“Fed Reverse Repo Usage Dips: A Sign of Easing Market Strains”

Introduction

In recent financial developments, the Federal Reserve’s reverse repurchase agreement (reverse repo) facility has experienced a significant decline, reaching its lowest usage level in three years. This facility, a critical tool for managing short-term interest rates and ensuring liquidity in the financial system, allows financial institutions to park excess cash with the Fed overnight in exchange for Treasury securities. The decrease in reverse repo usage suggests a shift in market dynamics, potentially indicating improved liquidity conditions or changes in the demand for short-term safe assets. This trend is noteworthy as it reflects broader economic conditions and the evolving landscape of monetary policy implementation.

Impact Of Fed Reverse Repo Usage Decline On Financial Markets

The recent decline in the Federal Reserve’s reverse repurchase agreement (reverse repo) usage to a three-year low has sparked considerable interest and analysis within financial markets. This development is significant as it reflects underlying shifts in liquidity conditions and monetary policy dynamics. To understand the implications of this decline, it is essential to explore the role of reverse repos in the broader financial system and how changes in their usage can impact market behavior.

Reverse repos are a tool used by the Federal Reserve to manage short-term interest rates and control the supply of money in the banking system. In a reverse repo transaction, the Fed sells securities to financial institutions with an agreement to repurchase them at a later date. This mechanism allows the Fed to absorb excess liquidity from the banking system, thereby influencing short-term interest rates. When reverse repo usage is high, it typically indicates that there is an abundance of liquidity in the market, prompting the Fed to intervene to maintain its target interest rate.

The recent decline in reverse repo usage suggests a shift in the liquidity landscape. One possible explanation for this trend is the normalization of monetary policy following the extraordinary measures taken during the COVID-19 pandemic. As the economy recovers and stabilizes, the need for aggressive liquidity management diminishes, leading to a natural reduction in reverse repo activity. This decline may also reflect improved balance sheet conditions among financial institutions, reducing their reliance on the Fed’s facilities for short-term funding needs.

Moreover, the decrease in reverse repo usage can have several implications for financial markets. Firstly, it may signal a tightening of monetary conditions, as reduced reliance on reverse repos could lead to upward pressure on short-term interest rates. This, in turn, can influence borrowing costs for businesses and consumers, potentially impacting economic growth. Additionally, changes in reverse repo activity can affect the yield curve, which is a critical indicator for investors assessing future economic conditions. A steeper yield curve, resulting from higher short-term rates, might suggest expectations of stronger economic growth or rising inflation.

Furthermore, the decline in reverse repo usage can also impact market liquidity and volatility. With less intervention from the Fed, financial markets may experience greater fluctuations as they adjust to changing liquidity conditions. This could lead to increased volatility in asset prices, particularly in fixed-income markets where interest rate expectations play a crucial role. Investors may need to reassess their strategies in light of these developments, considering the potential for heightened market swings.

In addition to these direct effects, the decline in reverse repo usage may also have broader implications for monetary policy. It could signal a shift in the Fed’s approach to managing liquidity and interest rates, potentially influencing future policy decisions. As the central bank navigates the post-pandemic economic landscape, it may need to recalibrate its tools and strategies to address evolving challenges and opportunities.

In conclusion, the recent decline in Fed reverse repo usage to a three-year low is a noteworthy development with significant implications for financial markets. By understanding the role of reverse repos and the factors driving this trend, market participants can better anticipate potential changes in interest rates, liquidity conditions, and asset price volatility. As the economic recovery progresses, continued monitoring of reverse repo activity will be essential for assessing the evolving landscape of monetary policy and its impact on financial markets.

Understanding The Fed’s Reverse Repo Mechanism

The Federal Reserve’s reverse repurchase agreement (reverse repo) mechanism is a critical tool in the central bank’s monetary policy arsenal, designed to manage short-term interest rates and ensure liquidity in the financial system. Recently, the usage of this mechanism has hit a three-year low, prompting discussions about its implications and the underlying factors contributing to this trend. To fully appreciate the significance of this development, it is essential to understand the reverse repo mechanism and its role in the broader context of monetary policy.

