“Navigating Uncertainty: Investors Brace for Election-Driven Market Waves in Stocks and Crypto”

Introduction

As the United States approaches another pivotal election cycle, investors are bracing for potential volatility across financial markets, including both traditional stocks and the burgeoning cryptocurrency sector. Historically, elections have been periods of uncertainty, often leading to fluctuations in market sentiment and asset prices. This year, with heightened political polarization and economic challenges, the stakes are particularly high. Investors are closely monitoring policy proposals, regulatory shifts, and geopolitical developments that could impact market dynamics. In anticipation of these changes, many are adjusting their portfolios, seeking to hedge against risks while positioning themselves to capitalize on potential opportunities. The interplay between political outcomes and market reactions underscores the complex landscape investors must navigate in the lead-up to the election.

Understanding Market Volatility During US Elections

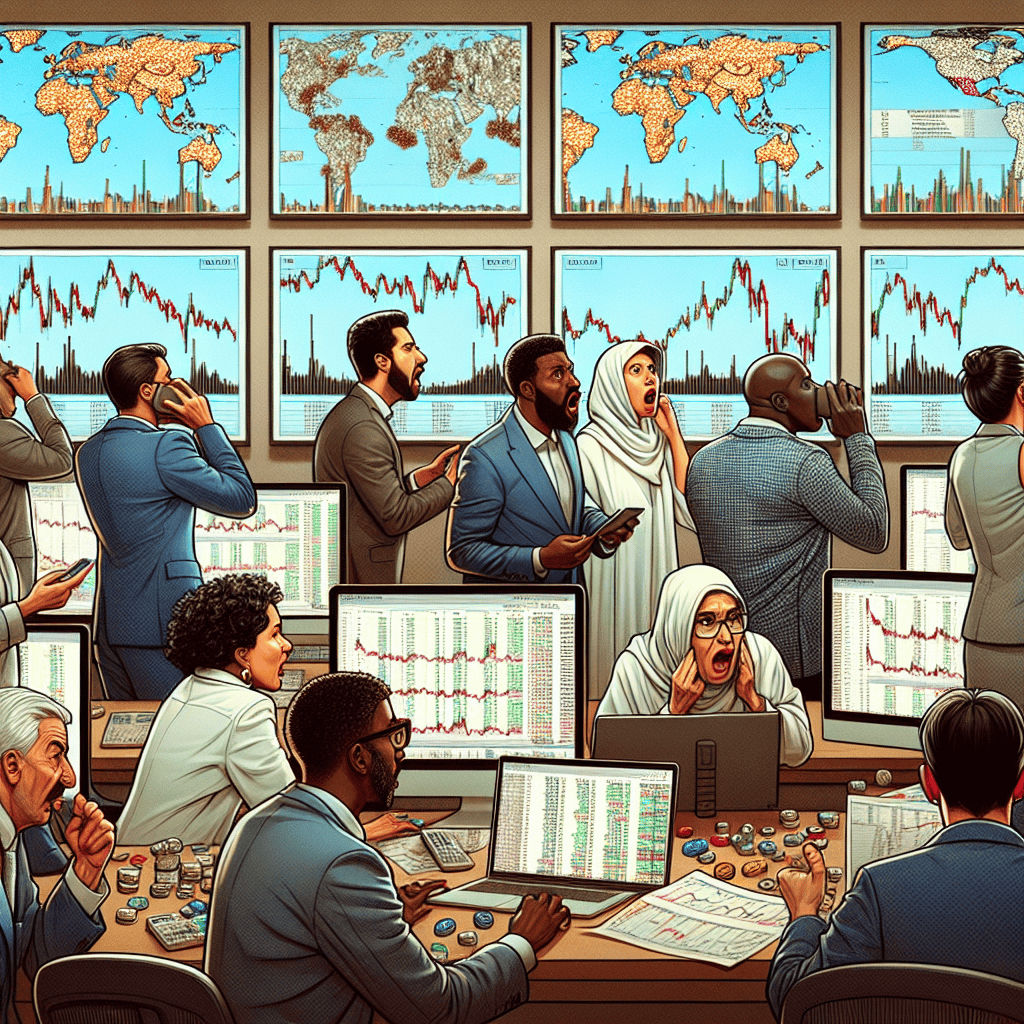

As the United States approaches another election cycle, investors are bracing for the potential volatility that often accompanies such significant political events. Historically, US elections have been periods of heightened uncertainty, which can lead to increased market fluctuations. This phenomenon is not limited to traditional stock markets but extends to the burgeoning cryptocurrency sector as well. Understanding the dynamics of market volatility during US elections is crucial for investors seeking to navigate these turbulent times effectively.

