Revelations”

Introduction

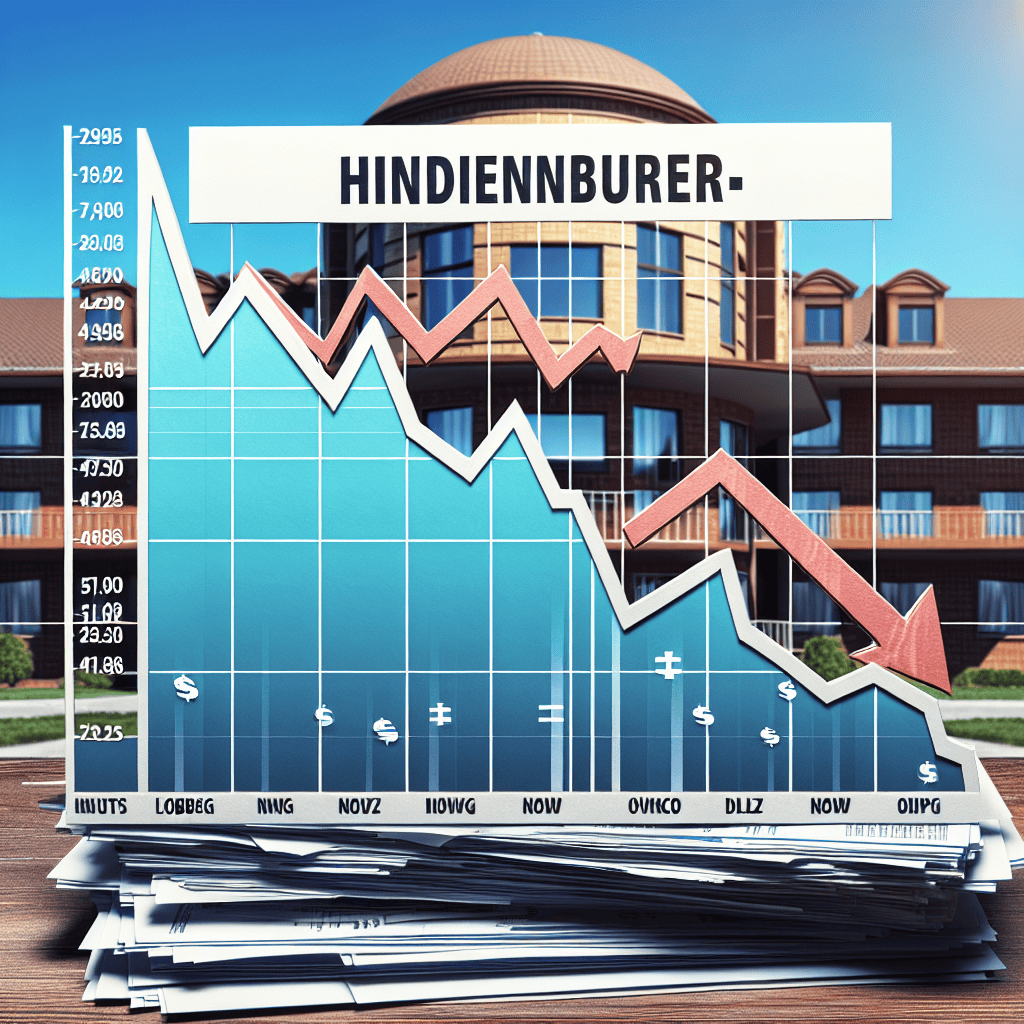

Nursing Home Operator PACS recently experienced a significant decline in its stock value following the release of a critical report by Hindenburg Research. The report, known for its in-depth investigative approach, raised serious concerns about the company’s financial practices and operational transparency. Hindenburg’s analysis highlighted potential discrepancies in PACS’s financial statements and questioned the sustainability of its business model, leading to a sharp sell-off in the market. This development has put PACS under intense scrutiny from investors and regulators, as stakeholders seek clarity on the allegations and the company’s future prospects.