At its core, a reverse repo is a transaction in which the Federal Reserve sells securities to financial institutions with an agreement to repurchase them at a later date. This process temporarily removes cash from the banking system, thereby helping to control the supply of money and influence short-term interest rates. By adjusting the terms and volume of reverse repos, the Fed can effectively manage liquidity conditions and steer the federal funds rate towards its target range.

The recent decline in reverse repo usage can be attributed to several interrelated factors. Firstly, the overall liquidity in the financial system has been abundant, partly due to the Fed’s previous quantitative easing measures and the substantial fiscal stimulus provided during the pandemic. This excess liquidity has reduced the need for financial institutions to engage in reverse repos as a means of managing their cash balances.

Moreover, the Federal Reserve’s interest rate hikes aimed at curbing inflation have also played a role. As the central bank raises rates, the opportunity cost of holding excess reserves increases, prompting banks to seek higher-yielding alternatives. Consequently, the demand for reverse repos diminishes as financial institutions find more attractive investment opportunities elsewhere.

In addition to these factors, the Treasury’s issuance of short-term securities has provided banks with alternative avenues for parking their excess cash. The increased supply of Treasury bills and other short-term instruments has offered competitive returns, further reducing the reliance on reverse repos as a liquidity management tool.

While the decline in reverse repo usage might suggest a shift in market dynamics, it is important to recognize that this mechanism remains a vital component of the Fed’s toolkit. The central bank continues to monitor market conditions closely and stands ready to adjust its operations as needed to maintain control over short-term interest rates. The flexibility of the reverse repo facility allows the Fed to respond swiftly to changes in the economic landscape, ensuring that monetary policy objectives are met.

Furthermore, the reduced reliance on reverse repos does not necessarily indicate a weakening of the Fed’s influence over financial markets. Instead, it reflects the evolving nature of market conditions and the central bank’s ability to adapt its strategies accordingly. As the economic recovery progresses and the Fed navigates the challenges of balancing growth and inflation, the reverse repo mechanism will remain an essential instrument for maintaining stability and promoting efficient market functioning.

In conclusion, the recent decline in the usage of the Federal Reserve’s reverse repo mechanism underscores the dynamic interplay between monetary policy, market conditions, and financial institutions’ behavior. While the current trend reflects a confluence of factors, including abundant liquidity and rising interest rates, the reverse repo facility continues to serve as a crucial tool for managing short-term interest rates and ensuring liquidity in the financial system. As the Fed continues to adapt to changing economic conditions, the reverse repo mechanism will remain an integral part of its efforts to achieve its monetary policy objectives.

Reasons Behind The Three-Year Low In Fed Reverse Repo Usage

The recent decline in the Federal Reserve’s reverse repurchase agreement (reverse repo) usage to a three-year low has sparked considerable interest among financial analysts and economists. This development is significant as it reflects underlying shifts in the financial markets and broader economic conditions. To understand the reasons behind this trend, it is essential to explore the mechanics of reverse repos, the current economic landscape, and the Federal Reserve’s monetary policy stance.

Reverse repos are a tool used by the Federal Reserve to manage short-term interest rates and control the supply of money in the economy. In a reverse repo transaction, the Fed sells securities to financial institutions with an agreement to repurchase them at a later date. This process temporarily reduces the amount of reserves in the banking system, thereby influencing interest rates. The recent decline in reverse repo usage suggests a change in the demand for these transactions, which can be attributed to several factors.

Firstly, the current economic environment plays a crucial role in shaping the demand for reverse repos. Over the past few years, the U.S. economy has experienced a period of recovery and growth following the disruptions caused by the COVID-19 pandemic. As economic conditions have improved, there has been a corresponding increase in liquidity within the financial system. This abundance of liquidity reduces the need for financial institutions to engage in reverse repo transactions, as they have sufficient reserves to meet their short-term funding requirements.

Moreover, the Federal Reserve’s monetary policy decisions have a direct impact on reverse repo usage. In recent months, the Fed has signaled a shift towards a more accommodative monetary policy stance, maintaining low interest rates to support economic growth. This policy approach has contributed to the ample liquidity in the financial system, further diminishing the necessity for reverse repo operations. Additionally, the Fed’s ongoing asset purchase programs have injected substantial amounts of liquidity into the market, reinforcing the trend of reduced reverse repo activity.

