“Boeing’s Profits Take a Nosedive: Navigating Turbulence After the Strike”

Introduction

Boeing, a leading aerospace manufacturer, is facing a significant decline in profitability following a recent strike that disrupted its operations. The strike, initiated by a substantial portion of its workforce, has led to production halts and delivery delays, impacting the company’s financial performance. This downturn comes at a critical time as Boeing was navigating recovery from previous challenges, including the global pandemic and issues with its 737 MAX aircraft. The financial repercussions of the strike are expected to be profound, affecting not only immediate revenue streams but also long-term contracts and market confidence. As Boeing grapples with these challenges, the company must strategize effectively to mitigate the financial impact and restore its position in the competitive aerospace industry.

Impact Of Labor Strikes On Boeing’s Financial Health

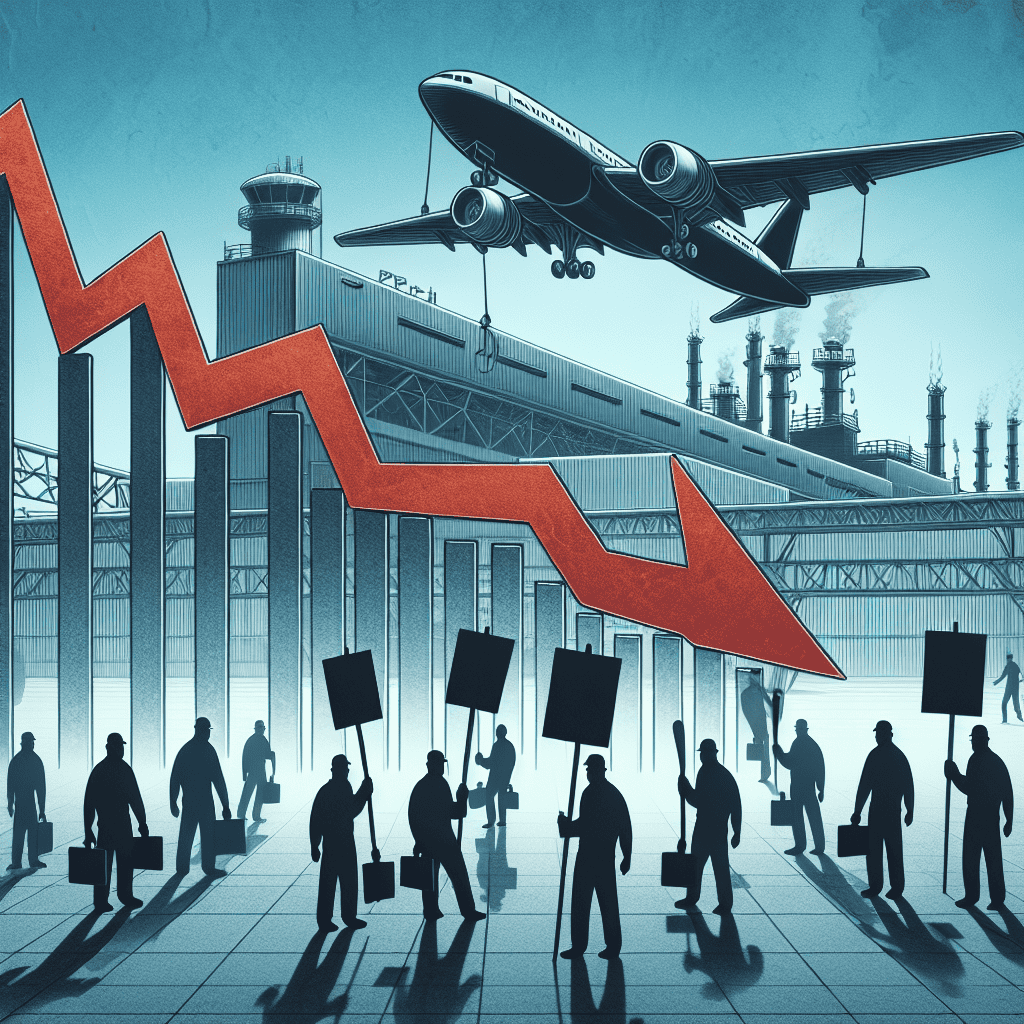

Boeing, a titan in the aerospace industry, has long been a symbol of American manufacturing prowess. However, recent labor strikes have cast a shadow over its financial health, threatening to significantly impact its profitability. The strikes, primarily driven by disputes over wages, benefits, and working conditions, have disrupted production lines and delayed deliveries, leading to a cascade of financial repercussions for the company.

