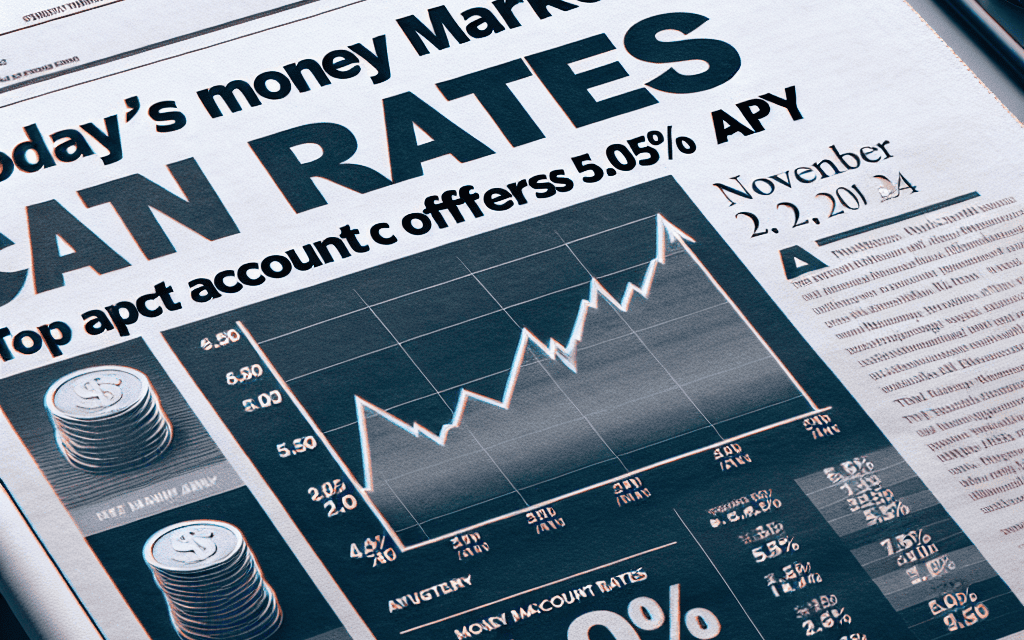

“Maximize Your Savings: Discover Top Money Market Accounts Offering 5.05% APY!”

Introduction

As of November 2, 2024, money market accounts are presenting attractive opportunities for savers, with top account offers reaching an impressive 5.05% annual percentage yield (APY). These accounts, known for their blend of savings and checking account features, provide a secure and flexible option for individuals looking to maximize their returns while maintaining liquidity. The competitive rates reflect the current economic climate and interest rate trends, making it an opportune time for consumers to explore these financial products. With varying terms and conditions across different financial institutions, it’s essential for savers to compare offerings to find the best fit for their financial goals.

Understanding Money Market Accounts: Key Features And Benefits

Money market accounts (MMAs) have long been a popular choice for individuals seeking a secure and flexible way to grow their savings. As of November 2, 2024, the financial landscape presents an attractive opportunity for savers, with top money market account offers reaching an impressive 5.05% annual percentage yield (APY). Understanding the key features and benefits of these accounts can help individuals make informed decisions about where to place their funds.

At their core, money market accounts are a type of deposit account offered by banks and credit unions. They combine features of both savings and checking accounts, providing account holders with the ability to earn interest while maintaining easy access to their funds. One of the primary attractions of MMAs is their competitive interest rates, which are typically higher than those offered by traditional savings accounts. The current rate of 5.05% APY is particularly noteworthy, as it allows savers to maximize their returns in a relatively low-risk environment.

In addition to attractive interest rates, money market accounts offer a range of features that enhance their appeal. For instance, many MMAs come with check-writing privileges and debit card access, providing a level of liquidity that is not commonly found in other savings vehicles. This flexibility makes money market accounts an ideal choice for individuals who may need to access their funds for unexpected expenses or short-term financial goals. Furthermore, MMAs are insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), depending on the institution, which ensures that deposits are protected up to the standard insurance amount.

While the benefits of money market accounts are clear, it is important for potential account holders to be aware of certain limitations. For example, MMAs often require a higher minimum balance than traditional savings accounts, which can be a barrier for some savers. Additionally, there may be restrictions on the number of transactions allowed per month, typically limited to six withdrawals or transfers. These limitations are in place to maintain the account’s status as a savings vehicle rather than a transactional account.

