“FuboTV Q3: Subscriber Surge, Narrowing Losses, Brightened Outlook!”

Introduction

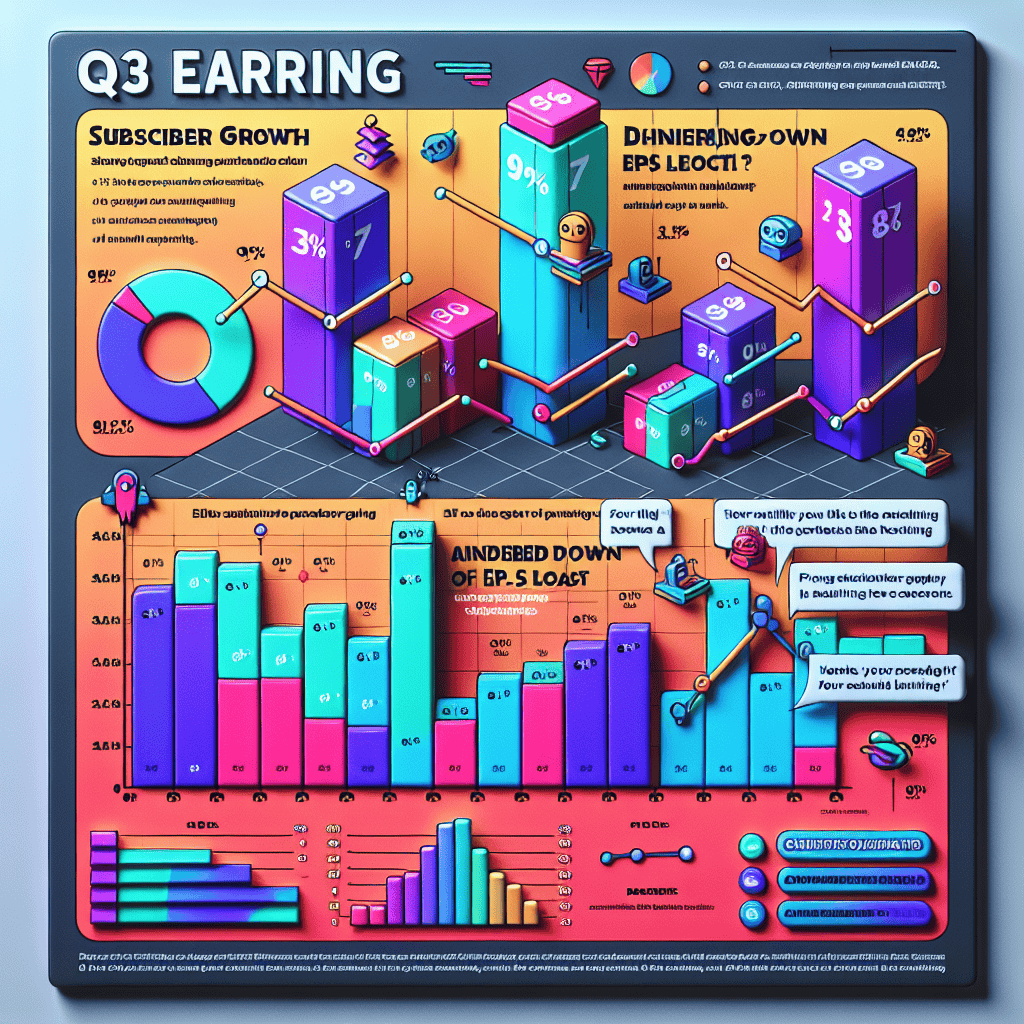

FuboTV’s third-quarter earnings report reveals a robust performance, highlighted by a 9% increase in subscriber growth, signaling strong consumer demand and engagement. The company also reported a narrowing of its earnings per share (EPS) loss, reflecting improved financial management and operational efficiencies. In light of these positive developments, FuboTV has raised its annual outlook, indicating confidence in its strategic direction and future growth prospects. This performance underscores FuboTV’s competitive positioning in the streaming industry and its potential for continued expansion.

