“Market Moves: Key Stocks to Watch as Harris and Trump Battle for the White House”

Introduction

As the 2024 presidential race intensifies, with Vice President Kamala Harris and former President Donald Trump vying for the White House, investors are closely monitoring key stocks that could be influenced by the election’s outcome. The political landscape can significantly impact various sectors, from healthcare and energy to technology and infrastructure. Harris’s policies may focus on renewable energy, healthcare reform, and technology innovation, potentially benefiting companies in these sectors. Conversely, Trump’s platform might emphasize deregulation, fossil fuels, and traditional manufacturing, which could boost stocks in those areas. As the election approaches, market participants are keenly observing these dynamics to make informed investment decisions, understanding that the political climate can create both opportunities and risks in the stock market.

Impact Of Political Uncertainty On Tech Stocks

As the race for the White House intensifies between Kamala Harris and Donald Trump, investors are closely monitoring the impact of political uncertainty on the stock market, particularly within the technology sector. Historically, political events have had a significant influence on market dynamics, and the current election cycle is no exception. The technology sector, a cornerstone of the modern economy, is especially sensitive to political shifts due to its global reach and regulatory implications. Consequently, investors are keenly observing key tech stocks that could be affected by the outcome of this high-stakes election.

One of the primary concerns for tech investors is the potential for regulatory changes. Both candidates have expressed differing views on how to handle big tech companies, which could lead to varying degrees of regulatory scrutiny. Kamala Harris, representing the Democratic Party, has indicated a willingness to impose stricter regulations on tech giants to address issues such as data privacy, antitrust concerns, and misinformation. This stance could lead to increased compliance costs and operational challenges for major players like Facebook, Google, and Amazon. On the other hand, Donald Trump has generally favored a more laissez-faire approach, although his administration has also pursued antitrust actions against certain tech companies. The uncertainty surrounding these regulatory policies makes it crucial for investors to keep a close watch on these stocks as the election approaches.

In addition to regulatory concerns, trade policies are another area where political uncertainty could impact tech stocks. The technology sector is deeply intertwined with global supply chains, and any changes in trade agreements or tariffs could have significant repercussions. Under the Trump administration, there has been a focus on renegotiating trade deals and imposing tariffs, particularly with China, which has affected companies like Apple and Intel that rely on Chinese manufacturing and markets. A Harris administration might pursue a different approach, potentially easing tensions and fostering more stable trade relations. Investors are therefore evaluating how these potential shifts in trade policy could influence the profitability and strategic decisions of tech companies.

Moreover, the broader economic policies proposed by each candidate could also play a role in shaping the tech sector’s future. For instance, tax policies are a critical consideration for tech companies, many of which have substantial international operations. Changes in corporate tax rates or international tax agreements could impact the bottom line of these firms. Harris has proposed increasing corporate taxes to fund various social programs, which could affect the cash flow and investment strategies of tech companies. Conversely, Trump’s tax policies have generally favored lower corporate taxes, which could continue to benefit the sector if he is re-elected.

Finally, the overall market sentiment and investor confidence are likely to be influenced by the election’s outcome. Political stability and clarity on future policies can drive market optimism, while prolonged uncertainty may lead to volatility. As such, tech stocks, known for their growth potential and market influence, are particularly susceptible to these fluctuations. Investors are advised to stay informed about the political landscape and its potential implications for the tech sector, as these factors will undoubtedly play a crucial role in shaping investment strategies in the coming months. By closely monitoring these key stocks and understanding the broader political context, investors can better navigate the challenges and opportunities presented by this pivotal election.

Energy Sector Volatility Amid Election Tensions

As the United States approaches the final stretch of the presidential race between Kamala Harris and Donald Trump, the energy sector finds itself at the center of a whirlwind of volatility. This sector, already subject to the ebbs and flows of global market dynamics, is now further influenced by the political climate, with investors keenly observing how the election outcome might shape future energy policies. The stakes are high, and the implications for key stocks within this sector are significant.