To begin with, the immediate effect of the strikes is evident in the halt of production. Boeing’s assembly lines, which are typically a hive of activity, have come to a standstill. This disruption not only affects the company’s ability to meet its delivery schedules but also incurs substantial costs associated with idle facilities and labor. Moreover, the delay in fulfilling orders can lead to penalties and strained relationships with customers, further exacerbating the financial strain.

In addition to the direct costs of halted production, Boeing faces increased labor costs as a result of the negotiations that follow such strikes. Historically, labor strikes often culminate in agreements that include wage increases and improved benefits for workers. While these concessions are necessary to resolve disputes and resume operations, they inevitably lead to higher operational costs for the company. In an industry where margins are already thin, these additional expenses can significantly erode profitability.

Furthermore, the impact of labor strikes extends beyond immediate financial losses. The aerospace industry is highly competitive, with companies like Airbus constantly vying for market share. Any disruption in Boeing’s operations provides an opportunity for competitors to capitalize on its inability to deliver on time. Customers, particularly airlines with tight schedules and expansion plans, may turn to other manufacturers to meet their needs, resulting in a potential loss of future business for Boeing.

The strikes also have a ripple effect on Boeing’s supply chain. The aerospace industry relies on a complex network of suppliers for components and materials. When production halts, suppliers face reduced orders, which can lead to financial difficulties and even insolvency for smaller companies. This disruption can cause long-term damage to Boeing’s supply chain, making it more challenging to ramp up production once operations resume.

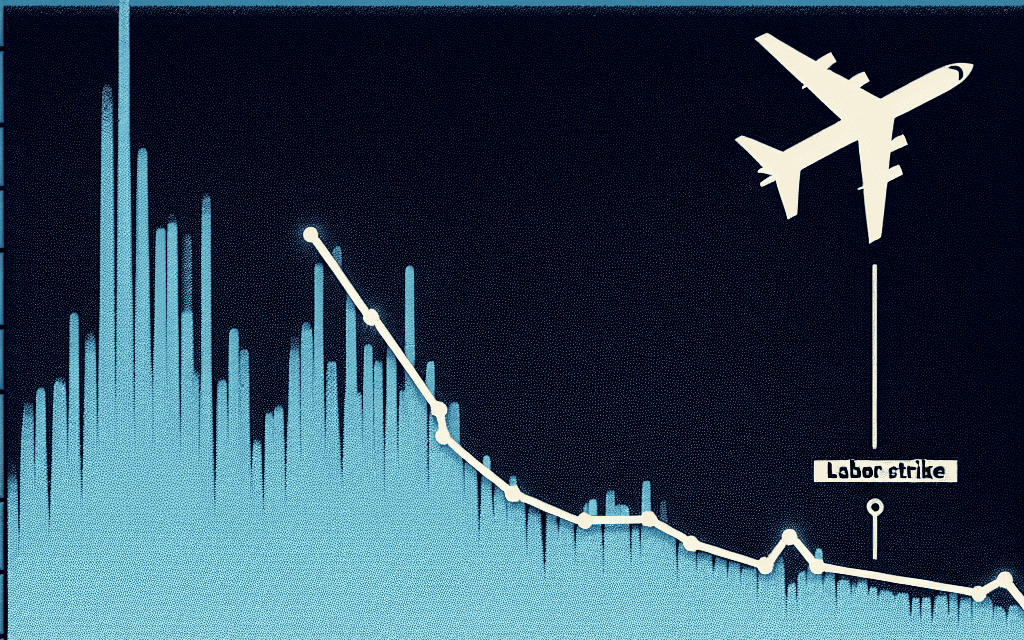

Moreover, the financial markets are acutely sensitive to disruptions in major corporations like Boeing. The strikes have already led to fluctuations in Boeing’s stock price, reflecting investor concerns about the company’s ability to manage labor relations and maintain profitability. A prolonged strike could further erode investor confidence, making it more difficult for Boeing to raise capital in the future.