Impact Of Hindenburg Short Report On Nursing Home Operators

The recent release of a short report by Hindenburg Research has sent shockwaves through the financial markets, particularly affecting the stocks of nursing home operators. Hindenburg, known for its investigative research and short-selling strategies, has targeted several companies in the past, often leading to significant market reactions. This time, the focus is on the nursing home sector, where the report has raised serious concerns about financial practices and operational transparency. As a result, the stocks of several nursing home operators have experienced a precipitous decline, causing investors to reassess their positions and prompting broader discussions about the sector’s future.

The Hindenburg report alleges that certain nursing home operators have engaged in questionable financial practices, including overstating revenues and understating liabilities. These allegations have cast a shadow over the sector, as investors fear potential regulatory scrutiny and legal challenges. The report’s findings suggest that some operators may have manipulated financial statements to present a more favorable picture of their financial health, thereby misleading investors and stakeholders. This has led to a crisis of confidence, with investors rapidly divesting from these companies, resulting in a sharp drop in their stock prices.

Moreover, the report highlights operational issues within the nursing home sector, such as inadequate staffing levels and substandard care, which have been exacerbated by the ongoing challenges posed by the COVID-19 pandemic. These operational deficiencies not only raise ethical concerns but also pose significant financial risks, as they could lead to increased regulatory oversight and potential penalties. The combination of financial and operational red flags has created a perfect storm, leading to heightened volatility in the stocks of nursing home operators.

In response to the Hindenburg report, some nursing home operators have issued statements defending their financial practices and operational standards. They argue that the report is based on selective information and does not accurately reflect the complexities of the industry. However, these reassurances have done little to calm investor nerves, as the market remains wary of potential fallout. The situation underscores the importance of transparency and accountability in the sector, as investors demand greater clarity and assurance regarding the financial and operational health of these companies.

The impact of the Hindenburg report extends beyond the immediate financial repercussions for nursing home operators. It has sparked a broader conversation about the sustainability and ethical considerations of the nursing home industry as a whole. With an aging population and increasing demand for elder care, the sector is poised for growth. However, the recent revelations have highlighted the need for robust regulatory frameworks and oversight to ensure that nursing home operators adhere to high standards of care and financial integrity.

In conclusion, the Hindenburg short report has had a profound impact on nursing home operators, leading to significant stock market declines and raising critical questions about the sector’s practices. As the industry grapples with these challenges, it is imperative for operators to prioritize transparency and accountability to restore investor confidence and ensure the long-term viability of their businesses. The situation serves as a stark reminder of the importance of ethical practices and regulatory compliance in maintaining the trust of investors and the public. As the dust settles, the nursing home sector must navigate these turbulent waters with a renewed focus on integrity and excellence in care.

Financial Implications For Nursing Home PACS After Short Report

The financial landscape for nursing home operator PACs has been significantly altered following the release of a short report by Hindenburg Research. This report, known for its critical analysis and often damning conclusions, has sent ripples through the market, causing a notable decline in the stock prices of these PACs. The implications of this report are multifaceted, affecting not only the immediate financial standing of these entities but also their long-term strategic planning and investor relations.

Initially, the Hindenburg report raised concerns about the financial practices and operational transparency of several nursing home operator PACs. By highlighting potential discrepancies in financial reporting and questioning the sustainability of their business models, the report has cast doubt on the reliability of these organizations. Consequently, investors have reacted with caution, leading to a sharp sell-off in the stocks of the implicated PACs. This market reaction underscores the power of short reports in influencing investor sentiment and the volatility they can introduce to stock prices.

Moreover, the financial implications extend beyond the immediate drop in stock prices. The affected nursing home operator PACs now face increased scrutiny from both regulators and investors. This heightened attention necessitates a reevaluation of their financial practices and corporate governance structures. In response, these organizations may need to implement more rigorous auditing processes and enhance transparency in their financial disclosures to rebuild investor confidence. Such measures, while potentially costly and time-consuming, are essential to mitigate the long-term impact of the report’s findings.

In addition to internal changes, the external environment for nursing home operator PACs is also likely to shift. The Hindenburg report may prompt regulatory bodies to take a closer look at the sector, potentially leading to stricter regulations and oversight. This could result in increased compliance costs for these organizations, further affecting their financial performance. However, it could also lead to a more stable and trustworthy market environment in the long run, benefiting both operators and investors.