To begin with, the energy sector’s performance is often closely tied to the political landscape, as government policies can significantly impact everything from regulatory frameworks to subsidies and tax incentives. Under a Harris administration, there is an expectation of a stronger push towards renewable energy sources, aligning with broader Democratic goals of reducing carbon emissions and combating climate change. This could potentially benefit companies involved in solar, wind, and other renewable technologies. Stocks such as NextEra Energy, a leader in renewable energy, and Tesla, with its focus on sustainable energy solutions, could see increased investor interest as a result.

Conversely, a Trump victory might signal a continuation of policies favoring traditional energy sources, such as oil and natural gas. Trump’s administration has historically supported deregulation efforts and has been a proponent of energy independence through domestic fossil fuel production. This could bode well for companies like ExxonMobil and Chevron, which are heavily invested in oil and gas exploration and production. These companies might experience a boost in stock prices if investors anticipate a favorable regulatory environment that supports their business models.

Moreover, the geopolitical implications of the election cannot be overlooked. Energy stocks are often sensitive to international relations, particularly with major oil-producing nations. A change in administration could lead to shifts in foreign policy, affecting global oil prices and, consequently, the valuation of energy stocks. For instance, a Harris administration might adopt a more diplomatic approach towards Iran, potentially easing sanctions and impacting global oil supply dynamics. This could influence the stock performance of companies with significant exposure to international markets.

In addition to these political considerations, the energy sector is also grappling with broader market trends, such as the ongoing transition towards cleaner energy sources and technological advancements. Regardless of the election outcome, the global push for sustainability is likely to continue, driven by both consumer demand and international agreements. This presents opportunities for companies that are able to innovate and adapt to these changes. Investors may want to keep an eye on firms that are investing in research and development to stay ahead in the evolving energy landscape.

In conclusion, as Harris and Trump vie for the presidency, the energy sector remains a focal point for investors seeking to navigate the uncertainties of the election. The outcome will likely have profound implications for key stocks within this sector, influenced by anticipated shifts in policy, regulatory environments, and international relations. By closely monitoring these developments, investors can better position themselves to capitalize on the opportunities and mitigate the risks associated with this period of heightened volatility. As the election draws near, the energy sector’s trajectory will undoubtedly be shaped by the political decisions made in the coming months, making it a critical area to watch.

Healthcare Stocks To Watch During The Election

As the 2024 presidential election approaches its final stretch, the political landscape is charged with anticipation, particularly as Kamala Harris and Donald Trump vie for the White House. This political contest is not only a pivotal moment for the nation but also a significant period for investors, especially those with interests in the healthcare sector. The policies and priorities of each candidate could have profound implications for healthcare stocks, making it crucial for investors to monitor key players in this industry.

Healthcare has consistently been a central issue in American politics, and this election is no exception. Both candidates have outlined distinct healthcare agendas that could influence market dynamics. Kamala Harris, with her focus on expanding access to healthcare and reducing costs, has proposed policies that could benefit companies involved in telemedicine and pharmaceuticals, particularly those that focus on generic drugs and biosimilars. Her emphasis on affordable healthcare could lead to increased demand for cost-effective medical solutions, potentially boosting the prospects of companies that align with these goals.

Conversely, Donald Trump’s approach to healthcare, which includes reducing regulatory burdens and promoting competition, could favor large pharmaceutical companies and healthcare providers. His policies might encourage innovation and the development of new drugs, benefiting firms with strong research and development capabilities. Additionally, Trump’s focus on deregulation could lead to a more favorable environment for biotech firms, which often face lengthy and costly approval processes.

In light of these differing policy perspectives, several healthcare stocks warrant close attention. For instance, companies like Teladoc Health, which specializes in telemedicine, could see significant growth if Harris’s policies to expand healthcare access are implemented. The pandemic has already accelerated the adoption of telehealth services, and further support from the government could solidify this trend, making Teladoc a stock to watch.