In conclusion, the recent labor strikes at Boeing have far-reaching implications for the company’s financial health. The immediate costs of halted production and increased labor expenses are compounded by potential long-term challenges, including loss of market share and supply chain disruptions. As Boeing navigates these turbulent times, it must find a balance between addressing workers’ demands and maintaining its competitive edge in the global aerospace market. The resolution of these strikes will be crucial in determining Boeing’s ability to recover and sustain its profitability in the years to come.

Analyzing Boeing’s Profit Margins Post-Strike

Boeing, a titan in the aerospace industry, has long been a symbol of American manufacturing prowess and innovation. However, recent developments have cast a shadow over its financial outlook, particularly in the wake of a significant strike that has disrupted its operations. The strike, initiated by a substantial portion of Boeing’s workforce, has not only halted production lines but also raised concerns about the company’s profitability in the near future. As we delve into the implications of this labor unrest, it becomes evident that Boeing’s profit margins are poised to decline significantly.

To understand the potential impact on Boeing’s profitability, it is essential to consider the context and scale of the strike. The labor action, driven by demands for better wages, improved working conditions, and job security, has garnered widespread attention. With thousands of employees participating, the strike has effectively brought several of Boeing’s key production facilities to a standstill. This disruption is particularly concerning given Boeing’s reliance on a steady production schedule to meet its delivery commitments and maintain cash flow. Consequently, the immediate effect of the strike is a delay in the production and delivery of aircraft, which directly translates to deferred revenue and increased costs.

Moreover, the financial ramifications of the strike extend beyond the immediate halt in production. Boeing is likely to incur additional expenses related to resolving the labor dispute, including potential wage increases and enhanced benefits for its workforce. These concessions, while necessary to restore operations, will inevitably inflate the company’s operating costs. Furthermore, the strike has highlighted underlying tensions between management and labor, which may necessitate ongoing investments in employee relations and workplace improvements to prevent future disruptions. Such expenditures, while crucial for long-term stability, will exert further pressure on Boeing’s profit margins.

In addition to the direct costs associated with the strike, Boeing faces broader challenges that compound its financial woes. The aerospace industry is still grappling with the lingering effects of the COVID-19 pandemic, which severely impacted air travel demand and, consequently, aircraft orders. Although there has been a gradual recovery, the pace remains uneven, and airlines continue to exercise caution in fleet expansion. This cautious approach translates to a slower order book for Boeing, limiting its revenue growth potential at a time when it is already contending with strike-related setbacks.

Furthermore, Boeing’s competitive landscape is intensifying, with rival Airbus making significant strides in capturing market share. Airbus’s ability to maintain production continuity and capitalize on Boeing’s operational disruptions poses a threat to Boeing’s market position. As airlines evaluate their fleet strategies, Boeing’s recent challenges may prompt some to reconsider their supplier preferences, potentially leading to lost business opportunities.

In conclusion, the strike at Boeing represents a critical juncture for the company, with significant implications for its profitability. The immediate production disruptions, coupled with increased labor costs and ongoing industry challenges, are likely to result in a notable decline in profit margins. As Boeing navigates this turbulent period, it must not only address the immediate concerns of its workforce but also strategically position itself to regain its competitive edge in a rapidly evolving aerospace market. The path forward will require a delicate balance of financial prudence, operational resilience, and a renewed focus on innovation to ensure Boeing’s long-term success.