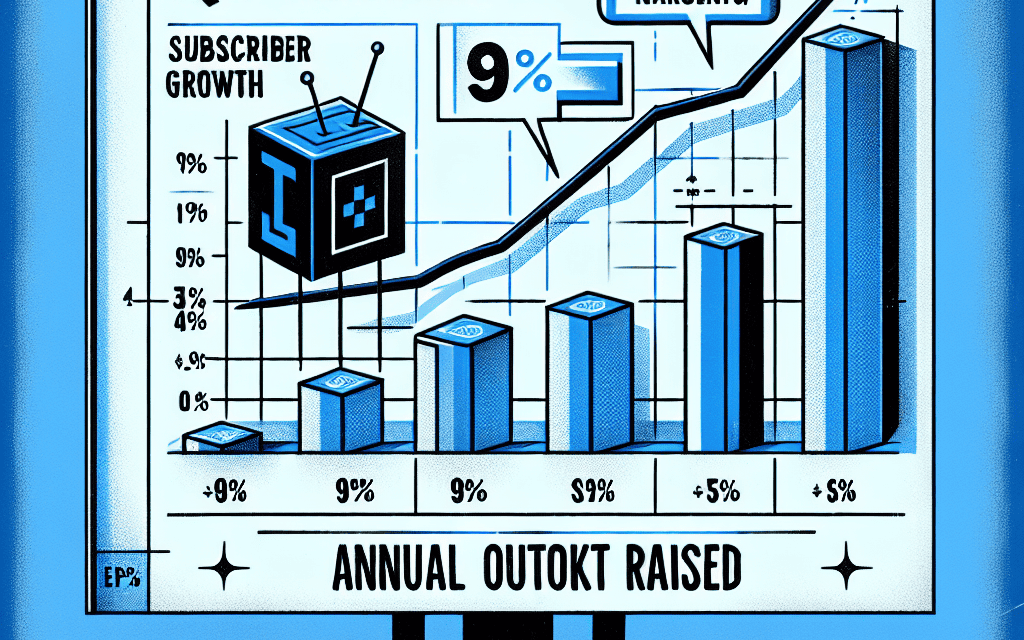

Subscriber Growth: FuboTV Achieves 9% Increase in Q3

In the third quarter of the fiscal year, FuboTV has demonstrated a notable performance, marked by a 9% increase in subscriber growth. This achievement underscores the company’s strategic initiatives aimed at expanding its user base and enhancing its market presence. The growth in subscribers is a testament to FuboTV’s ability to attract and retain viewers in an increasingly competitive streaming landscape. This success can be attributed to a combination of factors, including an expanded content library, improved user experience, and targeted marketing efforts.

Transitioning to the financial aspects, FuboTV has also reported a narrowing of its earnings per share (EPS) loss. This development is significant as it indicates the company’s progress towards achieving financial stability and profitability. The reduction in EPS loss can be linked to effective cost management strategies and increased revenue from the growing subscriber base. By optimizing operational efficiencies and leveraging economies of scale, FuboTV has managed to improve its financial performance, which is a positive signal for investors and stakeholders.

Moreover, the company’s decision to raise its annual outlook reflects confidence in its growth trajectory and future prospects. This upward revision in guidance suggests that FuboTV anticipates continued momentum in subscriber acquisition and revenue generation. The raised outlook is likely influenced by the company’s strategic investments in content acquisition and technology enhancements, which are expected to drive further engagement and customer satisfaction.

In addition to these financial metrics, FuboTV’s focus on delivering a diverse and compelling content offering has played a crucial role in attracting new subscribers. The platform’s emphasis on live sports, entertainment, and news has resonated well with audiences seeking a comprehensive streaming solution. By securing exclusive broadcasting rights and forming partnerships with major content providers, FuboTV has strengthened its competitive position and differentiated itself from other streaming services.