Despite these constraints, the current high APY offerings make money market accounts an attractive option for those looking to grow their savings. The 5.05% APY available today is a reflection of broader economic conditions, including interest rate trends set by the Federal Reserve. As interest rates rise, financial institutions often adjust their offerings to remain competitive, benefiting consumers who are in a position to take advantage of these changes.

In conclusion, money market accounts offer a compelling combination of high interest rates, liquidity, and security, making them a valuable tool for savers. The current top rate of 5.05% APY underscores the potential for significant returns in today’s financial environment. By understanding the key features and benefits of MMAs, individuals can make informed decisions that align with their financial goals. As always, it is advisable for savers to compare different account offerings and consider their own financial needs and circumstances before committing to a particular account. With careful consideration, money market accounts can serve as a powerful component of a well-rounded financial strategy.

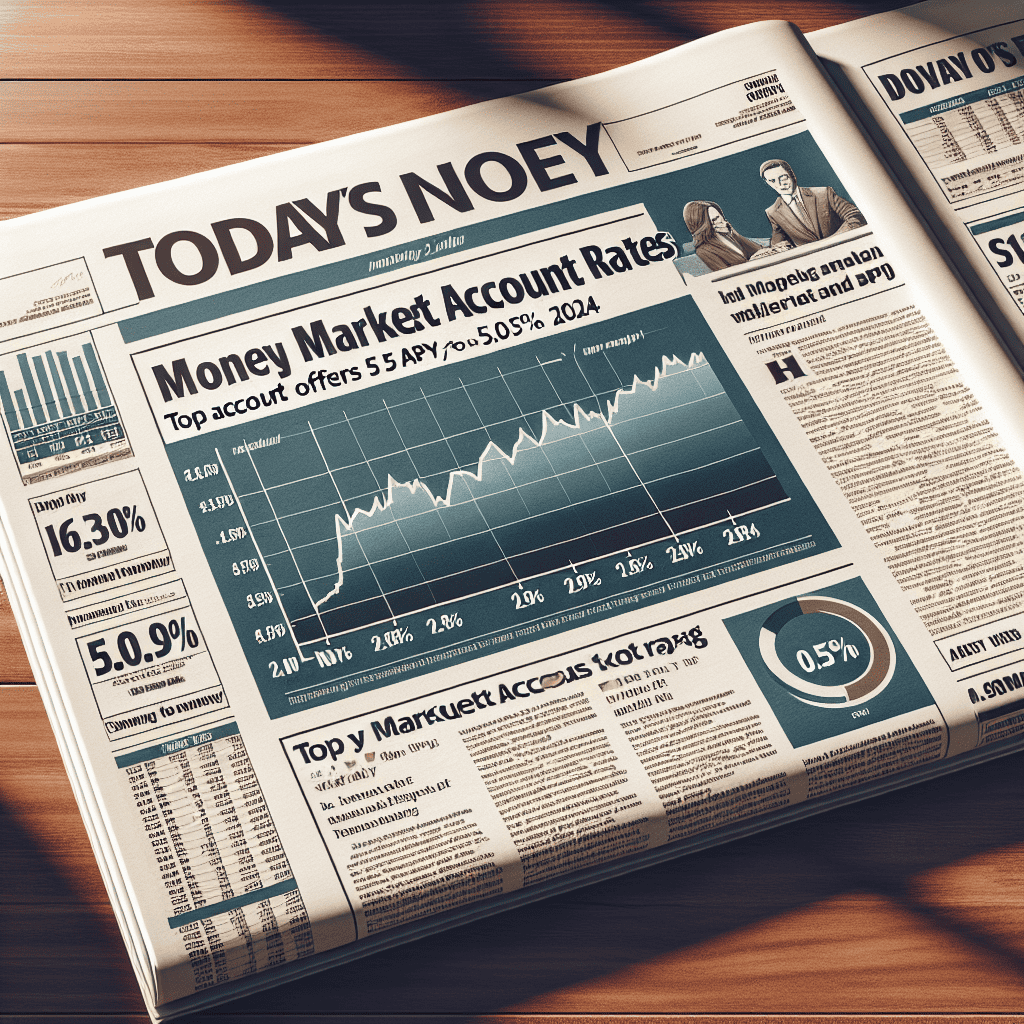

Comparing Money Market Account Rates: How 5.05% APY Stands Out

In the ever-evolving landscape of personal finance, money market accounts (MMAs) have emerged as a popular choice for individuals seeking a balance between liquidity and higher interest rates. As of November 2, 2024, the financial market has witnessed a notable shift, with some money market accounts offering an impressive 5.05% annual percentage yield (APY). This development prompts a closer examination of how such rates compare to other financial instruments and what factors contribute to their appeal.