To begin with, it is essential to recognize that market volatility is a natural response to uncertainty. Elections, by their very nature, introduce a degree of unpredictability as investors attempt to anticipate the potential policy changes that could arise from a shift in political power. This uncertainty can lead to rapid buying and selling as market participants adjust their portfolios in response to perceived risks and opportunities. Consequently, stock markets often experience increased volatility in the months leading up to and immediately following an election.

Moreover, the impact of elections on market volatility is not uniform across all sectors. Certain industries may be more sensitive to potential policy changes, such as healthcare, energy, and finance, which are often at the forefront of political debates. Investors in these sectors may experience heightened volatility as they attempt to gauge the implications of different electoral outcomes. For instance, a candidate proposing significant healthcare reforms could lead to fluctuations in healthcare stocks as investors speculate on the potential impact on the industry.

In addition to traditional stock markets, the cryptocurrency sector is also susceptible to election-induced volatility. Cryptocurrencies, known for their inherent volatility, can experience even greater price swings during election periods. This is partly due to the speculative nature of the market and the fact that regulatory stances on digital assets can vary significantly between political parties. Investors in cryptocurrencies must remain vigilant, as changes in regulatory policies could have profound effects on the market’s trajectory.

Furthermore, the global nature of financial markets means that US elections can have far-reaching implications beyond domestic borders. International investors closely monitor US elections, as the outcomes can influence global economic policies, trade agreements, and geopolitical relations. Consequently, foreign markets may also experience volatility in response to US electoral developments, further complicating the investment landscape.

To mitigate the risks associated with election-related volatility, investors can employ several strategies. Diversification remains a fundamental approach, as spreading investments across various asset classes and sectors can help reduce exposure to any single source of risk. Additionally, maintaining a long-term perspective can be beneficial, as markets often stabilize once the election uncertainty subsides and new policies are clarified. Investors may also consider utilizing hedging strategies, such as options or futures contracts, to protect their portfolios from adverse market movements.

In conclusion, understanding market volatility during US elections is essential for investors seeking to navigate these periods of uncertainty. By recognizing the factors that contribute to increased volatility and employing prudent investment strategies, investors can better position themselves to weather the potential market fluctuations. As the upcoming US election approaches, staying informed and adaptable will be key to managing the challenges and opportunities that arise in both traditional and cryptocurrency markets.

Strategies for Investors to Mitigate Election-Induced Risks

As the United States approaches another pivotal election, investors are bracing for potential market volatility that often accompanies such political events. Historically, elections have been periods of uncertainty, with markets reacting to the anticipated and actual outcomes. This year, the stakes are particularly high, given the complex interplay of economic, social, and geopolitical factors. Consequently, investors are seeking strategies to mitigate the risks associated with election-induced volatility, not only in traditional stock markets but also in the burgeoning cryptocurrency sector.

To begin with, diversification remains a cornerstone strategy for investors aiming to cushion their portfolios against election-related turbulence. By spreading investments across various asset classes, sectors, and geographic regions, investors can reduce the impact of adverse movements in any single area. For instance, while certain sectors like healthcare or energy might experience heightened volatility due to policy shifts, others such as consumer staples or utilities might offer more stability. Similarly, international diversification can provide a buffer against domestic political uncertainties, as global markets may not be as directly affected by U.S. election outcomes.

In addition to diversification, maintaining a long-term perspective is crucial. Elections, by their nature, are transient events, and while they can cause short-term market fluctuations, the long-term trajectory of markets is typically driven by broader economic fundamentals. Investors who focus on their long-term goals and resist the urge to make impulsive decisions based on election news are often better positioned to weather the storm. This approach is particularly relevant in the context of cryptocurrencies, which are known for their volatility. By maintaining a disciplined investment strategy and avoiding reactionary trades, investors can potentially capitalize on the long-term growth prospects of digital assets.

Moreover, hedging strategies can be employed to protect portfolios from downside risks. Options and futures contracts, for example, can be used to hedge against potential losses in stock positions. In the cryptocurrency market, investors might consider using stablecoins or engaging in derivatives trading to manage risk. These instruments can provide a level of insurance against adverse price movements, allowing investors to navigate uncertain times with greater confidence.