On the other hand, pharmaceutical giants such as Pfizer and Johnson & Johnson might benefit from Trump’s deregulatory stance. These companies have robust pipelines and the resources to navigate a competitive market environment. If regulatory hurdles are reduced, they could expedite the introduction of new drugs, potentially increasing their market share and profitability.

Moreover, biotech firms like Moderna and Gilead Sciences could also be impacted by the election outcome. Trump’s policies might provide these companies with the flexibility needed to innovate and bring new treatments to market more swiftly. However, investors should remain cautious, as the regulatory landscape can shift rapidly depending on the election results.

In addition to these specific stocks, the broader healthcare sector, represented by indices such as the Health Care Select Sector SPDR Fund (XLV), could experience volatility as the election approaches. Investors should be prepared for fluctuations driven by policy announcements and debates, which could influence market sentiment and stock performance.

Ultimately, the outcome of the Harris-Trump race will shape the future of healthcare policy in the United States, with significant implications for the stock market. Investors should remain vigilant, keeping a close eye on policy developments and their potential impact on healthcare stocks. By staying informed and adaptable, they can navigate the uncertainties of this election season and position themselves for potential opportunities in the healthcare sector.

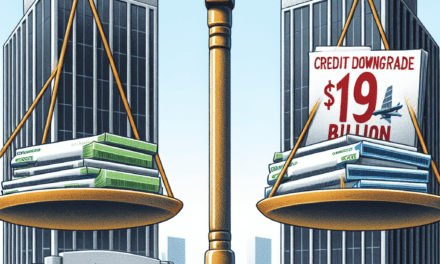

Financial Stocks And Election-Driven Market Fluctuations

As the United States approaches the final stretch of the presidential race between Kamala Harris and Donald Trump, investors are keenly observing the financial markets for signs of volatility and opportunity. Historically, election periods have been characterized by market fluctuations, driven by the uncertainty surrounding potential policy changes and their impact on various sectors. In this context, financial stocks often find themselves at the center of attention, as they are particularly sensitive to shifts in economic policy and regulatory environments. Consequently, investors are closely monitoring key financial stocks that could be significantly influenced by the outcome of this high-stakes election.

One of the primary factors affecting financial stocks during election periods is the anticipated regulatory landscape. Under a Harris administration, there is an expectation of increased regulatory scrutiny, particularly concerning large financial institutions. This could lead to tighter regulations and potentially higher compliance costs, which might weigh on the profitability of major banks. On the other hand, a continuation of the Trump administration is likely to maintain the current deregulatory stance, which has generally been favorable for financial institutions. Therefore, stocks of major banks such as JPMorgan Chase, Bank of America, and Goldman Sachs are under close watch, as their performance could be directly impacted by the election’s outcome.

In addition to regulatory considerations, fiscal policy is another critical factor influencing financial stocks. A Harris victory could usher in a more expansive fiscal policy, with increased government spending aimed at stimulating economic growth and addressing social inequalities. This could lead to a rise in interest rates, which would benefit banks by widening the spread between the interest they pay on deposits and the interest they earn on loans. Conversely, Trump’s fiscal policies have focused on tax cuts and deregulation, which have also been supportive of financial stocks by boosting corporate profits and encouraging investment. As such, investors are evaluating how these differing fiscal approaches might affect the financial sector’s profitability and growth prospects.

Moreover, the broader economic implications of the election are also at play. The financial sector is highly sensitive to economic cycles, and the election’s outcome could influence the trajectory of the U.S. economy. A Harris administration might prioritize policies aimed at sustainable growth and reducing income inequality, potentially leading to a more stable economic environment in the long term. In contrast, Trump’s policies have been geared towards immediate economic expansion, which could result in short-term gains for financial stocks but also increase the risk of economic overheating. Consequently, investors are weighing these potential scenarios as they assess the future performance of financial stocks.