To begin with, money market accounts are a type of savings account that typically offer higher interest rates than traditional savings accounts. They achieve this by investing in short-term, low-risk securities, which allows them to provide better returns while maintaining a high degree of liquidity. The current rate of 5.05% APY is particularly attractive, especially when juxtaposed with the national average for savings accounts, which hovers around 0.40% APY. This stark contrast underscores the potential benefits of opting for a money market account, particularly for those who prioritize both safety and yield.

Moreover, the 5.05% APY offered by top money market accounts today is competitive even when compared to other investment vehicles such as certificates of deposit (CDs) and Treasury bills. While CDs can offer similar or slightly higher rates, they often require funds to be locked in for a predetermined period, which can limit accessibility. In contrast, money market accounts provide the flexibility of easy access to funds, making them an appealing option for individuals who may need to withdraw money on short notice.

In addition to their competitive rates, money market accounts are also insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per institution. This insurance provides a layer of security that is particularly reassuring in times of economic uncertainty. As a result, money market accounts are often seen as a safe haven for those looking to preserve capital while earning a reasonable return.

However, it is important to consider the factors that influence the rates offered by money market accounts. These rates are often tied to the federal funds rate, which is set by the Federal Reserve. As the Federal Reserve adjusts interest rates in response to economic conditions, the yields on money market accounts can fluctuate accordingly. Therefore, while the current 5.05% APY is attractive, potential account holders should remain vigilant and informed about economic trends that could impact future rates.

Furthermore, when evaluating money market accounts, it is crucial to consider any associated fees or minimum balance requirements. Some accounts may offer high APYs but impose fees that can erode the overall return. Therefore, a thorough comparison of account terms and conditions is essential to ensure that the benefits of a high APY are not offset by hidden costs.

In conclusion, the current offering of a 5.05% APY on money market accounts represents a compelling opportunity for savers seeking a combination of high returns and liquidity. By understanding the dynamics that influence these rates and carefully evaluating account terms, individuals can make informed decisions that align with their financial goals. As the financial landscape continues to evolve, staying informed about the latest developments in money market account rates will be key to maximizing the benefits of this versatile financial tool.

Top Banks Offering 5.05% APY On Money Market Accounts

In the ever-evolving landscape of personal finance, money market accounts have emerged as a popular choice for individuals seeking a balance between liquidity and higher interest rates. As of November 2, 2024, several top banks are offering competitive annual percentage yields (APY) on money market accounts, with some reaching as high as 5.05%. This development is particularly noteworthy for savers looking to maximize their returns while maintaining easy access to their funds.

To begin with, money market accounts are a type of savings account that typically offer higher interest rates compared to traditional savings accounts. They achieve this by investing in short-term, low-risk securities, which allows banks to pass on higher returns to account holders. The current economic climate, characterized by fluctuating interest rates and inflationary pressures, has prompted banks to adjust their offerings to attract more customers. Consequently, the 5.05% APY being offered by some institutions is a reflection of these broader economic trends.

Among the top banks offering this attractive rate, several have distinguished themselves through their robust financial products and customer service. These institutions have recognized the importance of providing competitive rates to retain existing customers and attract new ones. Moreover, they have leveraged technology to enhance the customer experience, offering online and mobile banking options that make it easier for account holders to manage their finances.

In addition to the appealing interest rates, these banks often provide other benefits to money market account holders. For instance, many offer features such as check-writing privileges and debit card access, which enhance the account’s liquidity and convenience. This combination of high returns and flexibility makes money market accounts an attractive option for individuals who want to earn more on their savings without sacrificing accessibility.

However, it is important for potential account holders to consider certain factors before opening a money market account. While the 5.05% APY is enticing, it is crucial to understand the terms and conditions associated with these accounts. Some banks may require a minimum balance to qualify for the advertised rate, and failing to maintain this balance could result in lower interest earnings or additional fees. Additionally, account holders should be aware of any transaction limits, as exceeding these could incur penalties.