Furthermore, the company’s commitment to innovation and technology has enhanced the overall user experience, making it more appealing to potential subscribers. Features such as cloud DVR, personalized recommendations, and multi-screen viewing options have contributed to higher customer retention rates. These technological advancements not only improve user satisfaction but also provide FuboTV with valuable data insights to further refine its offerings and marketing strategies.

As the streaming industry continues to evolve, FuboTV’s ability to adapt and innovate will be critical to sustaining its growth momentum. The company’s strategic focus on expanding its content portfolio, optimizing its platform, and enhancing customer engagement positions it well to capitalize on emerging opportunities in the market. Additionally, FuboTV’s efforts to diversify its revenue streams through advertising and partnerships are expected to bolster its financial performance in the long term.

In conclusion, FuboTV’s impressive 9% increase in subscriber growth during the third quarter, coupled with a narrowing EPS loss and an optimistic annual outlook, highlights the company’s strong operational execution and strategic foresight. As it continues to navigate the dynamic streaming landscape, FuboTV’s commitment to delivering value to its subscribers and stakeholders remains unwavering. With a clear focus on innovation, content excellence, and financial discipline, FuboTV is poised to achieve sustained success and further solidify its position as a leading player in the streaming industry.

Financial Performance: EPS Loss Narrows for FuboTV

In the third quarter of 2023, FuboTV demonstrated notable progress in its financial performance, particularly in terms of narrowing its earnings per share (EPS) loss. This improvement is a significant indicator of the company’s ongoing efforts to enhance its financial health and operational efficiency. The narrowing of the EPS loss can be attributed to a combination of strategic initiatives and favorable market conditions that have collectively contributed to a more robust financial standing for the company.

One of the primary drivers behind this positive financial trajectory is FuboTV’s impressive subscriber growth, which reached a remarkable 9% in the third quarter. This growth is indicative of the company’s ability to attract and retain a larger audience, thereby expanding its revenue base. The increase in subscribers not only boosts the company’s top line but also provides a more substantial foundation for future growth and profitability. As more consumers continue to shift towards streaming services, FuboTV’s strategic positioning in the market allows it to capitalize on this trend effectively.

Moreover, the company’s focus on enhancing its content offerings and user experience has played a crucial role in driving subscriber growth. By investing in a diverse range of programming and ensuring a seamless viewing experience, FuboTV has managed to differentiate itself in a competitive streaming landscape. This differentiation is essential for maintaining subscriber loyalty and attracting new users, both of which are critical for sustaining long-term growth.

In addition to subscriber growth, FuboTV’s efforts to optimize its cost structure have contributed to the narrowing of its EPS loss. The company has implemented various cost-saving measures aimed at improving operational efficiency and reducing unnecessary expenditures. These measures have enabled FuboTV to allocate resources more effectively, thereby enhancing its overall financial performance. As a result, the company is better positioned to achieve profitability in the future, provided it continues to manage its costs prudently.

Furthermore, FuboTV’s decision to raise its annual outlook reflects its confidence in sustaining this positive momentum. By adjusting its projections upward, the company signals to investors and stakeholders that it anticipates continued growth and improved financial results in the coming quarters. This optimistic outlook is supported by the company’s strategic initiatives, which are designed to drive further subscriber acquisition and retention while maintaining a focus on cost management.

The narrowing of the EPS loss, coupled with strong subscriber growth and an improved annual outlook, underscores FuboTV’s commitment to achieving financial stability and long-term success. As the company continues to navigate the evolving streaming landscape, its ability to adapt and innovate will be crucial in maintaining its competitive edge. By leveraging its strengths and addressing potential challenges, FuboTV is well-positioned to capitalize on emerging opportunities and deliver value to its shareholders.

In conclusion, FuboTV’s third-quarter financial performance highlights the company’s progress in narrowing its EPS loss, driven by robust subscriber growth and effective cost management. The raised annual outlook further emphasizes the company’s confidence in its strategic direction and potential for future success. As FuboTV continues to execute its growth strategy, it remains poised to strengthen its position in the streaming industry and achieve sustainable financial performance.