Long-Term Financial Implications Of Strikes On Boeing

Boeing, a titan in the aerospace industry, has long been a symbol of innovation and economic strength. However, recent labor strikes have cast a shadow over its financial outlook, suggesting a significant decline in profitability. The strikes, primarily driven by disputes over wages, benefits, and working conditions, have not only disrupted production schedules but also raised concerns about the long-term financial implications for the company. As Boeing navigates these turbulent waters, it is crucial to examine how such labor disputes can affect its financial health in the long run.

To begin with, the immediate impact of the strikes is evident in the disruption of Boeing’s production lines. Delays in manufacturing and delivery schedules can lead to substantial financial losses, as the company may face penalties for late deliveries and incur additional costs to expedite production once operations resume. Moreover, the strikes have strained relationships with suppliers and customers, potentially leading to a loss of future business. This disruption in the supply chain can have a cascading effect, further exacerbating financial challenges.

In addition to the immediate operational disruptions, the strikes have highlighted underlying issues within Boeing’s labor relations. The demands for better wages and improved working conditions reflect a broader dissatisfaction among the workforce, which could lead to further unrest if not adequately addressed. This ongoing tension may necessitate increased investment in labor relations and employee satisfaction initiatives, diverting resources from other critical areas such as research and development. Consequently, Boeing may find itself in a position where it must balance short-term financial pressures with the need to invest in long-term growth and innovation.

Furthermore, the financial implications of the strikes extend beyond direct operational costs. The uncertainty surrounding labor relations can have a detrimental effect on investor confidence, potentially leading to a decline in stock prices. Investors may perceive the strikes as indicative of deeper structural issues within the company, prompting a reevaluation of Boeing’s long-term profitability and growth prospects. This shift in investor sentiment can increase the cost of capital for Boeing, making it more challenging to finance future projects and expansions.

Moreover, the strikes have occurred at a time when Boeing is already grappling with other significant challenges, including the ongoing recovery from the 737 MAX crisis and the impact of the COVID-19 pandemic on the aviation industry. These concurrent issues compound the financial strain on the company, making it imperative for Boeing to adopt a comprehensive strategy to address both immediate and long-term challenges. This strategy may involve renegotiating labor contracts, enhancing operational efficiencies, and exploring new revenue streams to offset potential losses.

In conclusion, the recent labor strikes at Boeing underscore the complex interplay between labor relations and financial performance. While the immediate impact of the strikes is evident in production disruptions and increased costs, the long-term implications are equally significant. Boeing must navigate these challenges with a strategic approach that addresses both the root causes of labor unrest and the broader financial landscape. By doing so, the company can mitigate the decline in profitability and position itself for sustainable growth in the future. As Boeing charts its course forward, the lessons learned from these strikes will undoubtedly shape its approach to labor relations and financial management in the years to come.

Boeing’s Strategic Response To Profit Decline After Strikes

Boeing, a titan in the aerospace industry, has long been synonymous with innovation and reliability. However, recent labor strikes have cast a shadow over its financial outlook, prompting the company to reassess its strategic priorities. The strikes, which were primarily driven by disputes over wages and working conditions, have not only disrupted production schedules but also significantly impacted Boeing’s profitability. As the company navigates these turbulent times, it is imperative to explore the strategic responses Boeing is implementing to mitigate the decline in profits and restore stability.

In the wake of the strikes, Boeing’s immediate focus has been on resolving labor disputes to ensure a swift return to normal operations. Negotiations with labor unions have been prioritized, with the aim of reaching agreements that satisfy both the workforce and the company’s financial constraints. By fostering a more collaborative relationship with its employees, Boeing hopes to prevent future disruptions and maintain a steady production flow. This approach underscores the importance of human capital in the aerospace sector, where skilled labor is crucial for maintaining high standards of quality and safety.

Simultaneously, Boeing is intensifying its efforts to optimize operational efficiency. The company is scrutinizing its supply chain processes to identify areas where costs can be reduced without compromising quality. By leveraging advanced technologies such as artificial intelligence and data analytics, Boeing aims to streamline production and enhance decision-making processes. These technological advancements are expected to play a pivotal role in reducing overhead costs and improving overall productivity, thereby cushioning the financial impact of the strikes.