Another factor influencing the decline in reverse repo usage is the evolving regulatory landscape. Financial institutions are subject to various regulatory requirements that affect their balance sheet management and liquidity needs. Changes in these regulations can alter the incentives for banks and other financial entities to participate in reverse repo transactions. For instance, adjustments to capital and liquidity requirements may lead institutions to seek alternative methods for managing their short-term funding needs, thereby reducing their reliance on reverse repos.

Furthermore, the global economic context cannot be overlooked when analyzing the decline in reverse repo usage. International financial markets are interconnected, and developments in other major economies can have ripple effects on U.S. financial markets. For example, changes in monetary policy by other central banks, fluctuations in global interest rates, and shifts in investor sentiment can all influence the demand for reverse repos in the United States.

In conclusion, the recent decline in Fed reverse repo usage to a three-year low is a multifaceted phenomenon driven by a combination of improved economic conditions, accommodative monetary policy, regulatory changes, and global economic dynamics. As the financial landscape continues to evolve, it will be crucial for policymakers and market participants to monitor these factors closely to understand their implications for the broader economy and financial stability. This development underscores the importance of maintaining a flexible and responsive approach to monetary policy in an ever-changing economic environment.

Implications For Interest Rates Amidst Declining Reverse Repo Activity

The recent decline in the Federal Reserve’s reverse repurchase agreement (reverse repo) usage to a three-year low has sparked considerable discussion among economists and financial analysts. This development is particularly significant as it may have far-reaching implications for interest rates and the broader economic landscape. To understand the potential consequences, it is essential to first examine the role of reverse repos in the financial system. Reverse repos are a tool used by the Federal Reserve to manage short-term interest rates and control the supply of money in the economy. By engaging in reverse repos, the Fed sells securities to financial institutions with an agreement to repurchase them at a later date. This mechanism helps to absorb excess liquidity from the banking system, thereby influencing the federal funds rate, which is the interest rate at which banks lend to each other overnight.

The recent decline in reverse repo activity suggests a shift in the liquidity dynamics of the financial system. One possible explanation for this trend is the increased demand for Treasury securities, which has reduced the need for financial institutions to engage in reverse repos to park their excess cash. Additionally, the Federal Reserve’s ongoing balance sheet reduction, aimed at normalizing monetary policy after years of quantitative easing, may have contributed to the decreased reliance on reverse repos. As the Fed allows its holdings of Treasury and mortgage-backed securities to mature without reinvestment, the supply of available securities for reverse repos diminishes, leading to reduced activity.

This decline in reverse repo usage could have several implications for interest rates. Firstly, it may signal a tightening of monetary conditions, as the reduced need for reverse repos indicates that financial institutions are finding alternative avenues to deploy their excess liquidity. Consequently, this could lead to upward pressure on short-term interest rates, as the demand for borrowing funds increases relative to supply. Moreover, the decline in reverse repo activity may also reflect a broader shift in market expectations regarding the Federal Reserve’s monetary policy stance. If market participants anticipate a more hawkish approach from the Fed, characterized by higher interest rates to combat inflation, they may adjust their portfolios accordingly, reducing the need for reverse repos.

Furthermore, the decrease in reverse repo usage could have implications for the yield curve, which represents the relationship between short-term and long-term interest rates. A steeper yield curve, resulting from rising short-term rates, could signal increased confidence in the economy’s growth prospects. However, it could also indicate concerns about inflationary pressures, prompting the Fed to adopt a more aggressive tightening stance. Conversely, a flatter yield curve might suggest that the market expects slower economic growth or that the Fed will maintain a more accommodative policy stance.

In conclusion, the decline in the Federal Reserve’s reverse repo usage to a three-year low is a noteworthy development with potential implications for interest rates and the broader economic environment. As financial institutions adjust to changing liquidity dynamics and market expectations, the impact on short-term interest rates and the yield curve will be closely monitored by policymakers and market participants alike. Understanding these shifts is crucial for anticipating future monetary policy actions and their effects on the economy. As such, continued analysis of reverse repo activity and its implications will remain a key focus for those seeking to navigate the complexities of the financial landscape.