Strategic Outlook: FuboTV Raises Annual Forecast

In the rapidly evolving landscape of streaming services, FuboTV has emerged as a notable player, particularly in the realm of sports-centric content. The company’s recent third-quarter earnings report has provided a glimpse into its strategic trajectory, marked by significant subscriber growth and a refined financial outlook. As the streaming industry becomes increasingly competitive, FuboTV’s performance in this quarter underscores its potential to carve out a distinct niche.

FuboTV reported a 9% increase in subscriber growth, a testament to its ability to attract and retain viewers in a crowded market. This growth can be attributed to several strategic initiatives, including an expanded content library and enhanced user experience. By focusing on sports enthusiasts, FuboTV has differentiated itself from other streaming platforms, offering a unique value proposition that resonates with a specific audience segment. This targeted approach has not only bolstered subscriber numbers but also strengthened customer loyalty, a critical factor in sustaining long-term growth.

In addition to subscriber growth, FuboTV’s earnings per share (EPS) loss has narrowed, indicating improved financial health. This reduction in losses reflects the company’s efforts to optimize operational efficiencies and manage costs effectively. By streamlining operations and leveraging economies of scale, FuboTV has been able to reduce its financial deficit, positioning itself for future profitability. This financial discipline is crucial as the company navigates the challenges of scaling its operations while maintaining quality service delivery.

Moreover, FuboTV’s decision to raise its annual outlook is a strategic move that signals confidence in its growth trajectory. By adjusting its forecast upwards, the company is not only acknowledging its recent successes but also setting ambitious targets for the future. This revised outlook is likely based on a combination of factors, including anticipated subscriber growth, potential market expansion, and continued innovation in content offerings. By setting higher expectations, FuboTV is challenging itself to maintain momentum and capitalize on emerging opportunities in the streaming sector.

The strategic outlook for FuboTV is further bolstered by its commitment to innovation and adaptation. As consumer preferences continue to evolve, the company has demonstrated agility in responding to market demands. This includes investing in technology to enhance streaming quality, expanding its content portfolio to include more diverse offerings, and exploring partnerships that can enhance its competitive edge. By staying attuned to industry trends and consumer needs, FuboTV is well-positioned to navigate the complexities of the streaming landscape.

In conclusion, FuboTV’s third-quarter performance highlights its strategic focus on growth and financial stability. The 9% increase in subscriber numbers, coupled with a narrowed EPS loss, reflects the company’s ability to execute its vision effectively. By raising its annual outlook, FuboTV is setting the stage for continued success, driven by innovation and a keen understanding of its target audience. As the streaming industry continues to evolve, FuboTV’s strategic initiatives and financial discipline will be key determinants of its ability to sustain growth and achieve long-term profitability. Through these efforts, FuboTV is not only enhancing its market position but also reinforcing its commitment to delivering value to its subscribers and stakeholders alike.

Market Impact: How FuboTV’s Q3 Results Affect the Industry

FuboTV’s third-quarter earnings report has sent ripples through the streaming industry, highlighting both the company’s strategic advancements and the broader market implications. The announcement of a 9% increase in subscriber growth, alongside a narrowing of the earnings per share (EPS) loss, has positioned FuboTV as a formidable player in the competitive streaming landscape. Moreover, the company’s decision to raise its annual outlook underscores its confidence in sustaining this upward trajectory. These developments not only reflect FuboTV’s internal progress but also signal potential shifts in industry dynamics.

To begin with, the 9% subscriber growth is a testament to FuboTV’s ability to attract and retain viewers in a saturated market. This growth can be attributed to several factors, including an expanded content library, strategic partnerships, and a focus on sports programming, which remains a significant draw for audiences. As FuboTV continues to enhance its offerings, competitors may feel the pressure to innovate and diversify their content to maintain market share. This competitive environment could lead to an acceleration of content acquisition and production across the industry, benefiting consumers with more diverse viewing options.