Furthermore, staying informed and vigilant is essential for investors during election periods. By keeping abreast of political developments, policy proposals, and potential regulatory changes, investors can make more informed decisions. This is particularly pertinent in the cryptocurrency space, where regulatory developments can have significant implications for market dynamics. Engaging with reliable news sources and financial analysts can provide valuable insights into how election outcomes might influence market trends.

Finally, maintaining liquidity is a prudent strategy during periods of potential volatility. By ensuring that a portion of their portfolio is held in cash or cash-equivalents, investors can remain agile and ready to capitalize on opportunities that may arise from market dislocations. This liquidity can also serve as a safety net, providing the flexibility to adjust positions as the political landscape evolves.

In conclusion, while U.S. elections invariably introduce a degree of uncertainty into financial markets, investors can employ a range of strategies to mitigate associated risks. Through diversification, a long-term perspective, hedging, staying informed, and maintaining liquidity, investors can navigate the complexities of election-induced volatility across both stocks and cryptocurrencies. By adopting these strategies, they can position themselves to not only protect their portfolios but also potentially benefit from the opportunities that arise in the wake of political change.

Historical Analysis of Stock Market Trends During Election Years

As the United States approaches another election cycle, investors are keenly aware of the potential volatility that could impact both traditional stock markets and the burgeoning cryptocurrency sector. Historically, election years have been characterized by heightened uncertainty, which often translates into increased market volatility. This phenomenon can be attributed to the anticipation of policy changes that accompany a new administration, as well as the general unpredictability of electoral outcomes. By examining past election years, investors can gain insights into potential market behaviors and better prepare for the fluctuations that may arise.

Looking back at previous election cycles, it becomes evident that stock markets often experience a degree of turbulence. For instance, during the 2000 presidential election, the uncertainty surrounding the contested results led to a temporary dip in the stock market. Similarly, the 2008 election, set against the backdrop of a global financial crisis, saw significant market volatility as investors grappled with the implications of a new administration’s approach to economic recovery. These examples underscore the fact that elections can serve as catalysts for market movements, driven by both political and economic factors.

Moreover, the impact of elections on stock markets is not uniform and can vary depending on the sectors involved. Certain industries may react more sensitively to potential policy shifts. For example, healthcare and energy stocks often experience fluctuations based on the anticipated regulatory environment under a new administration. Investors, therefore, tend to closely monitor candidates’ platforms and proposed policies to gauge which sectors might benefit or suffer post-election. This sector-specific analysis allows investors to make more informed decisions, potentially mitigating risks associated with election-induced volatility.

In recent years, the rise of cryptocurrencies has added another layer of complexity to the investment landscape during election cycles. Unlike traditional stocks, cryptocurrencies operate in a decentralized market, which can be influenced by a different set of factors, including regulatory developments and technological advancements. However, the political climate still plays a significant role. For instance, discussions around cryptocurrency regulation and taxation can lead to market fluctuations, as seen in past election years when candidates have proposed varying degrees of oversight for digital assets. As a result, investors in the crypto space must also remain vigilant, keeping an eye on political developments that could impact the market.

Transitioning from historical analysis to current strategies, investors are increasingly employing a range of tactics to navigate election-year volatility. Diversification remains a cornerstone of risk management, allowing investors to spread their exposure across different asset classes and sectors. Additionally, some investors opt for hedging strategies, such as options and futures, to protect their portfolios against potential downturns. These approaches are complemented by a focus on long-term investment horizons, which can help mitigate the short-term noise often associated with election cycles.

In conclusion, while election years are inherently unpredictable, historical trends provide valuable insights into potential market behaviors. By understanding the patterns of past election cycles and considering the unique dynamics of both stock and cryptocurrency markets, investors can better prepare for the volatility that may arise. Through careful analysis and strategic planning, they can navigate the complexities of election-year investing, positioning themselves to capitalize on opportunities while minimizing risks. As the upcoming election approaches, staying informed and adaptable will be key to successfully managing investments in an ever-evolving political and economic landscape.

The Impact of US Elections on Cryptocurrency Markets

As the United States approaches another pivotal election cycle, investors across various financial markets are bracing for potential volatility, particularly within the cryptocurrency sector. Historically, U.S. elections have been a significant source of market fluctuations, and the upcoming election is expected to be no different. The cryptocurrency market, known for its inherent volatility, is likely to experience pronounced swings as investors react to political developments and policy announcements. Understanding the potential impact of the U.S. elections on cryptocurrency markets requires a comprehensive analysis of several interrelated factors.