How The Fed’s Reverse Repo Usage Affects Liquidity In The Banking System

The Federal Reserve’s reverse repurchase agreement (reverse repo) facility has recently seen its usage drop to a three-year low, a development that holds significant implications for liquidity within the banking system. To understand the impact of this decline, it is essential to first grasp the function of the reverse repo facility. Essentially, the Federal Reserve uses reverse repos as a tool to manage short-term interest rates and control the amount of liquidity in the financial system. By engaging in reverse repos, the Fed sells securities to financial institutions with an agreement to repurchase them at a later date, thereby temporarily reducing the amount of cash in the banking system.

The recent decrease in reverse repo usage suggests a shift in the liquidity dynamics of the financial markets. This decline can be attributed to several factors, including changes in market conditions and adjustments in monetary policy. As the economy continues to recover from the disruptions caused by the pandemic, demand for liquidity has evolved. Financial institutions may find themselves with ample reserves, reducing their reliance on the Fed’s reverse repo facility. Moreover, the Federal Reserve’s ongoing efforts to taper its asset purchases and signal future interest rate hikes have influenced market participants’ behavior, leading to a recalibration of liquidity needs.

The reduction in reverse repo usage has a direct impact on the liquidity available in the banking system. When the Fed engages in fewer reverse repos, it effectively leaves more cash in the hands of financial institutions. This increased liquidity can have several effects. On one hand, it may lead to lower short-term interest rates as banks and other financial entities find themselves with excess reserves, which they may be willing to lend at lower rates. On the other hand, the abundance of liquidity can also contribute to inflationary pressures if it leads to an increase in lending and spending.

Furthermore, the decline in reverse repo usage reflects broader trends in the financial markets. As the economy stabilizes, financial institutions may be more confident in their ability to manage liquidity without relying heavily on the Fed’s facilities. This confidence is bolstered by the Fed’s clear communication regarding its monetary policy intentions, which helps market participants anticipate changes and adjust their strategies accordingly. Additionally, the evolving regulatory environment, which has emphasized the importance of maintaining adequate liquidity buffers, may have encouraged banks to optimize their liquidity management practices.

In conclusion, the drop in the Federal Reserve’s reverse repo usage to a three-year low is a noteworthy development that underscores changes in the liquidity landscape of the banking system. This decline is influenced by a combination of economic recovery, monetary policy adjustments, and evolving market conditions. As financial institutions navigate this environment, the implications for short-term interest rates and overall economic activity will continue to unfold. The Federal Reserve’s role in managing liquidity remains crucial, and its actions will be closely monitored by market participants seeking to understand the future trajectory of interest rates and economic growth. Ultimately, the interplay between reverse repo usage and liquidity in the banking system highlights the complex dynamics at play in the post-pandemic economic landscape.