Moreover, Boeing is exploring diversification strategies to bolster its revenue streams. The company is expanding its focus beyond commercial aircraft to include sectors such as defense and space exploration. By tapping into these high-growth markets, Boeing seeks to offset the losses incurred from the strikes and create new opportunities for long-term profitability. This strategic pivot not only broadens Boeing’s business portfolio but also positions the company to capitalize on emerging trends in the aerospace industry.

In addition to these internal measures, Boeing is also strengthening its customer relationships to ensure sustained demand for its products. The company is engaging with airlines and other stakeholders to understand their evolving needs and tailor its offerings accordingly. By providing customized solutions and maintaining a strong customer service ethos, Boeing aims to reinforce its market position and secure future contracts. This customer-centric approach is essential for rebuilding trust and confidence in the brand, particularly in the aftermath of production delays caused by the strikes.

Furthermore, Boeing is committed to enhancing its financial resilience through prudent fiscal management. The company is reviewing its capital allocation strategies to prioritize investments that yield the highest returns. By maintaining a disciplined approach to financial planning, Boeing seeks to safeguard its cash flow and ensure the availability of resources for strategic initiatives. This financial prudence is crucial for navigating the uncertainties of the post-strike landscape and sustaining long-term growth.

In conclusion, Boeing’s strategic response to the decline in profitability following the strikes is multifaceted, encompassing labor relations, operational efficiency, diversification, customer engagement, and financial management. By addressing these key areas, Boeing aims to mitigate the adverse effects of the strikes and position itself for a robust recovery. As the company continues to adapt to the evolving aerospace landscape, its ability to implement these strategies effectively will be instrumental in restoring profitability and maintaining its status as an industry leader.

Comparing Pre- And Post-Strike Profitability At Boeing

Boeing, a titan in the aerospace industry, has long been synonymous with innovation and profitability. However, recent developments have cast a shadow over its financial outlook. The recent strike by its workforce has raised concerns about the company’s profitability, prompting analysts to compare its financial performance before and after the labor unrest. This comparison reveals a significant decline in profitability, underscoring the profound impact of the strike on Boeing’s financial health.

Before the strike, Boeing enjoyed a period of robust profitability, driven by strong demand for its commercial aircraft and defense products. The company’s ability to deliver cutting-edge technology and maintain a competitive edge in the market contributed to its impressive financial performance. During this period, Boeing’s profit margins were buoyed by efficient production processes and a steady stream of orders from airlines and governments worldwide. The pre-strike era was characterized by a sense of stability and growth, with Boeing consistently meeting or exceeding its financial targets.

However, the strike has disrupted this trajectory, leading to a significant decline in profitability. The labor unrest, which stemmed from disputes over wages, benefits, and working conditions, resulted in a halt in production at several key facilities. This disruption not only delayed the delivery of aircraft but also increased operational costs as Boeing scrambled to address the demands of its workforce. The financial impact of the strike was further exacerbated by penalties and compensation claims from customers affected by the delays. Consequently, Boeing’s profit margins have been squeezed, and its financial performance has taken a hit.

In addition to the immediate financial repercussions, the strike has also had long-term implications for Boeing’s profitability. The disruption in production has strained relationships with suppliers and customers, potentially affecting future orders and contracts. Moreover, the increased labor costs resulting from the strike settlement have added to the company’s financial burden. As Boeing navigates these challenges, it faces the daunting task of regaining the trust of its stakeholders and restoring its reputation as a reliable partner in the aerospace industry.

Furthermore, the strike has highlighted vulnerabilities in Boeing’s operational model, prompting a reevaluation of its strategies. The company is now compelled to invest in measures to prevent future labor disputes, which may include enhancing employee engagement and revisiting its labor relations policies. While these initiatives are crucial for long-term stability, they also entail additional costs that could further impact profitability in the short term.

As Boeing grapples with these challenges, it is also contending with broader industry trends that could influence its financial performance. The aerospace sector is undergoing a transformation, with increasing emphasis on sustainability and digitalization. Boeing must adapt to these changes while managing the fallout from the strike, a balancing act that requires strategic foresight and agility.