Furthermore, it is advisable for individuals to compare the offerings of different banks to ensure they are getting the best deal. While the APY is a significant factor, other considerations such as customer service, ease of access, and additional account features should also play a role in the decision-making process. By conducting thorough research and evaluating their financial goals, individuals can select a money market account that aligns with their needs.

In conclusion, the current offering of 5.05% APY on money market accounts by top banks presents a compelling opportunity for savers. This rate not only provides a higher return on savings but also offers the flexibility and convenience that many individuals seek in a financial product. As the financial landscape continues to evolve, staying informed about such opportunities can empower individuals to make sound financial decisions that enhance their overall financial well-being.

How To Choose The Best Money Market Account For Your Needs

When considering the best money market account for your financial needs, it is essential to evaluate several key factors that can significantly impact your savings strategy. As of November 2, 2024, some of the top money market accounts offer an attractive annual percentage yield (APY) of 5.05%, making them a compelling option for those looking to maximize their returns. However, selecting the right account involves more than just focusing on the highest APY. To make an informed decision, it is crucial to consider the account’s features, fees, and accessibility, as well as your personal financial goals.

To begin with, understanding the APY is fundamental. The APY represents the real rate of return on your deposit, taking into account the effect of compounding interest. A higher APY can significantly boost your savings over time, especially when compounded frequently. However, while a 5.05% APY is enticing, it is important to ensure that the account offering this rate aligns with your overall financial objectives. For instance, if you anticipate needing frequent access to your funds, you should verify that the account allows for easy withdrawals without incurring penalties.

In addition to the APY, consider the account’s minimum balance requirements. Many money market accounts require a minimum deposit to open the account or to earn the advertised APY. Failing to meet these requirements can result in lower interest rates or additional fees, which can erode your earnings. Therefore, it is advisable to choose an account with a minimum balance requirement that you can comfortably maintain, ensuring that you can fully benefit from the high APY without unnecessary costs.

Furthermore, it is essential to examine the fee structure associated with the money market account. Some accounts may charge monthly maintenance fees, transaction fees, or penalties for exceeding a certain number of withdrawals per month. These fees can quickly add up and diminish the overall return on your investment. Consequently, selecting an account with low or no fees can enhance your savings potential. Additionally, some financial institutions offer fee waivers if certain conditions are met, such as maintaining a minimum balance or setting up direct deposits, which can be advantageous for account holders.

Accessibility is another critical factor to consider when choosing a money market account. While some accounts offer convenient online and mobile banking options, others may have limited access to physical branches or ATMs. Depending on your preference for digital versus in-person banking, you should select an account that provides the level of access you require. Moreover, if you travel frequently or live in a rural area, an account with a broad ATM network or robust online services may be particularly beneficial.

Finally, aligning your choice of a money market account with your financial goals is paramount. Whether you are saving for a short-term goal, such as a vacation or an emergency fund, or a long-term objective, like a down payment on a home, the right account can help you achieve your targets more efficiently. By carefully considering the APY, fees, accessibility, and your personal financial needs, you can select a money market account that not only offers a competitive rate but also supports your broader financial strategy. In conclusion, while the allure of a 5.05% APY is significant, a comprehensive evaluation of all these factors will ensure that you choose the best money market account for your unique circumstances.

The Impact Of Interest Rates On Money Market Account Returns

In the ever-evolving landscape of personal finance, money market accounts (MMAs) have long been a favored choice for individuals seeking a balance between liquidity and higher interest returns. As of November 2, 2024, the financial market has witnessed a notable shift, with top money market account offers reaching an impressive 5.05% annual percentage yield (APY). This development prompts a closer examination of how interest rates influence the returns on these accounts and the broader implications for account holders.

To understand the impact of interest rates on money market account returns, it is essential to first consider the fundamental nature of these accounts. Money market accounts are a type of savings account that typically offers higher interest rates than standard savings accounts, while also providing limited check-writing and debit card privileges. The interest rates on MMAs are closely tied to the prevailing economic conditions, particularly the Federal Reserve’s monetary policy decisions. When the Federal Reserve adjusts the federal funds rate, it indirectly influences the interest rates offered by financial institutions on various deposit accounts, including money market accounts.