Furthermore, the reputational damage inflicted by the report cannot be overlooked. Nursing home operator PACs must now work diligently to restore their public image and reassure stakeholders of their commitment to ethical and transparent business practices. This may involve strategic communication efforts and the implementation of corporate social responsibility initiatives to demonstrate their dedication to the well-being of their residents and the integrity of their operations.

In light of these challenges, nursing home operator PACs must also consider the broader implications for their strategic planning. The need to adapt to a more scrutinized and potentially regulated environment may drive these organizations to innovate and diversify their service offerings. By exploring new business models and leveraging technology to improve operational efficiency, they can better position themselves for future growth and resilience.

In conclusion, the Hindenburg short report has undeniably impacted the financial standing of nursing home operator PACs, prompting a reevaluation of their practices and strategies. While the immediate effects are evident in the decline of stock prices, the long-term implications may lead to positive changes in transparency, regulation, and innovation within the sector. As these organizations navigate this challenging landscape, their ability to adapt and respond effectively will be crucial in determining their future success and stability.

Analyzing The Hindenburg Report: What It Means For Investors

The recent release of a short report by Hindenburg Research has sent shockwaves through the financial markets, particularly affecting the shares of nursing home operator PACS. This development has left investors grappling with the implications of the report and the potential long-term impact on their investments. To understand the situation fully, it is essential to delve into the contents of the Hindenburg report and analyze its significance for investors.

Hindenburg Research, known for its investigative approach to uncovering financial discrepancies and potential fraud, has targeted PACS with allegations that have raised serious concerns. The report accuses PACS of engaging in questionable financial practices, including overstating revenues and understating liabilities. Such allegations, if proven true, could significantly undermine the company’s financial stability and investor confidence. Consequently, the immediate market reaction was a sharp decline in PACS’s stock price, reflecting the uncertainty and fear among investors.

For investors, the Hindenburg report serves as a critical reminder of the importance of due diligence and the need to scrutinize financial statements and corporate governance practices. The allegations against PACS highlight potential red flags that investors should be vigilant about, such as discrepancies in financial reporting and lack of transparency. Moreover, the report underscores the necessity for investors to diversify their portfolios to mitigate risks associated with individual stocks, especially those in sectors prone to regulatory scrutiny and operational challenges.

In addition to the immediate financial implications, the Hindenburg report may also have broader ramifications for the nursing home industry as a whole. The sector has been under increased scrutiny due to regulatory changes and heightened public awareness of care standards. If the allegations against PACS lead to regulatory investigations or legal actions, it could prompt a reevaluation of industry practices and potentially result in stricter regulations. This, in turn, could affect the operational costs and profitability of other companies within the sector, thereby influencing investor sentiment and market dynamics.

Furthermore, the situation with PACS highlights the role of short sellers and activist investors in the financial ecosystem. While some view short selling as a mechanism that brings to light corporate malfeasance, others criticize it for creating market volatility and potentially harming companies’ reputations. Regardless of one’s stance, the influence of short reports like Hindenburg’s cannot be underestimated, as they can trigger significant market movements and force companies to address underlying issues.

For investors considering their next steps, it is crucial to approach the situation with a balanced perspective. While the allegations in the Hindenburg report are serious, it is important to await further developments, such as responses from PACS and any regulatory findings, before making hasty investment decisions. Engaging with financial advisors and conducting independent research can provide valuable insights and help investors navigate the complexities of the current market environment.

In conclusion, the Hindenburg short report on PACS serves as a stark reminder of the potential risks inherent in investing, particularly in sectors facing regulatory and operational challenges. For investors, it emphasizes the importance of due diligence, diversification, and a cautious approach to market developments. As the situation unfolds, staying informed and adaptable will be key to managing investments effectively in an ever-evolving financial landscape.

Nursing Home Industry’s Response To Hindenburg Allegations

The nursing home industry has been thrust into the spotlight following a recent report by Hindenburg Research, which has sent shockwaves through the sector. The report, which targeted a prominent nursing home operator, has led to a significant decline in the operator’s publicly traded shares, causing widespread concern among stakeholders. As the industry grapples with the implications of these allegations, it is crucial to examine the responses from various quarters within the nursing home community.