In conclusion, the comparison of Boeing’s pre- and post-strike profitability reveals a significant decline, driven by the immediate and long-term impacts of the labor unrest. While the company is taking steps to address these challenges, the road to recovery is fraught with obstacles. Boeing’s ability to navigate this complex landscape will determine its future profitability and its standing in the aerospace industry. As the company charts its path forward, it must balance the demands of its workforce, the expectations of its customers, and the evolving dynamics of the industry to emerge stronger and more resilient.

Investor Reactions To Boeing’s Profitability Decline

Boeing, a titan in the aerospace industry, has long been a bellwether for investors seeking stability and growth. However, recent developments have cast a shadow over its financial outlook, particularly following a significant strike that has disrupted its operations. The strike, which involved thousands of workers, primarily centered around demands for better wages and improved working conditions. As a result, Boeing’s profitability is expected to decline significantly, a prospect that has elicited varied reactions from the investor community.

In the immediate aftermath of the strike, Boeing’s stock experienced a noticeable dip, reflecting investor concerns about the company’s ability to meet its production targets and maintain its competitive edge. The strike not only halted production lines but also delayed the delivery of several key aircraft models, exacerbating existing supply chain challenges. Consequently, investors are now grappling with the potential long-term implications of these disruptions on Boeing’s financial health.

Transitioning to the broader market perspective, the strike has underscored the vulnerability of even the most established companies to labor disputes. Investors, who typically prioritize stability and predictability, are now reassessing their portfolios in light of these developments. Some are opting to diversify their investments, seeking refuge in sectors less susceptible to such disruptions. Others, however, view the current situation as a temporary setback, believing that Boeing’s strong fundamentals and historical resilience will eventually restore its profitability.

Moreover, the strike has prompted a reevaluation of Boeing’s labor relations strategy. Investors are increasingly scrutinizing the company’s approach to employee engagement and its ability to foster a harmonious working environment. This shift in focus is indicative of a broader trend in the investment community, where environmental, social, and governance (ESG) factors are gaining prominence. As such, Boeing’s response to the strike and its efforts to address worker grievances will be closely monitored by investors who prioritize sustainable and ethical business practices.

In addition to labor relations, the strike has also highlighted the importance of operational efficiency in maintaining profitability. Boeing’s ability to streamline its production processes and mitigate the impact of future disruptions will be critical in restoring investor confidence. To this end, the company is expected to implement a series of strategic initiatives aimed at enhancing its operational resilience. These measures may include investing in automation technologies, optimizing supply chain management, and strengthening relationships with key suppliers.

Furthermore, the strike has reignited discussions about the role of government intervention in labor disputes. Some investors are advocating for more robust regulatory frameworks to prevent prolonged strikes and ensure the continuity of essential industries. This perspective is particularly relevant in the aerospace sector, where production delays can have far-reaching implications for national and global economies.

In conclusion, Boeing’s anticipated decline in profitability post-strike has elicited a spectrum of reactions from investors. While some are adopting a cautious approach, others remain optimistic about the company’s long-term prospects. The situation serves as a reminder of the complex interplay between labor relations, operational efficiency, and investor sentiment. As Boeing navigates these challenges, its ability to adapt and innovate will be crucial in shaping its future trajectory and restoring investor confidence.

Future Outlook For Boeing’s Profitability After Strikes

Boeing, a titan in the aerospace industry, has long been a symbol of innovation and economic strength. However, recent developments suggest that the company’s profitability is poised for a significant decline following a series of labor strikes. These strikes, primarily driven by disputes over wages, working conditions, and job security, have not only disrupted production schedules but also cast a shadow over Boeing’s financial outlook. As the company navigates these turbulent waters, it is crucial to examine the multifaceted impact of these strikes on its future profitability.