Firstly, the regulatory landscape surrounding cryptocurrencies is a critical area of concern for investors. The stance of the incoming administration on digital assets can significantly influence market dynamics. For instance, a government that adopts a favorable regulatory framework could spur increased adoption and investment in cryptocurrencies, thereby driving up prices. Conversely, stringent regulations or an outright crackdown on digital currencies could lead to market contractions. As such, investors are closely monitoring the policy positions of candidates and their potential impact on the regulatory environment.

Moreover, the broader economic policies proposed by candidates can also affect cryptocurrency markets. Economic strategies that influence inflation, interest rates, and fiscal stimulus can indirectly impact digital assets. Cryptocurrencies, particularly Bitcoin, are often viewed as a hedge against inflation and currency devaluation. Therefore, policies that are perceived to lead to higher inflation could drive more investors towards cryptocurrencies as a store of value. On the other hand, policies that stabilize the economy and strengthen the U.S. dollar might reduce the appeal of cryptocurrencies as an alternative investment.

In addition to regulatory and economic considerations, geopolitical factors associated with the U.S. elections can also play a role in shaping cryptocurrency markets. The global nature of digital currencies means that international relations and trade policies can have far-reaching effects. For example, tensions between the U.S. and other major economies could lead to increased uncertainty, prompting investors to seek refuge in decentralized assets like cryptocurrencies. Conversely, improved international relations and trade agreements might bolster traditional markets, potentially drawing investment away from digital currencies.

Furthermore, the sentiment and behavior of retail investors, who constitute a significant portion of the cryptocurrency market, are likely to be influenced by the election outcome. Retail investors often react to news and events with heightened sensitivity, leading to rapid price movements. The proliferation of social media and online trading platforms has amplified this effect, as information spreads quickly and can trigger collective buying or selling. Consequently, the election results and subsequent policy announcements could lead to swift and substantial shifts in market sentiment.

In conclusion, the upcoming U.S. elections present a complex array of factors that could impact cryptocurrency markets. Investors are advised to remain vigilant and consider the potential implications of regulatory changes, economic policies, geopolitical developments, and retail investor behavior. By staying informed and adopting a strategic approach, investors can better navigate the anticipated volatility and position themselves to capitalize on opportunities that may arise in the aftermath of the elections. As the political landscape continues to evolve, the interplay between traditional financial markets and the burgeoning cryptocurrency sector will undoubtedly remain a focal point for investors worldwide.

Diversification Tactics for Investors Facing Election Uncertainty

As the United States approaches another pivotal election cycle, investors are bracing for potential market volatility that often accompanies such political events. Historically, elections have been periods of uncertainty, with markets reacting to the anticipated and actual outcomes of the electoral process. This year, the stakes are particularly high, with both traditional stock markets and the burgeoning cryptocurrency sector poised to experience fluctuations. Consequently, investors are increasingly turning to diversification tactics to mitigate risks and capitalize on potential opportunities.

Diversification, a fundamental principle of investment strategy, involves spreading investments across various asset classes to reduce exposure to any single risk. In the context of election uncertainty, this approach becomes even more critical. Investors are advised to consider a balanced portfolio that includes a mix of equities, bonds, and alternative assets such as cryptocurrencies. By doing so, they can potentially cushion their portfolios against the unpredictable swings that may arise from election-related developments.

In the stock market, sectors such as healthcare, technology, and energy are often sensitive to political changes, as different administrations may implement varying policies that impact these industries. For instance, a government favoring renewable energy could boost stocks in that sector, while another focusing on traditional energy sources might have the opposite effect. Therefore, investors are encouraged to analyze the policy platforms of leading candidates and adjust their portfolios accordingly. This strategic allocation can help investors position themselves advantageously, regardless of the election outcome.

Meanwhile, the cryptocurrency market presents a unique set of challenges and opportunities. Unlike traditional markets, cryptocurrencies operate in a decentralized environment, which can make them less susceptible to direct political influence. However, regulatory changes stemming from election results can still impact this sector significantly. For example, a government that adopts a favorable stance towards digital currencies could lead to increased adoption and higher valuations, while a more restrictive approach might dampen market enthusiasm. As such, investors are advised to stay informed about potential regulatory shifts and consider including a diversified range of cryptocurrencies in their portfolios to hedge against specific risks.