Furthermore, the global economic landscape cannot be ignored, as the U.S. election has far-reaching implications beyond domestic borders. International trade policies, foreign relations, and global economic stability are all factors that could be influenced by the election’s outcome, thereby affecting financial stocks with significant international exposure. Companies like Citigroup and Morgan Stanley, which have substantial global operations, are particularly susceptible to changes in international policy and economic conditions. As such, investors are keeping a close eye on these stocks, considering how the election might alter the global economic environment and impact their international business activities.

In conclusion, as Harris and Trump vie for the presidency, financial stocks remain a focal point for investors navigating election-driven market fluctuations. By closely monitoring regulatory, fiscal, and economic factors, as well as the global implications of the election, investors aim to position themselves strategically in anticipation of the potential impacts on the financial sector.

Defense Industry Stocks In The Spotlight

As the race for the White House intensifies between Kamala Harris and Donald Trump, the defense industry finds itself under the spotlight, with investors keenly observing key stocks that could be influenced by the election’s outcome. The defense sector, traditionally a significant component of the U.S. economy, often experiences fluctuations based on political climates and policy directions. Consequently, the final stretch of this presidential race presents a critical period for stakeholders in defense stocks, as each candidate’s stance on military spending and international relations could have profound implications.

To begin with, Lockheed Martin, a leading player in the defense industry, remains a focal point for investors. Known for its advanced aerospace and defense technologies, Lockheed Martin’s fortunes are closely tied to government contracts and defense budgets. Under a Harris administration, there might be a shift towards more diplomatic and multilateral approaches, potentially affecting defense spending priorities. However, Harris’s commitment to maintaining national security could still ensure steady demand for Lockheed Martin’s offerings. Conversely, a Trump victory might signal continued robust defense spending, given his administration’s previous emphasis on military strength and modernization, which could further bolster Lockheed Martin’s prospects.

Similarly, Raytheon Technologies, another giant in the defense sector, stands to be impacted by the election’s outcome. Raytheon’s diverse portfolio, ranging from missile systems to cybersecurity solutions, positions it well to adapt to varying defense strategies. A Harris presidency might prioritize emerging threats such as cyber warfare, potentially benefiting Raytheon’s cybersecurity division. On the other hand, Trump’s focus on traditional military capabilities could sustain demand for Raytheon’s missile and defense systems, ensuring continued growth.

Moreover, Northrop Grumman, renowned for its expertise in aerospace and defense technologies, is another stock to watch. The company’s involvement in cutting-edge projects like the B-21 Raider bomber and various space initiatives makes it a critical player in the defense landscape. A Harris administration might emphasize space exploration and innovation, aligning with Northrop Grumman’s strategic interests. Meanwhile, Trump’s administration has shown support for space-related defense initiatives, which could further enhance Northrop Grumman’s growth trajectory.

In addition to these major players, smaller defense firms such as L3Harris Technologies and General Dynamics also warrant attention. L3Harris, with its focus on communication and electronic systems, could benefit from increased emphasis on modernizing military communication infrastructure under either administration. General Dynamics, known for its land and marine systems, might see varying impacts based on each candidate’s defense priorities, with potential shifts in focus from traditional land systems to more advanced marine technologies.

Furthermore, the geopolitical landscape plays a crucial role in shaping defense industry dynamics. As tensions with global powers like China and Russia persist, both Harris and Trump are likely to maintain a strong defense posture, albeit through different strategies. This geopolitical uncertainty could drive sustained interest in defense stocks, as investors seek to hedge against potential risks.

In conclusion, as Kamala Harris and Donald Trump vie for the presidency, the defense industry remains a critical area of focus for investors. The election’s outcome could significantly influence defense spending priorities and international relations, thereby impacting key stocks in the sector. By closely monitoring these developments, investors can better navigate the complexities of the defense market during this pivotal period.