In recent times, the Federal Reserve has adopted a more aggressive stance in its monetary policy, primarily in response to inflationary pressures and economic growth dynamics. This has led to a series of interest rate hikes, which, in turn, have contributed to the rise in money market account rates. As financial institutions compete to attract depositors, they adjust their offered rates to remain competitive, resulting in the current scenario where top money market accounts offer an APY of 5.05%.

The increase in money market account rates presents both opportunities and considerations for account holders. On one hand, higher interest rates mean that savers can enjoy more substantial returns on their deposits, enhancing their overall financial growth. This is particularly advantageous for individuals who prioritize safety and liquidity, as money market accounts are insured by the Federal Deposit Insurance Corporation (FDIC) up to the applicable limits, providing a secure avenue for savings.

However, it is crucial for account holders to remain vigilant and informed about the broader economic context. While higher interest rates can lead to increased returns, they may also signal underlying economic challenges, such as inflationary pressures or tightening credit conditions. Consequently, individuals should consider their financial goals and risk tolerance when deciding how much to allocate to money market accounts versus other investment vehicles.

Moreover, the competitive landscape among financial institutions means that account holders should regularly review and compare the rates offered by different banks and credit unions. By doing so, they can ensure that they are maximizing their returns and taking full advantage of the prevailing interest rate environment. Additionally, understanding the terms and conditions associated with money market accounts, such as minimum balance requirements and potential fees, is essential to making informed decisions.

In conclusion, the current rise in money market account rates to 5.05% APY reflects broader economic trends and the Federal Reserve’s monetary policy actions. While this presents an opportunity for savers to achieve higher returns, it also necessitates a careful consideration of the economic landscape and individual financial objectives. By staying informed and proactive, account holders can effectively navigate the complexities of the financial market and optimize their savings strategies.

Money Market Accounts Vs. Savings Accounts: Which Is Better?

In the ever-evolving landscape of personal finance, individuals are constantly seeking the most advantageous ways to grow their savings. As of November 2, 2024, money market accounts have emerged as a compelling option, with top account offers reaching an impressive 5.05% annual percentage yield (APY). This development prompts a closer examination of money market accounts in comparison to traditional savings accounts, as savers strive to determine which option better aligns with their financial goals.

To begin with, it is essential to understand the fundamental differences between money market accounts and savings accounts. Both serve as vehicles for saving money while earning interest, yet they possess distinct characteristics that cater to different financial needs. Money market accounts typically offer higher interest rates than savings accounts, as evidenced by the current 5.05% APY. This higher yield is often attributed to the account’s investment in short-term, low-risk securities, which allows financial institutions to pass on greater returns to account holders. In contrast, savings accounts generally offer lower interest rates, reflecting their more conservative approach to safeguarding deposits.

Moreover, money market accounts often provide account holders with limited check-writing privileges and debit card access, features that are not commonly associated with traditional savings accounts. This added flexibility can be particularly appealing to individuals who desire the ability to access their funds with ease while still benefiting from competitive interest rates. However, it is important to note that money market accounts may require higher minimum balances to open and maintain, which could be a potential drawback for those with limited initial capital.

On the other hand, savings accounts are renowned for their simplicity and accessibility. They are widely available at most financial institutions and typically do not impose stringent minimum balance requirements. This makes them an attractive option for individuals who are just beginning their savings journey or who prefer a straightforward approach to managing their finances. Additionally, savings accounts are often insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), providing a layer of security that is highly valued by risk-averse savers.

When deciding between a money market account and a savings account, it is crucial to consider one’s financial objectives and liquidity needs. For those seeking to maximize their interest earnings while maintaining some degree of access to their funds, a money market account with a competitive APY, such as the current 5.05%, may be the optimal choice. Conversely, individuals who prioritize ease of access and lower account maintenance requirements may find that a traditional savings account better suits their needs.

In conclusion, the decision between a money market account and a savings account ultimately hinges on individual preferences and financial circumstances. As interest rates continue to fluctuate, it is advisable for savers to remain informed about the latest offerings and to periodically reassess their financial strategies. By carefully weighing the benefits and limitations of each account type, individuals can make informed decisions that align with their long-term financial goals, ensuring that their savings work as effectively as possible in today’s dynamic economic environment.