In addition to subscriber growth, the narrowing of FuboTV’s EPS loss is a critical indicator of the company’s improving financial health. By optimizing operational efficiencies and managing costs, FuboTV has demonstrated its commitment to achieving profitability. This financial discipline is likely to resonate with investors, potentially leading to increased investment in the company. Furthermore, FuboTV’s financial performance may set a benchmark for other streaming services, encouraging them to adopt similar cost-management strategies to enhance their profitability.

The decision to raise the annual outlook is another significant aspect of FuboTV’s Q3 results. This move reflects the company’s optimism about its future prospects and its ability to capitalize on current market trends. By projecting a more favorable financial future, FuboTV is likely to attract further investor interest, which could result in increased capital for expansion and innovation. This positive outlook may also influence industry sentiment, prompting other streaming services to reassess their growth strategies and market positioning.

Moreover, FuboTV’s performance highlights the growing importance of niche markets within the streaming industry. By focusing on sports content, FuboTV has carved out a unique space for itself, appealing to a dedicated audience segment. This specialization not only differentiates FuboTV from its competitors but also underscores the potential for other streaming services to explore niche markets. As a result, the industry may witness a diversification of content offerings, with companies seeking to cater to specific audience preferences.

In conclusion, FuboTV’s Q3 earnings report has significant implications for the streaming industry. The company’s subscriber growth, improved financial performance, and raised annual outlook signal a robust competitive position and a promising future. These developments are likely to influence industry trends, encouraging innovation, financial discipline, and market diversification. As FuboTV continues to evolve, its impact on the streaming landscape will be closely watched by competitors, investors, and consumers alike, shaping the future of entertainment consumption.

Revenue Trends: Analyzing FuboTV’s Financial Health

In the third quarter of 2023, FuboTV demonstrated notable financial resilience and strategic growth, as evidenced by its latest earnings report. The company, which has been carving out a niche in the competitive streaming landscape, reported a 9% increase in subscriber growth. This uptick in subscribers is a testament to FuboTV’s ability to attract and retain viewers in a market saturated with options. The increase in subscribers is not only a reflection of the company’s robust content offerings but also its strategic marketing efforts and partnerships that have expanded its reach and appeal.

Transitioning to the financial specifics, FuboTV’s earnings per share (EPS) loss narrowed during this quarter, signaling an improvement in operational efficiency and cost management. This narrowing of EPS loss is a crucial indicator of the company’s trajectory towards profitability. It suggests that FuboTV is effectively managing its expenses while simultaneously scaling its operations. The reduction in losses can be attributed to a combination of increased revenue from the growing subscriber base and strategic cost-cutting measures that have been implemented over the past few quarters.

Moreover, FuboTV’s revenue trends reveal a positive trajectory, with the company raising its annual outlook. This upward revision in the annual forecast is a strong indicator of confidence from the management in the company’s future performance. It reflects an expectation of continued subscriber growth and revenue generation, driven by an expanding content library and enhanced user experience. The raised outlook also suggests that FuboTV anticipates further capitalizing on the growing demand for streaming services, particularly in the sports and live events segments, which are core to its offerings.

In analyzing FuboTV’s financial health, it is essential to consider the broader industry context. The streaming industry is characterized by rapid technological advancements and shifting consumer preferences, which require companies to be agile and innovative. FuboTV’s ability to adapt to these changes and maintain a competitive edge is crucial for its long-term success. The company’s focus on sports-centric content differentiates it from other streaming platforms, providing a unique value proposition that appeals to a specific audience segment.

Furthermore, FuboTV’s strategic investments in technology and content acquisition are pivotal to sustaining its growth momentum. By enhancing its platform’s capabilities and expanding its content portfolio, FuboTV is well-positioned to capture a larger share of the market. These investments are likely to drive further subscriber growth and revenue, contributing to the company’s overall financial health.