Renewable Energy Stocks And Election Outcomes

As the United States approaches the final stretch of the presidential race between Kamala Harris and Donald Trump, investors are keenly observing the potential impact of the election outcome on various sectors, particularly renewable energy. The policies and priorities of the candidates could significantly influence the trajectory of renewable energy stocks, making it crucial for investors to monitor key players in this sector. The renewable energy industry, encompassing solar, wind, and other sustainable technologies, has been gaining momentum as the world increasingly shifts towards cleaner energy sources. This transition is not only driven by environmental concerns but also by technological advancements and economic incentives. Consequently, the political landscape plays a pivotal role in shaping the future of this industry, as government policies can either accelerate or hinder its growth.

Kamala Harris, representing the Democratic Party, has consistently advocated for robust climate action and a transition to renewable energy. Her platform emphasizes the importance of reducing carbon emissions and investing in clean energy infrastructure. If elected, Harris is likely to push for policies that support the expansion of renewable energy, potentially benefiting companies involved in solar and wind energy production. For instance, solar energy companies such as First Solar and SunPower could see increased demand for their products and services under a Harris administration. These companies are well-positioned to capitalize on any government incentives aimed at boosting solar energy adoption, making them key stocks to watch.

On the other hand, Donald Trump, the Republican candidate, has historically prioritized traditional energy sources such as oil and gas. His administration has rolled back several environmental regulations, arguing that such measures are necessary to support economic growth and energy independence. If Trump secures another term, the renewable energy sector may face challenges in terms of policy support and funding. However, it is important to note that market forces and state-level initiatives have continued to drive renewable energy growth despite federal policies. In this context, companies like NextEra Energy, which has a diversified portfolio including both renewable and traditional energy sources, may remain resilient regardless of the election outcome.

Moreover, the global trend towards sustainability and the increasing competitiveness of renewable technologies suggest that the sector’s growth is likely to persist in the long term. Investors should also consider the potential impact of international climate agreements and collaborations, which could further bolster the renewable energy market. As such, companies with a strong international presence, such as Vestas Wind Systems, may benefit from global efforts to combat climate change.

In conclusion, the upcoming presidential election presents both opportunities and challenges for renewable energy stocks. While a Harris victory could provide a significant boost to the sector through supportive policies and investments, a Trump win may necessitate a reliance on market dynamics and state-level initiatives to sustain growth. Investors should closely monitor the political developments and consider the broader trends influencing the renewable energy industry. By doing so, they can make informed decisions and potentially capitalize on the evolving landscape of this critical sector. As the race for the White House intensifies, the future of renewable energy stocks remains intricately linked to the election’s outcome, underscoring the importance of strategic investment decisions in this pivotal moment.

Retail Sector Stocks Facing Election Pressure

As the race for the White House intensifies between Kamala Harris and Donald Trump, the retail sector finds itself under significant scrutiny. Investors are keenly observing how the political climate might influence consumer behavior and, consequently, retail stocks. The outcome of the election could have profound implications for the sector, with potential shifts in economic policy, trade agreements, and consumer confidence all playing pivotal roles. Therefore, it is crucial to monitor key stocks within this sector that may be particularly sensitive to the election’s outcome.

Firstly, large retail chains such as Walmart and Target are often seen as bellwethers for the retail industry. These companies have a broad customer base and extensive supply chains, making them susceptible to changes in trade policies and tariffs. Under a Harris administration, there might be a push towards more stringent regulations and a focus on sustainability, which could impact operational costs. Conversely, a Trump victory might continue the current administration’s deregulatory stance, potentially benefiting these giants by reducing compliance costs. Investors should keep a close eye on these companies’ stock performance as the election approaches, as any policy announcements could lead to significant market movements.