Historical Trends In Fed Reverse Repo Usage And Their Significance

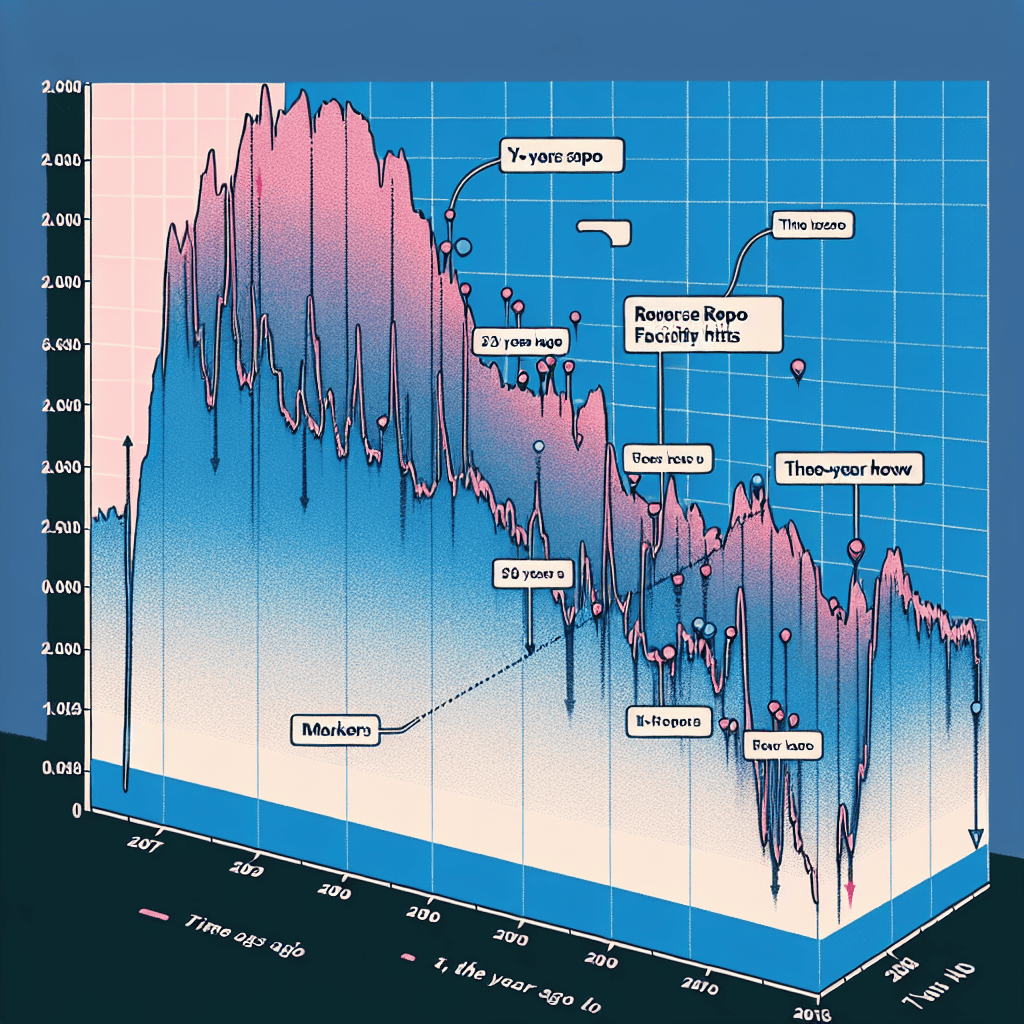

The Federal Reserve’s reverse repurchase agreement (reverse repo) facility has long been a critical tool in managing short-term interest rates and ensuring liquidity in the financial system. Recently, the usage of this facility has hit a three-year low, marking a significant shift in the dynamics of monetary policy and market operations. To understand the implications of this trend, it is essential to explore the historical patterns of reverse repo usage and their broader significance in the financial landscape.

Reverse repos are transactions in which the Federal Reserve sells securities to financial institutions with an agreement to repurchase them at a later date. This mechanism allows the Fed to absorb excess liquidity from the banking system, thereby helping to maintain the federal funds rate within its target range. Historically, the usage of reverse repos has fluctuated in response to changing economic conditions and monetary policy objectives. During periods of abundant liquidity, such as after the 2008 financial crisis, the Fed’s balance sheet expanded significantly, leading to increased reliance on reverse repos to manage the surplus reserves in the banking system.