In conclusion, FuboTV’s Q3 earnings report paints a picture of a company on a promising path towards financial stability and growth. The 9% increase in subscriber growth, coupled with a narrowing EPS loss and an optimistic annual outlook, underscores the company’s strategic progress. As FuboTV continues to navigate the dynamic streaming landscape, its focus on delivering value through unique content offerings and technological innovation will be key to sustaining its upward trajectory. The company’s ability to balance growth with financial prudence will ultimately determine its success in achieving long-term profitability and market leadership.

Competitive Edge: FuboTV’s Position in the Streaming Market

In the rapidly evolving landscape of streaming services, FuboTV has carved out a distinctive niche, primarily focusing on live sports and entertainment. The company’s recent Q3 earnings report highlights its strategic positioning and competitive edge in the market. With a notable 9% growth in subscriber numbers, FuboTV is demonstrating its ability to attract and retain viewers in a crowded field. This growth is particularly significant given the intense competition from established giants like Netflix, Disney+, and Amazon Prime Video, which dominate the streaming industry. However, FuboTV’s emphasis on live sports content provides a unique value proposition that sets it apart from its competitors.

The narrowing of FuboTV’s EPS loss further underscores the company’s progress toward financial stability. This improvement in earnings per share indicates that FuboTV is effectively managing its operational costs while expanding its subscriber base. Such financial discipline is crucial for streaming services, which often face high content acquisition and technology infrastructure expenses. By narrowing its losses, FuboTV is signaling to investors and stakeholders that it is on a path toward profitability, a key factor in sustaining long-term growth and competitiveness.

Moreover, FuboTV’s decision to raise its annual outlook reflects confidence in its strategic initiatives and market positioning. This upward revision suggests that the company anticipates continued subscriber growth and revenue generation, driven by its robust content offerings and targeted marketing efforts. The raised outlook also indicates that FuboTV is successfully navigating the challenges posed by the dynamic streaming environment, including shifting consumer preferences and technological advancements.

Transitioning to the broader market context, FuboTV’s focus on live sports content is a critical differentiator. As consumers increasingly seek personalized and real-time viewing experiences, FuboTV’s comprehensive sports coverage appeals to a dedicated audience segment. This focus not only enhances subscriber loyalty but also opens up opportunities for strategic partnerships and advertising revenue. By capitalizing on the growing demand for live sports streaming, FuboTV is positioning itself as a leader in this niche market, thereby strengthening its competitive edge.

Furthermore, FuboTV’s technological innovations, such as cloud-based DVR and multi-view streaming, enhance the user experience and provide additional value to subscribers. These features cater to the evolving expectations of modern viewers, who prioritize flexibility and convenience in their streaming services. By continuously enhancing its platform capabilities, FuboTV is ensuring that it remains at the forefront of technological advancements in the industry.

In conclusion, FuboTV’s Q3 earnings report highlights its strategic positioning and competitive advantages in the streaming market. The company’s subscriber growth, narrowing EPS loss, and raised annual outlook are indicative of its successful navigation of industry challenges and its focus on delivering unique value to its audience. As FuboTV continues to leverage its strengths in live sports content and technological innovation, it is well-positioned to maintain its competitive edge and achieve sustained growth in the dynamic streaming landscape. This strategic focus not only differentiates FuboTV from its competitors but also reinforces its commitment to providing a superior viewing experience for its subscribers.

Future Prospects: What FuboTV’s Q3 Earnings Mean for Investors

FuboTV’s third-quarter earnings report has provided a fresh perspective on the company’s trajectory, offering investors a blend of optimism and caution. The streaming service, known for its focus on live sports, has demonstrated notable progress in subscriber growth, reporting a 9% increase. This uptick is a promising indicator of FuboTV’s ability to attract and retain viewers in a highly competitive market. The growth in subscribers is not merely a numerical achievement; it reflects the company’s strategic efforts to enhance its content offerings and improve user experience, thereby solidifying its position in the streaming landscape.