In addition to the retail giants, e-commerce platforms like Amazon and eBay are also under the microscope. The pandemic has accelerated the shift towards online shopping, and these companies have reaped substantial benefits. However, the political landscape could alter their trajectory. A Harris administration might advocate for stronger antitrust regulations, which could pose challenges for Amazon’s market dominance. On the other hand, Trump’s administration has been relatively lenient towards big tech, which might allow these companies to continue their expansion unabated. Thus, the election outcome could have a direct impact on their growth prospects and stock valuations.

Moreover, specialty retailers such as Home Depot and Lowe’s are also worth monitoring. These companies have experienced a surge in demand as consumers invest in home improvement projects during the pandemic. However, their future performance could be influenced by the election’s impact on housing policies and interest rates. A Harris administration might prioritize affordable housing initiatives, potentially boosting demand for home improvement products. In contrast, Trump’s policies might focus on deregulation and tax cuts, which could also stimulate the housing market. Therefore, investors should consider how these potential policy shifts might affect these stocks.

Furthermore, the apparel sector, represented by companies like Nike and Gap, faces its own set of challenges. Trade policies and tariffs are critical factors for these companies, as many rely on global supply chains. A Harris administration might seek to renegotiate trade agreements, which could lead to increased costs for apparel retailers. Conversely, Trump’s approach might maintain the status quo, allowing these companies to continue their current operations without significant disruptions. Consequently, the election’s outcome could have a substantial impact on their profitability and stock performance.

In conclusion, as Harris and Trump vie for the presidency, the retail sector remains a focal point for investors. The election’s outcome could lead to significant shifts in economic policy, affecting consumer behavior and retail stocks. By closely monitoring key players such as Walmart, Amazon, Home Depot, and Nike, investors can better navigate the uncertainties of this election season. As the final stretch of the White House race unfolds, the retail sector will undoubtedly remain under the spotlight, with its performance closely tied to the political landscape.

Q&A

1. **Question:** Which sectors are likely to be impacted by the Harris and Trump face-off in the White House race?

**Answer:** Key sectors include healthcare, renewable energy, and traditional energy, as policy differences between the candidates could significantly impact these industries.

2. **Question:** How might healthcare stocks be affected by the election?

**Answer:** Healthcare stocks could be volatile, with potential impacts on pharmaceutical companies and insurers depending on the candidates’ differing healthcare policies.

3. **Question:** What is the potential impact on renewable energy stocks?

**Answer:** Renewable energy stocks might see increased interest if Harris, who supports green energy initiatives, gains momentum in the race.

4. **Question:** How could traditional energy stocks be influenced by the election outcome?

**Answer:** Traditional energy stocks, such as oil and gas companies, might perform better if Trump, who supports fossil fuel industries, appears to have an advantage.

5. **Question:** What role do financial stocks play in the election context?

**Answer:** Financial stocks could be influenced by regulatory policies, with potential deregulation under Trump and increased regulation under Harris.

6. **Question:** Are there any specific technology stocks to watch during the election?

**Answer:** Technology stocks, particularly those involved in data privacy and antitrust issues, could be impacted by differing regulatory approaches from the candidates.

7. **Question:** How might defense stocks react to the election dynamics?

**Answer:** Defense stocks could be affected by foreign policy stances and military spending priorities, with potential increases under Trump and possible shifts under Harris.

Conclusion

As the final stretch of the White House race between Kamala Harris and Donald Trump unfolds, investors should closely monitor key stocks that could be influenced by the election’s outcome. Sectors such as renewable energy, healthcare, and technology may see significant movement depending on the candidates’ policy proposals and potential regulatory changes. Renewable energy stocks could benefit from Harris’s focus on climate change and clean energy initiatives, while traditional energy stocks might fare better under Trump’s administration. Healthcare stocks could experience volatility based on differing approaches to healthcare reform. Additionally, technology companies might be impacted by varying stances on data privacy and antitrust regulations. Overall, the election’s outcome could lead to shifts in market sentiment and sector performance, making it crucial for investors to stay informed and agile in their investment strategies.