Moreover, international diversification is another tactic that investors can employ to navigate election volatility. By investing in global markets, investors can reduce their reliance on the US economy and political landscape. This approach not only spreads risk but also opens up opportunities in regions that may be experiencing growth independent of US political dynamics. Emerging markets, in particular, can offer attractive prospects, although they come with their own set of risks that must be carefully evaluated.

In addition to asset diversification, investors should also consider diversifying their investment strategies. Employing a mix of active and passive investment approaches can provide flexibility and resilience in uncertain times. Active management allows investors to respond quickly to market changes, while passive strategies, such as index funds, offer stability and lower costs over the long term.

In conclusion, as the US election approaches, investors are wise to adopt a diversified approach to their portfolios. By spreading investments across various asset classes, sectors, and geographies, and by employing a mix of investment strategies, they can better navigate the uncertainties and potential volatilities that elections often bring. This comprehensive approach not only helps in managing risks but also positions investors to seize opportunities that may arise in the ever-evolving financial landscape.

How Political Outcomes Influence Investor Sentiment

As the United States approaches another pivotal election cycle, investors are bracing for potential volatility across both traditional stock markets and the burgeoning cryptocurrency sector. Historically, political outcomes have wielded significant influence over investor sentiment, often dictating market trends and shaping investment strategies. The anticipation of policy shifts, regulatory changes, and economic reforms typically associated with new administrations can lead to heightened market fluctuations, as investors attempt to predict and react to the potential impacts on their portfolios.

In the stock market, the influence of political outcomes is often immediate and pronounced. Investors closely monitor election results to gauge the likelihood of changes in fiscal policy, taxation, and government spending. For instance, a government perceived as business-friendly might spur optimism among investors, leading to a rally in stock prices. Conversely, an administration that signals increased regulation or higher corporate taxes could trigger a sell-off, as investors reassess the profitability of their holdings. The anticipation of such shifts can lead to pre-election volatility, as market participants adjust their positions in response to polling data and political forecasts.

Moreover, the impact of political outcomes extends beyond domestic markets, influencing global investor sentiment. The United States, as a major economic powerhouse, plays a critical role in international trade and finance. Consequently, changes in U.S. policy can have ripple effects across global markets. For example, a shift towards protectionist trade policies might raise concerns about international trade relations, affecting investor confidence worldwide. This interconnectedness underscores the importance of political stability and predictability in maintaining investor confidence, both domestically and internationally.

In recent years, the rise of cryptocurrencies has added a new dimension to how political outcomes influence investor sentiment. Unlike traditional markets, the cryptocurrency sector operates in a largely decentralized and unregulated environment. However, this does not render it immune to political developments. Regulatory clarity, or the lack thereof, remains a significant concern for crypto investors. Elections that bring about changes in regulatory approaches to digital assets can lead to substantial market movements. For instance, the prospect of stricter regulations might deter investment in cryptocurrencies, while a more lenient regulatory stance could encourage greater adoption and investment.

Furthermore, the decentralized nature of cryptocurrencies means that they are often viewed as a hedge against political and economic instability. During times of political uncertainty, some investors may turn to digital assets as a means of preserving value, potentially driving up demand and prices. This dynamic adds an additional layer of complexity to how political outcomes influence investor sentiment in the crypto space.

As investors prepare for the upcoming U.S. election, they must navigate a landscape characterized by uncertainty and potential volatility. Diversification remains a key strategy, allowing investors to mitigate risks associated with political outcomes. By spreading investments across different asset classes and geographies, investors can reduce their exposure to any single political event or policy change. Additionally, staying informed about political developments and their potential market implications is crucial for making informed investment decisions.

In conclusion, political outcomes have a profound impact on investor sentiment, influencing both traditional stock markets and the evolving cryptocurrency sector. As the U.S. election approaches, investors must remain vigilant, adapting their strategies to account for potential policy shifts and regulatory changes. By understanding the interplay between politics and markets, investors can better position themselves to navigate the challenges and opportunities that lie ahead.

Preparing Your Investment Portfolio for Election Year Fluctuations

As the United States approaches another election year, investors are bracing for the inevitable market fluctuations that accompany such political events. Historically, election years have been characterized by increased volatility in financial markets, as uncertainty surrounding potential policy changes and leadership shifts can lead to unpredictable movements in both traditional stocks and emerging asset classes like cryptocurrencies. Consequently, preparing an investment portfolio to withstand these fluctuations is crucial for investors seeking to safeguard their assets and capitalize on potential opportunities.