Tips For Maximizing Returns On Your Money Market Account

In the ever-evolving landscape of personal finance, money market accounts (MMAs) have emerged as a popular choice for individuals seeking a balance between liquidity and higher interest rates. As of November 2, 2024, some of the top money market accounts are offering an impressive 5.05% annual percentage yield (APY), making them an attractive option for savers. To maximize returns on your money market account, it is essential to understand the nuances of these accounts and implement strategies that align with your financial goals.

First and foremost, it is crucial to shop around and compare different money market accounts. Financial institutions often offer varying APYs, and even a slight difference in rates can significantly impact your returns over time. By conducting thorough research and comparing offers from banks and credit unions, you can identify accounts that provide the most competitive rates. Additionally, consider the reputation and stability of the institution, as these factors can influence the security of your deposits.

Once you have selected a suitable money market account, it is important to maintain a balance that meets or exceeds the minimum requirement to earn the advertised APY. Many accounts stipulate a minimum balance to qualify for the highest interest rate, and failing to meet this threshold can result in a lower yield. Therefore, it is advisable to monitor your account balance regularly and ensure it remains above the required level. This practice not only maximizes your returns but also helps avoid potential fees associated with falling below the minimum balance.

Furthermore, consider the benefits of automating your savings. By setting up automatic transfers from your checking account to your money market account, you can ensure consistent contributions and take advantage of compound interest. This strategy not only simplifies the savings process but also reinforces disciplined financial habits. Over time, these regular contributions can significantly enhance the growth of your savings, especially when combined with a competitive APY.

In addition to maintaining a healthy balance and automating savings, it is wise to stay informed about changes in interest rates and market conditions. Economic factors, such as inflation and Federal Reserve policies, can influence the interest rates offered by financial institutions. By keeping abreast of these developments, you can make informed decisions about whether to move your funds to a different account or institution offering better rates. Staying proactive in this regard ensures that you are always optimizing your returns.

Moreover, it is beneficial to periodically review the terms and conditions of your money market account. Financial institutions may update their policies, fees, or interest rates, and being aware of these changes can help you avoid unexpected costs or missed opportunities for higher returns. Regularly reviewing your account details allows you to make timely adjustments and maintain alignment with your financial objectives.

Finally, while maximizing returns is important, it is equally essential to consider the role of a money market account within your broader financial strategy. These accounts are ideal for short-term savings goals or as a component of an emergency fund due to their liquidity and relatively higher interest rates compared to traditional savings accounts. By understanding the purpose of your money market account and integrating it into your overall financial plan, you can effectively leverage its benefits while pursuing long-term financial success.

In conclusion, with top money market accounts offering up to 5.05% APY, there are ample opportunities to enhance your savings. By carefully selecting an account, maintaining a sufficient balance, automating contributions, staying informed about market conditions, and reviewing account terms, you can maximize your returns and achieve your financial goals.

Q&A

1. **What is the highest APY offered for money market accounts as of November 2, 2024?**

The highest APY offered is 5.05%.

2. **Are there any fees associated with the top money market accounts?**

Many top money market accounts have no monthly maintenance fees, but it’s important to check specific account terms.

3. **What is the minimum deposit required to open a top money market account?**

Minimum deposit requirements vary, but some accounts may require as little as $1,000.

4. **How does the APY of money market accounts compare to traditional savings accounts?**

Money market accounts typically offer higher APYs compared to traditional savings accounts.

5. **Are money market accounts FDIC insured?**

Yes, money market accounts are generally FDIC insured up to $250,000 per depositor, per bank.

6. **Can you write checks from a money market account?**

Yes, many money market accounts allow check-writing privileges.

7. **What factors should be considered when choosing a money market account?**

Consider the APY, fees, minimum deposit requirements, and additional features like check-writing or ATM access.

Conclusion

As of November 2, 2024, money market account rates have become increasingly competitive, with top offers reaching an annual percentage yield (APY) of 5.05%. This reflects a favorable environment for savers seeking to maximize their returns on liquid assets. The elevated rates suggest a response to broader economic conditions, possibly including higher interest rates set by central banks to manage inflation. Savers should consider these high-yield options as a means to enhance their savings strategy, while also evaluating the terms and conditions associated with these accounts to ensure they align with their financial goals and liquidity needs.