In the wake of the Hindenburg report, industry leaders have been quick to address the allegations, emphasizing their commitment to transparency and ethical practices. Many operators have reiterated their dedication to providing high-quality care to residents, underscoring the importance of maintaining trust with families and communities. This response is not only a defensive measure but also a proactive step to reassure stakeholders that the industry remains steadfast in its mission to deliver compassionate and competent care.

Moreover, industry associations have played a pivotal role in shaping the collective response to the report. These organizations have called for a thorough investigation into the allegations, advocating for a fair and balanced approach to ensure that any wrongdoing is appropriately addressed. By doing so, they aim to uphold the integrity of the industry and protect the interests of both residents and employees. This collective stance highlights the industry’s recognition of the need for accountability and transparency in the face of such serious accusations.

In addition to industry leaders and associations, regulatory bodies have also been prompted to take action. The report has spurred discussions about the need for stricter oversight and more rigorous compliance standards within the nursing home sector. Regulators are now under pressure to enhance their monitoring mechanisms to prevent potential misconduct and ensure that operators adhere to the highest standards of care. This increased scrutiny is seen as a necessary step to restore confidence in the industry and safeguard the welfare of residents.

Furthermore, the Hindenburg report has sparked a broader conversation about the financial practices of nursing home operators. Investors and analysts are now scrutinizing the financial health and operational transparency of these entities more closely. This heightened attention is likely to lead to more stringent financial reporting requirements, compelling operators to adopt more robust governance frameworks. As a result, the industry may witness a shift towards greater financial accountability, which could ultimately benefit all stakeholders involved.

While the immediate impact of the Hindenburg report has been largely negative, it also presents an opportunity for the nursing home industry to reflect and improve. By addressing the allegations head-on and implementing necessary reforms, operators can strengthen their operations and enhance their reputation. This period of introspection and reform could lead to a more resilient and trustworthy industry, better equipped to meet the challenges of an aging population.

In conclusion, the nursing home industry’s response to the Hindenburg allegations has been multifaceted, involving leaders, associations, regulators, and investors. While the report has undoubtedly posed significant challenges, it has also catalyzed a movement towards greater transparency, accountability, and financial integrity. As the industry navigates this turbulent period, its commitment to upholding the highest standards of care and governance will be crucial in restoring trust and ensuring the well-being of residents.

Short Selling And Its Effects On Nursing Home Operator Stocks

The world of finance is often characterized by its volatility, with stock prices subject to rapid fluctuations based on market sentiment, economic indicators, and company-specific news. One of the more dramatic influences on stock prices can be the release of a short report, particularly from a well-known entity such as Hindenburg Research. Recently, the nursing home operator PACS experienced a significant decline in its stock value following the publication of a Hindenburg short report, highlighting the profound impact such reports can have on investor confidence and market dynamics.

Short selling, a strategy where investors bet against a company’s stock, can be a contentious practice. Proponents argue that it serves as a mechanism for uncovering overvalued stocks and promoting market efficiency. Critics, however, contend that it can lead to undue pressure on companies, especially when short sellers release reports that may influence public perception. In the case of PACS, Hindenburg’s report raised serious concerns about the company’s financial health and operational practices, leading to a sharp sell-off in its shares.

The Hindenburg report alleged that PACS had engaged in questionable accounting practices and misrepresented its financial position. Such allegations, whether substantiated or not, can have immediate and severe repercussions. Investors, wary of potential risks, often react swiftly to such reports, leading to a rapid decline in stock prices. In the case of PACS, the market’s reaction was no different, with the stock plummeting as investors sought to mitigate potential losses.

This situation underscores the broader implications of short selling on nursing home operator stocks. The healthcare sector, and nursing homes in particular, are often viewed as stable investments due to the consistent demand for their services. However, they are not immune to the effects of market speculation and negative publicity. When a short report targets a company within this sector, it can lead to increased scrutiny from regulators, potential legal challenges, and a loss of trust among stakeholders.

Moreover, the impact of such reports extends beyond immediate financial losses. For nursing home operators like PACS, the reputational damage can be significant. Trust is a critical component in the healthcare industry, and any suggestion of financial impropriety can erode the confidence of patients, families, and partners. This can lead to a decline in occupancy rates and revenue, further exacerbating the company’s financial challenges.