To begin with, understanding the historical context of election year market behavior is essential. Traditionally, stock markets have experienced heightened volatility during election years, driven by the uncertainty of electoral outcomes and their subsequent impact on economic policies. This uncertainty can lead to increased market speculation, as investors attempt to anticipate the direction of future policy changes. For instance, sectors that are heavily influenced by government regulation, such as healthcare and energy, often experience significant price swings as investors react to potential shifts in policy. Therefore, diversifying one’s portfolio across various sectors can help mitigate the risks associated with such volatility.

In addition to traditional stocks, the cryptocurrency market has emerged as a significant player in the investment landscape, and it too is susceptible to election year fluctuations. Cryptocurrencies, known for their inherent volatility, can experience even more pronounced price movements during periods of political uncertainty. This is partly due to the speculative nature of the asset class and its sensitivity to regulatory developments. As governments worldwide continue to grapple with how to regulate digital currencies, any indication of potential policy changes can lead to rapid shifts in market sentiment. Thus, investors with exposure to cryptocurrencies should remain vigilant and consider employing strategies such as dollar-cost averaging to manage risk.

Moreover, maintaining a long-term perspective is vital when navigating election year volatility. While short-term market movements can be unsettling, it is important to remember that elections are cyclical events, and markets have historically rebounded from election-related disruptions. By focusing on long-term investment goals and maintaining a diversified portfolio, investors can better weather the storm of election year volatility. Additionally, staying informed about the political landscape and potential policy implications can provide valuable insights into how different sectors and asset classes may be affected.

Furthermore, employing risk management strategies can be beneficial in preparing for election year fluctuations. For instance, utilizing options and other hedging instruments can help protect against downside risk while still allowing for potential upside gains. Additionally, maintaining a cash reserve can provide flexibility to capitalize on buying opportunities that may arise during periods of market turbulence. By proactively managing risk, investors can position themselves to navigate the uncertainties of an election year more effectively.

In conclusion, as the United States gears up for another election year, investors must prepare their portfolios for the accompanying market volatility. By understanding historical market behavior, diversifying across asset classes, maintaining a long-term perspective, and employing risk management strategies, investors can better position themselves to navigate the uncertainties of an election year. While the road ahead may be fraught with challenges, a well-prepared investment portfolio can help mitigate risks and seize opportunities that arise during this tumultuous period.

Q&A

1. **What are investors anticipating with the upcoming US election?**

Investors are anticipating increased market volatility across both stocks and cryptocurrencies due to uncertainties surrounding the election outcome and its potential impact on economic policies.

2. **How might the US election impact stock markets?**

The election could lead to fluctuations in stock markets as investors react to potential changes in fiscal policies, regulatory environments, and geopolitical relations depending on the election results.

3. **Why are cryptocurrencies also expected to be volatile during the US election?**

Cryptocurrencies may experience volatility due to their sensitivity to macroeconomic factors and investor sentiment, which can be influenced by political events and uncertainty.

4. **What strategies are investors using to manage election-related volatility?**

Investors are employing strategies such as diversifying portfolios, using options and futures for hedging, and increasing cash reserves to manage potential risks associated with election-related volatility.

5. **Which sectors might be most affected by the election results?**

Sectors such as healthcare, energy, and technology could be significantly affected, as different political outcomes may lead to varying regulatory and policy changes impacting these industries.

6. **How do past elections inform current investor behavior?**

Historical patterns show that markets often experience increased volatility during election periods, prompting investors to be cautious and adjust their strategies based on past election outcomes and market reactions.

7. **What role does investor sentiment play in market volatility during elections?**

Investor sentiment plays a crucial role as it can drive market movements based on perceptions of political stability, economic policies, and future growth prospects, leading to increased buying or selling pressure.

Conclusion

Investors are bracing for heightened volatility in both stock and cryptocurrency markets as the US election approaches. Historically, elections can lead to uncertainty, prompting market fluctuations due to potential policy changes and shifts in economic direction. In anticipation, investors are diversifying portfolios, increasing cash reserves, and utilizing hedging strategies to mitigate risks. The crypto market, known for its volatility, may experience amplified movements as investors react to election outcomes and regulatory prospects. Overall, the election period is expected to be a critical time for market participants, requiring careful navigation and strategic planning to manage potential volatility.