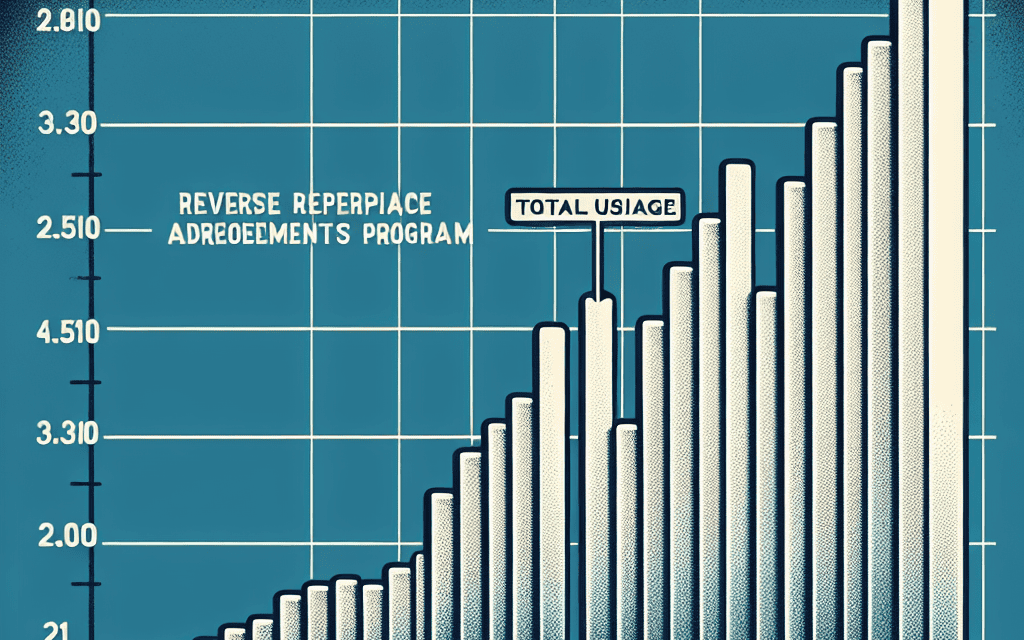

In recent years, the reverse repo facility has played a pivotal role in the Fed’s efforts to normalize monetary policy following the extraordinary measures taken during the COVID-19 pandemic. As the economy began to recover, the Fed gradually reduced its asset purchases and signaled a shift towards tightening monetary policy. Consequently, the demand for reverse repos surged as financial institutions sought to park their excess reserves in a safe and remunerative manner. This trend reached its peak in 2021, when the facility saw record usage levels, reflecting the abundant liquidity conditions and the Fed’s commitment to maintaining control over short-term interest rates.

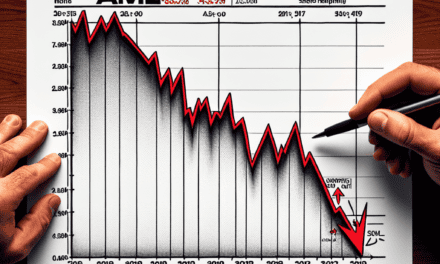

However, the recent decline in reverse repo usage suggests a changing landscape. Several factors contribute to this development, including the Fed’s ongoing balance sheet reduction, which has gradually drained excess reserves from the banking system. As the Fed allows its securities holdings to mature without reinvestment, the supply of reserves diminishes, reducing the need for financial institutions to engage in reverse repos. Additionally, the rise in interest rates, driven by the Fed’s tightening cycle, has made alternative investment opportunities more attractive, further decreasing the reliance on the reverse repo facility.

The significance of this trend extends beyond the immediate mechanics of monetary policy. A decline in reverse repo usage can signal a normalization of liquidity conditions, indicating that the financial system is adjusting to a new equilibrium. This shift may also reflect increased confidence among market participants, as they find more lucrative opportunities in the broader economy. Moreover, the reduced reliance on reverse repos can enhance the Fed’s flexibility in managing its balance sheet and implementing future policy adjustments.

In conclusion, the recent drop in Fed reverse repo usage to a three-year low marks a notable development in the context of historical trends. It underscores the evolving dynamics of monetary policy and liquidity management as the economy transitions from a period of extraordinary accommodation to a more normalized environment. While the implications of this trend are multifaceted, it ultimately highlights the Fed’s ongoing efforts to balance its dual mandate of promoting maximum employment and price stability. As the financial landscape continues to evolve, monitoring reverse repo usage will remain crucial in understanding the broader implications for monetary policy and market stability.

Future Outlook: What A Low Reverse Repo Usage Means For The Economy

The recent decline in the Federal Reserve’s reverse repurchase agreement (reverse repo) usage to a three-year low has sparked discussions about its implications for the broader economy. This development is noteworthy, as the reverse repo facility has been a critical tool for the Federal Reserve in managing short-term interest rates and ensuring liquidity in the financial system. To understand the future outlook, it is essential to explore the reasons behind this decline and what it signifies for economic conditions moving forward.