In response to the Hindenburg report, PACS has vehemently denied the allegations, asserting that its financial practices are sound and transparent. The company has pledged to conduct an internal review and cooperate with any regulatory inquiries. While such measures may help to restore some degree of confidence, the road to recovery can be long and arduous.

In conclusion, the case of PACS highlights the significant effects that short selling and related reports can have on nursing home operator stocks. While these reports can serve as a catalyst for necessary scrutiny and reform, they also pose challenges for companies striving to maintain their reputation and financial stability. As the situation unfolds, it will be crucial for PACS and similar companies to navigate these challenges with transparency and diligence, ensuring that they can continue to provide essential services while safeguarding their financial health.

Lessons Learned From The Hindenburg Report On Nursing Homes

The recent Hindenburg short report on nursing home operators has sent shockwaves through the industry, leading to a significant decline in the value of related publicly traded companies. This development has prompted a closer examination of the practices and financial health of these operators, offering several lessons for stakeholders in the healthcare sector. The report, which meticulously detailed alleged financial mismanagement and operational inefficiencies, serves as a stark reminder of the importance of transparency and accountability in the management of nursing homes.

One of the primary lessons from the Hindenburg report is the critical need for rigorous financial oversight. The report highlighted discrepancies in financial reporting and raised questions about the sustainability of certain business models within the nursing home sector. This underscores the necessity for operators to maintain accurate and transparent financial records, not only to comply with regulatory requirements but also to build trust with investors and the public. Financial transparency is essential for ensuring that resources are allocated efficiently and that the quality of care provided to residents is not compromised.

Moreover, the report has brought to light the importance of operational efficiency in nursing homes. Inefficiencies in staffing, resource allocation, and facility management can have a direct impact on the quality of care provided to residents. The allegations of understaffing and inadequate training mentioned in the report highlight the need for nursing home operators to prioritize the recruitment and retention of qualified staff. Ensuring that staff members are well-trained and adequately supported is crucial for maintaining high standards of care and for safeguarding the well-being of residents.

In addition to financial and operational considerations, the Hindenburg report emphasizes the significance of ethical governance in the nursing home industry. Allegations of unethical practices, such as prioritizing profits over patient care, have raised concerns about the moral responsibilities of nursing home operators. This situation serves as a reminder that ethical governance should be at the forefront of decision-making processes. Operators must balance financial objectives with their duty to provide compassionate and high-quality care to residents, ensuring that ethical considerations are integrated into every aspect of their operations.

Furthermore, the report has highlighted the role of regulatory bodies in overseeing the nursing home industry. It is evident that robust regulatory frameworks are essential for monitoring compliance and ensuring that nursing home operators adhere to established standards. Regulatory agencies must be vigilant in their oversight and enforcement activities, providing guidance and support to operators while holding them accountable for any lapses in care or financial management. This balance is crucial for fostering an environment where nursing homes can thrive while prioritizing the needs of their residents.

In conclusion, the Hindenburg short report on nursing home operators has provided valuable insights into the challenges and opportunities facing the industry. By emphasizing the importance of financial transparency, operational efficiency, ethical governance, and robust regulatory oversight, the report offers a roadmap for improving the quality of care in nursing homes. Stakeholders, including operators, investors, regulators, and policymakers, must work collaboratively to address these issues and ensure that nursing homes remain a safe and supportive environment for their residents. As the industry moves forward, these lessons will be instrumental in shaping a more resilient and compassionate future for nursing home care.

Future Outlook For Nursing Home Operators Post-Hindenburg Report

The recent Hindenburg short report has sent shockwaves through the nursing home industry, particularly affecting the financial stability of nursing home operator PACS. This report, which highlighted alleged financial mismanagement and operational inefficiencies, has led to a significant decline in investor confidence, causing PACS’s stock to plummet. As the dust begins to settle, stakeholders are left to ponder the future outlook for nursing home operators in the wake of such a critical report.