In addition to subscriber growth, FuboTV has made strides in narrowing its earnings per share (EPS) loss. This development is significant as it underscores the company’s commitment to improving its financial health. By reducing operational costs and optimizing revenue streams, FuboTV is gradually moving towards profitability. The narrowing of the EPS loss is a positive signal to investors, suggesting that the company is on a path to financial stability. This progress, however, should be viewed with cautious optimism, as the journey to profitability in the streaming industry is fraught with challenges, including high content acquisition costs and intense competition.

Moreover, FuboTV’s decision to raise its annual outlook further bolsters investor confidence. This upward revision indicates that the company anticipates continued growth and improved financial performance in the coming quarters. The raised outlook is likely a reflection of FuboTV’s strategic initiatives, such as expanding its content library, enhancing its technological infrastructure, and exploring new revenue opportunities. These efforts are aimed at not only attracting new subscribers but also increasing engagement and retention among existing users. For investors, the revised outlook serves as an encouraging sign that FuboTV is poised for sustained growth.

However, it is essential for investors to consider the broader context in which FuboTV operates. The streaming industry is characterized by rapid technological advancements and shifting consumer preferences, which can pose both opportunities and risks. As FuboTV continues to expand its offerings and improve its platform, it must remain agile and responsive to these changes. The company’s ability to innovate and adapt will be crucial in maintaining its competitive edge and achieving long-term success.

Furthermore, while FuboTV’s recent performance is commendable, investors should remain mindful of the potential challenges that lie ahead. The competitive landscape is fierce, with established players and new entrants vying for market share. Additionally, the economic environment, including factors such as inflation and consumer spending patterns, can impact FuboTV’s growth prospects. Therefore, a balanced approach that considers both the opportunities and risks is advisable for investors evaluating FuboTV’s future potential.

In conclusion, FuboTV’s Q3 earnings report presents a mixed yet promising picture for investors. The company’s achievements in subscriber growth, narrowing EPS loss, and an optimistic annual outlook are encouraging signs of progress. However, the dynamic nature of the streaming industry necessitates a cautious and informed approach. As FuboTV continues to navigate this complex landscape, its ability to innovate, adapt, and execute its strategic vision will be key determinants of its future success. Investors should closely monitor these developments, weighing the potential rewards against the inherent risks, to make informed decisions about their investment in FuboTV.

Q&A

1. **What was the subscriber growth for FuboTV in Q3?**

Subscriber growth for FuboTV in Q3 was 9%.

2. **How did FuboTV’s EPS (Earnings Per Share) perform in Q3?**

FuboTV’s EPS loss narrowed in Q3.

3. **Did FuboTV adjust its annual outlook following the Q3 results?**

Yes, FuboTV raised its annual outlook following the Q3 results.

4. **What was a key financial highlight for FuboTV in Q3?**

A key financial highlight was the narrowing of the EPS loss.

5. **How did the market react to FuboTV’s Q3 earnings report?**

The market reaction would depend on various factors, but typically, narrowing losses and raised outlooks are seen positively.

6. **What factors contributed to FuboTV’s subscriber growth in Q3?**

Specific factors are not detailed, but generally, subscriber growth can be attributed to increased demand for streaming services and effective marketing strategies.

7. **What is the significance of FuboTV raising its annual outlook?**

Raising the annual outlook signifies confidence in future performance and can positively influence investor sentiment.

Conclusion

FuboTV’s Q3 earnings report highlights a positive trajectory for the company, marked by a 9% increase in subscriber growth, which underscores its expanding user base and market presence. Additionally, the narrowing of the EPS loss indicates improved financial management and operational efficiency. The upward revision of the annual outlook further reflects confidence in sustained growth and profitability. Overall, these results suggest that FuboTV is successfully executing its strategic initiatives and is well-positioned for continued progress in the competitive streaming industry.