Reverse repos are transactions where the Federal Reserve sells securities to financial institutions with an agreement to repurchase them at a later date. This mechanism allows the Fed to absorb excess liquidity from the banking system, thereby helping to maintain control over short-term interest rates. A decrease in reverse repo usage suggests that there is less excess liquidity in the system, which can be attributed to several factors. One possible explanation is the recent tightening of monetary policy by the Federal Reserve, which has included raising interest rates to combat inflation. As interest rates rise, the demand for reverse repos typically diminishes, as financial institutions find more attractive investment opportunities elsewhere.

Moreover, the decline in reverse repo usage may also reflect improved liquidity conditions in the banking sector. Over the past few years, banks have bolstered their balance sheets, and the need for the Fed’s liquidity support has diminished. This is a positive sign, indicating that financial institutions are better equipped to manage their liquidity needs independently. Consequently, the reduced reliance on reverse repos can be seen as a vote of confidence in the stability and resilience of the financial system.

However, it is crucial to consider the broader economic context when assessing the implications of this trend. The decrease in reverse repo usage could also signal a shift in market expectations regarding future monetary policy. If market participants anticipate that the Federal Reserve will continue to tighten monetary policy, they may adjust their strategies accordingly, reducing their reliance on short-term liquidity facilities. This shift in expectations can have a ripple effect on various aspects of the economy, influencing everything from borrowing costs to investment decisions.

Furthermore, the decline in reverse repo usage may have implications for the Federal Reserve’s balance sheet normalization process. As the Fed seeks to reduce its holdings of securities accumulated during previous rounds of quantitative easing, the reduced demand for reverse repos could facilitate this process. By allowing securities to mature without reinvestment, the Fed can gradually shrink its balance sheet, thereby reducing its footprint in the financial markets. This approach aligns with the Fed’s long-term goal of returning to a more traditional monetary policy framework.

In conclusion, the recent drop in reverse repo usage to a three-year low offers valuable insights into the current state of the economy and the future trajectory of monetary policy. While it reflects improved liquidity conditions and a potential shift in market expectations, it also underscores the Federal Reserve’s ongoing efforts to manage its balance sheet and maintain control over short-term interest rates. As the economy continues to evolve, monitoring these developments will be crucial for understanding the broader implications for financial markets and economic growth. Ultimately, the decline in reverse repo usage serves as a reminder of the dynamic nature of monetary policy and its far-reaching impact on the economy.

Q&A

1. **What is the Fed Reverse Repo?**

– The Federal Reserve’s Reverse Repurchase Agreement (Reverse Repo) is a tool used to manage short-term interest rates and control the supply of money in the financial system by borrowing cash from financial institutions overnight in exchange for Treasury securities.

2. **Why did the Fed Reverse Repo usage hit a three-year low?**

– The decline in usage could be attributed to factors such as improved liquidity conditions in the banking system, changes in market interest rates, or adjustments in the Federal Reserve’s monetary policy operations.

3. **What impact does low Reverse Repo usage have on the financial markets?**

– Lower usage may indicate ample liquidity in the financial system, potentially leading to lower short-term interest rates and influencing borrowing costs and investment decisions.

4. **How does the Reverse Repo facility help the Federal Reserve?**

– It helps the Fed manage the supply of reserves in the banking system, maintain control over short-term interest rates, and ensure that its monetary policy stance is effectively transmitted to the broader economy.

5. **What are the implications of reduced Reverse Repo activity for banks?**

– Banks may have more excess reserves, reducing their need to participate in the facility, which could lead to increased lending and investment activities.

6. **How does the Reverse Repo rate compare to other interest rates?**

– The Reverse Repo rate is typically lower than the federal funds rate and serves as a floor for short-term interest rates, influencing other rates in the money markets.

7. **What could cause Reverse Repo usage to increase again?**

– Factors such as tighter liquidity conditions, changes in monetary policy, or increased demand for safe, short-term investments could lead to higher usage of the facility.

Conclusion

The decline in the Federal Reserve’s reverse repurchase agreement (reverse repo) usage to a three-year low suggests a shift in market dynamics and liquidity conditions. This reduction indicates that financial institutions are finding more attractive investment opportunities elsewhere, reflecting improved market confidence and potentially higher interest rates in other short-term instruments. It may also signal a normalization of monetary policy conditions as the economy stabilizes post-pandemic. However, continued monitoring is essential to assess the broader implications for financial markets and monetary policy.