In the immediate aftermath, nursing home operators are likely to face increased scrutiny from both investors and regulatory bodies. The Hindenburg report has not only cast doubt on PACS but has also raised questions about the broader industry’s transparency and governance practices. Consequently, operators may need to adopt more stringent financial reporting and compliance measures to restore trust and demonstrate their commitment to ethical practices. This shift could lead to increased operational costs, as companies invest in enhanced auditing processes and governance frameworks.

Moreover, the report has underscored the importance of operational efficiency in maintaining financial health. Nursing home operators may need to reassess their business models, focusing on optimizing resource allocation and improving service delivery. This could involve leveraging technology to streamline operations, such as implementing electronic health records and utilizing data analytics to enhance patient care. By embracing innovation, operators can potentially reduce costs and improve outcomes, thereby strengthening their competitive position in the market.

In addition to operational adjustments, nursing home operators must also consider the evolving regulatory landscape. The Hindenburg report has likely caught the attention of policymakers, who may respond with tighter regulations to ensure accountability and protect residents’ welfare. Operators should proactively engage with regulators, participating in discussions to shape policies that balance oversight with operational feasibility. By taking a collaborative approach, the industry can work towards establishing standards that promote transparency and quality care without imposing undue burdens on operators.

Furthermore, the report’s impact on investor sentiment cannot be overlooked. Nursing home operators may face challenges in securing capital, as investors become more cautious and risk-averse. To attract investment, operators will need to demonstrate robust financial health and a clear strategy for sustainable growth. This may involve diversifying revenue streams, such as expanding into ancillary services or exploring partnerships with healthcare providers. By presenting a compelling value proposition, operators can rebuild investor confidence and secure the necessary funding to support their operations.

Despite the challenges posed by the Hindenburg report, there are also opportunities for nursing home operators to differentiate themselves in the market. By prioritizing transparency, efficiency, and quality care, operators can position themselves as leaders in an industry undergoing transformation. This may involve investing in staff training and development to ensure a skilled workforce capable of delivering high-quality care. Additionally, operators can focus on enhancing the resident experience, fostering a culture of compassion and respect that sets them apart from competitors.

In conclusion, the Hindenburg short report has undoubtedly created a turbulent environment for nursing home operators, with PACS bearing the brunt of its impact. However, by addressing the issues raised and adapting to the changing landscape, operators can navigate these challenges and emerge stronger. Through strategic investments in governance, technology, and workforce development, the industry can rebuild trust and continue to provide essential services to an aging population. As operators chart a path forward, the lessons learned from this episode will be crucial in shaping a more resilient and sustainable future for the nursing home sector.

Q&A

1. **What is the main focus of the Hindenburg short report on the nursing home operator?**

– The report likely focuses on financial discrepancies, operational issues, or potential misconduct within the nursing home operator’s business practices.

2. **How did the stock price of the nursing home operator’s PAC react to the Hindenburg report?**

– The stock price of the nursing home operator’s PAC plummeted following the release of the Hindenburg report.

3. **What are some common allegations made in short reports like the one from Hindenburg?**

– Common allegations include financial misrepresentation, fraudulent activities, regulatory non-compliance, and poor corporate governance.

4. **What is the typical impact of a short report on a company’s market perception?**

– A short report can significantly damage a company’s market perception, leading to a loss of investor confidence and a decline in stock value.

5. **What actions might a company take in response to a damaging short report?**

– The company might issue a public statement refuting the claims, conduct an internal investigation, or take legal action against the entity that published the report.

6. **What role does a PAC (Political Action Committee) play in relation to a nursing home operator?**

– A PAC associated with a nursing home operator typically engages in political lobbying and campaign contributions to influence legislation and regulations favorable to the industry.

7. **What are potential long-term effects on a company after a short report is released?**

– Long-term effects can include sustained stock price volatility, increased regulatory scrutiny, potential legal challenges, and reputational damage.

Conclusion

The release of a short report by Hindenburg Research has led to a significant decline in the stock price of a nursing home operator’s publicly traded acquisition company (PAC). The report likely raised concerns about the company’s financial health, operational practices, or governance, prompting investors to sell off shares. This reaction underscores the influence of short reports on market perceptions and the potential vulnerabilities of companies targeted by such analyses. The situation highlights the importance of transparency and robust business practices for companies to maintain investor confidence and market stability.