To begin with, the immediate consequence of the strikes is the disruption of Boeing’s production lines. The aerospace industry is characterized by complex supply chains and precise timelines, and any interruption can lead to cascading delays. For Boeing, this means potential setbacks in the delivery of aircraft to customers, which could result in financial penalties and strained relationships with airlines and other clients. Moreover, the delay in production can lead to increased operational costs as the company may need to pay overtime or hire additional workers to catch up on lost time. These factors collectively contribute to a short-term dip in profitability.

In addition to production delays, the strikes have highlighted underlying issues within Boeing’s workforce management. The demands for better wages and improved working conditions reflect a broader dissatisfaction among employees, which could have long-term implications for the company’s operational efficiency. If Boeing fails to address these concerns adequately, it risks facing further labor unrest in the future. This potential for ongoing disputes could deter investors, who may view the company as a less stable investment, thereby affecting its stock performance and market valuation.

Furthermore, the financial impact of the strikes extends beyond immediate operational disruptions. Boeing’s reputation, a critical asset in the competitive aerospace market, may suffer as a result of these labor disputes. Customers and partners may perceive the company as being embroiled in internal conflicts, which could undermine confidence in its ability to deliver on commitments. This reputational damage could lead to a loss of business opportunities, as clients might opt for competitors perceived as more stable and reliable.

In response to these challenges, Boeing must adopt a strategic approach to mitigate the negative effects on its profitability. This involves not only resolving the current labor disputes but also implementing long-term measures to improve employee relations. By fostering a more inclusive and supportive work environment, Boeing can enhance workforce morale and productivity, thereby reducing the likelihood of future strikes. Additionally, the company should focus on strengthening its supply chain resilience to minimize the impact of any disruptions on production schedules.

Moreover, Boeing can explore diversification strategies to offset potential losses in its core aerospace business. By investing in emerging technologies and expanding into new markets, the company can create alternative revenue streams that bolster its financial stability. This proactive approach will be essential in navigating the post-strike landscape and ensuring sustained profitability.

In conclusion, while the recent strikes pose significant challenges to Boeing’s profitability, they also present an opportunity for the company to reassess and strengthen its operational and strategic foundations. By addressing labor concerns, enhancing supply chain resilience, and exploring diversification opportunities, Boeing can not only weather the current storm but also position itself for long-term success in the ever-evolving aerospace industry.

Q&A

1. **Question:** What was the primary cause of Boeing’s profitability decline post-strike?

**Answer:** The primary cause was the disruption in production and delivery schedules due to the strike, leading to increased costs and lost revenue.

2. **Question:** How did the strike impact Boeing’s supply chain?

**Answer:** The strike caused delays and inefficiencies in the supply chain, exacerbating production issues and increasing operational costs.

3. **Question:** What financial metrics were most affected by the strike at Boeing?

**Answer:** Revenue, operating income, and net profit margins were significantly affected due to reduced production and increased labor costs.

4. **Question:** Did Boeing face any long-term impacts on its market position due to the strike?

**Answer:** Yes, the strike potentially weakened Boeing’s competitive position by delaying new aircraft deliveries and affecting customer trust.

5. **Question:** How did the strike influence Boeing’s stock performance?

**Answer:** Boeing’s stock likely experienced volatility and a decline in value as investors reacted to the financial impact of the strike.

6. **Question:** What measures did Boeing take to mitigate the financial impact of the strike?

**Answer:** Boeing implemented cost-cutting measures, renegotiated supplier contracts, and adjusted production schedules to recover from the financial impact.

7. **Question:** How did the strike affect Boeing’s relationship with its workforce?

**Answer:** The strike strained relations with the workforce, leading to potential challenges in future negotiations and employee morale.

Conclusion

Boeing’s profitability is likely to decline significantly post-strike due to several factors. The disruption in production schedules and delivery timelines caused by the strike can lead to increased operational costs and potential penalties for delayed deliveries. Additionally, the strike may result in a loss of future contracts as clients seek more reliable suppliers, further impacting revenue streams. The need to negotiate higher wages and benefits to prevent future labor disputes could also increase long-term expenses. Combined, these elements can erode profit margins and reduce overall financial performance in the aftermath of the strike.